Bira91 Unlisted Shares

Bira91 (B9 Beverages Ltd.)

INE833U01014

Incorporation Date: 28-May-2012

Listing Status: DRHP Not Filed

About Bira91 Unlisted Shares

Overview of Bira91 Unlisted Shares

The Genesis of Bira91

The founder of Bira, Ankur Jain, during his stint in New York, had co-founded a health management start-up, Reliant MD. One of the US's most famous craft breweries, Brooklyn Brewery, was close to his place of business and his passion for craft beer expanded as he visited the brewery every Saturday afternoon. Upon his return to India, he discovered that there were no possibilities for Craft Beer. Jain decided to pivot after realising there was a market for beer in India.

Destiny and Jain‘s passion for craft beer made his dream come true in 2007 when he founded the Cerana Beverages (now B9 Beverages). A company that imported and distributed craft beer brands from Belgium, Germany and the US. Jain's experience helped him understand intricacies and the Indian taste palate much better. The beer was marketed in 330 ml bottles in Delhi, Mumbai and Bangalore. Cerena Beverages which is a beverage importer and distributor, controls India’s first and largest draught beer distribution network, which is found in restaurants and pubs across the country.

Timeline

→ 2015: Ankur Starts Bira 91 and launches wheat beers in Hauz Khas Village, New Delhi

→ 2016: Bira91 begins production in India from its first brewery at Maksi

→ 2017: Annual gross revenue crosses $55 million

→ 2018: Bira 91 becomes the largest draft beer brand in India

→ 2020: Annual gross revenue crosses $100 million and starts limited release taproom in Bangalore

Say cheers with Bira91 : India beer with a Belgian Heart

Bira 91 derived its name from Punjabi word Bira which literally means elder brother. Bira also signifies the brave one in Bengali. While, 91 represents India's country code, connoting the brand's roots. The reverse B in the logo signifies a spirit of nonchalant. The monkey mascot represents the urban millennial as the key consumer of Bira 91. Moreover, it manifests the idea of presenting the brand with a playful identity. Learn how bira is Navigating Challenges in India’s Dynamic Beer Industry.

Industry Overview

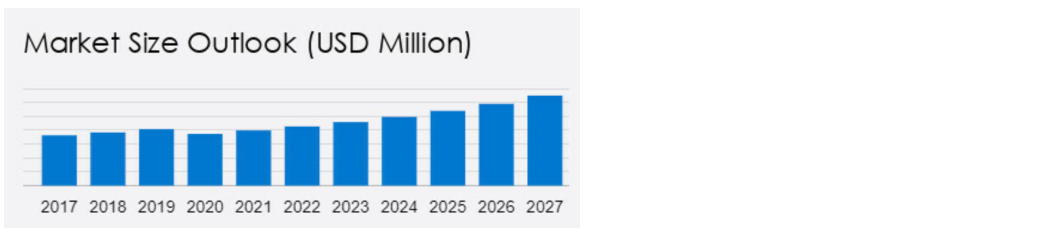

The beer market in India is estimated to increase by USD 4,449.19 million from 2022 to 2027. The market's growth momentum will progress at a CAGR of 8.76% during the forecast period. The market is fragmented due to the presence of diversified international and regional vendors. The growth of online retailing of beer is notably driving the market growth. In India, the use of the Internet for beer sales and marketing is increasing. However, e-commerce is helping small businesses such as craft beer makers get their products in front of a wide range of customers. Beer availability on online trading platforms expands vendor visibility and It also allows vendors to sell more to Internet-savvy customers.

