Renowned Non-Banking Financial Company (NBFC) HDB Financial Services, which was founded in 2008, has released its remarkable financial results for the nine months of FY24 and the quarter that ends on December 31, 2023. For investors and analysts who are interested in HDB Financial’s unlisted shares, these findings are especially important since they offer insightful information about the company’s financial situation and potential future growth.

Important Financial Aspects and Increases in the Value of HDB Financial Unlisted Shares

A consistent growth trajectory was demonstrated by HDB Financial Services in their most recent financial reports. For the nine months that concluded on December 31, 2023, the company’s Net Interest Income increased by 23% to INR 8098 crore from INR 6546 crore in the corresponding nine months of the previous fiscal year. This upward trend is a promising sign. This uptrend is a positive indicator for the valuation of HDB Financial unlisted shares.

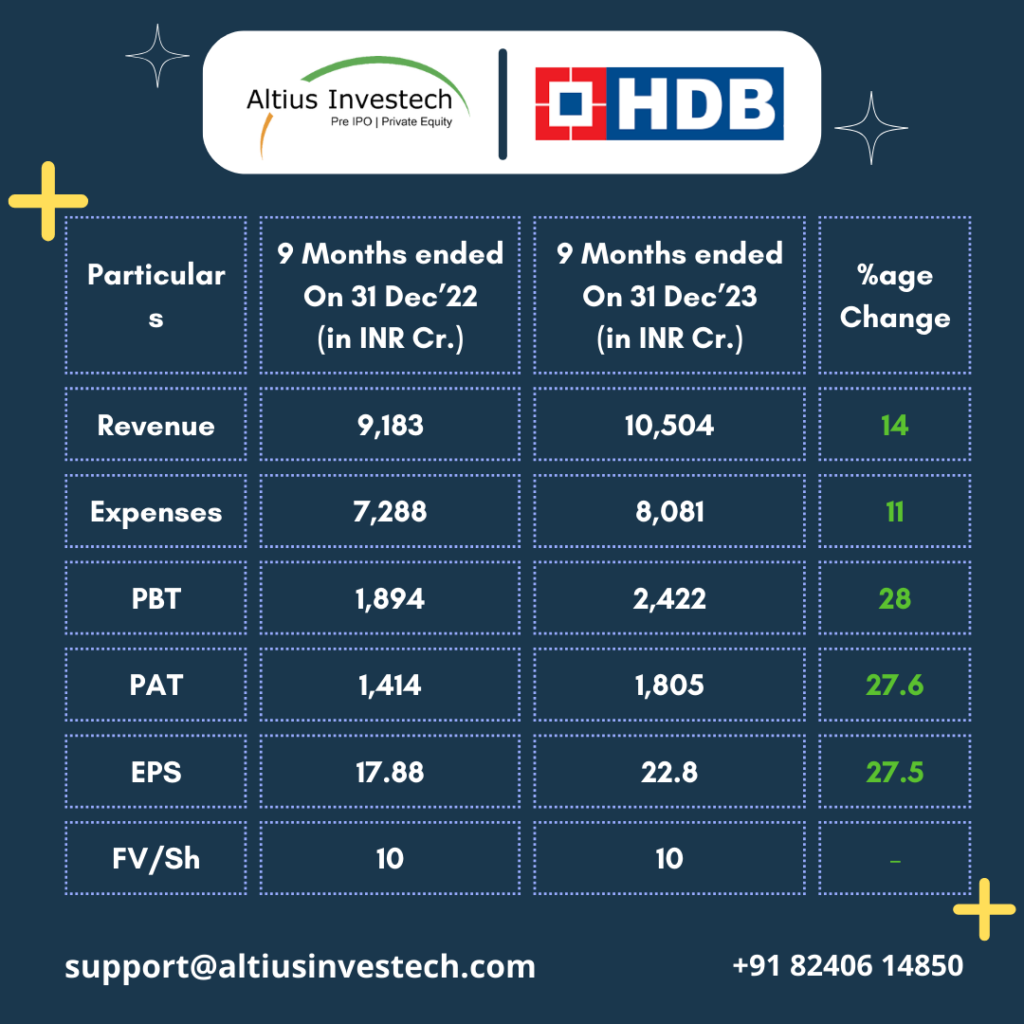

Furthermore, the overall income increased by 14% over the nine months that concluded in FY24, reaching Rs. 10504.3 crore as opposed to Rs. 9182.7 crore during the same time the previous year. The company’s excellent performance and the growing allure of HDB Financial’s unlisted shares in the financial market are highlighted by this significant revenue increase.

Cost Control and Functional Effectiveness

For the quarter ending December 31, 2023, overall expenses increased by 1.4% to Rs. 2746.2 crore from Rs. 2708.9 crore the previous quarter. The expenses climbed by 10.4% to Rs. 8081.4 crore throughout the course of the nine months. The attraction of HDB Financial’s unlisted shares is further enhanced by this controlled growth in expenses, which is indicative of HDB Financial Services‘ successful cost management techniques.

Analysis of Profitability

The profitability of HDB Financial is a salient feature that attracts investors to its unlisted shares. For the quarter ending December 31, 2023, Profit Before Tax (PBT) increased by 6% to Rs. 855.6 crore from Rs. 806.8 crore the previous quarter. The PBT for the nine-month period increased by an even more remarkable 27.9%, from Rs. 1894.2 crore to Rs. 2422.9 crore, compared to the previous year. The potential of HDB Financial’s unlisted shares is strongly indicated by this notable increase in profitability.

In a similar vein, the net profit for the quarter under review went from Rs. 600.8 crore to Rs. 636.8 crore, a 6% rise. For the nine months ending December 31, 2023, the net profit soared by 27%, reaching Rs. 1804.6 crore, up from Rs. 1413.9 crore in the same period of the previous fiscal year. This consistent rise in net profit highlights the solid financial foundation and growth prospects of HDB Financial Services, making HDB Financial unlisted shares an attractive proposition for investors.

NPA (Non Performing Asset)

In 9MFY24, gross non-performing assets (NPA) decreased from 3.23% in 9MFY23 to 2.75%.

Strong business operations and a diverse product portfolio

With a broad range of products including consumer loans (including gold, durable, auto, personal, and MF-backed loans), enterprise loans for SMEs, and asset finance for cars, HDB Financial Services has made a name for itself in the NBFC market. In addition, the business enhances its revenue streams by working with HDFC Life and HDFC Ergo to provide fee-based products including general and life insurance.

In addition, HDB Financial Services offers Business Process Outsourcing (BPO) services in collaboration with HDFC Bank, including collection services via its 15 call centers. The company, which has a vast network of 1,468 branches spread over 1,070 locations, is essential to the needs of both retail and commercial customers, which supports the unlisted shares of HDB Financial’s growth potential.

In summary

In summary, HDB Financial Services’ financial results for the quarter and nine months ended December 31, 2023, demonstrate a solid and expanding financial profile. The company’s rising profitability, well-managed spending, and expanding sales are important measures of its financial well-being. These elements, along with its wide range of products and broad operational network, make HDB Financial unlisted shares a desirable choice for investors seeking stability and growth in the financial industry.

To Invest in HDB Financial Services Pre-IPO Shares – Click Here

In case you need any personal assistance, you can reach out to us at +91 82406 14850

Also Read: