Indofil Industries Unlisted Shares

Indofil Industries Ltd.

INE071I01016

Incorporation Date: 09-Feb-1993

Listing Status: DRHP Not Filed

About Indofil Industries Unlisted Shares

Overview of Indofil Industries Unlisted Shares

A snapshot of Indofil Industries Ltd.

- Indofil Industries Limited was incorporated in 1962 as a subsidiary of Rohm and Haas Company, US.

- It later merged with Modipon Limited in 1985, operating as a division within Modipon until 2006.

- Subsequently, in 2007 it underwent separation from Modipon and was transferred to Indofil Organic Industries Limited, later rebranded as Indofil Industries Limited in 2010.

- Today, as part of the K. K. Modi Group, Indofil Industries Limited specializes in agrochemicals and speciality chemicals, emphasizing research and development for high-quality crop care.

- Its commitment to innovation is underscored by adherence to international quality standards: ISO 9001, OHSAS 18001, and ISO 14001.

- With a vision for growth, Indofil aims to achieve a 2-billion-dollar enterprise value within the next three years, driven by innovation and dedication to delivering superior chemical solutions globally.

- It boasts a well-equipped manufacturing infrastructure, a Research & Development team, and an extensive domestic and international distribution network.

- With an export presence in over 120 countries, Indofil is a leading supplier of Mancozeb formulations.

Business Segments

Business Segments: 1. Agricultural Chemicals | 2. Indofil Innovative Solutions (IIS)

- Agricultural Chemicals: It excels in strategic manufacturing and marketing of various agricultural products including Insecticides, Fungicides (such as Mancozeb, Tricyclazole, and Zineb), Bactericides, Herbicides, Acaricides, Surfactants, and Plant Growth Regulators (PGR), guided by the "Crop Care Concept". This ensures the safety and health of crops by identifying the problems affecting them and procuring the right solutions.

- Indofil Innovative Solutions: Focuses on providing innovative products for industries like Leather, Textile, Paints, Plastics, and Construction Chemicals. This division caters to small, medium and large industrial manufacturers globally.

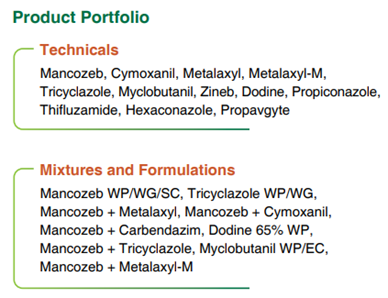

Product Portfolio

Agrochemicals

- Fungicides

- Herbicides

- Insecticides

- Surfactants and Plant Growth Regulators

- Acaricides

Specialty Chemicals

- Leather: Preservatives | Degreasing Agents | Syntans

- Plastics: Acrylic Impact Modifiers | Acrylic Processing Aids

- Textiles: Acrylic Binders | Silicone Emulsions | Water Repellents

- Coatings and Construction: Water-based Emulsions | Cement Modifiers

- Other Solutions: Resins and Binders | Waxes and Fillers

- Waterproofing: Chemicals Tile Adhesives

Mancozeb | Indofil's Core product

Indofil Industries is a leading global player in producing Mancozeb formulations - Fungicides. The company currently has a production capacity of 67,000 MT/year and plans to produce 75,000 MT per year.

- EU Approval Withdrawal: European governments withdrew approvals for Mancozeb in Feb 2021.

- Europe accounts for 10% of global Mancozeb consumption, significantly impacting this market segment.

- Challenges in Canada and India: Demands for a ban on Mancozeb originated in Canada (2018) and India (2020).

- Subsequent studies and re-evaluations in both countries resulted in Mancozeb being classified under the 'Restricted Category' in 2023.

- Latin America: One of the largest markets for Mancozeb | Indofil serves this market through its subsidiary in Brazil.

- Growth Projections: The market for Mancozeb is projected to reach USD 1,569.57 million by 2030, with a CAGR of 4.0% from 2022 to 2030.