Investment Timeline

Bira 91 has raised a total funding of $336M over 17 rounds till date whereas the last funding raised from Tiger Pacific Capital was valued at 5187 crores.

|

Year |

Amount |

Investors |

|

2016 |

$6 M |

Sequoia Capital, Kunal Bahl and Rohit Bansal (Co-founders - Snapdeal), Deepinder Goyal (zomato), Ashish Dhawan (ChrysCapital) |

|

2018 |

$50 M |

In 2018, the company raised a further amount of $50 million from Sofina, a Belgian family owned fund and its existing investors. |

|

2019 |

$14.3 M |

In May 2019, Bira 91 raised the funding of $4.3M from Sixth Sense Ventures in its Pre-Series C round. Bira raised $10 million in debt funding, to increase production capacity from 400,000 cases to 1.7 million cases. |

|

2021 |

$70 M |

Japanese integrated beverages Kirin Holdings invested $70MN valuing the alco-beverage firm between $230 mn to $240 mn. Bira is Kirin Holdings first investment in India. |

|

2023 |

$10 M |

Bira 91, an Indian craft beer maker, has raised $10 million from Japan's MUFG Bank. |

|

2024 |

$25 M |

The $25 million investment by Tiger Pacific Capital translates to approximately a 4% stake in B9 Beverages, valuing Bira 91 at around $625 million. |

Fresh Beer from the tap

When Ankur

put one of these imported beers on tap in ten Delhi eateries and bars, sales

volumes increased by almost 25 times!

What caused the unexpected spike?

Right out of the tap: More genuine and newer feeling

Less expensive than the bottle: Since bottles account for a significant

portion of the price

Improved Visibility: Unlike the bottles, which were either in the bar or

the refrigerator, they were constantly on display in front of the consumers.

Product Portfolio

As one of the fastest growing beers in the world, Bira 91 has built a strong portfolio of essential beers and aims to drive the global shift in beer towards more colour and flavour.

· Bira Blonde Summer Lager

· Bira White Wheat Ale

· Bira Gold Wheat Strong

· Bira Boom Strong Lager

· Bira Light Low Calorie Lager

Bira 91 has forayed into the Hard Seltzers category with the launch of ‘Grizly’ Hard Seltzer Ale recently in February 2023.

Insights of Bira91 Unlisted Shares

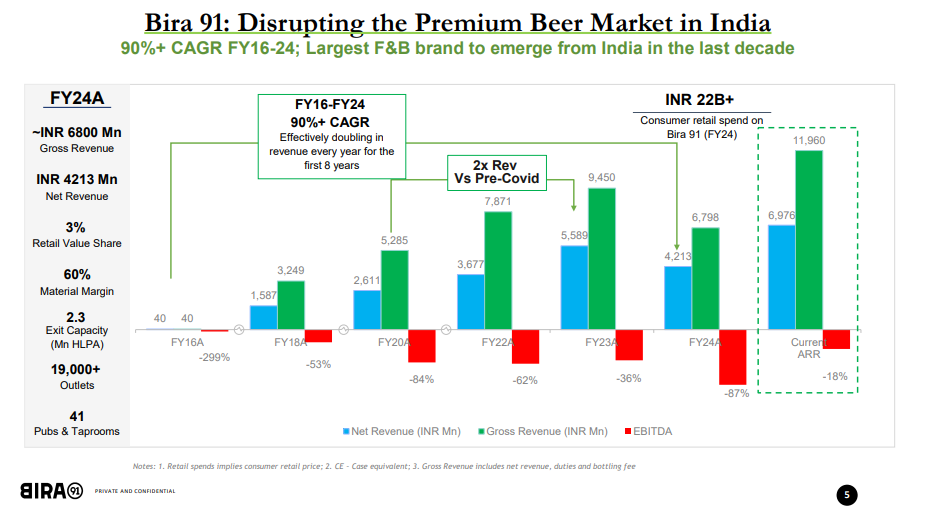

The quarterly revenue figures (in INR million) are as follows:

- Q2 FY24: 1,760

- Q3 FY24: 649

- Q4 FY24: 1,193

- Q1 FY25: 1,997

Q1 FY25 Gross Revenue stands at INR 1,997 million.

The company is experiencing topline growth, with a monthly gross revenue of approximately INR 1000 million. Key improvements include:

- Variable Margin: Improved by 40%, marking a 15% increase compared to last year.

- Fixed Costs: Under control with a 20% reduction compared to last year.

