Lords Mark Unlisted Shares

Lords Mark Industries Ltd.

INE0MPL01010

Incorporation Date: 01-Jul-1998

Listing Status: DRHP Not Filed

About Lords Mark Unlisted Shares

Overview of Lords Mark Unlisted Shares

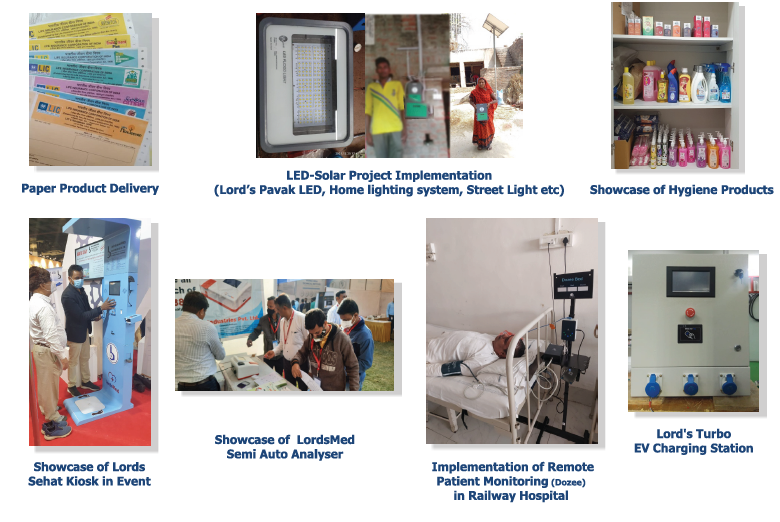

Business Overview

Lord’s Mark Industries Limited (LMIL), established in 1998 as a copier paper manufacturer, has since diversified into IVD/MedTech, Renewable Energy (Solar), and LED Design & Manufacturing. In the MedTech space, it produces testing kits for diseases like cancer and tuberculosis in collaboration with IIT Bombay and BARC. LMIL has received government approval to supply Sickle Cell Testing kits to Primary Health Centres for 1.5 years, with a project value of ₹650 crore and 5% royalty payable to IIT Bombay.

It also holds a 25-year agreement with BARC to manufacture cancer detection and tuberculosis testing equipment, with annual allocations from the Indian government. The company is partnered with the Ministry of Defense until 2028 to supply and maintain lighting for their vehicles, and its in-house LED brand "Praak" contributes 40% of lighting in Vande Bharat trains. Additionally, LMIL collaborates with Philips India on LED design and executes solar-powered LED street lighting projects through government tenders.

Journey of Lord's Mark

Journey of Lord's Mark

1998: -Started business with paper trading.

2006–2012: - Supplying to railways, postal stores, etc.

- Started renewable energy business.

- Diversified into LED manufacturing, railway, and defense project execution.

2012–2020: - Partnered with Philips.

- Exclusive partner to execute government-led projects in renewable energy (Solar, LED).

- Entered diagnostics & MedTech business – Lord’s Med.

2021: - Launched brands in hygiene category – MarvoSafe.

- New business initiatives.

- Partnership with PSU – Brothwolfe, HAL, ICMR-approved Lord’s Med.

- Antigen kit expansion in different segments – B2B and B2C.

- Diversified investments in growing sectors – EV, insurance.

2022–2023: - BREDA awarded the project to set up solar streetlights in Bihar.

- Collaboration between IIT-B & Lord’s Mark through Ministry of Tribal Affairs (MoTA) for Sickle Cell Testing.

- Collaborated with MapMyGenome for Genome Testing.

- Products launched with BARC for oncology-based MedTech products.

2024: - Awarded a contract to set up LED-based smart solar street lighting system in Ayodhya and Varanasi.

- Order pipeline of 300 Cr for renewable energy and LED projects.

Clientele

Business Model

Product Portfolio

1. Diagnostic and MedTech Division

- Offers analyzers, reagents, rapid antigen kits (ICMR-approved LordsMed Kit), and lab consumables.

- Addresses NCDs with affordable, innovative diagnostic solutions like Sickle Cell and cancer tests.

- Provides holistic hygiene products under SafeSehat and MarkoSafe.

- Manufactures generic drugs and surgical products.

- E-Smart Clinics bring affordable healthcare to rural areas via teleconsultation and diagnostics.

2. Renewable Energy Division

- Distributes solar-based products such as Off-grid and On-grid Solar Plants, Solar Home Lighting Systems, Solar Street Light Systems, and various LED lights.

