About Lord’s Mark Industries

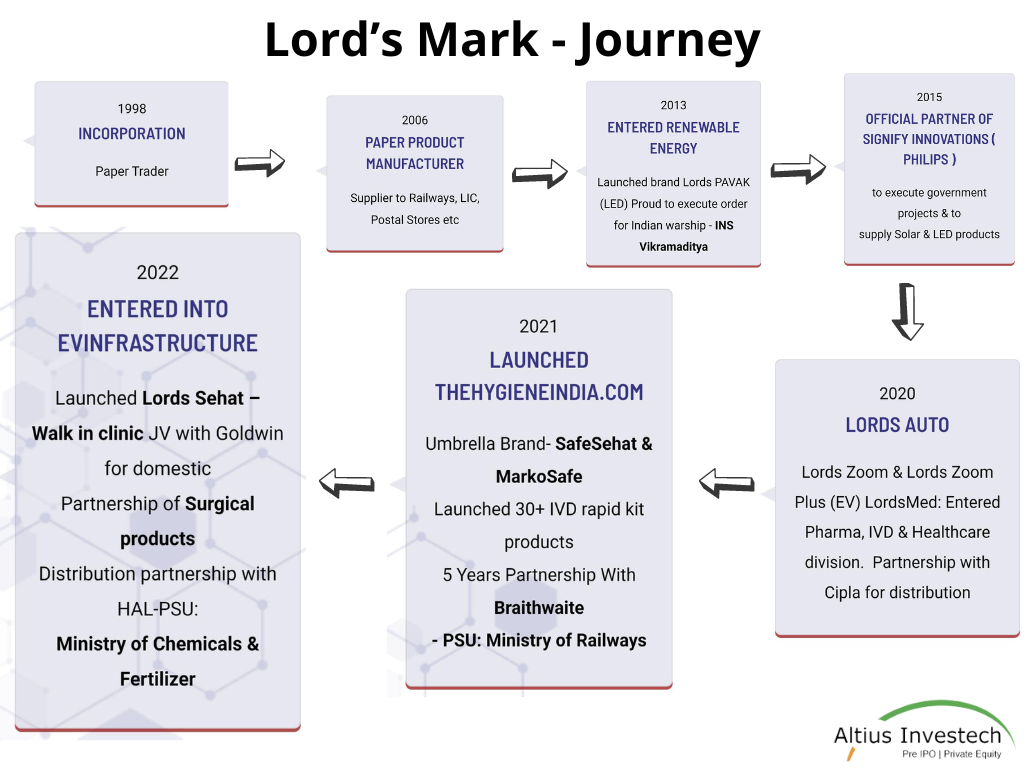

Lord’s Mark Industries, incorporated in 1998 in Mumbai, initially began its journey as a trader of Computer Continuous Paper Stationery and Copier Paper under the brand name “SAPPHIRE”. Over the past 25 years, the company has diversified its operations and expanded into multiple sectors including Paper manufacturing, Pharma, Renewable energy, and LED.

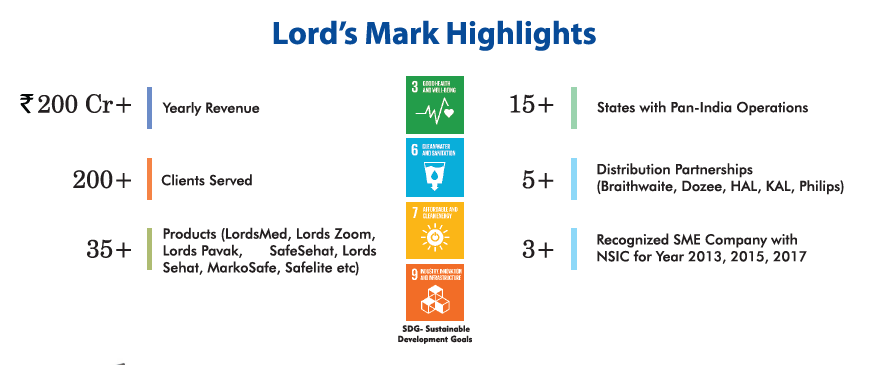

With a portfolio comprising more than 35 products, Lord’s Mark has established its presence in over 15 states across India and boasts a network of over 300 distributors. The company operates on a pan-India basis, catering to a wide range of clients including prominent names such as Coal India, Life Insurance Corporation of India, Ministry of Defense, ONGC, Indian Post, Indian Navy, and Indian Railways among others.

