Chennai Super Kings (CSK) Unlisted Shares

Chennai Super Kings Cricket Ltd. (CSK)

INE852S01026

Listing Status: DRHP Not Filed

About Chennai Super Kings (CSK) Unlisted Shares

Overview of Chennai Super Kings (CSK) Unlisted Shares

In September 2014, the Chennai Super Kings’ parent business, India Cements, made the decision to demerge the IPL franchise to a wholly-owned subsidiary, CSKCL. Chennai Super Kings remained owned by India Cements after being converted from a division to a 100% subsidiary. In 2008, India Cements made a $91 million proposal for the Chennai franchise and the sum that needed to be paid in ten years. The company set a record date of October 9, 2015, with the intention of distributing CSKCL shares in the ratio of 1:1 to India Cements Ltd. Shareholders.

An Overview

- The Indian premier league’s (IPL) brand value is at $3.2 billion in 2023, from $1.8 billion in 2022, an increase of 80 percent.

- The league’s business value also saw an increase of 80 percent and is worth $15.4 billion in 2023. One of the main reasons for this increase is the media rights deal with JioCinema and Disney Star, which is 3x the price of the five-year deal between Disney Star and the Board of Control for Cricket in India (BCCI) in 2017.

- As per the report, the media rights are expected to further increase during the next cycle. So far, the media rights have grown at a CAGR of 18 percent, between 2008 and 2023.

- The IPL is expected to go global by the next cycle in 2027 on similar lines to EPL, which would further enhance the growth in its revenue from broadcasting rights.

- Chennai Super Kings (CSK) was the number one IPL franchisee in terms of brand valuation, with $212 million in 2023, witnessing a growth of 45.2 percent from $146 million last year.

- Reason? Without a doubt the team’s captain MS Dhoni’s cult fan following and five title wins. This has helped in creating a strong brand identity.

From Seasonal to Evergreen: CSK's Formula for Sustainable Business Growth

• Chennai Super Kings (CSK) is more than just an IPL team - it's a global cricket powerhouse

• Not content with dominating the Indian cricket scene, CSK has recently ventured into the South Africa T20 (SA20) league with its Johannesburg-based franchise named Joburg Super Kings

• The CEO of CSK, Mr. Kasi Viswanathan, has stated that the team plans to be the world's leading T20 franchise by 2030

• To reach this ambitious target, CSK is planning to invest a whopping Rs. 150-200 crores in building a High-Performance Centre at Navalur - a move that's sure to boost the team's training and development capabilities to new heights

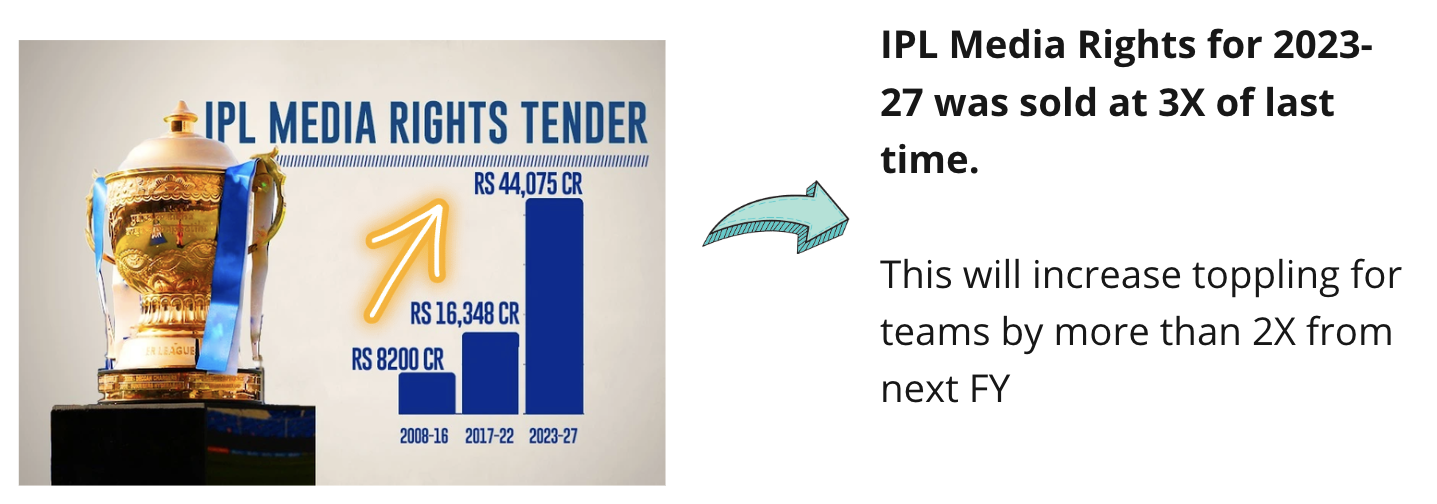

IPL Media Rights Auction

· On June 15, 2022, the Indian Premier League (IPL) achieved a significant milestone when the BCCI sold the media rights for the 2023–2027 season for Rs 48,075 Cr. TV rights brought in Rs 22,575 Cr, while internet rights brought in Rs 21,500 Cr for 410 matches. Read more about how IPL 2023 Ad Revenue Crossed. Rs 10,000 Cr!