- Promotes green energy initiatives to reduce dependency on fossil fuels.

3. Paper Division

- Specializes in Computer Continuous Paper Stationery, copier paper, and customized paper products for railway tickets, reservation charts, defense stationery, and more.

- Holds certifications including ISO 9001-2015 and BIS, and is registered with DGS&D and GEM for government supply.

- Recognized as a market leader in the printing of Computer Continuous Paper Stationery.

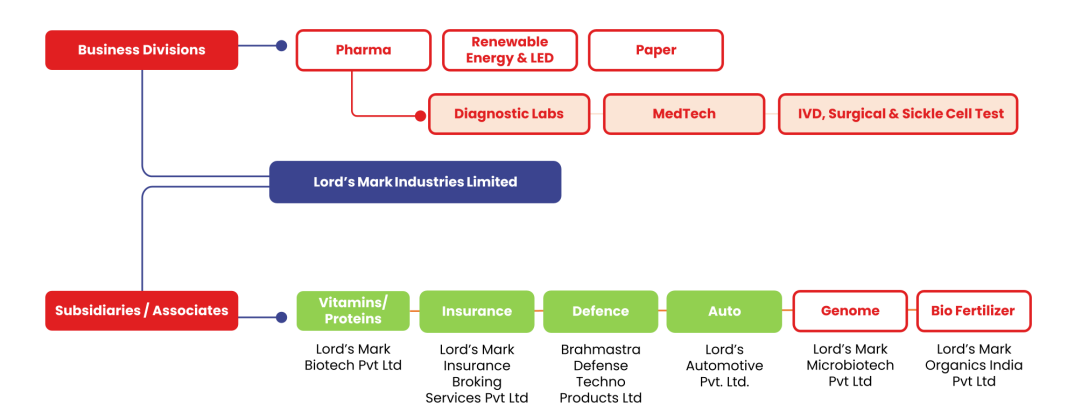

Lord's Mark Business Division

Management of the Company

Dr. Sachidanand Upadhyay: MD & CEO

- Qualifications: MBA in Marketing & Finance, BE Mechanical, Doctorates in Business Management and Brand Positioning & Marketing.

Mr. Manav Teli: Executive Director

- Qualifications: B.Com (Mumbai University), Diploma in Business Management.

- A seasoned entrepreneur with 20+ years of association with the group, overseeing the IVD and Pathology business

Insights of Lords Mark Unlisted Shares

Details Of Bonus Issue:

After accounting for the bonus equity shares, the total outstanding shares of Lords Mark stand at approximately 17.80 crore. As of the record date for the bonus issue, the outstanding shares were around 11.85 crore. Given the bonus issuance ratio of 1:2 (one bonus share for every two shares held), the total bonus equity shares issued amount to approximately 5.90 crore.

Source: Filing of the PAS-3 form

Financial Highlights

- Net Revenue Increased by 81.6%, reaching ₹555.22 Crores in 2024, driven by strong sales growth and expanded market presence.

- EBITDA Grew by 70.6%, amounting to ₹37.25 Crores, reflecting improved operational efficiency and cost management.

- PBIT Increased by 87.1%, reaching ₹33.84 Crores, showing enhanced operational profitability.

- PAT Surged by 142.7%, to ₹11.26 Crores, highlighting significant improvement in bottom-line performance.

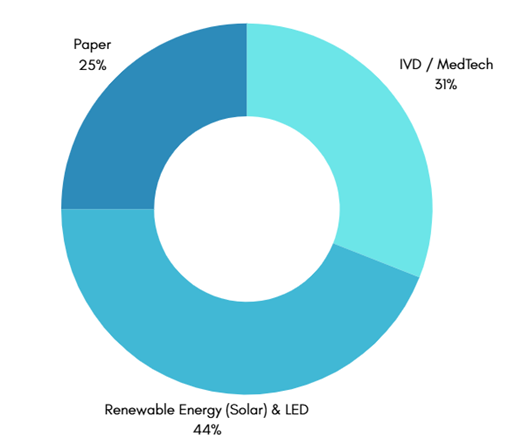

Revenue Breakup:

Global Foot Print

The worldwide healthcare branch of Lord's Mark Industries Ltd. is expected to export more than 6.55 million diagnostic supplies to SAARC countries following the recent inauguration of LordsMed's export division for diagnostic supplies. LordsMed has sent an astounding 4.55 million diagnostic supplies so far, and by the end of this month, they hope to have shipped a another 2 million. The company wants to become a major participant in the production and export of in vitro diagnostics (IVD) worldwide.