| Company Name | LORD’S MARK INDUSTRIES LIMITED |

| Company Type | Unlisted Public Company |

| Industry | Manufacturing (Paper, Pharmaceuticals, Renewable Energy, and LED Lighting) |

| Founded | 1998 |

| Registered Address | Mumbai, Maharashtra, India |

| Website | lordsmark.com |

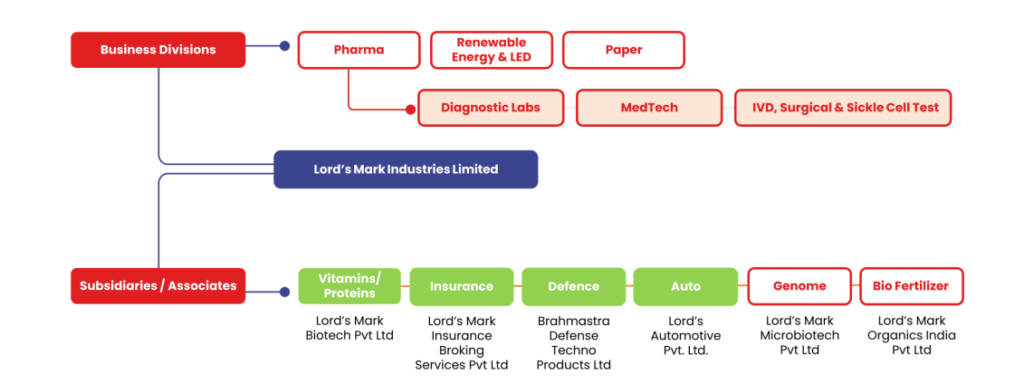

Lord’s Mark Business Divisions

Lord’s Mark Industries: Vision, Mission, and Values

| Aspect | Description |

|---|---|

| Vision | Delivering value to all stakeholders and partners by creating sustainable business to become a globally recognized brand in diversified industries. |

| Mission | To be recognized as one of the fastest growing business conglomerates through quality products, innovative approach, and unbreakable trust. |

| Values | – Thrive on Opportunity – Embrace Growth – Speed of Light Execution – Innovation & Collaboration |

Lord’s Mark – Journey

Lord’s Mark Industries: Product Portfolio Overview

Lord’s Mark Industries operates in three main divisions:

Diagnostic And Medtech Division:

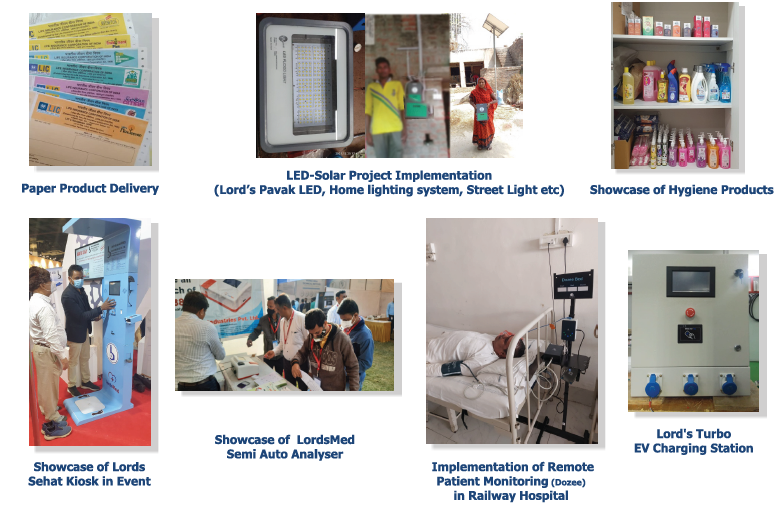

This division focuses on healthcare-related products. Under the Diagnostics vertical, LordsMed offers a range of diagnostic products including analyzers, reagents, rapid antigen kits (including the ICMR-approved LordsMed Rapid antigen kit), and lab consumables. In the Holistic Hygiene segment, products under brands like SafeSehat and MarkoSafe are offered, including natural health and hygiene products. The Surgical segment includes the manufacturing of generic drugs and surgical products.

Renewable Energy Division:

Lord’s Mark Industries is actively involved in the distribution of solar-based products and appliances, promoting green environment initiatives and reducing dependency on traditional energy resources. Products include Offgrid Solar Plants, Ongrid Solar Plants, Solar Home Lighting Systems, Solar Street Light Systems, LED lights of various types, and other innovative products utilizing solar power.

Paper Division

The company’s Paper division specializes in manufacturing various paper products. This includes Computer Continuous Paper Stationery, copier paper, and other paper products such as reservation charts, railway tickets, coupons, postal acknowledgment slips, and stationery required by the defense sector. Lord’s Mark Industries is a market leader in the printing of Computer Continuous Paper Stationery and has received certifications such as ISO 9001-2015 for the Paper Printing process and Bureau of Indian Standard (BIS) certification for paper manufacturing. They are also registered with organizations like the Directorate General of Supplies & Disposals (DGS&D) and Government E-Market (GEM) for the supply of paper products.

