About the Company: Waaree Energies

Waaree Energies Limited, established in 1989 and headquartered in Mumbai, India, is a leading force in the renewable energy sector, particularly solar energy. Boasting India’s largest aggregate installed capacity of 12GW across its plants in Gujarat as of June 30, 2023, Waaree has cemented its position as a key contributor to India’s clean energy transition. With a notable presence in the global solar module export market for Fiscal 2023, the company demonstrates its competitiveness and commitment to delivering high-quality renewable energy solutions worldwide.

Serving a diverse clientele of 407 customers in India and 20 customers abroad, Waaree has established itself as a trusted provider of solar energy solutions, backed by its track record of supplying over 6GW of solar modules and commissioning more than 1.1GW of solar EPC projects. Through its relentless focus on innovation, sustainability, and excellence, Waaree continues to drive the adoption of solar energy, contributing significantly to the fight against climate change and advancing the renewable energy agenda.

| Company Name | Waaree Energies Limited |

| Company Type | Unlisted Public Company. Buy Waaree Energy Unlisted Shares |

| Industry | Solar PV Modules and Solar Energy Solutions |

| Founded | 1989 |

| Headquarters | Mumbai, Maharashtra, India |

| Website | www.waaree.com |

Vision and Mission

Vision

- Waaree Energies’ vision is to provide high-quality and cost-effective sustainable energy solutions across all markets.

- They aim to reduce carbon footprint, paving the way for sustainable energy.

- Their goal is to improve the quality of present and future human life through their initiatives.

Mission

By their commitment to its stakeholders, Waaree Energies Limited strives for continuous improvement in the quality of their products and services.

Subsidiary Companies

| Company Name | Remarks |

| Waaree Renewable Technologies Limited | The listed Engineering, Procurement, and Construction (EPC) arm of the company focuses on renewable energy projects in IPP and O&M, etc. As of July 31, 2023, the company had a market capitalisation of H2,911 crore. |

| Waaree Technologies Limited: | Listed Energy Technology Company (ETC) arm, providing opportunities in solar energy and electrical storage systems. As on July 31, 2023, the company had a market capitalisation of H463 crore. |

Manufacturing Plant

Waaree Energies currently operates four state-of-the-art plants in Gujarat with a total installed capacity of 12 GW. The company plans to expand further, aiming for an additional 6 GW of backward integration from ingot to module stage, potentially reaching a consolidated capacity of 20 GW by FY 2024-25. Additionally, Waaree Energies is set to achieve a cell manufacturing capacity of 5.4 GW by FY 2023-24. Recently, the Waaree Group secured a contract to establish a one MW green hydrogen plant, reaffirming its commitment to renewable energy solutions.

Manufacturing Capacities

- Solar module manufacturing: Waaree Energies has increased its solar module manufacturing capacity to 12 GW and is currently undergoing expansion to reach 20 GW by FY 2024-25, including 6 GW of ingot to wafer manufacturing. This expansion strategically positions the company to meet the growing demand for solar energy in India and globally, leveraging a significant market opportunity.

- Solar cell manufacturing: The anticipated solar cell manufacturing capacity is set to reach 5.4 gigawatts (GW) by March 2024.

Product Portfolio

- PV module: Waaree Energies holds the distinction of being India’s largest solar panel manufacturer, with an impressive operational capacity of 12 GW for a range of solar PV modules. These modules (Mono PERC, Bifacial, BIPV, Flexible, and Polycrystalline) showcase the company’s commitment to diverse cutting-edge solar solutions.

- Inverter: Waaree Energies has gained industry recognition for its extensive range of quality, reliable, and efficient single and three-phase inverters. The company offers off-grid and on-grid inverters, addressing diverse energy needs and providing robust solutions for solar power systems.

- Solar products: Waaree Energies provides an extensive selection of solar products, such as solar street lights, home lighting systems, power packs, mobile chargers, and water pumps. These offerings address diverse energy requirements, reflecting the Company’s dedication to delivering sustainable solutions across various applications.