· TV Rights for the Indian subcontinent have been sold to The Walt Disney Company India owned Star, while the digital rights have been bagged by Viacom18. The league signed a major title deal with TATA for Rs, 670 Cr.

· The Five Year revenue just from IPL Media Rights stands at upwards of Rs 2400 Cr for Chennai Super Kings (CSK) from FY 2023 onwards.

· IPL Media Rights for the period 2018-22: Star Sports had picked up the composite rights for Rs 16,347 Cr. By virtue of these rights, the revenue share of franchises over the next 5-year period was 50% of the above amount after deducting the production expenses incurred during the season.

· The league also signed a major title deal with VIVO for Rs, 2199 crore for the same period. ( 2018-2022). A combination of sponsorship and media rights ensures, the franchise will receive over Rs 1000 crore in the form of central revenue over the next five years from the BCCI-IPL. However, the Franchisees have to share 20% of the income with BCCI.

CSK Sponsors

CSK recently entered into an agreement with Gulf carrier Etihad Airways to become its official sponsor in 2024. CSK has a lot of brands under its belt like – The Muthoot Group, India Cements, Jio, Dream 11 etc.

CSK Revenue Streams

-

Central Media Rights – Major income from IPL broadcasting deals.

-

Sponsorships – Brand deals with companies like TVS Eurogrip and Gulf Oil.

-

Ticket Sales – Revenue from packed home matches at Chepauk Stadium.

-

Merchandise Sales – Jerseys, caps, and other fan gear.

-

Prize Money – Earnings from IPL performance (e.g., ₹20 crore for 2023 win).

-

Digital Platforms – Ad revenue from YouTube and social media content.

-

International Ventures – Ownership of teams in SA20 (Joburg Super Kings) and MLC (Texas Super Kings).

-

Cricket Academies – Income from training academies under Superking Ventures.

Insights of Chennai Super Kings (CSK) Unlisted Shares

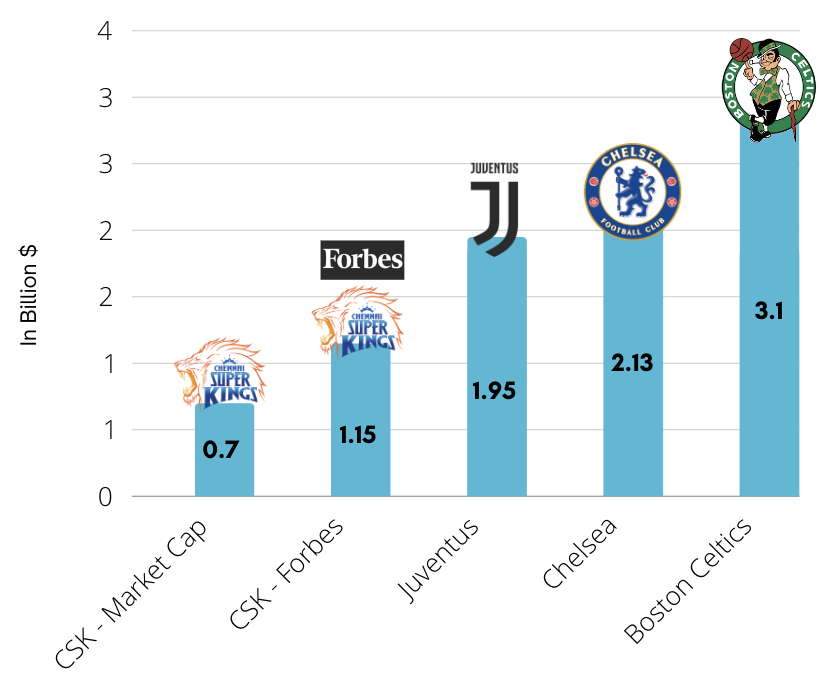

Global Comparison

Valuations in comparison to peers

· Mumbai Indians owned by Reliance Industries - a brand value of $190 million.

