Waaree Energies Unlisted Shares

Waaree Energies Ltd.

INE377N01017

Incorporation Date: 19-Sep-1989

Listing Status: Now Listed

About Waaree Energies Unlisted Shares

Overview of Waaree Energies Unlisted Shares

Waaree Energies Limited, established in 1989 and headquartered in Mumbai, India, is a leading force in the renewable energy sector, particularly solar energy. Boasting India’s largest aggregate installed capacity of 12GW across its plants in Gujarat as of June 30, 2023, Waaree has cemented its position as a key contributor to India’s clean energy transition. With a notable presence in the global solar module export market for Fiscal 2023, the company demonstrates its competitiveness and commitment to delivering high-quality renewable energy solutions worldwide.

| Company Name | Waaree Energies Limited |

| Company Type | Unlisted Public Company |

| Industry | Solar PV Modules and Solar Energy Solutions |

| Founded | 1989 |

| Headquarters | Mumbai, Maharashtra, India |

| Website | www.waaree.com |

Timeline

- 1985: The promoter starts trading in measuring instruments.

- 1991: Waaree Instruments begins manufacturing measuring instruments.

- 2007: Expands into solar module manufacturing with a 30MW line in Surat.

- 2011: Exits the instruments business, acquired by Baumer Group, and enters the EPC business.

- 2014: Forms a joint venture with NEEPCO for solar power projects in India.

- 2017: Acquires full ownership of Waaneep Solar, achieving a solar portfolio over 100 MW.

- 2017-2019: Commissions a 1 GW solar PV module plant. | Establishes a 49.5 MW solar power plant in Vietnam. | Sells Waaneep Solar to Hero Solar in tranches.

- 2019-2021: Increases manufacturing capacity to 2.0 GW and expands the franchisee network to over 300 solar power centers.

- 2022-2023: Expands manufacturing capacity to 12 GW and begins solar cell manufacturing with a targeted capacity of 5.4 GW by 2024.

Waaree: Subsidiary Companies

| Company Name | Remarks |

| Waaree Renewable Technologies Limited | The listed Engineering, Procurement, and Construction (EPC) arm of the company focuses on renewable energy projects in IPP and O&M, etc. As of July 27, 2024, the company had a market capitalisation of ₹ 1900 crore. |

| Waaree Technologies Limited: | Listed Energy Technology Company (ETC) arm, providing opportunities in solar energy and electrical storage systems. As on May 27, 2024, the company had a market capitalisation of ₹1500 crore. |

Manufacturing Plant Highlights

| Aspect | Details |

|---|---|

| Current Operations | - Operates four state-of-the-art plants in Gujarat - Total installed capacity: 12 GW |

| Expansion Plans | |

| - Solar Module Manufacturing | - Expanding to a consolidated capacity of 20 GW by FY 2024-25 - Includes 6 GW of ingot to module stage |

| - Solar Cell Manufacturing | - Targeting a capacity of 5.4 GW by March 2024 |

| Renewable Energy Commitment | - Secured a contract to establish a one MW green hydrogen plant |

| Strategic Positioning | - Expansion aims to meet growing solar energy demand in India and globally - Leverages a significant market opportunity through increased manufacturing capacities |

Product Portfolio

- PV module: Waaree Energies holds the distinction of being India’s largest solar panel manufacturer, with an impressive operational capacity of 12 GW for a range of solar PV modules. These modules (Mono PERC, Bifacial, BIPV, Flexible, and Polycrystalline) showcase the company’s commitment to diverse cutting-edge solar solutions.

- Inverter: Waaree Energies has gained industry recognition for its extensive range of quality, reliable, and efficient single and three-phase inverters. The company offers off-grid and on-grid inverters, addressing diverse energy needs and providing robust solutions for solar power systems.

- Solar products: Waaree Energies provides an extensive selection of solar products, such as solar street lights, home lighting systems, power packs, mobile chargers, and water pumps. These offerings address diverse energy requirements, reflecting the Company’s dedication to delivering sustainable solutions across various applications.