Future Products:

- Green hydrogen manufacturing: The Waaree Group has secured a contract for a one-megawatt green hydrogen capacity, signaling its entry into green hydrogen production.

- Electrolyzer manufacturing: The Group plans to manufacture electrolyzers to meet the increasing demand for green hydrogen, positioning itself as a sustainable energy solutions partner.

Diversified Offerings

- BIPV (Building-Integrated Photovoltaics): These panels seamlessly incorporate solar panels into building designs, enhancing aesthetics and energy efficiency. These integrated systems generate electricity while serving as functional building elements, contributing to sustainability.

- Flexible solar panels: These are lightweight adaptable photovoltaic devices that can be installed on various surfaces, including curved or irregular ones. Their flexibility enables them to conform to different shapes and structures, expanding the possibilities for integrating solar energy into a range of applications and environments.

- Bifacial solar panels: These are advanced photovoltaic modules that capture sunlight not only from the front but also from the rear. This design allows them to generate electricity from direct and reflected sunlight, increasing energy output.

- Monocrystalline PERC (Passivated Emitter and Rear Cell): These solar panels are high-efficiency photovoltaic modules. They feature a single crystal structure that enhances electron flow, and the passivation layer on the rear side improves energy capture. This technology results in improved overall performance and greater energy generation.

- Polycrystalline solar panels: These are photovoltaic modules made from multiple silicon crystal fragments. They are more cost-effective to produce. Polycrystalline panels offer a balance between efficiency and affordability, making them a popular choice for solar energy installations.

Acquisitions

Indo Solar Limited: In the fiscal year 2022-23, Waaree Energies strengthened its market presence by acquiring a 96.15% stake in Indo Solar Limited through the National Company Law Tribunal (NCLT) route. This strategic move is expected to enhance the company’s position in and around the National Capital Region (NCR).

Digital Edge

- Online store: Waaree’s online store offers a comprehensive one-stop shop for solar solutions. Providing a variety of solar kits and convenient financing options from all major lenders.

- Waaree Experts: Waaree Energies embarked on a journey to onboard electricians to support installation, commissioning, real-time troubleshooting, and other servicing needs of customers, reinforcing the gig economy of India.

- Waaree Prime: This pioneering programme by Waaree Energies rewards partners for exceptional contribution, fostering a robust service ecosystem, and enhancing customer satisfaction.

Management of the Company

Hitesh Chimanlal Doshi: Chairman & Managing Director of Waaree Energies

Hitesh Chimanlal Doshi, the company’s founder and promoter since 1989, holds a key position within the organization. With over 21 years of experience in the engineering industry, he oversaw the company’s financial performance, investments, and business ventures. Mr. Doshi played a crucial role in providing strategic advice to the Board, developing and executing the company’s business strategies, and establishing policies and legal guidelines. He holds a Bachelor’s degree in Commerce from the University of Mumbai and a Doctorate in professional entrepreneurship in business project management from the European Continental University.

Hitesh Pranjivan Mehta: Whole-time Director & CFO of Waaree Energies

Hitesh Pranjivan Mehta has served as a director in the Waaree Group since April 1, 2011, bringing over 22 years of expertise in engineering, solar, and oil industries. He played a pivotal role in leading the company’s short and long-term strategy and establishing strategic goals. Hitesh Pranjivan Mehta previously served as a Director at Waaree Instruments Limited. He holds a Bachelor’s degree in Commerce from the University of Bombay and is a member of the Institute of Chartered Accountants of India.

Richa Manoj Goyal : Independent Director of Waaree Energies

Richa Manoj Goyal has been a valued member of the company since 2021. She holds qualifications as a Company Secretary and LLB and operates as the Proprietor of RM Legal, a leading law firm in Surat. The firm caters to all kinds of industries for matters related to Corporate laws, IBC code, GST, Trademarks, Copyright, Patents and Design act, Insolvency, and Bankruptcy code, drafting and reviewing of legal agreements, startup consulting, and documentation. Her firm handles trademark and patent registration on a national and international level. Her team comprises Chartered Accountants, Company Secretaries, and Lawyers. She is a qualified CS and LLB from Ahmedabad.