· Kolkata Knight Riders owned by Red Chillies Entertainment is estimated at $181 million approx.

· Royal Challengers Bangalore backed by United Spirits of Vijay Mallya earlier, now Diageo is estimated brand value of $195 million.

CSK Unlisted Share Price Journey

CSK Unlisted Shares were introduced into the unlisted market in April-21 at a price of 74 per share and the stock made a low of 64 in June-21. The stock then went up by more than 3x and made a high of 229 in April-22 and the stock then went into a correction and closed at around 165 in March-23. Since then the stock has almost remained range bound at a range of 150 to 193. For more insights on CSK Pre-IPO share journey consider reading this blog. CSK unlisted share price has gone from 20Rs to 200Rs a 10X increase in barely 3 years.

Recent News (Dec, 2024):

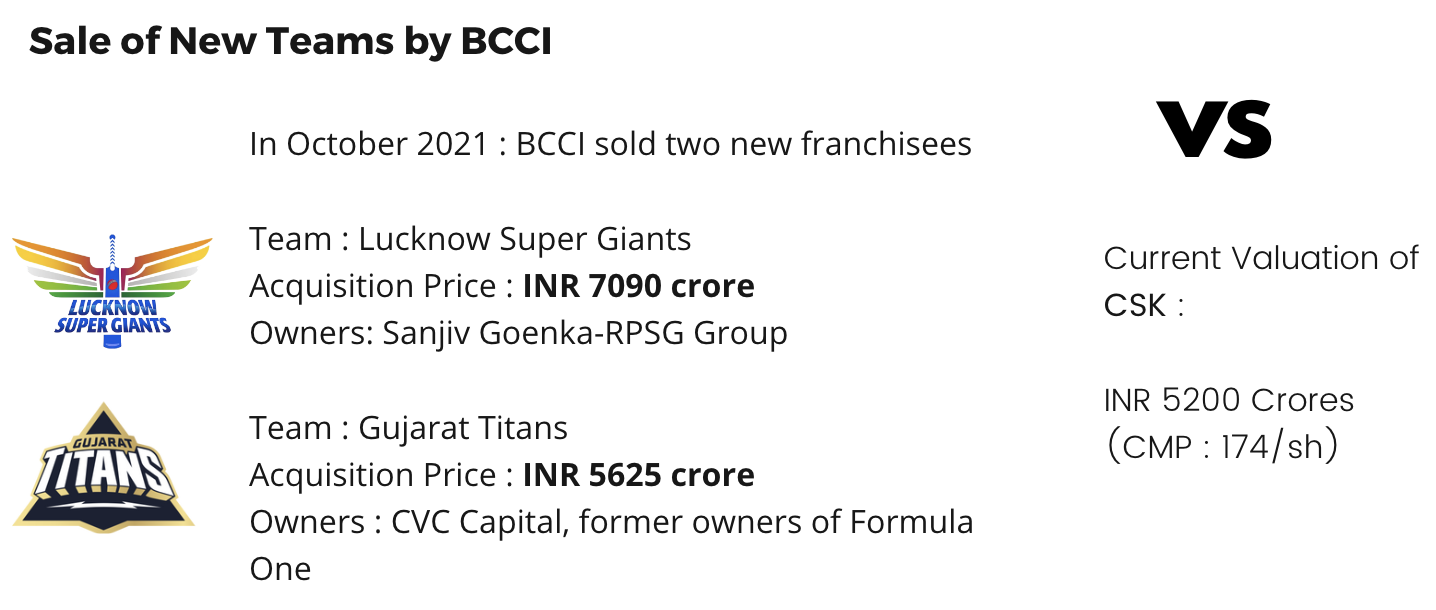

Gujarat Titans Stake Sale Could Spark CSK Valuation Re-Rating

- Indian conglomerate Torrent Group is reportedly set to buy the majority stake in Gujarat Titans at a valuation of $1-$1.5 billion, with the deal expected to be announced after the IPL ownership lock-in period ends in February 2025.

- This move could set a new benchmark for IPL franchise valuations, creating ripple effects across the cricketing ecosystem.

Financial Charts of Chennai Super Kings (CSK) Unlisted Shares

Balance Sheet of Chennai Super Kings (CSK) Unlisted Shares

Profit and Loss of Chennai Super Kings (CSK) Unlisted Shares

Ancillary of Chennai Super Kings (CSK) Unlisted Shares

Ratio Analysis

Peers

Industry Benchmarking

Segment Revenue

Subsidaries

Security Allotment

Corporate Governance

Team Management Details

FAQs of Chennai Super Kings (CSK) Unlisted Shares

-

How to buy CSK Ltd.?