Manufacturing Units

- Indofil has four manufacturing facilities with state-of-the-art PLC (Programmable Logic Control) and DCS (Distributed Control System) systems alongside multiple toll manufacturing units across India.

- The first plant, established in Thane, Maharashtra in 1962, produces fungicides and pesticides

- Indofil expanded in Gujarat, adding Mancozeb mixtures and new fungicide molecules, with two plants at Dahej SEZ (Special Economic Zone) and one at Dahej GIDC (Gujarat Industrial Development Corporation).

- The increased production capacity has reduced process costs.

- The large chemical cluster at Dahej provides additional support to Indofil Industries Ltd.

Company Initiatives and New Ventures

(1) Embracing Green Chemistry: Diversified product portfolio with natural bio-fertilizers and bio-stimulants.

(2) Specialty Chemicals Venture: Entered paint, leather, textile, and plastic industries with emulsifiers.

(3) Innovation Focus: R&D facilities - 23.35 Crs. investment | Cumulative Capex of 1,743 Crs. as of FY23.

Subsidiaries & Joint Ventures

Details of subsidiaries:

|

Company Name |

Profit after Taxation (in Crs.) |

% of Shareholding |

|

Good Investment (India) Ltd |

1.012 |

100% |

|

Quick Investments (India) Ltd |

0.52 |

100% |

|

Indofil Bangladesh Industries Pvt Ltd |

(0.20) |

100% |

|

Indofil Industries Netherlands BV |

(0.26) |

100% |

|

Indofil Industries (International) BV |

(0.02) |

100% |

|

Indofil Costa Rica SA |

N.A. |

100% |

|

Indofil Industries DO Brazil LTDA |

0.14 |

100% |

|

Indofil Philippines, Inc. |

0.50 |

100% |

|

Agrowin Biosciences S.R.L. |

0.02 |

96.55% |

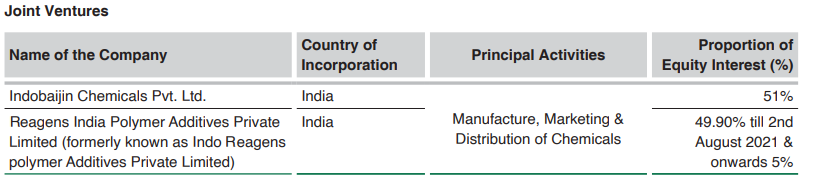

Joint Ventures of The Company includes:

- Partnered with world-famous PVC additives producer Reagans (San Giorgio, Italy) to find solutions for the heat stabilisers market | 2019.

- To transform into a self-sufficient producer of Carbon Disulphide (CS2), Indofil entered into a joint venture with Shanghai Baijin Chemicals Group Company Ltd | 2014.

Intrinsic Value of Indofil Industries Ltd.

- Indofil Industries holds 65,45,020 shares of Godfrey Philips India Limited (CMP – Rs 3,905.10/share).

- As of May 23rd 2024, the total investment value is Rs 2555.89 Crs.

- Outstanding shares of Indofil Industries: 2.29 Crs.

- Intrinsic Worth of Indofil Industries Ltd per share: Rs 1113.28 considering only Godfrey Philips India Limited's holding.

- Discount: 30% (Approx)

Godfrey Philips announced a dividend of Rs. 44 / share for FY23.

- Indofil would have received approximately Rs. 28 Crs. as dividend income.

- Taking the stake of Godfrey: Approx Rs. 2500 Crs + PAT(at a 20x multiple of Rs. 6000Crs.) we expect Indofil to be valued at ₹8500 Crs.

- Expected Price / Share: ₹3702

On June 6, 2024, Grant Thornton valued Indofil Industries Ltd. at approximately ₹10,500 Crs.

- While the current MCAP stands at Rs. 2217.76 Crs. as of 7th June 2024.

- The number of outstanding shares of the Company: 2.29 Crs.