Future Products

- Green hydrogen manufacturing: The Waaree Group has secured a contract for a one-megawatt green hydrogen capacity, signaling its entry into green hydrogen production.

- Electrolyzer Manufacturing: The Group plans to manufacture electrolyzers to meet the increasing demand for green hydrogen, positioning itself as a sustainable energy solutions partner.

Aquisitions

Indo Solar Limited: In the fiscal year 2022-23, Waaree Energies strengthened its market presence by acquiring a 96.15% stake in Indo Solar Limited through the National Company Law Tribunal (NCLT) route. This strategic move is expected to enhance the company’s position in and around the National Capital Region (NCR).

Board Members

Insights of Waaree Energies Unlisted Shares

Financial Highlights

₹ in crores

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Total Income | 6860 | 2946 | 1983 |

| Profit After Tax | 500 | 80 | 46 |

| Earning per share | 21.82 | 3.84 | 2.36 |

Waaree Energies has demonstrated remarkable financial performance with a CAGR of 85.99% in total income and 200% in profit after tax over the past two years. This impressive growth reflects effective business strategies, successful market penetration, and efficient cost management, underscoring the company's strong position in the renewable energy sector and its ability to deliver significant value to stakeholders.

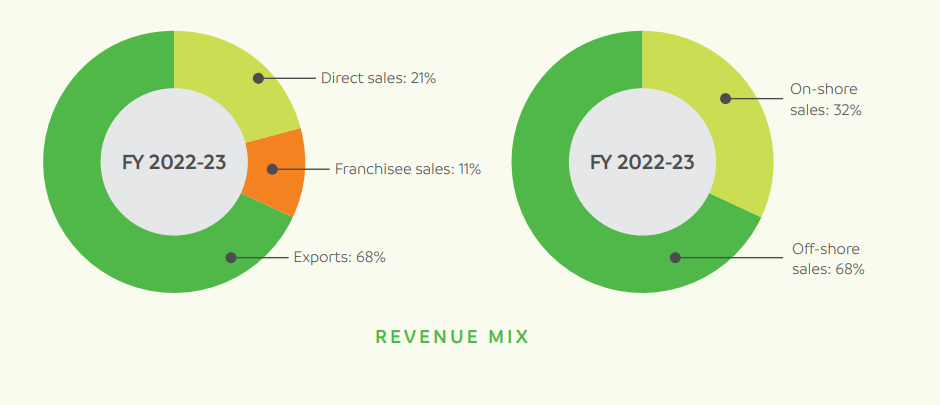

Revenue Mix

Industry Overview

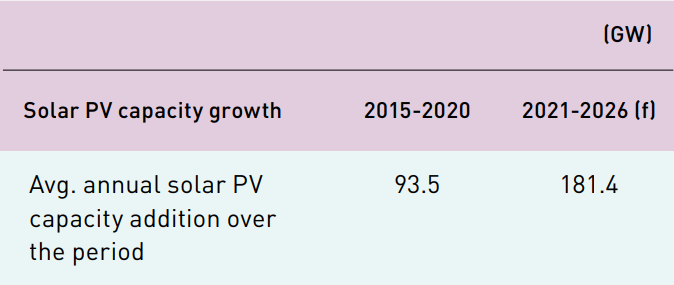

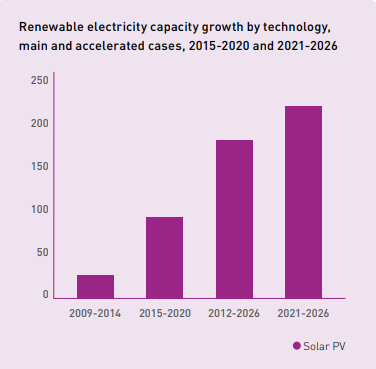

Global Solar PV Market Forecast

The global solar market is expected to grow at a faster pace over the next five years due to higher global renewable installations driven by the stronger policy support and ambitious climate targets announced for COP26. The International Energy Agency (IEA) forecasts that global solar capacity additions could reach approximately 1100 GW between 2021 and 2026, averaging 181.4 GW per year, nearly double the rate (93.5 GW) over the preceding five years.