SENIOR LEADERSHIP OF BIRA

The company boasts a diverse and experienced senior leadership team that has been working together for over 9 years. Led by Ankur Jain, the Founder and CEO, who has earned multiple recognitions, including being listed in Fortune 40 Under 40 and GQ India's 50 Most Influential Young Indian Innovators. The leadership team is composed of experts across various domains, including:

- Sudhir Jain: SVP, Manufacturing & Sustainability

- Vinaya Jain: SVP Finance & CFO

- Nayanabhiram Deekonda: VP, Product & Growth, People

(AND MANY MORE)

Backed by Marquee Investors with Highest Corporate Governance Standards

The complete file for the Bira investor presentation update for Q1-FY25 is attached at the provided link. Please refer to it for detailed information.

https://drive.google.com/file/d/1lszDgLb-Jiy6NdICL-QzarOietzGrCg9/view?usp=drivesdk

Financial Insights

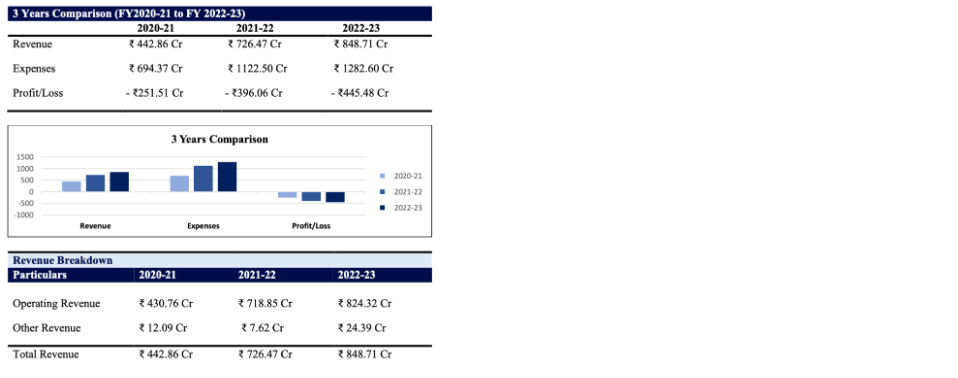

· Revenue Doubled in 2 years from FY-21 to FY-23 and increased by 17% from FY-22 to FY-23.

· Bira 91 growth remained sluggish as compared to FY22. The sale of beer comprised almost all its sales and income from this channel grew only 13% in FY23 which impacted its topline growth.

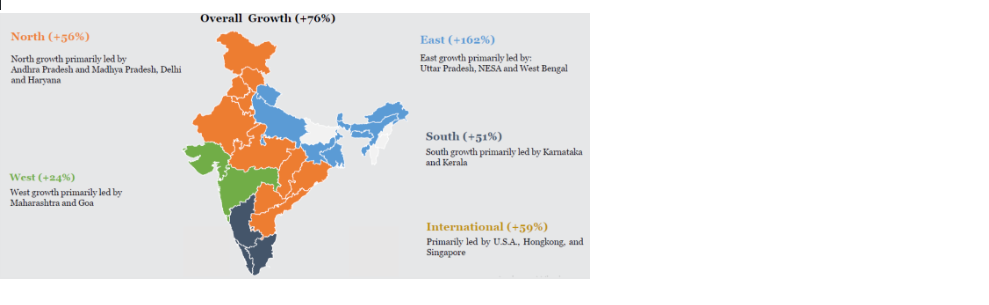

Regional Volume Performance

Bira 91 witnessed a 76% growth in volumes in between FY-21 & FY-22.

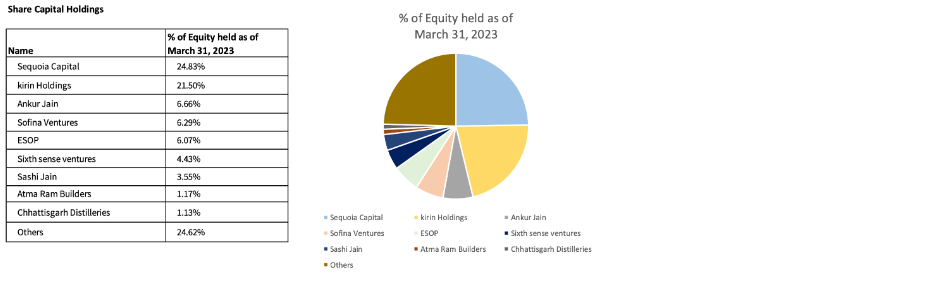

Bira 91 Shareholding Pattern

Bira 91 has a very strong cap table with the likes of Sequoia Capital, Kirin Holdings, Sixth sense ventures.

