Spray Engineering Devices Unlisted Shares

Spray Engineering Devices Ltd.

INE528I01015

Incorporation Date: 08-Nov-2004

Listing Status: DRHP Not Filed

About Spray Engineering Devices Unlisted Shares

Overview of Spray Engineering Devices Unlisted Shares

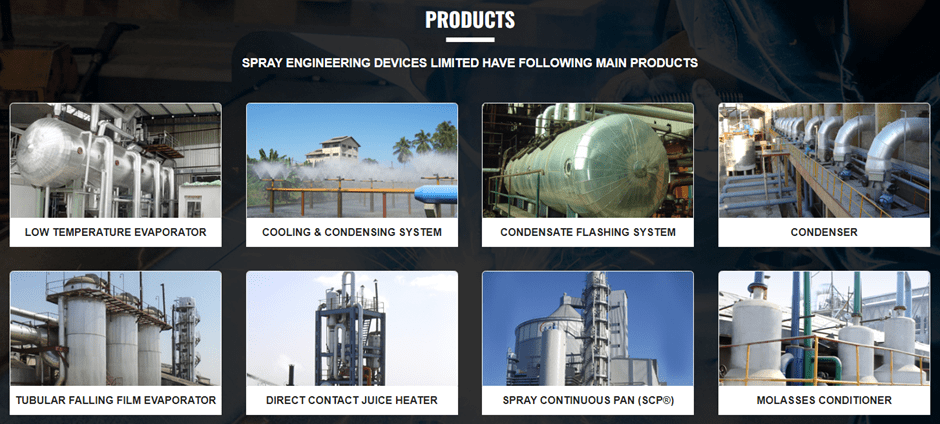

Spray Engineering Devices Limited (SED) is pioneer in the fields of Evaporation, Heat Exchanger, Condensation and Crystallization. Established in 2004 from a modest start of manufacturing of spray nozzles, SED today has established its existence in many countries by providing innovative technologies and solutions for sugar & allied industries. SED has offered modern designed, engineered equipment’s, project management consultancy for green as well as brown field sugar & allied projects, complete plant automation, EPC solutions & turnkey projects.

- They have three modern fabrication & automation units at Baddi, Himachal Pradesh, India. Their products are successfully commissioned in more than 500 Sugar factories in India and around 40 countries globally.

- The steam consumption of sugar industry has been reduced to 25% on cane using SED's Innovative products and technologies. The power (40 kW/Ton) consumption has been reduced up to 22-24 kW/Ton on cane and factory has managed to operate with Zero freshwater management.

- SED has also established Boiler Free Jaggery Production Unit for 100% bagasse saving which is commercially available for a sustainable technological solution assuring profitable business proposition.

- The innovation Index of SED is evident from more than 90 innovative and design patent granted globally in the name of the company.

Business Verticals

Products

Clientele

Insights of Spray Engineering Devices Unlisted Shares

Consolidated Financial Highlights

| Metric (₹ in crores) | FY 2024-25 | FY 2023-24 | % Growth / (Decline) |

|---|---|---|---|

| Operational Revenue | 460.97 | 547.35 | (15.79%) ↓ |

| EBITDA | 38.76 | 88.22 | (72.34%) ↓ |

| PBT (Profit Before Tax) | 20.56 | 74.34 | (72.34%) ↓ |

| PAT (Profit After Tax) | 14.75 | 53.16 | (71.75%) ↓ |

| Reserves (Other Equity) | 179.94 | 100.69 | +78.73% ↑ |

| Book Value (₹ per share) | 81.68 | 47.76 | +71.03% ↑ |

Operational Revenue: Declined by 15.79%, reflecting a temporary contraction in business activity after a high base year

EBITDA: Dropped by 72.34%, indicating pressure on margins due to higher input costs and subdued operating leverage.

-

PAT (Profit After Tax): Fell by 71.75%, as profitability moderated alongside lower revenues and increased depreciation and finance costs.

-

EPS (Earnings Per Share): Decreased by 74.36%, in line with the drop in net profit.

-

Reserves: Expanded by 78.73%, mainly driven by fresh equity infusion and retained earnings, strengthening the balance sheet.