Industry Overview

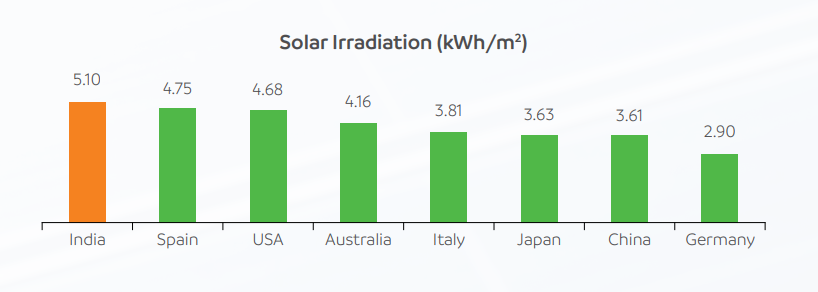

India is recognized as one of the world’s prime destinations for solar energy, boasting a substantial landmass and a tropical climate that ensures extensive sunlight exposure. With approximately 5,000 trillion kWh of solar radiation annually and around 300 sunny days per year, the country has immense solar energy potential, far surpassing its current requirements. This reality underscores the importance for companies like Waaree Energies to aggressively expand their capacity to manufacture solar modules, meeting the burgeoning demand for renewable energy nationwide. Moreover, these assurances have led to the formulation of national policies supporting renewable energy companies like Waaree Energies, facilitating long-term growth and development. The Indian government’s commitment to decarbonization aligns with the global transition towards renewable energy sources.

The Indian Prime Minister made five decisive commitments from India at the COP26 in 2021

- Increase its non-fossil energy capacity to 500 GW by 2030.

- Meet 50% of its energy requirements from renewable energy by 2030.

- Reduce its total carbon emissions by one billion tonnes from 2021 to 2030.

- Reduce the carbon intensity of its economy by more than 45%.

- Achieve net zero carbon footprint target by 2070.

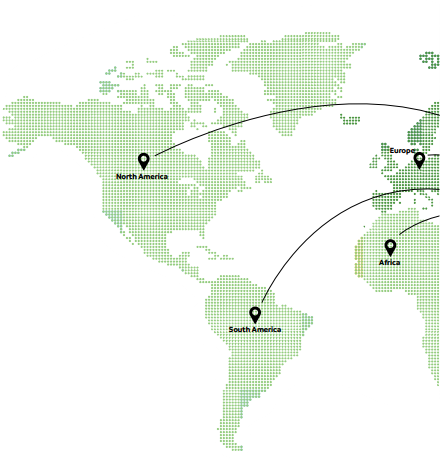

Global Market Presence and Reach

With a robust market presence, the company boasts over 300 franchises and operates more than 1400 retail sales points throughout India. Its reach extends across 20 countries, including regions in North America, Europe, the Middle East, Asia, Africa, and Australia.

.

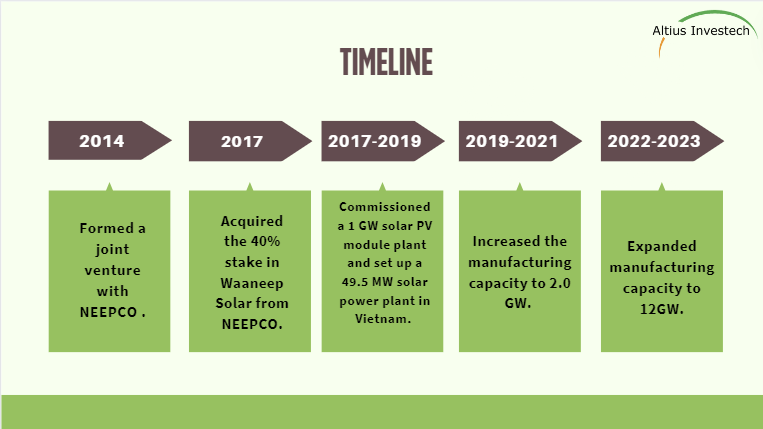

Expansion and Strategic Development: Waaree Energies’ Journey in Renewable Energy (2017-2023)