Key Recent Development

- The company received approval from ICMR for Sickle Cell and Genome Testing, expanding its testing capabilities.

- Approval was granted to manufacture machines for blood tests for animals of all types, diversifying the product portfolio.

- The company is the only one in India with a license to manufacture Rapid, Biochemistry, Serology, and Analyzer machines under one roof, giving it a competitive edge.

- The company has started in-house manufacturing of blood test machines, strengthening its production capabilities and reducing dependency on external suppliers.

Recent Development

- Lords Mark has raised a total funding of $3.61M over 1 round. Its latest funding round was a Series A round on Feb 03, 2025 for ₹31.2Cr. 1 investor participated in its latest round, which include Brand Capital, Bennett, Coleman, Hindustan Media Ventures and Sanikamarketing.

Lord’s Mark Industries is going public via a reverse merger with Kratos Energy, approved by SEBI, with BSE listing expected in 90–120 days. The company aims to boost its presence in medtech, diagnostics, and renewables, targeting ₹950 crore revenue by FY26.

Fundraise Timeline

Pre-IPO Round (Current Phase)

Lord’s Mark is raising ₹100 crore by issuing new shares before going public. The money will be used for:

- Building solar power projects (agreement already signed),

- Working capital for its IVD (diagnostics) business, and

Developing MedTech prototypes to get US FDA and CE certifications.

Reverse Merger (Planned for Feb 2025)

Instead of doing a traditional IPO, the company will become public by merging with an already listed company. This process, called a reverse merger, is already in progress with the application filed in court (NCLT).

Follow-on Public Offer (Planned for Aug 2025)

After being listed, Lord’s Mark plans to raise another ₹500 crore by issuing more shares or preference shares. The funds will be used for:

- ₹325 crore for day-to-day operations and working capital,

- ₹175 crore for manufacturing MedTech equipment.

5 Year Growth Roadmap

FY 2026

- Listing by way of reverse merger.

- IPO, Preferential Allotment ~ Rs 500 Cr.

- Scale up the manufacturing plant for MedTech products.

- Module manufacturing plant in Lucknow.

- Electronics board manufacturing for MedTech in-house in Pune.

- Demerger of Paper Division.

FY 2027

- MNC with multiple global businesses and global footprint in association with partners in the EU, USA, and GCC countries.

- Full-fledged R&D team in India as an independent research wing.

FY 2028

- Whole-time manufacturing for MedTech business.

FY 2029

- Target group valuation of USD 1 Bn+.

- Group revenue of Rs 5000 Cr+.

- Demerger of IVD, Surgical Consumables, Sickle Cell, MedTech Division.

Important Company Update

The company has issued a formal clarification regarding an anonymous email circulated on 20 February 2026, which contained false and misleading allegations. The management has categorically denied all claims, stating that the email appears to be motivated by malicious or professional enmity and has no factual basis.

The allegation of a “₹700 Cr scam” was termed incorrect and implausible, as the company’s net worth itself is significantly lower than the amount alleged.

Key Highlights

-

The company follows high standards of governance, transparency, and ethical conduct.

-

It is rated BBB+ by a SEBI-approved external credit rating agency.

-

Credit facilities are regularly reviewed by five leading PSU and private sector banks.

-

Skilled professionals have been hired to strengthen compliance, due diligence, and regulatory reporting.

Listing Status Update

-

Amalgamation completed on 24 September 2025 pursuant to NCLT approval.

-

Final listing application filed with BSE on 27 November 2025.

-

SEBI cleared the application on 6 February 2026, subject to certain compliances.

-

Listing and trading fees were paid on 10 February 2026.

-

The company is currently completing final, time-bound compliances, described as the last stage before listing.

Additional Clarifications

-

The company continues to make regular disclosures to the exchange on business developments.

-

Auditors are peer-reviewed and well-established firms.

-

Legal action is being initiated to trace the sender and address the matter legally.

Management Statement

The company stated that its operations, financial position, and growth plans remain unaffected, and it remains committed to protecting shareholder interests.

Financial Charts of Lords Mark Unlisted Shares

Balance Sheet of Lords Mark Unlisted Shares

Profit and Loss of Lords Mark Unlisted Shares

Ancillary of Lords Mark Unlisted Shares

Ratio Analysis

Peers

Industry Benchmarking

Segment Revenue

Subsidaries

Security Allotment

Corporate Governance

Team Management Details

FAQs of Lords Mark Unlisted Shares

-

How to buy Lords Mark Industries Pvt Ltd.?