Market Capitalisation of

Bira 91 Unlisted Shares

Equity shares 1.6 crores outstanding as on 31st March, 2023.

Market Cap = (1.6 * 600) = 1011

Bira has around 7 crore preference shares.

Market Cap on a dilutive basis = (8.6 cr * 600) = 5160 approx.

(Share Price taken as on date of 1st March, 2024)

Bira 91's ₹80 Crore Rebranding Blunder: A pricey Name Change

Craft beer giant Bira 91 recently faced a major financial setback due to a seemingly minor rebranding move—dropping “Private” from its legal name to become B9 Beverages Ltd. The change, aimed at preparing for a 2026 IPO, triggered regulatory hurdles across Indian states, halting sales for 4–6 months. This disruption led to an ₹80 crore inventory write-off and a steep FY24 loss of ₹748 crore, exceeding its annual revenue of ₹638 crore. Policy changes in key markets like Delhi NCR and Andhra Pradesh compounded the blow. Despite the turmoil, Bira 91 remains confident in its recovery and IPO roadmap.

IPO Plans

While Bira 91 has expressed an intention to go public in the past, the timing is currently uncertain. Here's what we know:

Evidence of IPO plans:

· Public company status: In 2022, B9 Beverages converted itself into a public company called B9 Beverages Limited, a key step in the IPO process.

· Previous statements: Bira 91's CEO, Ankur Jain, previously stated plans for an IPO in the next three to five years, which would have placed it within the timeframe of 2022 to 2027.

· Expansion and fundraising: Recent efforts like acquiring The Beer Cafe, building new production facilities, and seeking fresh funds could be seen as preparation for an eventual IPO.

Bira Unlisted Share Price Journey

Bira unlisted shares were introduced into the unlisted market in April-21 at a price of 800 per share and the stock made a high of 1055 per share in December 2021. Since then Bira Unlisted Shares has remained a bit subdued in terms of stock performance and has faced a correction of around 45% from the highs of 1055 it made in December 2021. If you're looking to buy profitable unlisted shares, BIRA should be one of your top picks. Read more about it here. To gain an in-depth understanding of BIRA91, read this blog.

Financial Charts of Bira91 Unlisted Shares

Balance Sheet of Bira91 Unlisted Shares

Profit and Loss of Bira91 Unlisted Shares

Ancillary of Bira91 Unlisted Shares

Ratio Analysis

Peers

Industry Benchmarking

Segment Revenue

Subsidaries

Security Allotment

Corporate Governance

Team Management Details

FAQs of Bira91 Unlisted Shares

-

How to buy Bira91 (B9 Beverages Ltd.)?

Below are three ways through which you can purchase Bira91 (B9 Beverages Ltd.):

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to buy Bira91 (B9 Beverages Ltd.), please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

How to sell Bira91 (B9 Beverages Ltd.)?

Below are three ways through which you can sell Bira91 (B9 Beverages Ltd.):

- We at Altius Investech have many actively traded scripts and are market makers of unlisted shares. To check out all the unlisted shares traded. (Click on link). To submit a request to sell Bira91 (B9 Beverages Ltd.), please click on the trade button at the top of this page

- Additionally, you can download our app from your play store or app store, register on our application, and engage in active trading there.

Download the Altius App here https://onelink.to/hf4m72 - You can also reach out to us at : +91 8240614850 / +91 8240861716

-

What is the price of Bira91 (B9 Beverages Ltd.)?

We provide a two way quote on all the shares we deal in. Your buy price for Bira91 (B9 Beverages Ltd.) is ₹159 and your sell price for Bira91 (B9 Beverages Ltd.) is ₹75. The price is based on our estimates and market conditions.

-

What is the lock-in period of Bira91 (B9 Beverages Ltd.)?

The lock-in period for Bira91 (B9 Beverages Ltd.) varies depending on the category of investors:

- For retail Investors, HNIs, or Body Corporates, the lock-in period is 6 months from the date of the listing of Bira91 (B9 Beverages Ltd.)