-

Book Value: Rose by 66.31%, underscoring enhanced shareholder equity and long-term financial stability.

Private Placement Details of Spray Engineering (16th May 2024):

Type of Issue: Private Placement of Equity Shares

Issue Price: ₹277 per share

- Face Value: ₹10 per share

- Premium: ₹267 per share

Number of Equity Shares Issued: 25,09,642 shares

Total Amount Raised: ₹69,51,56.634 (₹277 × 25,09,64.2 shares)

For the official notice and further details, please visit the provided link.

https://drive.google.com/file/d/1D_R1bLhSiL2wcLWC5d8gXTL6QReBs-Ms/view?usp=drivesd

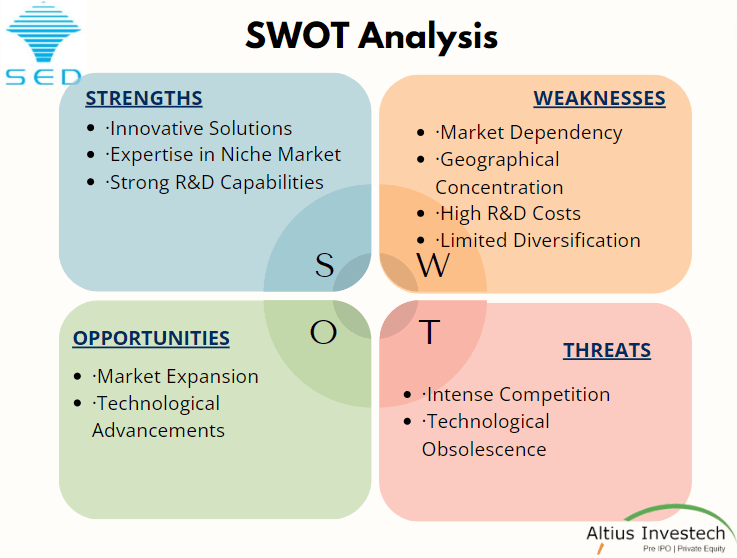

SWOT Analysis

Industry Outlook

In FY 2024–25, India’s engineering sector continued its strong momentum, reaching an estimated market size of around USD 110 billion, expanding at a steady ~10% CAGR driven by robust domestic manufacturing and infrastructure investments. Engineering exports surged to USD 116.7 billion, up 6.7% YoY from USD 109.2 billion in FY 2023–24, accounting for over 26% of India’s total merchandise exports, with the US, UAE, Saudi Arabia, UK, and Germany remaining key destinations. Imports also rose moderately to USD 58–60 billion, largely from China, Japan, and Germany, reflecting continued demand for high-value machinery and components. The sector’s growth in 2025 is underpinned by rising global orders in auto components, industrial machinery, and EPC projects, alongside India’s expanding role as a preferred engineering and manufacturing hub.

Funding

The company recently raised 72 Crs from 24 investors at a premium of 277/- Per share on a share of FV 10/. These investors were totally allotted 25 Lacs Shares (Approx) valuing the company at 720 Crs.

Financial Charts of Spray Engineering Devices Unlisted Shares

Balance Sheet of Spray Engineering Devices Unlisted Shares

Profit and Loss of Spray Engineering Devices Unlisted Shares

Ancillary of Spray Engineering Devices Unlisted Shares

Ratio Analysis

Peers

Industry Benchmarking

Segment Revenue

Subsidaries

Security Allotment

Corporate Governance

Team Management Details

FAQs of Spray Engineering Devices Unlisted Shares

-

How to buy Spray Engineering Devices Ltd.?

Below are three ways through which you can purchase Spray Engineering Devices Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to buy Spray Engineering Devices Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

How to sell Spray Engineering Devices Ltd.?

Below are three ways through which you can sell Spray Engineering Devices Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to sell Spray Engineering Devices Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

What is the price of Spray Engineering Devices Ltd.?

We provide a two way quote on all the shares we deal in. Your buy price for Spray Engineering Devices Ltd. is ₹245 and your sell price for Spray Engineering Devices Ltd. is ₹215. The price is based on our estimates and market conditions.

-

What is the lock-in period of Spray Engineering Devices Ltd.?