Between 2017 and 2023, Waaree Energies Limited significantly expanded its operations and capabilities in the renewable energy sector. This included forming a joint venture, acquiring a stake in Waaneep Solar, commissioning a solar PV module plant, and increasing manufacturing capacity to 12 GW. These strategic moves underscore Waaree’s commitment to growth and innovation in renewable energy

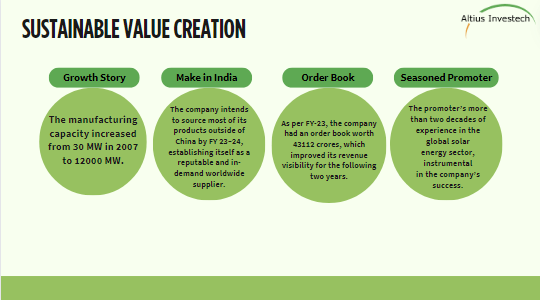

Powering Progress: Waaree Energies’ Growth and Vision

Waaree Energies has experienced remarkable growth, elevating its manufacturing capacity from 30 MW in 2007 to an impressive 12,000 MW. Embracing the Make in India initiative, the company aims to reduce reliance on Chinese imports by sourcing most products domestically by FY 23–24, positioning itself as a reliable global supplier. Bolstered by an order book worth 43,112 crores as of FY-23, Waaree enjoys enhanced revenue visibility for the next two years, reflecting strong demand and market confidence. This success is further underscored by the promoter’s extensive two-decade experience in the global solar energy sector, playing a pivotal role in Waaree’s journey to prominence.

Waaree Energies: Awards

Brand:

- RE Brand of the Year at RenewX Awards 2023.

- Atmanirbhar India State Business Leader – Modules, 2022.

- Best exporter of FY 2021-22.

EPC:

- Best-performing Modules & Solar PV EPC Company of the Year, 2023.

- Solar EPC Company of the Year, 2022.

- Most preferred solar panels for rooftops in Maharashtra.

Module Manufacturing:

- Leading Renewable Energy Manufacturer at Green Energy Summit FY 2022-23.

- ‘Most Preferred Workplaces in Manufacturing 2022-23’ by Marksmen International.

Senior Management:

- Chief Executive of the Year (Renewables) from ET Energy Leadership Award.

Highlights of FY 2022-2023

During the year under review, Waaree Energies partnered with Shree Jay Ambe Mahila Mandal in Sanjan. This organisation is committed to promoting health awareness and providing free medical checks in rural areas. The company collaborated with this NGO, prioritising health checks leading awareness initiatives in rural communities.

Peer Comparison (as on 07.03.2023)

| Particulars | Waaree | Adani Green |

| Total Income | 6860 | 7792 |

| PAT | 500 | 973 |

| EPS | 21.82 | 6.15 |

| CMP (March 24) | 2000 | 1950 |

| P/E | 95.55 | 317 |

| Market Cap | 50741.83 Cr | 309200 |

Recent News

Waaree Energies Files DRHP for IPO to Raise ₹3000 Crore

Waaree Energies Limited, India’s largest solar PV module manufacturer with an installed capacity of 12 GW, has filed a Draft Red Herring Prospectus (DRHP) with SEBI for an IPO to raise to ₹3000 crore. The IPO will include a fresh issue of equity shares and an offer for sale of up to 3,200,000 Equity Shares. The proceeds will be used to establish a 6 GW manufacturing facility in Odisha and for general corporate purposes. Axis Capital Limited, IIFL Securities Limited, Jefferies India Private Limited, Nomura Financial Advisory and Securities (India) Private Limited, SBI Capital Markets Limited, Intensive Fiscal Services Private Limited, and ITI Capital Limited will be the Book Running Lead Managers for the issue.