Below are three ways through which you can purchase Lords Mark Industries Pvt Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to buy Lords Mark Industries Pvt Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

How to sell Lords Mark Industries Pvt Ltd.?

Below are three ways through which you can sell Lords Mark Industries Pvt Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to sell Lords Mark Industries Pvt Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

What is the price of Lords Mark Industries Pvt Ltd.?

We provide a two way quote on all the shares we deal in. Your buy price for Lords Mark Industries Pvt Ltd. is ₹79 and your sell price for Lords Mark Industries Pvt Ltd. is ₹70. The price is based on our estimates and market conditions.

-

What is the lock-in period of Lords Mark Industries Pvt Ltd.?

The lock-in period for Lords Mark Industries Pvt Ltd. varies depending on the category of investors:

- For retail Investors, HNIs, or Body Corporates, the lock-in period is 6 months from the date of the listing of Lords Mark Industries Pvt Ltd.

- For Venture Capital Funds or Foreign Venture Capital Investors, there is a lock-in period of 6 months from the date of acquisition of Lords Mark Industries Pvt Ltd.

- For AIF-II (Alternative Investment Funds - Category II), there is no lock-in period

August 2021 saw the introduction of this regulation by SEBI. The purpose of the regulation change, which lowered the lock-in period from a year to six months, was to incentivize additional investments in firms getting ready for initial public offerings, or IPOs. Since its introduction, a number of Portfolio Management Services (PMS) have advised their clients to purchase Pre-IPO shares in order to take advantage of the advantages associated with early-stage investments. This reduction in the lock-in period is considered as a significant step forward.

-

How is the Lords Mark Industries Pvt Ltd. price calculated?

Fundamental & Comparative valuation models and the forces of demand and supply in the market for unlisted shares dictate the price. These prices are based on our estimates and transaction history of Lords Mark Industries Pvt Ltd.. The price is also determined from the most recent funding round for Lords Mark Industries Pvt Ltd.. This provides us with a benchmark valuation, offering a clear indication of the company's current market value as perceived by investors and industry experts.

-

What are the lot sizes of Lords Mark Industries Pvt Ltd.?

We can generally arrange lot sizes starting with an investment of INR 20,000. To confirm the lot sizes of Lords Mark Industries Pvt Ltd. with us kindly click here.

-

What are the financials of Lords Mark Industries Pvt Ltd.?

The financials of Lords Mark Industries Pvt Ltd. which includes the P/L of Lords Mark Industries Pvt Ltd. and the Balance Sheet of Lords Mark Industries Pvt Ltd. is in the financials section (Click on link).

-

Where can I find the annual report of Lords Mark Industries Pvt Ltd.?

The annual report of Lords Mark Industries Pvt Ltd. is available in the annual report section (Click on link).

-

Is buying Lords Mark Industries Pvt Ltd. legal in India?

Yes, buying and selling unlisted shares in India is indeed 100% legal. This activity is regulated and governed under the guidelines provided by the Securities and Exchange Board of India (SEBI). Investors and traders must adhere to these regulations and guidelines to ensure compliance with legal and financial standards. It's important for participants in the unlisted share market to be aware of and understand these regulations to engage in transactions legally and securely.

-

Short-term Capital Gain taxes to be paid on Lords Mark Industries Pvt Ltd.?

When you sell unlisted shares within a period of two years from the date of acquisition, any profit earned from the sale is classified as Short-term Capital Gain (STCG). This gain is then added to your total income for that financial year. The tax on this short-term capital gain is calculated based on your applicable individual income tax slab rates. Therefore, the rate at which you will pay tax on the STCG from unlisted shares depends on your total income, including this gain, and the tax slab it falls under as per the prevailing income tax laws in India. It's important for investors to consider these tax implications when engaging in transactions involving unlisted shares.

-

Long-term Capital Gain taxes to be paid on Lords Mark Industries Pvt Ltd. and how are They Taxed?

Long-term Capital Gains (LTCG) on unlisted shares in India refer to the profits earned from the sale of unlisted shares that have been held for more than two years. The key aspects of LTCG on unlisted shares include:

- Tax Rate: LTCG on unlisted shares is taxed at a rate of 20%.

- Indexation Benefit: This is a significant advantage for investors. Indexation allows for adjusting the purchase price of the shares for inflation, which can reduce the taxable gain.

- Importance for Investors: Understanding LTCG is crucial, especially for High Net-worth Individuals (HNIs) and retail investors, as it impacts their investment strategy and tax planning. Knowing these details helps in making informed investment decisions.