- Expected price per share: ₹4585

- The current Market price is ₹966, which indicates a 374% discount on the share.

The value unlocking for the shareholders of the Company (Indofil Industries Ltd.), as a part of the K.K. Modi Group, is presently hindered by internal problems and the absence of near-term IPO plans.

Insights of Indofil Industries Unlisted Shares

Financial Highlights

| Metric | FY 24-25 | FY 23-24 | Change (%) |

|---|---|---|---|

| Revenue (including other income) | 3,419 | 3,119 | 9.61% |

| Net Profit After Tax | 452 | 332 | 36.14% |

| EPS (₹) | 203.92 | 155.57 | 31.05% |

INDUSTRY OVERVIEW :

-

Large & Growing Market – The global agrochemical industry is worth over USD 297 billion (2024) and expected to reach USD 395 billion by 2033, while India’s crop protection market is projected to grow at ~5–8% CAGR, driven by rising food demand and export opportunities.

-

Rising Food Security Needs – Increasing population, shrinking arable land, and climate challenges are boosting the demand for fertilizers, pesticides, and crop protection chemicals to secure higher yields.

-

Shift Toward Sustainable Solutions – Regulators and consumers are pushing for eco-friendly products, biopesticides, and integrated pest management practices, changing the product mix across markets.

-

Global Supply Chain & Input Costs – Heavy dependence on China and a few other regions for raw materials leads to volatility in costs and supply disruptions, pushing firms toward backward integration and local sourcing.

-

Competitive & Regulatory Intensity – The sector faces stiff competition from global majors and local players, while strict environmental regulations and safety standards (especially in EU/US) make registrations costly and time-consuming.

Opportunities

Strengthening India's Manufacturing Position

Advantages: Low-cost production, skilled manpower, and Supply Chain Resilience enhance India's attractiveness as a manufacturing destination.

'China Plus One' Strategy: Adopted by many countries as a business strategy to channel investments into manufacturing in other promising developing economies such as India, Thailand, Turkey or Vietnam.

Future Growth Drivers:

- Patent Expirations: Opportunities arise as patents on key molecules expire.

- High demand for pesticides & Price Premiums

- Innovation in environmentally friendly production methods.

- Export Growth Outlook: FY24 - Exports are projected to grow by 12-14%.

Government Initiatives and Regulatory Standards:

- Make In India & Aatmanirbhar Bharat Abhiyan

- Production-Linked Incentive (PLI) Scheme: (10-20% incentives)

- Stringent Regulations: India's laws and regulations ensure rigorous checks and balances for chemical manufacturing, including fertilizers, under the Insecticides Act of 1968 and The Insecticide Rules of 1971.

- This builds consumer trust worldwide, reinforcing its reputation as a reliable source of high-quality agrochemicals.

Financial Charts of Indofil Industries Unlisted Shares

Balance Sheet of Indofil Industries Unlisted Shares

Profit and Loss of Indofil Industries Unlisted Shares

Ancillary of Indofil Industries Unlisted Shares

Ratio Analysis

Peers

Industry Benchmarking

Segment Revenue

Subsidaries

Security Allotment

Corporate Governance

Team Management Details

FAQs of Indofil Industries Unlisted Shares

-

How to buy Indofil Industries Ltd.?

Below are three ways through which you can purchase Indofil Industries Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to buy Indofil Industries Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

How to sell Indofil Industries Ltd.?

Below are three ways through which you can sell Indofil Industries Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to sell Indofil Industries Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

What is the price of Indofil Industries Ltd.?

We provide a two way quote on all the shares we deal in. Your buy price for Indofil Industries Ltd. is ₹1499 and your sell price for Indofil Industries Ltd. is ₹1300. The price is based on our estimates and market conditions.

-

What is the lock-in period of Indofil Industries Ltd.?

The lock-in period for Indofil Industries Ltd. varies depending on the category of investors:

- For retail Investors, HNIs, or Body Corporates, the lock-in period is 6 months from the date of the listing of Indofil Industries Ltd.