- For Venture Capital Funds or Foreign Venture Capital Investors, there is a lock-in period of 6 months from the date of acquisition of Bira91 (B9 Beverages Ltd.)

- For AIF-II (Alternative Investment Funds - Category II), there is no lock-in period

August 2021 saw the introduction of this regulation by SEBI. The purpose of the regulation change, which lowered the lock-in period from a year to six months, was to incentivize additional investments in firms getting ready for initial public offerings, or IPOs. Since its introduction, a number of Portfolio Management Services (PMS) have advised their clients to purchase Pre-IPO shares in order to take advantage of the advantages associated with early-stage investments. This reduction in the lock-in period is considered as a significant step forward.

-

How is the Bira91 (B9 Beverages Ltd.) price calculated?

Fundamental & Comparative valuation models and the forces of demand and supply in the market for unlisted shares dictate the price. These prices are based on our estimates and transaction history of Bira91 (B9 Beverages Ltd.). The price is also determined from the most recent funding round for Bira91 (B9 Beverages Ltd.). This provides us with a benchmark valuation, offering a clear indication of the company's current market value as perceived by investors and industry experts.

-

What are the lot sizes of Bira91 (B9 Beverages Ltd.)?

We can generally arrange lot sizes starting with an investment of INR 20,000. To confirm the lot sizes of Bira91 (B9 Beverages Ltd.) with us kindly click here.

-

What are the financials of Bira91 (B9 Beverages Ltd.)?

The financials of Bira91 (B9 Beverages Ltd.) which includes the P/L of Bira91 (B9 Beverages Ltd.) and the Balance Sheet of Bira91 (B9 Beverages Ltd.) is in the financials section (Click on link).

-

Where can I find the annual report of Bira91 (B9 Beverages Ltd.)?

The annual report of Bira91 (B9 Beverages Ltd.) is available in the annual report section (Click on link).

-

Is buying Bira91 (B9 Beverages Ltd.) legal in India?

Yes, buying and selling unlisted shares in India is indeed 100% legal. This activity is regulated and governed under the guidelines provided by the Securities and Exchange Board of India (SEBI). Investors and traders must adhere to these regulations and guidelines to ensure compliance with legal and financial standards. It's important for participants in the unlisted share market to be aware of and understand these regulations to engage in transactions legally and securely.

-

Short-term Capital Gain taxes to be paid on Bira91 (B9 Beverages Ltd.)?

When you sell unlisted shares within a period of two years from the date of acquisition, any profit earned from the sale is classified as Short-term Capital Gain (STCG). This gain is then added to your total income for that financial year. The tax on this short-term capital gain is calculated based on your applicable individual income tax slab rates. Therefore, the rate at which you will pay tax on the STCG from unlisted shares depends on your total income, including this gain, and the tax slab it falls under as per the prevailing income tax laws in India. It's important for investors to consider these tax implications when engaging in transactions involving unlisted shares.

-

Long-term Capital Gain taxes to be paid on Bira91 (B9 Beverages Ltd.) and how are They Taxed?

Long-term Capital Gains (LTCG) on unlisted shares in India refer to the profits earned from the sale of unlisted shares that have been held for more than two years. The key aspects of LTCG on unlisted shares include:

- Tax Rate: LTCG on unlisted shares is taxed at a rate of 20%.

- Indexation Benefit: This is a significant advantage for investors. Indexation allows for adjusting the purchase price of the shares for inflation, which can reduce the taxable gain.

- Importance for Investors: Understanding LTCG is crucial, especially for High Net-worth Individuals (HNIs) and retail investors, as it impacts their investment strategy and tax planning. Knowing these details helps in making informed investment decisions.

- Calculation: LTCG is calculated by subtracting the indexed cost of acquisition (the purchase price adjusted for inflation) from the sale price of the shares. The profit thus calculated is subject to a 20% tax.

- Applicability: LTCG tax is applicable to profits from the sale of unlisted shares held for more than two years.

- Relevance: This tax is particularly relevant to investors in the unlisted share market, including those considering selling their holdings after a period of more than two years.