- Calculation: LTCG is calculated by subtracting the indexed cost of acquisition (the purchase price adjusted for inflation) from the sale price of the shares. The profit thus calculated is subject to a 20% tax.

- Applicability: LTCG tax is applicable to profits from the sale of unlisted shares held for more than two years.

- Relevance: This tax is particularly relevant to investors in the unlisted share market, including those considering selling their holdings after a period of more than two years.

-

Applicability of Taxes on Lords Mark Industries Pvt Ltd. once it is listed?

When shares initially bought in the unlisted market become listed, the taxation rules change significantly if these shares are sold through a stock exchange. Here's what investors need to know:

Transition to Listed Market Tax Rates: Once unlisted shares are listed on the stock exchange and subsequently sold, the tax rates applicable to listed securities come into effect. This shift means that the favourable tax treatments for listed shares, as per the prevailing tax laws, will apply.

Taxation Based on Holding Period: The crucial factor in determining the type of capital gains tax (Long-term or Short-term) is the holding period of the shares. Importantly, this period is calculated from the original purchase date when the shares were unlisted.

Long-term vs. Short-term Capital Gains: If the shares are sold after being held for more than one year from the date of purchase (including the period when they were unlisted), they are subject to Long-term Capital Gains (LTCG) tax.

Conversely, if sold within one-year, Short-term Capital Gains (STCG) tax rates apply.

Significance for Investors: This information is vital for investors in the unlisted market, as it impacts their tax planning and decision-making process. Understanding these nuances ensures that investors can strategically plan the sale of their shares post-listing to optimize tax implications.

Advice for Investors: It's advisable for investors to keep a record of their purchase dates and monitor the listing dates closely. Additionally, staying updated with the latest tax regulations or consulting with a financial advisor is recommended for accurate tax calculations and compliance. -

How does Altius Investech source Lords Mark Industries Pvt Ltd.?

At Altius Investech, our approach to sourcing Boat Unlisted Share (Imagine Marketing) involves a strategic and direct method. Primarily, we acquire these shares from the below key groups:

Employees of the Company: Employee stock option plans (ESOPs) or other compensation packages frequently include shares for firm employees. For a various reasons, such as including portfolio diversification or financial considerations, some of these employees may eventually choose to sell their shares. We engage with these employees, providing them a platform to sell their shares.

Initial Investors: These are the angel or early-stage investors who provided capital to the business in its early stages. These original investors may look to sell all or part of their ownership position in the company as it develops and flourishes. This might be done for various reasons such as in order to maximise their investment, reallocate resources, or make other calculated financial decisions.

Funding rounds and VC funds: Altius Investech sources the shares from private placement rounds in which private companies seek to obtain capital from the market. Through our platform, venture capital funds can liquidate their shares and we receive the inventory from them when they decide to sell a portion of their ownership through block trades.

By establishing connections with these groups, Altius Investech guarantees our clients a steady and dependable supply of Boat Unlisted Share (Imagine Marketing). This process not only makes it easier for employees and initial investors in liquidating their assets, but it also gives our clients access to shares that aren't often found on the open market. Our platform effectively facilitates a win-win situation for both buyers and sellers. -

How to trust Altius Investech before buying Lords Mark Industries Pvt Ltd. from its platform?

Altius Investech stands at being India's fastest growing and leading marketplace for buying and selling unlisted shares. We believe in enabling access to alternative sources of investments at lower entry barriers to private equity investments.

With more than 25 years of experience, Altius Investech has carved a niche in the financial market by serving more than 8000 clients. The incredible journey is further highlighted by the vast number of transactions that Altius Investech has facilitated transactions that have already exceeded 300 crores.

For investors Altius Investech curates investment opportunities in companies at reasonable valuations which are on the verge of an IPO leading to massive value unlocking. Investments are backed by thorough research and sound investment thesis, with a time bound exit plan.

For ESOP Shareholder and existing Investors, we assist them to liquidate their shares even if they are not publicly traded by creating a platform where we find the right buyers and sellers for the best prices.

Altius Investech have been featured in top media news outlets like Economic Times, Financial Express, Money control. Check out about us on these - leading publications (Click on link) Our journey over these years has not just been about numbers; it's been about building trust and reliability.

We at Altius Investech are dedicated to upholding the greatest levels of ethics and transparency, making sure that your investment experience is not only profitable but also safe and reliable.

Press of Lords Mark Unlisted Shares

Featured Blogs of Lords Mark Unlisted Shares

Annual Report of Lords Mark Unlisted Shares

Company Information of Lords Mark Unlisted Shares

Featured Companies