Key Clients

The following are just a few of the prestigious clients the company has supplied its goods:

Lord’s Mark Highlights

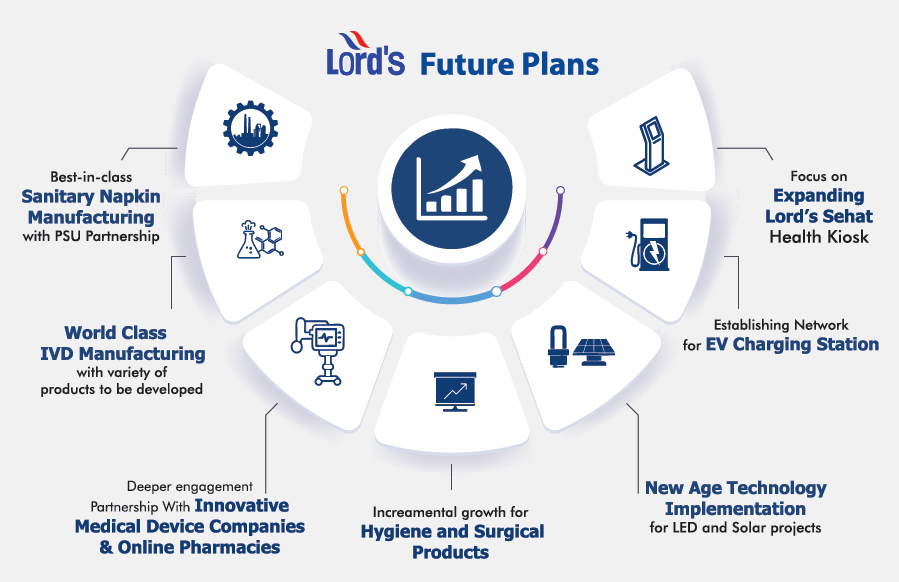

Lord’s Mark: Future Plans

Their plans entail a strategic roadmap for expansion, acknowledging that no industry can flourish without a clear vision. They are steadfastly pursuing their objectives to deliver optimal innovative solutions for their partners and clients.

Management of the Company

Dr. Sachidanand Upadhyay – Managing Director, CEO

Dr. Sachidanand Upadhyay currently holds the position of Managing Director and CEO at Lord’s Mark Industries Limited. With a robust professional background and expertise in business management, Dr. Upadhyay has played a pivotal role in steering the company towards growth and success. Over the past 24 years, he has demonstrated a keen understanding of market dynamics, leading the company through strategic diversification and technological advancements. Dr. Upadhyay’s vision is centered on creating sustainable business practices and delivering value to all stakeholders. His leadership has been instrumental in shaping Lord’s Mark Industries into a dynamic and forward-thinking organization poised for continued expansion and innovation.

Manav Teli – Executive Director

Manav Teli, currently serving as the Executive Director at Lord’s Mark, brings a wealth of experience and expertise to the table. With a background in BCOM with a focus on economics and marketing, Manav is recognized as both an entrepreneur and innovator in the industry. With over 30 years of experience in leading businesses and entrepreneurial ventures, he has honed his skills as a business strategist and innovative administrator. Throughout his career, Manav has demonstrated a keen ability to drive growth and foster innovation, making him a valuable asset to Lord’s Mark Industries.

.

.

Industry Overview

The manufacturing industry in India is a vital pillar of the country’s economy, encompassing diverse sectors such as automotive, pharmaceuticals, textiles, and electronics. With initiatives like “Make in India,” the sector has witnessed significant growth, attracting both domestic and international investments. India boasts a large pool of skilled labor, a burgeoning domestic market, and favorable government policies aimed at promoting manufacturing and boosting exports. Despite challenges such as infrastructure constraints and regulatory complexities, efforts are underway to address these issues and drive sustainable growth. With advancements in technology and digitalization driving innovation and efficiency, India’s manufacturing sector is poised for continued expansion and global competitiveness, offering ample opportunities for businesses to thrive and contribute to the nation’s economic development.

IPO Plans

On December 2023, Lord’s Mark Industries has revealed its plans to go public in the first half of 2024, with the aim of raising Rs 500 crores. The company intends to utilize the proceeds to bolster its subsidiaries, focusing on the development of medtech products, innovative diagnostic solutions, expansion of its pathology lab pan India, and the export of medical diagnostic products and machines.

IDBI Capital and Mirae Asset have been appointed as the merchant bankers for the listing process. Sachidanand Upadhyay, the Managing Director of Lord’s Mark Industries, expressed confidence in the company’s growth trajectory, highlighting the success of its Diagnostic-Medtech and Solar-LED divisions, along with its subsidiaries’ strategic plans to deepen market penetration.