Below are three ways through which you can purchase CSK Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to buy CSK Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

How to sell CSK Ltd.?

Below are three ways through which you can sell CSK Ltd.:

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to sell CSK Ltd., please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

What is the price of CSK Ltd.?

We provide a two way quote on all the shares we deal in. Your buy price for CSK Ltd. is ₹183 and your sell price for CSK Ltd. is ₹170. The price is based on our estimates and market conditions.

-

What is the lock-in period of CSK Ltd.?

The lock-in period for CSK Ltd. varies depending on the category of investors:

- For retail Investors, HNIs, or Body Corporates, the lock-in period is 6 months from the date of the listing of CSK Ltd.

- For Venture Capital Funds or Foreign Venture Capital Investors, there is a lock-in period of 6 months from the date of acquisition of CSK Ltd.

- For AIF-II (Alternative Investment Funds - Category II), there is no lock-in period

August 2021 saw the introduction of this regulation by SEBI. The purpose of the regulation change, which lowered the lock-in period from a year to six months, was to incentivize additional investments in firms getting ready for initial public offerings, or IPOs. Since its introduction, a number of Portfolio Management Services (PMS) have advised their clients to purchase Pre-IPO shares in order to take advantage of the advantages associated with early-stage investments. This reduction in the lock-in period is considered as a significant step forward.

-

How is the CSK Ltd. price calculated?

Fundamental & Comparative valuation models and the forces of demand and supply in the market for unlisted shares dictate the price. These prices are based on our estimates and transaction history of CSK Ltd.. The price is also determined from the most recent funding round for CSK Ltd.. This provides us with a benchmark valuation, offering a clear indication of the company's current market value as perceived by investors and industry experts.

-

What are the lot sizes of CSK Ltd.?

We can generally arrange lot sizes starting with an investment of INR 20,000. To confirm the lot sizes of CSK Ltd. with us kindly click here.

-

What are the financials of CSK Ltd.?

The financials of CSK Ltd. which includes the P/L of CSK Ltd. and the Balance Sheet of CSK Ltd. is in the financials section (Click on link).

-

Where can I find the annual report of CSK Ltd.?

The annual report of CSK Ltd. is available in the annual report section (Click on link).

-

Is buying CSK Ltd. legal in India?

Yes, buying and selling unlisted shares in India is indeed 100% legal. This activity is regulated and governed under the guidelines provided by the Securities and Exchange Board of India (SEBI). Investors and traders must adhere to these regulations and guidelines to ensure compliance with legal and financial standards. It's important for participants in the unlisted share market to be aware of and understand these regulations to engage in transactions legally and securely.

-

Short-term Capital Gain taxes to be paid on CSK Ltd.?

When you sell unlisted shares within a period of two years from the date of acquisition, any profit earned from the sale is classified as Short-term Capital Gain (STCG). This gain is then added to your total income for that financial year. The tax on this short-term capital gain is calculated based on your applicable individual income tax slab rates. Therefore, the rate at which you will pay tax on the STCG from unlisted shares depends on your total income, including this gain, and the tax slab it falls under as per the prevailing income tax laws in India. It's important for investors to consider these tax implications when engaging in transactions involving unlisted shares.

-

Long-term Capital Gain taxes to be paid on CSK Ltd. and how are They Taxed?

Long-term Capital Gains (LTCG) on unlisted shares in India refer to the profits earned from the sale of unlisted shares that have been held for more than two years. The key aspects of LTCG on unlisted shares include:

- Tax Rate: LTCG on unlisted shares is taxed at a rate of 20%.

- Indexation Benefit: This is a significant advantage for investors. Indexation allows for adjusting the purchase price of the shares for inflation, which can reduce the taxable gain.

- Importance for Investors: Understanding LTCG is crucial, especially for High Net-worth Individuals (HNIs) and retail investors, as it impacts their investment strategy and tax planning. Knowing these details helps in making informed investment decisions.

- Calculation: LTCG is calculated by subtracting the indexed cost of acquisition (the purchase price adjusted for inflation) from the sale price of the shares. The profit thus calculated is subject to a 20% tax.

- Applicability: LTCG tax is applicable to profits from the sale of unlisted shares held for more than two years.

- Relevance: This tax is particularly relevant to investors in the unlisted share market, including those considering selling their holdings after a period of more than two years.

-

Applicability of Taxes on CSK Ltd. once it is listed?