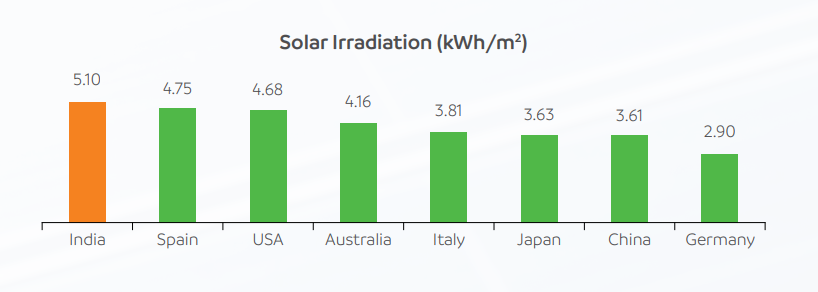

Indian Solar Market

As India announced to reach 280GW in solar power, the domestic solar market has the potential of an additional 230 GW of solar installations over the next nine years which is approximately 25 GW per year. In line with this ambitious goal, the government of India proposed an additional allocation of `19,500 crore for the Production Linked

Incentive for the manufacturing of high-efficiency modules in the Budget 2022-23.

Key trends influencing the solar sector:

- Ambitious climate change targets by major countries across the world.

- Large market opportunity led to many new players.

- Innovation in solar is driven by demand for highly efficient modules and emerging customer needs.

- Short-term price pressure on solar PV manufacturers due to rising commodity prices.

The Indian Prime Minister made five decisive commitments from India at the COP26 in 2021

- Increase its non-fossil energy capacity to 500 GW by 2030.

- Meet 50% of its energy requirements from renewable energy by 2030.

- Reduce its total carbon emissions by one billion tonnes from 2021 to 2030.

- Reduce the carbon intensity of its economy by more than 45%.

- Achieve net zero carbon footprint target by 2070.

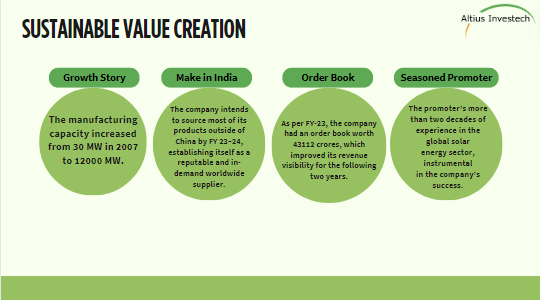

Powering Progress: Waaree Energies’ Growth and Vision

Waaree Energies has experienced remarkable growth, elevating its manufacturing capacity from 30 MW in 2007 to an impressive 12,000 MW. Embracing the Make in India initiative, the company aims to reduce reliance on Chinese imports by sourcing most products domestically by FY 23–24, positioning itself as a reliable global supplier. Bolstered by an order book worth 43,112 crores as of FY-23, Waaree enjoys enhanced revenue visibility for the next two years, reflecting strong demand and market confidence. This success is further underscored by the promoter’s extensive two-decade experience in the global solar energy sector, playing a pivotal role in Waaree’s journey to prominence.

Peer Comparison

| Particulars | Vikram Solar | Waaree Energies |

| Total Income | 2092 | 6860 |

| EBITDA | 187 | 944 |

| EBITDA Margins | 8.94% | 13.76% |

| PAT | 15 | 500 |

| Net Profit Margin | 0.7% | 7.3% |

| EPS | 0.56 | 21.82 |

| PEG ratio | 3.168 | 0.166 |

| Shares outstanding | 26 | 24 |

| Market Cap | 6988 | 48672 |

| CMP (29 April, 2024) | 270 | 2000 |

| P/E | 392.86 | 91.66 |

| P/S | 2.72 | 7.10 |

Recent News

Waaree Energies Secures 280 MW Solar Module Supply Order from Mahindra Susten

On February 27, 2024, Waaree Energies announced a significant order from Mahindra Susten for 280 MW of AHNAY Series Bi-55 545Wp solar modules, to be delivered in the third quarter of the next fiscal year. While the order value is undisclosed, Waaree Energies, with an annual capacity of 12 GW, reinforces its position as a leading solar module manufacturer in India.