- For Venture Capital Funds or Foreign Venture Capital Investors, there is a lock-in period of 6 months from the date of acquisition of Indofil Industries Ltd.

- For AIF-II (Alternative Investment Funds - Category II), there is no lock-in period

August 2021 saw the introduction of this regulation by SEBI. The purpose of the regulation change, which lowered the lock-in period from a year to six months, was to incentivize additional investments in firms getting ready for initial public offerings, or IPOs. Since its introduction, a number of Portfolio Management Services (PMS) have advised their clients to purchase Pre-IPO shares in order to take advantage of the advantages associated with early-stage investments. This reduction in the lock-in period is considered as a significant step forward.

-

How is the Indofil Industries Ltd. price calculated?

Fundamental & Comparative valuation models and the forces of demand and supply in the market for unlisted shares dictate the price. These prices are based on our estimates and transaction history of Indofil Industries Ltd.. The price is also determined from the most recent funding round for Indofil Industries Ltd.. This provides us with a benchmark valuation, offering a clear indication of the company's current market value as perceived by investors and industry experts.

-

What are the lot sizes of Indofil Industries Ltd.?

We can generally arrange lot sizes starting with an investment of INR 20,000. To confirm the lot sizes of Indofil Industries Ltd. with us kindly click here.

-

What are the financials of Indofil Industries Ltd.?

The financials of Indofil Industries Ltd. which includes the P/L of Indofil Industries Ltd. and the Balance Sheet of Indofil Industries Ltd. is in the financials section (Click on link).

-

Where can I find the annual report of Indofil Industries Ltd.?

The annual report of Indofil Industries Ltd. is available in the annual report section (Click on link).

-

Is buying Indofil Industries Ltd. legal in India?

Yes, buying and selling unlisted shares in India is indeed 100% legal. This activity is regulated and governed under the guidelines provided by the Securities and Exchange Board of India (SEBI). Investors and traders must adhere to these regulations and guidelines to ensure compliance with legal and financial standards. It's important for participants in the unlisted share market to be aware of and understand these regulations to engage in transactions legally and securely.

-

Short-term Capital Gain taxes to be paid on Indofil Industries Ltd.?

When you sell unlisted shares within a period of two years from the date of acquisition, any profit earned from the sale is classified as Short-term Capital Gain (STCG). This gain is then added to your total income for that financial year. The tax on this short-term capital gain is calculated based on your applicable individual income tax slab rates. Therefore, the rate at which you will pay tax on the STCG from unlisted shares depends on your total income, including this gain, and the tax slab it falls under as per the prevailing income tax laws in India. It's important for investors to consider these tax implications when engaging in transactions involving unlisted shares.

-

Long-term Capital Gain taxes to be paid on Indofil Industries Ltd. and how are They Taxed?

Long-term Capital Gains (LTCG) on unlisted shares in India refer to the profits earned from the sale of unlisted shares that have been held for more than two years. The key aspects of LTCG on unlisted shares include:

- Tax Rate: LTCG on unlisted shares is taxed at a rate of 20%.

- Indexation Benefit: This is a significant advantage for investors. Indexation allows for adjusting the purchase price of the shares for inflation, which can reduce the taxable gain.

- Importance for Investors: Understanding LTCG is crucial, especially for High Net-worth Individuals (HNIs) and retail investors, as it impacts their investment strategy and tax planning. Knowing these details helps in making informed investment decisions.

- Calculation: LTCG is calculated by subtracting the indexed cost of acquisition (the purchase price adjusted for inflation) from the sale price of the shares. The profit thus calculated is subject to a 20% tax.

- Applicability: LTCG tax is applicable to profits from the sale of unlisted shares held for more than two years.

- Relevance: This tax is particularly relevant to investors in the unlisted share market, including those considering selling their holdings after a period of more than two years.

-

Applicability of Taxes on Indofil Industries Ltd. once it is listed?