When shares initially bought in the unlisted market become listed, the taxation rules change significantly if these shares are sold through a stock exchange. Here's what investors need to know:

Transition to Listed Market Tax Rates: Once unlisted shares are listed on the stock exchange and subsequently sold, the tax rates applicable to listed securities come into effect. This shift means that the favourable tax treatments for listed shares, as per the prevailing tax laws, will apply.

Taxation Based on Holding Period: The crucial factor in determining the type of capital gains tax (Long-term or Short-term) is the holding period of the shares. Importantly, this period is calculated from the original purchase date when the shares were unlisted.

Long-term vs. Short-term Capital Gains: If the shares are sold after being held for more than one year from the date of purchase (including the period when they were unlisted), they are subject to Long-term Capital Gains (LTCG) tax.

Conversely, if sold within one-year, Short-term Capital Gains (STCG) tax rates apply.

Significance for Investors: This information is vital for investors in the unlisted market, as it impacts their tax planning and decision-making process. Understanding these nuances ensures that investors can strategically plan the sale of their shares post-listing to optimize tax implications.

Advice for Investors: It's advisable for investors to keep a record of their purchase dates and monitor the listing dates closely. Additionally, staying updated with the latest tax regulations or consulting with a financial advisor is recommended for accurate tax calculations and compliance. -

How does Altius Investech source CSK Ltd.?

At Altius Investech, our approach to sourcing Boat Unlisted Share (Imagine Marketing) involves a strategic and direct method. Primarily, we acquire these shares from the below key groups:

Employees of the Company: Employee stock option plans (ESOPs) or other compensation packages frequently include shares for firm employees. For a various reasons, such as including portfolio diversification or financial considerations, some of these employees may eventually choose to sell their shares. We engage with these employees, providing them a platform to sell their shares.

Initial Investors: These are the angel or early-stage investors who provided capital to the business in its early stages. These original investors may look to sell all or part of their ownership position in the company as it develops and flourishes. This might be done for various reasons such as in order to maximise their investment, reallocate resources, or make other calculated financial decisions.

Funding rounds and VC funds: Altius Investech sources the shares from private placement rounds in which private companies seek to obtain capital from the market. Through our platform, venture capital funds can liquidate their shares and we receive the inventory from them when they decide to sell a portion of their ownership through block trades.

By establishing connections with these groups, Altius Investech guarantees our clients a steady and dependable supply of Boat Unlisted Share (Imagine Marketing). This process not only makes it easier for employees and initial investors in liquidating their assets, but it also gives our clients access to shares that aren't often found on the open market. Our platform effectively facilitates a win-win situation for both buyers and sellers. -

How to trust Altius Investech before buying CSK Ltd. from its platform?

Altius Investech stands at being India's fastest growing and leading marketplace for buying and selling unlisted shares. We believe in enabling access to alternative sources of investments at lower entry barriers to private equity investments.

With more than 25 years of experience, Altius Investech has carved a niche in the financial market by serving more than 8000 clients. The incredible journey is further highlighted by the vast number of transactions that Altius Investech has facilitated transactions that have already exceeded 300 crores.

For investors Altius Investech curates investment opportunities in companies at reasonable valuations which are on the verge of an IPO leading to massive value unlocking. Investments are backed by thorough research and sound investment thesis, with a time bound exit plan.

For ESOP Shareholder and existing Investors, we assist them to liquidate their shares even if they are not publicly traded by creating a platform where we find the right buyers and sellers for the best prices.

Altius Investech have been featured in top media news outlets like Economic Times, Financial Express, Money control. Check out about us on these - leading publications (Click on link) Our journey over these years has not just been about numbers; it's been about building trust and reliability.

We at Altius Investech are dedicated to upholding the greatest levels of ethics and transparency, making sure that your investment experience is not only profitable but also safe and reliable.

Press of Chennai Super Kings (CSK) Unlisted Shares

Featured Blogs of Chennai Super Kings (CSK) Unlisted Shares

Annual Report of Chennai Super Kings (CSK) Unlisted Shares

Company Information of Chennai Super Kings (CSK) Unlisted Shares

Stay Connected.

Registered Address

73A, GC Avenue, Kolkata -13Corporate Address

Floor 5 , unit 501 Merlin Infinite DN-51, Street Number 11, DN Block, Sector V, Bidhannagar, Kolkata, West Bengal 700091Chennai Office

19/10, Guru Vappa Chetty Street, Chintadripet, Chennai - 600002

Dubai Office

2701, Executive Tower G, Business Bay, Dubai, UAE

Andhra Pradesh & Telangana Office

54-19-25/1, Flat no.101, Sai Residency, Nelson Mandela Park Road, LIC Colony, Vijayawada (Urban), Andhra Pradesh - 520008Altius Investech