Waaree Energies Partners with NTPC to Supply 135 MW Solar PV Modules

In November 2023, Waaree Energies Ltd. announced a partnership with NTPC Ltd. to supply over 135 MW of solar PV modules for a project in Anta, Rajasthan, to be completed within four months. This collaboration with NTPC, India's largest power utility with a 73,824 MW capacity, highlights the importance of advancing renewable energy initiatives.

IPO Plan

Waaree Energies has filed a DRHP for its IPO, marking a significant move towards sustainable energy solutions. The IPO comprises a fresh issue of shares worth Rs 3,000 crore, along with an offer for sale of 32 lakh shares. Prominent shareholders, including Promoter Waaree Sustainable Finance Pvt., Chandurkar Investments Pvt., and individual shareholder Samir Surendra Shah, are part of the offer for sale. Read more about Waaree Energy IPO Plan.

Primary Objective of the IPO

The primary objective of the IPO is to raise capital for establishing a state-of-the-art 6 GW ingot wafer, solar cell, and solar PV module manufacturing facility in Odisha, with approximately Rs 2,500 crore earmarked for this ambitious initiative. This reflects Waaree Energies’ commitment to expanding its manufacturing capabilities and contributing to India’s renewable energy landscape. The remaining funds will be utilized for general corporate purposes.

Lead Managers and Market Presence

The IPO is being managed by reputed financial institutions, including Axis Capital, IIFL Securities, Jefferies India, Nomura Financial Services, SBI Capital Markets, Intensive, and ITI Capital. As Waaree Energies embarks on this IPO journey, it not only aims to fuel its expansion plans but also contributes to the broader mission of promoting sustainable energy solutions. Investors and stakeholders anticipate this IPO, recognizing the company’s pivotal role in shaping the future of solar energy in India and beyond.

Awards and Recognitions

- RE Brand of the Year at RenewX Awards 2023.

- Atmanirbhar India State Business Leader – Modules, 2022.

- Best exporter of FY 2021-22.Best-performing Modules & Solar PV EPC Company of the Year, 2023.

- Solar EPC Company of the Year, 2022.

- Most preferred solar panels for rooftops in Maharashtra.

- Leading Renewable Energy Manufacturer at Green Energy Summit FY 2022-23.

- Most Preferred Workplaces in Manufacturing 2022-23’ by Marksmen International.

- Chief Executive of the Year (Renewables) from ET Energy Leadership Award.

Read our Deep Dive Blog on Waaree: Fueling the Future: A Deep Dive into Waaree Energies' Renewable Energy Odyssey (CLICK HERE)

Financial Charts of Waaree Energies Unlisted Shares

Balance Sheet of Waaree Energies Unlisted Shares

Profit and Loss of Waaree Energies Unlisted Shares

Ancillary of Waaree Energies Unlisted Shares

Ratio Analysis

Peers

Industry Benchmarking

Segment Revenue

Subsidaries

Security Allotment

Corporate Governance

Team Management Details

FAQs of Waaree Energies Unlisted Shares

-

How to buy Waaree Energies Ltd.?

Below are three ways through which you can purchase Waaree Energies Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to buy Waaree Energies Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

How to sell Waaree Energies Ltd.?

Below are three ways through which you can sell Waaree Energies Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to sell Waaree Energies Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

What is the price of Waaree Energies Ltd.?

We provide a two way quote on all the shares we deal in. Your buy price for Waaree Energies Ltd. is ₹2899 and your sell price for Waaree Energies Ltd. is ₹2500. The price is based on our estimates and market conditions.

-

What is the lock-in period of Waaree Energies Ltd.?

The lock-in period for Waaree Energies Ltd. varies depending on the category of investors:

- For retail Investors, HNIs, or Body Corporates, the lock-in period is 6 months from the date of the listing of Waaree Energies Ltd.