Waaree Energies Secures 280 MW Solar Module Supply Order from Mahindra Susten

On February 27, 2024, Waaree Energies announced securing a significant order from Mahindra Susten for the supply of 280 MW of solar modules. The agreement between the two companies entails the delivery of AHNAY Series Bi-55 545Wp modules, with the expected delivery slated for the third quarter of the next fiscal year. While the order value remains undisclosed, Waaree Energies, a leading solar module manufacturer in India with a capacity of 12 GW per year, affirms its position as a key player in the renewable energy sector.

Waaree Energies Partners with NTPC to Supply 135 MW Solar PV Modules

In November 2023, Waaree Energies Ltd. announced a partnership with NTPC Ltd. to supply over 135 MW of solar photovoltaic (PV) modules for a solar power project in Anta, Rajasthan. The completion of this order is expected within four months. NTPC Ltd., India’s largest power utility company, with an installed capacity of 73,824 MW, underscores the significance of this collaboration in advancing renewable energy initiatives.

IPO Plans

Waaree Energies has filed a Draft Red Herring Prospectus (DRHP) for its initial public offering (IPO), marking a significant move towards sustainable energy solutions. The IPO comprises a fresh issue of shares worth Rs 3,000 crore, along with an offer for sale of 32 lakh shares. Prominent shareholders, including Promoter Waaree Sustainable Finance Pvt., Chandurkar Investments Pvt., and individual shareholder Samir Surendra Shah, are part of the offer for sale. Read more about Waaree Energy IPO Plan.

Primary Objective of the IPO

The primary objective of the IPO is to raise capital for establishing a state-of-the-art 6 GW ingot wafer, solar cell, and solar PV module manufacturing facility in Odisha, with approximately Rs 2,500 crore earmarked for this ambitious initiative. This reflects Waaree Energies’ commitment to expanding its manufacturing capabilities and contributing to India’s renewable energy landscape. The remaining funds will be utilized for general corporate purposes.

Lead Managers and Market Presence

The IPO is being managed by reputed financial institutions, including Axis Capital, IIFL Securities, Jefferies India, Nomura Financial Services, SBI Capital Markets, Intensive, and ITI Capital. As Waaree Energies embarks on this IPO journey, it not only aims to fuel its expansion plans but also contributes to the broader mission of promoting sustainable energy solutions. Investors and stakeholders anticipate this IPO, recognizing the company’s pivotal role in shaping the future of solar energy in India and beyond.

Waaree Energies Limited Share Price (as of 07.03.2024)

- The buy price of Waaree Energies varies based on quantity, ranging from 2105 for quantities between 26-99 shares to 2085 for quantities between 1001 – 9999 shares, with corresponding rates per share.

- The 52-week high is 2085, and the 52-week low is 555 indicating the range of fluctuations in the share price. Additionally, the sell price of Waaree Energies is fixed at 1825.

Currently, Waaree Energies Limited Share Price is trading at around Rs. 2085/share.

Financial Metrics for Waaree Energies(as of 07.03.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 95.55 |

