Portfolio Management services (PMS)

What are Portfolio Management services (PMS)?

Portfolio Management Services (PMS) is a licensed, professional investment solution tailored for long-term, high-net-worth investors. Regulated by SEBI, PMS in India requires a minimum investment of ₹50 lakhs, offering sophisticated strategies that surpass traditional mutual funds, ideal for seasoned investors seeking targeted wealth growth.

With PMS, investors gain access to a dedicated portfolio manager who provides insights, customization, and timely adjustments based on evolving market conditions and client objectives.

Our Research

What did we do

- We spoke to over 20 Fund managers and over 100 clients to understand their needs

- Came up with a strategy on how to park the money based on risk and return requirement

- Found funds with differentiated strategies

Key Findings

- Looked at niche funds with good Downside Capture and better risk and returns

- Timing the entry right for investment

Our Filters

Firms that excelled in bull markets and also outperformed during periods of market turmoil, showcasing impressive downside capture ratios.

Types of Portfolio Management services (PMS)

Discretionary PMS

The portfolio manager has full authority to make investment decisions without consulting the client.

Non-Discretionary PMS

The manager provides advice, but the client makes the final investment decisions.

Advisory PMS

The manager acts as a consultant, offering recommendations for the client to execute independently.

PMS and AIFs differ significantly from mutual funds. PMS focuses on a select few companies, avoiding over-diversification, whereas mutual funds adopt a highly diversified approach to cater to the masses. While diversification helps mutual funds reduce volatility, it doesn’t always equate to lower risk—in fact, exposure to lesser-known companies can sometimes increase risk.

How is PMS Different from Mutual Funds?

- Customization: Personalized portfolios

- Focus: Focuses on a concentrated set of companies, selecting high-conviction stocks.

- Flexibility: Faster decision-making

- Ownership: Investments are held in the investor’s name, with direct ownership of underlying securities.

- Compliance: Less regulatory requirements

What is better for you: PMS or AIF?

Portfolio Management Services (PMS)

- Corpus of Rs. 50lacs to 2 Cr

- Higher Liquidity needs

- Shorter investing Time horizon

- Greater control over investments

- Lower Risk Parameters

Alternate investment fund (AIF)

- Corpus of Rs. 1 Cr to 5 Cr or >

- Access to PIPE & QIB

- Higher Risk Tolerance

- Long term Capital appreciation

- Access to Unconventional Markets

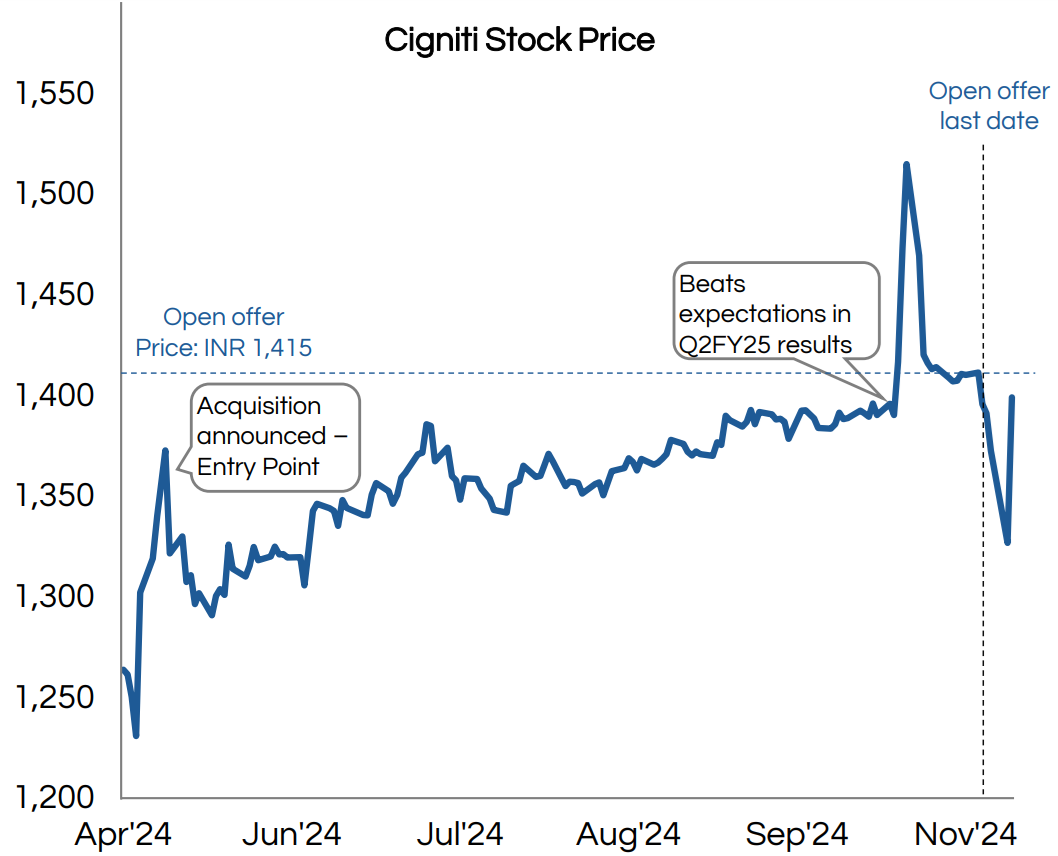

Special Situations

How can PMS benefit from situations of sudden increase in the prices of companies

| Details | Value |

|---|---|

| Trigger | May’24: Coforge agreed to acquire majority stake in Cigniti Technologies |

| Open Offer Price | INR 1,415 |

| Min. Acceptance | 57% |

| Est. Acceptance | 100% (based on assessment) |

| Est time to Complete | 4 months from the date of acquisition |

| Risk | Low as minimal approvals required |

- At INR 1358 WACA, there was an opportunity to get a minimum return of 4-5% in 4 months, providing annualized yield of of 14.4%

- But post a good quarterly result the stock went up, resulting in an XIRR of 33% in this situation

We are delighted to offer you a curated selection of the best-performing Portfolio Management Services (PMS) from across the country. Handpicked to match your unique financial goals, these PMS options combine expert strategies, personalized attention, and proven performance to deliver optimal results.Let us guide you through these exclusive opportunities to maximize your portfolio’s potential. Contact us today to learn more and start your journey toward financial excellence.

If interested, please fill out the Form and our team will get back to you!

Stay Connected.

Registered Address

73A, GC Avenue, Kolkata -13Corporate Address

Floor 5 , unit 501 Merlin Infinite DN-51, Street Number 11, DN Block, Sector V, Bidhannagar, Kolkata, West Bengal 700091Chennai Office

19/10, Guru Vappa Chetty Street, Chintadripet, Chennai - 600002

Dubai Office

2701, Executive Tower G, Business Bay, Dubai, UAE

Andhra Pradesh & Telangana Office

54-19-25/1, Flat no.101, Sai Residency, Nelson Mandela Park Road, LIC Colony, Vijayawada (Urban), Andhra Pradesh - 520008Altius Investech