-

Applicability of Taxes on Bira91 (B9 Beverages Ltd.) once it is listed?

When shares initially bought in the unlisted market become listed, the taxation rules change significantly if these shares are sold through a stock exchange. Here's what investors need to know:

Transition to Listed Market Tax Rates: Once unlisted shares are listed on the stock exchange and subsequently sold, the tax rates applicable to listed securities come into effect. This shift means that the favourable tax treatments for listed shares, as per the prevailing tax laws, will apply.

Taxation Based on Holding Period: The crucial factor in determining the type of capital gains tax (Long-term or Short-term) is the holding period of the shares. Importantly, this period is calculated from the original purchase date when the shares were unlisted.

Long-term vs. Short-term Capital Gains: If the shares are sold after being held for more than one year from the date of purchase (including the period when they were unlisted), they are subject to Long-term Capital Gains (LTCG) tax.

Conversely, if sold within one-year, Short-term Capital Gains (STCG) tax rates apply.

Significance for Investors: This information is vital for investors in the unlisted market, as it impacts their tax planning and decision-making process. Understanding these nuances ensures that investors can strategically plan the sale of their shares post-listing to optimize tax implications.

Advice for Investors: It's advisable for investors to keep a record of their purchase dates and monitor the listing dates closely. Additionally, staying updated with the latest tax regulations or consulting with a financial advisor is recommended for accurate tax calculations and compliance. -

How does Altius Investech source Bira91 (B9 Beverages Ltd.)?

At Altius Investech, our approach to sourcing Boat Unlisted Share (Imagine Marketing) involves a strategic and direct method. Primarily, we acquire these shares from the below key groups:

Employees of the Company: Employee stock option plans (ESOPs) or other compensation packages frequently include shares for firm employees. For a various reasons, such as including portfolio diversification or financial considerations, some of these employees may eventually choose to sell their shares. We engage with these employees, providing them a platform to sell their shares.

Initial Investors: These are the angel or early-stage investors who provided capital to the business in its early stages. These original investors may look to sell all or part of their ownership position in the company as it develops and flourishes. This might be done for various reasons such as in order to maximise their investment, reallocate resources, or make other calculated financial decisions.

Funding rounds and VC funds: Altius Investech sources the shares from private placement rounds in which private companies seek to obtain capital from the market. Through our platform, venture capital funds can liquidate their shares and we receive the inventory from them when they decide to sell a portion of their ownership through block trades.

By establishing connections with these groups, Altius Investech guarantees our clients a steady and dependable supply of Boat Unlisted Share (Imagine Marketing). This process not only makes it easier for employees and initial investors in liquidating their assets, but it also gives our clients access to shares that aren't often found on the open market. Our platform effectively facilitates a win-win situation for both buyers and sellers. -

How to trust Altius Investech before buying Bira91 (B9 Beverages Ltd.) from its platform?

Altius Investech stands at being India's fastest growing and leading marketplace for buying and selling unlisted shares. We believe in enabling access to alternative sources of investments at lower entry barriers to private equity investments.

With more than 25 years of experience, Altius Investech has carved a niche in the financial market by serving more than 8000 clients. The incredible journey is further highlighted by the vast number of transactions that Altius Investech has facilitated transactions that have already exceeded 300 crores.

For investors Altius Investech curates investment opportunities in companies at reasonable valuations which are on the verge of an IPO leading to massive value unlocking. Investments are backed by thorough research and sound investment thesis, with a time bound exit plan.

For ESOP Shareholder and existing Investors, we assist them to liquidate their shares even if they are not publicly traded by creating a platform where we find the right buyers and sellers for the best prices.

Altius Investech have been featured in top media news outlets like Economic Times, Financial Express, Money control. Check out about us on these - leading publications (Click on link) Our journey over these years has not just been about numbers; it's been about building trust and reliability.

We at Altius Investech are dedicated to upholding the greatest levels of ethics and transparency, making sure that your investment experience is not only profitable but also safe and reliable.

Press of Bira91 Unlisted Shares

Featured Blogs of Bira91 Unlisted Shares

Annual Report of Bira91 Unlisted Shares

Company Information of Bira91 Unlisted Shares

Featured Companies