| Price to Sales Ratio (P/S) | 7.41 |

| Price to Book Value (P/B) | 27.25 |

| Industry PE | 17.3 |

| Face Value | ₹ 10 |

| Book Value | ₹ 76 |

| Market Cap | ₹50741.83 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

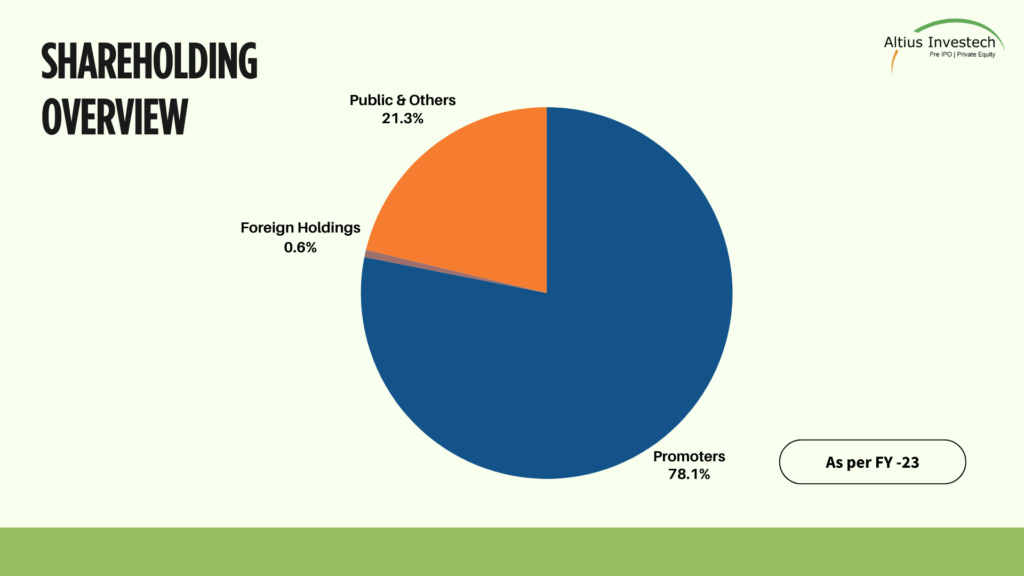

Shareholdings

| Shareholding Above 5% | Holding % |

| Waaree Sustainable Finance Private Limited | 23.68 |

| Hitesh Chimanlal Doshi | 5.8 |

| Viren Chimanlal Doshi | 4.5 |

Financials

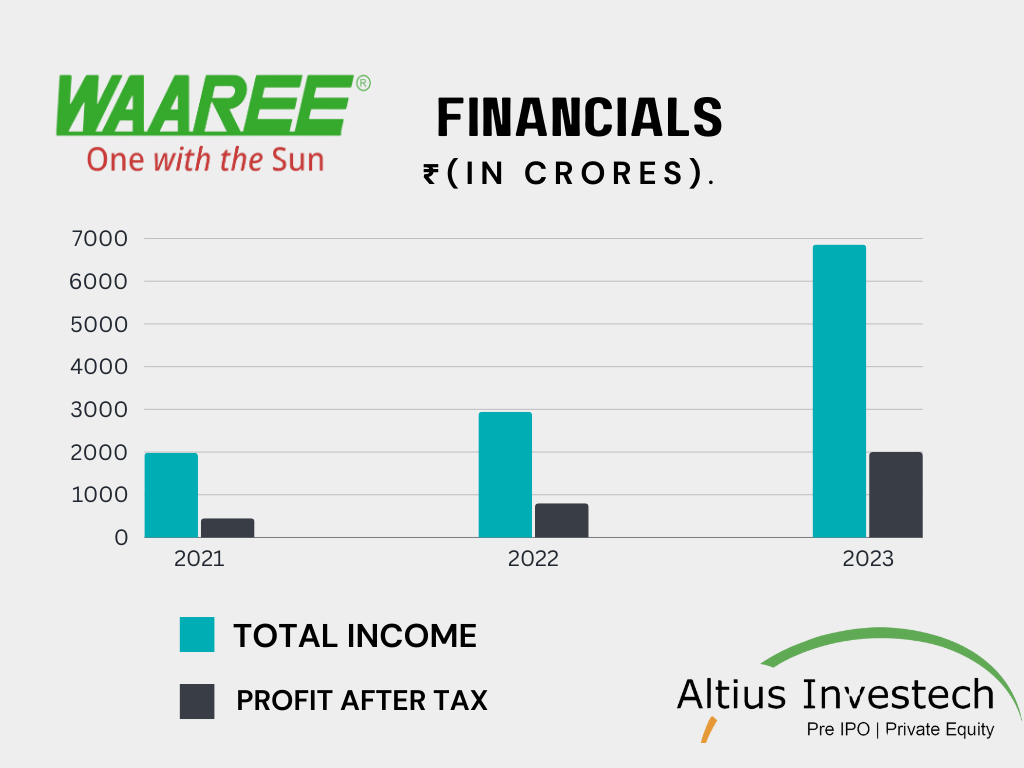

₹(in crores)