The lock-in period for Spray Engineering Devices Ltd. varies depending on the category of investors:

- For retail Investors, HNIs, or Body Corporates, the lock-in period is 6 months from the date of the listing of Spray Engineering Devices Ltd.

- For Venture Capital Funds or Foreign Venture Capital Investors, there is a lock-in period of 6 months from the date of acquisition of Spray Engineering Devices Ltd.

- For AIF-II (Alternative Investment Funds - Category II), there is no lock-in period

August 2021 saw the introduction of this regulation by SEBI. The purpose of the regulation change, which lowered the lock-in period from a year to six months, was to incentivize additional investments in firms getting ready for initial public offerings, or IPOs. Since its introduction, a number of Portfolio Management Services (PMS) have advised their clients to purchase Pre-IPO shares in order to take advantage of the advantages associated with early-stage investments. This reduction in the lock-in period is considered as a significant step forward.

-

How is the Spray Engineering Devices Ltd. price calculated?

Fundamental & Comparative valuation models and the forces of demand and supply in the market for unlisted shares dictate the price. These prices are based on our estimates and transaction history of Spray Engineering Devices Ltd.. The price is also determined from the most recent funding round for Spray Engineering Devices Ltd.. This provides us with a benchmark valuation, offering a clear indication of the company's current market value as perceived by investors and industry experts.

-

What are the lot sizes of Spray Engineering Devices Ltd.?

We can generally arrange lot sizes starting with an investment of INR 20,000. To confirm the lot sizes of Spray Engineering Devices Ltd. with us kindly click here.

-

What are the financials of Spray Engineering Devices Ltd.?

The financials of Spray Engineering Devices Ltd. which includes the P/L of Spray Engineering Devices Ltd. and the Balance Sheet of Spray Engineering Devices Ltd. is in the financials section (Click on link).

-

Where can I find the annual report of Spray Engineering Devices Ltd.?

The annual report of Spray Engineering Devices Ltd. is available in the annual report section (Click on link).

-

Is buying Spray Engineering Devices Ltd. legal in India?

Yes, buying and selling unlisted shares in India is indeed 100% legal. This activity is regulated and governed under the guidelines provided by the Securities and Exchange Board of India (SEBI). Investors and traders must adhere to these regulations and guidelines to ensure compliance with legal and financial standards. It's important for participants in the unlisted share market to be aware of and understand these regulations to engage in transactions legally and securely.

-

Short-term Capital Gain taxes to be paid on Spray Engineering Devices Ltd.?

When you sell unlisted shares within a period of two years from the date of acquisition, any profit earned from the sale is classified as Short-term Capital Gain (STCG). This gain is then added to your total income for that financial year. The tax on this short-term capital gain is calculated based on your applicable individual income tax slab rates. Therefore, the rate at which you will pay tax on the STCG from unlisted shares depends on your total income, including this gain, and the tax slab it falls under as per the prevailing income tax laws in India. It's important for investors to consider these tax implications when engaging in transactions involving unlisted shares.

-

Long-term Capital Gain taxes to be paid on Spray Engineering Devices Ltd. and how are They Taxed?

Long-term Capital Gains (LTCG) on unlisted shares in India refer to the profits earned from the sale of unlisted shares that have been held for more than two years. The key aspects of LTCG on unlisted shares include:

- Tax Rate: LTCG on unlisted shares is taxed at a rate of 20%.

- Indexation Benefit: This is a significant advantage for investors. Indexation allows for adjusting the purchase price of the shares for inflation, which can reduce the taxable gain.

- Importance for Investors: Understanding LTCG is crucial, especially for High Net-worth Individuals (HNIs) and retail investors, as it impacts their investment strategy and tax planning. Knowing these details helps in making informed investment decisions.

- Calculation: LTCG is calculated by subtracting the indexed cost of acquisition (the purchase price adjusted for inflation) from the sale price of the shares. The profit thus calculated is subject to a 20% tax.

- Applicability: LTCG tax is applicable to profits from the sale of unlisted shares held for more than two years.

- Relevance: This tax is particularly relevant to investors in the unlisted share market, including those considering selling their holdings after a period of more than two years.