When shares initially bought in the unlisted market become listed, the taxation rules change significantly if these shares are sold through a stock exchange. Here's what investors need to know:

Transition to Listed Market Tax Rates: Once unlisted shares are listed on the stock exchange and subsequently sold, the tax rates applicable to listed securities come into effect. This shift means that the favourable tax treatments for listed shares, as per the prevailing tax laws, will apply.

Taxation Based on Holding Period: The crucial factor in determining the type of capital gains tax (Long-term or Short-term) is the holding period of the shares. Importantly, this period is calculated from the original purchase date when the shares were unlisted.

Long-term vs. Short-term Capital Gains: If the shares are sold after being held for more than one year from the date of purchase (including the period when they were unlisted), they are subject to Long-term Capital Gains (LTCG) tax.

Conversely, if sold within one-year, Short-term Capital Gains (STCG) tax rates apply.

Significance for Investors: This information is vital for investors in the unlisted market, as it impacts their tax planning and decision-making process. Understanding these nuances ensures that investors can strategically plan the sale of their shares post-listing to optimize tax implications.

Advice for Investors: It's advisable for investors to keep a record of their purchase dates and monitor the listing dates closely. Additionally, staying updated with the latest tax regulations or consulting with a financial advisor is recommended for accurate tax calculations and compliance. -

How does Altius Investech source Indofil Industries Ltd.?

At Altius Investech, our approach to sourcing Boat Unlisted Share (Imagine Marketing) involves a strategic and direct method. Primarily, we acquire these shares from the below key groups:

Employees of the Company: Employee stock option plans (ESOPs) or other compensation packages frequently include shares for firm employees. For a various reasons, such as including portfolio diversification or financial considerations, some of these employees may eventually choose to sell their shares. We engage with these employees, providing them a platform to sell their shares.

Initial Investors: These are the angel or early-stage investors who provided capital to the business in its early stages. These original investors may look to sell all or part of their ownership position in the company as it develops and flourishes. This might be done for various reasons such as in order to maximise their investment, reallocate resources, or make other calculated financial decisions.

Funding rounds and VC funds: Altius Investech sources the shares from private placement rounds in which private companies seek to obtain capital from the market. Through our platform, venture capital funds can liquidate their shares and we receive the inventory from them when they decide to sell a portion of their ownership through block trades.

By establishing connections with these groups, Altius Investech guarantees our clients a steady and dependable supply of Boat Unlisted Share (Imagine Marketing). This process not only makes it easier for employees and initial investors in liquidating their assets, but it also gives our clients access to shares that aren't often found on the open market. Our platform effectively facilitates a win-win situation for both buyers and sellers. -

How to trust Altius Investech before buying Indofil Industries Ltd. from its platform?

Altius Investech stands at being India's fastest growing and leading marketplace for buying and selling unlisted shares. We believe in enabling access to alternative sources of investments at lower entry barriers to private equity investments.

With more than 25 years of experience, Altius Investech has carved a niche in the financial market by serving more than 8000 clients. The incredible journey is further highlighted by the vast number of transactions that Altius Investech has facilitated transactions that have already exceeded 300 crores.

For investors Altius Investech curates investment opportunities in companies at reasonable valuations which are on the verge of an IPO leading to massive value unlocking. Investments are backed by thorough research and sound investment thesis, with a time bound exit plan.

For ESOP Shareholder and existing Investors, we assist them to liquidate their shares even if they are not publicly traded by creating a platform where we find the right buyers and sellers for the best prices.

Altius Investech have been featured in top media news outlets like Economic Times, Financial Express, Money control. Check out about us on these - leading publications (Click on link) Our journey over these years has not just been about numbers; it's been about building trust and reliability.

We at Altius Investech are dedicated to upholding the greatest levels of ethics and transparency, making sure that your investment experience is not only profitable but also safe and reliable.

Press of Indofil Industries Unlisted Shares

Featured Blogs of Indofil Industries Unlisted Shares

Company Information of Indofil Industries Unlisted Shares

Featured Companies