Introduction

In a strategic move set to reshape the financial landscape, HDFC Bank is gearing up for a significant development – the initiation of the IPO process for its subsidiary, HDB Financial Services.

IPO Buzz – HDB Financial Services Takes Centre Stage

Preparing for the IPO Journey

- HDB Financial Services, HDFC Bank’s non-bank finance arm with a 94.7% stake, is poised to embark on the IPO journey.

- Chief Financial Officer Srinivasan Vaidyanathan emphasized the commencement of preparatory work, with a deadline extending until September 2025 for the IPO launch.

About the Company

HDB Financial Services (HDBFS) is a prominent Non-Banking Financial Company (NBFC) in India, dedicated to meeting the financial needs of both individual and business clients. Established in 2008, HDBFS is well-established and financially robust.

The company holds the status of a Systemically Important Non-Deposit taking NBFC, highlighting its significance in the financial sector. HDBFS has earned prestigious CARE AAA and CRISIL AAA ratings for its long-term debt and bank facilities, and an A1+ rating for its short-term debt and commercial papers, underscoring its reliability and financial strength.

HDBFS offers a diverse range of products, grouped into three main categories:

- Loans: HDBFS provides various loan products to cater to the diverse financial needs of its customers.

- Fee-based Products: The company offers fee-based financial products, providing additional services beyond traditional lending.

- BPO Services: HDBFS also engages in Business Process Outsourcing (BPO) services, contributing to its comprehensive portfolio and adding value to its clients.

Overall, HDB Financial Services stands out as a robust and trustworthy financial institution, offering a broad spectrum of financial solutions to both retail and commercial clients in India.

Promoters or Management

| Name | Designation | Experience |

| Arijit Basu | Chairman | 40 Years |

| Ramesh G. | MD&CEO | 27 Years |

To know more about the Unlisted Share price of NSE Shares on our platform. Click- https://altiusinvestech.com/company/national-stock-exchange-ltd-nseFundamentals

| HDB Financial Services Limited Unlisted Share price ( Source– Altius Investech) | ₹795 |

| Lot Size | 25 |

| 52 Week High ( Source- Altius Investech) | 795 |

| 52 Week Low ( Source- Altius Investech) | 625 |

| Depository | NSDL&CDSL |

| Market Cap (in Cr) | ₹65290.5 |

| P/E Ratio | 33.33 |

| P/B Ratio | 5.71 |

| Debt to Equity | 4.49 |

| ROE (%) | 17.13 |

| Book Value | 144.51 |

| Face Value | 10 |

IPO Buzz – HDB Financial Services Takes Centre Stage

Preparing for the IPO Journey

- HDB Financial Services, HDFC Bank’s non-bank finance arm with a 94.7% stake, is poised to embark on the IPO journey.

- Chief Financial Officer Srinivasan Vaidyanathan emphasized the commencement of preparatory work, with a deadline extending until September 2025 for the IPO launch.