-

Applicability of Taxes on Spray Engineering Devices Ltd. once it is listed?

When shares initially bought in the unlisted market become listed, the taxation rules change significantly if these shares are sold through a stock exchange. Here's what investors need to know:

Transition to Listed Market Tax Rates: Once unlisted shares are listed on the stock exchange and subsequently sold, the tax rates applicable to listed securities come into effect. This shift means that the favourable tax treatments for listed shares, as per the prevailing tax laws, will apply.

Taxation Based on Holding Period: The crucial factor in determining the type of capital gains tax (Long-term or Short-term) is the holding period of the shares. Importantly, this period is calculated from the original purchase date when the shares were unlisted.

Long-term vs. Short-term Capital Gains: If the shares are sold after being held for more than one year from the date of purchase (including the period when they were unlisted), they are subject to Long-term Capital Gains (LTCG) tax.

Conversely, if sold within one-year, Short-term Capital Gains (STCG) tax rates apply.

Significance for Investors: This information is vital for investors in the unlisted market, as it impacts their tax planning and decision-making process. Understanding these nuances ensures that investors can strategically plan the sale of their shares post-listing to optimize tax implications.

Advice for Investors: It's advisable for investors to keep a record of their purchase dates and monitor the listing dates closely. Additionally, staying updated with the latest tax regulations or consulting with a financial advisor is recommended for accurate tax calculations and compliance. -

How does Altius Investech source Spray Engineering Devices Ltd.?

At Altius Investech, our approach to sourcing Boat Unlisted Share (Imagine Marketing) involves a strategic and direct method. Primarily, we acquire these shares from the below key groups:

Employees of the Company: Employee stock option plans (ESOPs) or other compensation packages frequently include shares for firm employees. For a various reasons, such as including portfolio diversification or financial considerations, some of these employees may eventually choose to sell their shares. We engage with these employees, providing them a platform to sell their shares.

Initial Investors: These are the angel or early-stage investors who provided capital to the business in its early stages. These original investors may look to sell all or part of their ownership position in the company as it develops and flourishes. This might be done for various reasons such as in order to maximise their investment, reallocate resources, or make other calculated financial decisions.

Funding rounds and VC funds: Altius Investech sources the shares from private placement rounds in which private companies seek to obtain capital from the market. Through our platform, venture capital funds can liquidate their shares and we receive the inventory from them when they decide to sell a portion of their ownership through block trades.

By establishing connections with these groups, Altius Investech guarantees our clients a steady and dependable supply of Boat Unlisted Share (Imagine Marketing). This process not only makes it easier for employees and initial investors in liquidating their assets, but it also gives our clients access to shares that aren't often found on the open market. Our platform effectively facilitates a win-win situation for both buyers and sellers. -

How to trust Altius Investech before buying Spray Engineering Devices Ltd. from its platform?

Altius Investech stands at being India's fastest growing and leading marketplace for buying and selling unlisted shares. We believe in enabling access to alternative sources of investments at lower entry barriers to private equity investments.

With more than 25 years of experience, Altius Investech has carved a niche in the financial market by serving more than 8000 clients. The incredible journey is further highlighted by the vast number of transactions that Altius Investech has facilitated transactions that have already exceeded 300 crores.

For investors Altius Investech curates investment opportunities in companies at reasonable valuations which are on the verge of an IPO leading to massive value unlocking. Investments are backed by thorough research and sound investment thesis, with a time bound exit plan.

For ESOP Shareholder and existing Investors, we assist them to liquidate their shares even if they are not publicly traded by creating a platform where we find the right buyers and sellers for the best prices.

Altius Investech have been featured in top media news outlets like Economic Times, Financial Express, Money control. Check out about us on these - leading publications (Click on link) Our journey over these years has not just been about numbers; it's been about building trust and reliability.

We at Altius Investech are dedicated to upholding the greatest levels of ethics and transparency, making sure that your investment experience is not only profitable but also safe and reliable.

Press of Spray Engineering Devices Unlisted Shares

Featured Blogs of Spray Engineering Devices Unlisted Shares

Annual Report of Spray Engineering Devices Unlisted Shares

Company Information of Spray Engineering Devices Unlisted Shares

Featured Companies