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Total Income | 6860.36 | 2945.85 | 1983.009 |

| Profit After Tax | 500.295 | 79.65 | 45.605 |

| Earning per share | 21.82 | 3.84 | 2.36 |

The impressive CAGR of 85.99% in total income and 200% in profit after tax over the past two years showcases the remarkable financial performance and rapid expansion of the company. This growth indicates a strong upward trajectory in revenue generation and profitability, reflecting effective business strategies, successful market penetration, and efficient cost management. Such substantial CAGR figures underscore Waaree Energies’ robust position in the renewable energy sector and its ability to capitalize on market opportunities while delivering value to stakeholders.

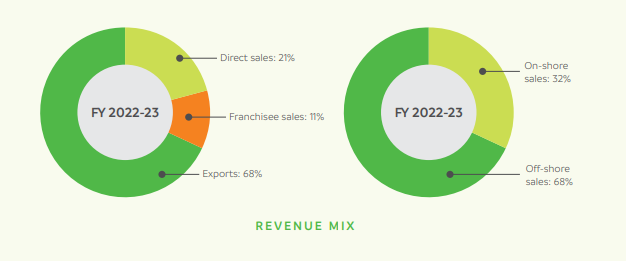

Revenue Mix

₹(in crores)

| Particulars | FY 2023 | FY 2022 |

| India | 1979 | 2171 |

| Outside India | 4616 | 658 |

| Total | 6595 | 2829 |

Waaree Energies focused on enhancing its presence in the international markets majorly Europe and US. The result is that exports climbed, and the company emerged as a dependable supplier to some of the largest marquee names in those markets, a substantial entry barrier for other players.

Conclusion

- Leading Player in Renewable Energy: Waaree Energies is a prominent player in the renewable energy sector, particularly in solar energy, with a robust presence both in India and abroad.

- India’s Largest Installed Capacity: As of June 30, 2023, Waaree Energies boasts India’s largest aggregate installed capacity of 12GW across its plants in Gujarat, showcasing its significant contribution to the nation’s clean energy transition.

- Aggressive Capacity Expansion: Committed to meeting the surging demand for solar energy, Waaree Energies is focused on expanding its manufacturing capabilities, aiming to reach a consolidated capacity of 20GW by FY 2024-25.

- IPO Plans: Waaree Energies filed its DRHP for an IPO with SEBI, seeking to raise Rs 3,000 crore through a fresh issue of shares and an offer for sale of up to 3,200,000 Equity Shares. The funds will primarily finance a 6 GW manufacturing facility in Odisha, underscoring the company’s commitment to renewable energy expansion. Read more about Waaree Energy IPO Plans.

- Financials: The company’s strong financial performance, reflected in its total income and profit after tax, underscores its resilience and growth trajectory. With a strategic focus on innovation and expansion, Waaree Energies is well-positioned to capitalize on emerging opportunities in the renewable energy sector.

- Product Portfolio: Waaree Energies’ diverse range of solar products, including PV modules, inverters, and solar solutions, highlights its commitment to providing high-quality and sustainable energy solutions. The company’s focus on innovation and sustainability underscores its leadership in the renewable energy space.

- Strategic Partnerships: Waaree Energies’ strategic collaborations with key players like NTPC Ltd. and Mahindra Susten underscore its leadership position and market relevance in the renewable energy landscape.

- Commitment to Sustainability: Through initiatives like its recent IPO filing and a strong focus on sustainability, Waaree Energies continues to drive innovation and progress in the renewable energy sector, contributing to a greener future.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/