HDB Financial Services – A Snapshot of Success

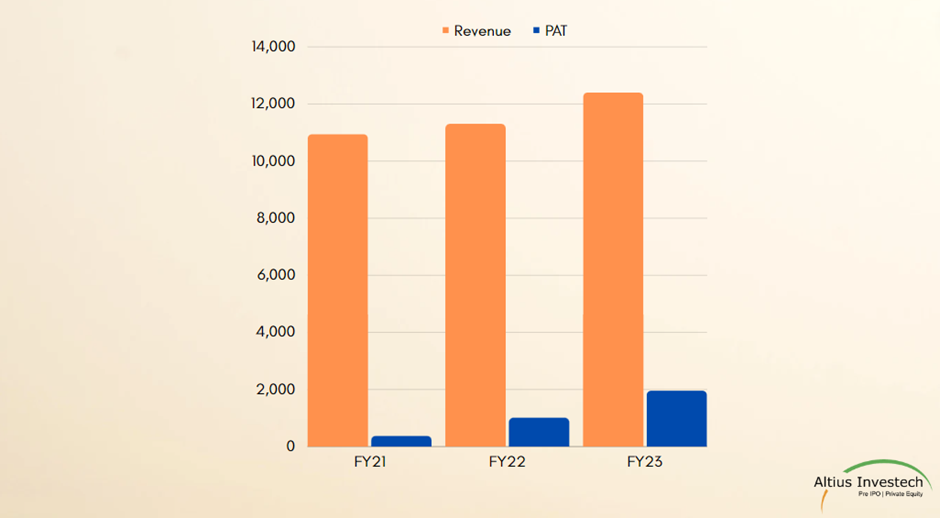

Financial Performance of HDB Financial Services (Unlisted)

₹ in Crores

| PARTICULARS | FY21 | FY22 | FY23 |

| Revenue | 10,944.80 | 11,306 | 12,403 |

| PAT | 378 | 1011 | 1959 |

| EPS | 4.79 | 12.79 | 24.75 |

To know more about the Financials of Tata Capital on our platform Altius Investech. Click- https://altiusinvestech.com/company/tatacapitalltdImpressive Loan Book Expansion

- The total loan book of HDB Financial Services soared to ₹840 billion as of December 31, 2023, registering a significant growth of 29.0%.

- Stage 3 loans, a critical indicator, stood at 2.25% of gross loans, reflecting a prudent approach to risk management.

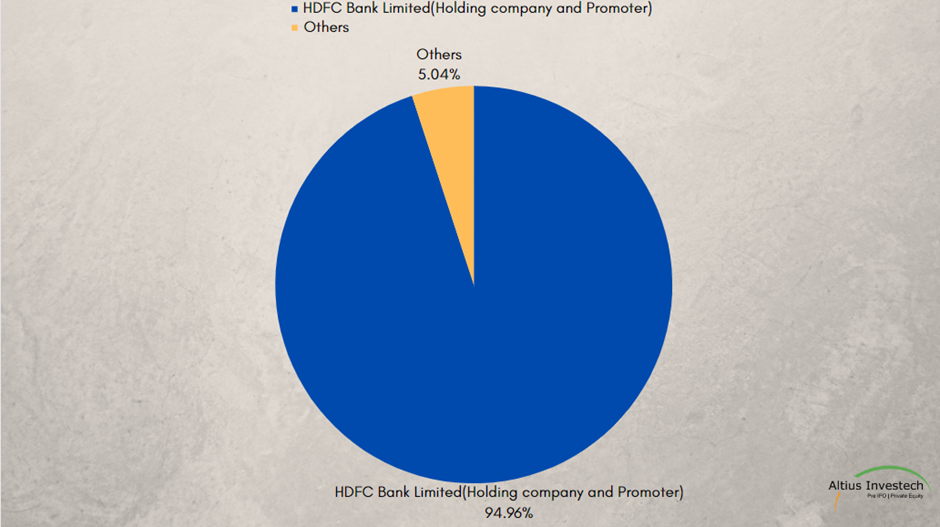

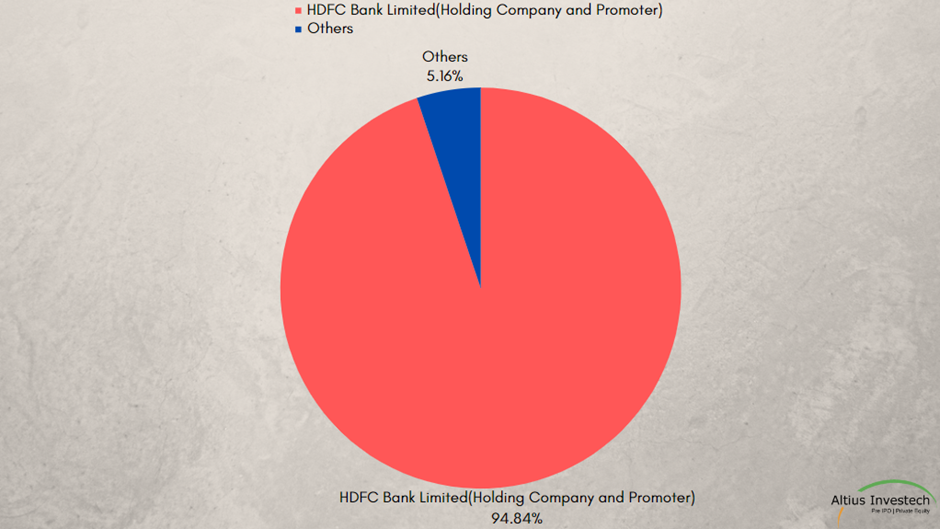

Shareholding Pattern

For the Year 2022

For the Year 2023

Key Milestones in the History of HDB Financial Services:

a) 2007–Incorporation: HDB Financial Services is established as a non-banking financial company (NBFC) in Mumbai, India.

b) 2008–Product Launch: The company introduces its inaugural product, a loan against property.

c) 2010–Diversification: HDB Financial Services expands its offerings to include personal loans and two-wheeler loans.

d) 2012–Portfolio Expansion: The company broadens its product portfolio, encompassing commercial vehicle loans, gold loans, and loans against securities.

e) 2015–Subsidiary Status: HDB Financial Services achieves subsidiary status, becoming part of HDFC Bank.

f) 2016–Product Innovations: The company ventures into credit cards and enters the insurance distribution sector.

g) 2017–Customer Milestone: HDB Financial Services surpasses the significant milestone of serving 1 million customers.

h) 2018–Strategic Partnerships: The company collaborates with fintech startups to bolster its digital capabilities.

i) 2019–Organizational Growth: HDB Financial Services surpasses 10,000 employees and unveils a new brand identity.

j) 2020–Pandemic Resilience: Despite challenges posed by the COVID-19 pandemic, HDB Financial Services adapts swiftly by introducing new digital products and services.

Despite the pandemic’s impact, HDB Financial Services demonstrates resilience, sustained growth, and ongoing innovation, solidifying its position as a leading NBFC in the Indian financial landscape.

To know more about the Unlisted share price of Utkarsh Coreinvest in our platform Altius Investech . Click- https://altiusinvestech.com/company/utkarsh-coreinvest-buy-sell-unlisted-sharesNoteworthy Achievements of HDB Financial Services:

Extensive Nationwide Presence:

Distribution Network: HDB Financial Services boasts a robust footprint, with over 1,400 branches strategically positioned across both urban and rural areas in India.

Diversified Financial Portfolio:

Comprehensive Offerings: The company offers a diverse array of financial products and services, ranging from personal and business loans to auto loans, loan against property, gold loans, and credit cards.

Customer-Centric Recognition:

Excellence in Service: Acknowledging its commitment to customer satisfaction, HDB Financial Services received the 2019 ET BFSI Award for “Excellence in Customer Service.”

Digital Innovation Accolades:

Tech Prowess: HDB Financial Services is recognized for its innovative use of technology, earning the 2020 IDC Digital Transformation Award for “Excellence in Omni-Experience Innovation.”

Exemplary Risk Management:

Risk Mitigation Excellence: The company’s sound risk management practices were honored with the 2020 ERM World Summit Award for the “Best Risk Management Framework Implementation in Financial Services.”

Commitment to Corporate Social Responsibility (CSR):

Social Impact: With a strong focus on sustainability and CSR, HDB Financial Services received the 2020 Golden Peacock Global Award for “Corporate Social Responsibility,” underscoring its impactful initiatives in this domain.

Conclusion

In conclusion, HDFC Bank’s bold move towards the IPO of HDB Financial Services aligns with its commitment to sustained growth and financial prudence. The stellar financial performance and ambitious expansion plans set a promising tone for the future. As the bank charts its course through regulatory challenges, the strategic vision remains unwavering, reinforcing HDFC Bank’s position as a key player in the ever-evolving financial landscape.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.