About the Company

DOMS Industries Limited is a company that started in 2006 and focuses on making and selling stationery and art products. Their main brand is called DOMS. They are known for creating a variety of high-quality products like pencils and mathematical instrument boxes. By March 2023, they have reached customers in more than 40 countries.

The company is quite successful, holding a significant market share of 29% for pencils and 30% for mathematical instrument boxes in the fiscal year 2023. They offer a diverse range of products, including items for school, art materials, paper stationery, kits and combos, office supplies, hobbies and crafts, and fine art products.

DOMS Industries Limited has a special partnership with some companies in the FILA Group to distribute and market their products in South Asia. This helps them reach more customers in that region.

Their products are available globally, thanks to a strong distribution network that spans across the Americas, Africa, Asia Pacific, Europe, and the Middle East. This means that people all around the world can easily access and enjoy their well-designed and high-quality stationery and art materials.

Company Vision and Mission

Vision

“To be recognized as India’s best-in-class business school in emerging knowledge domains of management, with expanding global reach through effective engagement with academia, industry, government, and other relevant stakeholders.”

Mission

- We support the foundational and life-long learning needs of all our stakeholders in functional and leadership roles.

- To develop differentiated talent-nurturing programs by integrating frontier management research with management theory and business practices.

- To proactively participate in strategic initiatives leading to new venture creation, performance excellence, and global engagement.

- We foster entrepreneurial thinking with environmental empathy, social responsibility, and corporate governance.

DOMS IPO DETAILS

DOMS IPO is a book-built issue of Rs 1,200.00 crores. The issue is a combination of fresh issue of Rs 350.00 crores and offer for sale of Rs 850.00 crores.

DOMS IPO price bands are yet to be announced.

DOMS IPO Timeline (Tentative Schedule)

DOMS IPO opens on December 13, 2023, and closes on December 15, 2023.

| IPO Open Date | Wednesday, December 13, 2023 |

| IPO Close Date | Friday, December 15, 2023 |

| Basis of Allotment | Monday, December 18, 2023 |

| Initiation of Refunds | Tuesday, December 19, 2023 |

| Credit of Shares to Demat | Tuesday, December 19, 2023 |

| Listing Date | Wednesday, December 20, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on December 15, 2023 |

Jm Financial Limited, Bnp Paribas, ICICI Securities Limited and Iifl Securities Limited are the book running lead managers of the DOMS IPO.

Objects of the Issue (DOMS IPO Objectives)

The net proceeds of the Fresh Issue, i.e., gross proceeds of the Fresh Issue less the offer expenses apportioned to the Company (“Net Proceeds”) are proposed to be utilised in the following manner:

1. Proposing to partly finance the cost of establishing a new manufacturing facility to expand its production capabilities for a wide range of writing instruments, watercolour pens, markers, and highlighters.

2. General corporate purposes.

DOMS Industries Limited Financial Information

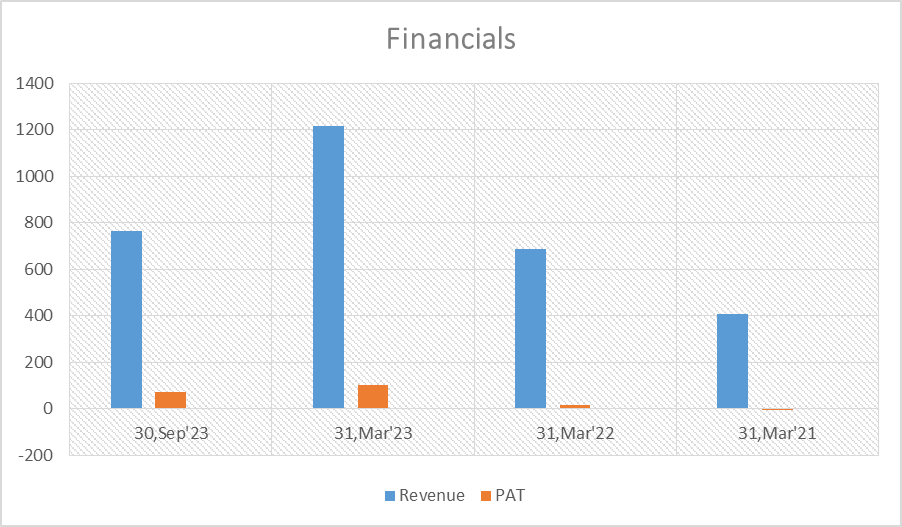

DOMS Industries Limited’s revenue increased by 77.28% and profit after tax (PAT) rose by 500.18% between the financial year ending with March 31, 2023 and March 31, 2022.

Amount in Crores (₹)

| Period Ended | 30 Sep, 2023 | 31 Mar, 2023 | 31 Mar, 2022 | 31 Mar, 2021 |

| Assets | 829.46 | 639.78 | 497.46 | 457.52 |

| Revenue | 764.22 | 1,216.52 | 686.23 | 408.79 |

| Profit After Tax | 73.91 | 102.87 | 17.14 | -6.03 |

| Net Worth | 397.61 | 337.43 | 247.25 | 233.61 |

| Reserves and Surplus | 341.36 | 337.06 | 246.87 | 233.24 |

| Total Borrowing | 176.38 | 100.07 | 84.90 | 97.27 |

Key Performance Indicator

| KPI | Values |

| ROE | 33.54% |

| ROCE | 33.31% |

| Debt/Equity | 0.28 |

| EPS (Rs) | 18.29 |

| RoNW | 28.39% |

DOMS IPO Peer Comparison

DOMS Industries Limited peer comparison with similar listed entities. (As on March 31, 2023)

| Company Name | EPS(Basic) | EPS(Diluted) | NAV per share (₹) | P/E(x) | RoNW (%) |

| DOMS Industries Limited | 18.29 | 18.29 | 59.99 | 28.39 | |

| Kokuyo Camlin Limited | 2.44 | 2.44 | 26.18 | 64.14 | 9.31 |

| Linc Limited | 25.15 | 25.15 | 119.16 | 28.15 | 21.10 |

| Navneet Education Limited | 9.04 | 9.04 | 17.78 | 15.86 | 17.78 |

| Flair Writing Industries Limited | 12.66 | 12.66 | 27.18 | 35.76 | 27.18 |

IPO’s Strengths

- Improved revenues, profitability, capital efficiency, and reduced debt levels in the past three years.

- Doms manages a diverse range of products in its portfolio.

- Established a strong brand name and is supported by an extensive network of domestic distributors and international partners.

IPO’s Weaknesses

- DOMS faces a concentration risk as 30% of its revenue comes from the wooden pencil, a product easily replicated by competitors.

- The potential for imitation poses a threat to DOMS’s brand, allowing smaller players to use a similar name fraudulently.

- The absence of formal contracts or exclusive supply agreements exposes DOMS to potential disruptions in its supply chain.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/