- For Venture Capital Funds or Foreign Venture Capital Investors, there is a lock-in period of 6 months from the date of acquisition of Waaree Energies Ltd.

- For AIF-II (Alternative Investment Funds - Category II), there is no lock-in period

August 2021 saw the introduction of this regulation by SEBI. The purpose of the regulation change, which lowered the lock-in period from a year to six months, was to incentivize additional investments in firms getting ready for initial public offerings, or IPOs. Since its introduction, a number of Portfolio Management Services (PMS) have advised their clients to purchase Pre-IPO shares in order to take advantage of the advantages associated with early-stage investments. This reduction in the lock-in period is considered as a significant step forward.

-

How is the Waaree Energies Ltd. price calculated?

Fundamental & Comparative valuation models and the forces of demand and supply in the market for unlisted shares dictate the price. These prices are based on our estimates and transaction history of Waaree Energies Ltd.. The price is also determined from the most recent funding round for Waaree Energies Ltd.. This provides us with a benchmark valuation, offering a clear indication of the company's current market value as perceived by investors and industry experts.

-

What are the lot sizes of Waaree Energies Ltd.?

We can generally arrange lot sizes starting with an investment of INR 20,000. To confirm the lot sizes of Waaree Energies Ltd. with us kindly click here.

-

What are the financials of Waaree Energies Ltd.?

The financials of Waaree Energies Ltd. which includes the P/L of Waaree Energies Ltd. and the Balance Sheet of Waaree Energies Ltd. is in the financials section (Click on link).

-

Where can I find the annual report of Waaree Energies Ltd.?

The annual report of Waaree Energies Ltd. is available in the annual report section (Click on link).

-

Is buying Waaree Energies Ltd. legal in India?

Yes, buying and selling unlisted shares in India is indeed 100% legal. This activity is regulated and governed under the guidelines provided by the Securities and Exchange Board of India (SEBI). Investors and traders must adhere to these regulations and guidelines to ensure compliance with legal and financial standards. It's important for participants in the unlisted share market to be aware of and understand these regulations to engage in transactions legally and securely.

-

Short-term Capital Gain taxes to be paid on Waaree Energies Ltd.?

When you sell unlisted shares within a period of two years from the date of acquisition, any profit earned from the sale is classified as Short-term Capital Gain (STCG). This gain is then added to your total income for that financial year. The tax on this short-term capital gain is calculated based on your applicable individual income tax slab rates. Therefore, the rate at which you will pay tax on the STCG from unlisted shares depends on your total income, including this gain, and the tax slab it falls under as per the prevailing income tax laws in India. It's important for investors to consider these tax implications when engaging in transactions involving unlisted shares.

-

Long-term Capital Gain taxes to be paid on Waaree Energies Ltd. and how are They Taxed?

Long-term Capital Gains (LTCG) on unlisted shares in India refer to the profits earned from the sale of unlisted shares that have been held for more than two years. The key aspects of LTCG on unlisted shares include:

- Tax Rate: LTCG on unlisted shares is taxed at a rate of 20%.

- Indexation Benefit: This is a significant advantage for investors. Indexation allows for adjusting the purchase price of the shares for inflation, which can reduce the taxable gain.

- Importance for Investors: Understanding LTCG is crucial, especially for High Net-worth Individuals (HNIs) and retail investors, as it impacts their investment strategy and tax planning. Knowing these details helps in making informed investment decisions.

- Calculation: LTCG is calculated by subtracting the indexed cost of acquisition (the purchase price adjusted for inflation) from the sale price of the shares. The profit thus calculated is subject to a 20% tax.

- Applicability: LTCG tax is applicable to profits from the sale of unlisted shares held for more than two years.

- Relevance: This tax is particularly relevant to investors in the unlisted share market, including those considering selling their holdings after a period of more than two years.

-

Applicability of Taxes on Waaree Energies Ltd. once it is listed?

When shares initially bought in the unlisted market become listed, the taxation rules change significantly if these shares are sold through a stock exchange. Here's what investors need to know:

Transition to Listed Market Tax Rates: Once unlisted shares are listed on the stock exchange and subsequently sold, the tax rates applicable to listed securities come into effect. This shift means that the favourable tax treatments for listed shares, as per the prevailing tax laws, will apply.

Taxation Based on Holding Period: The crucial factor in determining the type of capital gains tax (Long-term or Short-term) is the holding period of the shares. Importantly, this period is calculated from the original purchase date when the shares were unlisted.

Long-term vs. Short-term Capital Gains: If the shares are sold after being held for more than one year from the date of purchase (including the period when they were unlisted), they are subject to Long-term Capital Gains (LTCG) tax.

Conversely, if sold within one-year, Short-term Capital Gains (STCG) tax rates apply.

Significance for Investors: This information is vital for investors in the unlisted market, as it impacts their tax planning and decision-making process. Understanding these nuances ensures that investors can strategically plan the sale of their shares post-listing to optimize tax implications.

Advice for Investors: It's advisable for investors to keep a record of their purchase dates and monitor the listing dates closely. Additionally, staying updated with the latest tax regulations or consulting with a financial advisor is recommended for accurate tax calculations and compliance. -

How does Altius Investech source Waaree Energies Ltd.?

At Altius Investech, our approach to sourcing Boat Unlisted Share (Imagine Marketing) involves a strategic and direct method. Primarily, we acquire these shares from the below key groups:

Employees of the Company: Employee stock option plans (ESOPs) or other compensation packages frequently include shares for firm employees. For a various reasons, such as including portfolio diversification or financial considerations, some of these employees may eventually choose to sell their shares. We engage with these employees, providing them a platform to sell their shares.

Initial Investors: These are the angel or early-stage investors who provided capital to the business in its early stages. These original investors may look to sell all or part of their ownership position in the company as it develops and flourishes. This might be done for various reasons such as in order to maximise their investment, reallocate resources, or make other calculated financial decisions.

Funding rounds and VC funds: Altius Investech sources the shares from private placement rounds in which private companies seek to obtain capital from the market. Through our platform, venture capital funds can liquidate their shares and we receive the inventory from them when they decide to sell a portion of their ownership through block trades.

By establishing connections with these groups, Altius Investech guarantees our clients a steady and dependable supply of Boat Unlisted Share (Imagine Marketing). This process not only makes it easier for employees and initial investors in liquidating their assets, but it also gives our clients access to shares that aren't often found on the open market. Our platform effectively facilitates a win-win situation for both buyers and sellers. -

How to trust Altius Investech before buying Waaree Energies Ltd. from its platform?

Altius Investech stands at being India's fastest growing and leading marketplace for buying and selling unlisted shares. We believe in enabling access to alternative sources of investments at lower entry barriers to private equity investments.

With more than 25 years of experience, Altius Investech has carved a niche in the financial market by serving more than 8000 clients. The incredible journey is further highlighted by the vast number of transactions that Altius Investech has facilitated transactions that have already exceeded 300 crores.

For investors Altius Investech curates investment opportunities in companies at reasonable valuations which are on the verge of an IPO leading to massive value unlocking. Investments are backed by thorough research and sound investment thesis, with a time bound exit plan.

For ESOP Shareholder and existing Investors, we assist them to liquidate their shares even if they are not publicly traded by creating a platform where we find the right buyers and sellers for the best prices.

Altius Investech have been featured in top media news outlets like Economic Times, Financial Express, Money control. Check out about us on these - leading publications (Click on link) Our journey over these years has not just been about numbers; it's been about building trust and reliability.

We at Altius Investech are dedicated to upholding the greatest levels of ethics and transparency, making sure that your investment experience is not only profitable but also safe and reliable.

Press of Waaree Energies Unlisted Shares

Featured Blogs of Waaree Energies Unlisted Shares

Annual Report of Waaree Energies Unlisted Shares

Company Information of Waaree Energies Unlisted Shares

Featured Companies