Key Strengths

- Experienced Promoters and Management: The company is led by Mr. Sachidanand H. Upadhyay, who has over two decades of experience in various business verticals, along with Mr. Dinesh Tiwary, who has 18 years of experience in production and quality management.

- Diversified Business Profile: With three major divisions – Paper Products, Solar LED, and Pharma – the company caters to a wide range of industries and government institutions, ensuring a diversified revenue stream.

- Reputed Customer Base: The company supplies paper to central government institutions and executes government contracts for LED and Solar projects. It is also an official channel partner of Cipla for government business.

- Healthy Order Book Position: As of January 31, 2022, the company has a substantial order book for its LED and Pharma divisions, indicating a strong demand for its products and services.

- Comfortable Capital Structure: The company maintains a comfortable gearing ratio and healthy debt protection metrics, ensuring financial stability and sustainability. Overall, these strengths position the company well for future growth and success.

Key Weaknesses

- Modest Scale of Operations: The company’s revenues have remained modest, with fluctuations due to factors like lockdown restrictions. While capex investments are expected to improve operations, the scale remains modest, posing a challenge to achieving high revenues.

- Low Profitability Margins: The company’s PBILDT margins have improved gradually but remain moderate and on the lower side, mainly due to intense competition in the tender business. Competition forces the company to sacrifice margins to win tenders, impacting profitability.

- Working Capital Intensive Operations: The company’s working capital cycle has moderated but remains relatively high, leading to increased utilization of working capital limits. Additionally, the company faces counterparty risk due to its reliance on government organizations as major debtors.

- Exposure to Tender-Based Business Risks: The company’s revenue is largely derived from successful tender bids, making it vulnerable to the tender-based nature of operations. Intense competition and low operating margins pose challenges in maintaining profitability and market position.

Recent News

Lord’s Mark Industries Launches E Smart Clinic Project Nationwide

(March 2024) Lord’s Mark Industries Ltd., in collaboration with Unnat Bharat Abhiyan, launched the E Smart Clinic project, inaugurated by Prime Minister Narendra Modi at AIIMS Rajkot on March 7, 2024. This initiative aims to provide affordable diagnostics and medical consultations to rural India using patented technology developed by Lord’s Mark Industries and Dozee. The clinic, with its 99 percent accuracy, conducts blood tests in 20 minutes and connects patients with doctors online, aligning with the government’s vision of accessible healthcare. With plans to offer testing and consultation for less than Rs. 1000 per patient nationwide, the project represents a significant step towards equitable healthcare in India.

Lords Mark Industries Launches World-Class Diagnostic Testing Kits

(February 2024) Lords Mark Industries Ltd., through its healthcare division LordsMed, announced the launch of 10 world-class reagent and diagnostic testing kits targeting critical diseases. These kits boast 99.7% accuracy, high sensitivity, and a shelf-life of 24 months. With India patents filed, the company aims to strengthen preventive healthcare mechanisms. Manufacturing will take place in Maharashtra, with plans for global exports, targeting revenue of Rs 200 crores. Sachidanand Upadhyay, MD & CEO, highlighted the growing demand for quality diagnostic kits and the company’s commitment to meeting it. Lord’s Mark Industries, known for its diversification, is setting new benchmarks with its foray into the medical diagnostic industry.

Lords Mark Industries Targets Export of 6.55 Million Diagnostic Supplies to SAARC Countries

(January 2024): Lord’s Mark Industries, through its healthcare division LordsMed, plans to export over 6.55 million diagnostic supplies to SAARC countries. With a focus on becoming a global leader in In-Vitro Diagnostics (IVD), the company aims to provide top-quality solutions at an affordable cost. Expanding its reach beyond India, LordsMed is poised to supply neighboring countries with high-quality IVD products while exploring OEM opportunities and scaling up manufacturing capacity.

Share Price (as on 08.04.2024)

- The buy price of Lord’s Mark varies based on quantity, ranging from 175 for quantities between 5000 – 9999 shares to 166 for quantities between 20000 – 24999 shares, with corresponding rates per share.

- The 52-week high is 166, and the 52-week low is 157 indicating the range of fluctuations in the share price. Additionally, the sell price of Lord’s Mark is fixed at 145.

Currently, the Lord’s Mark Share Price is trading at around Rs. 160/share. CLICK HERE to Invest.

Financial Metrics for Lord’s Mark (as of 08.04.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 202.44 |

| Price to Sales Ratio (P/S) | 3.07 |

| Price to Book Value (P/B) | 19.79 |

| Industry PE | – |

| Face Value | ₹ 5 |

| Book Value | ₹8.39 |

| Market Cap | ₹939.26 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

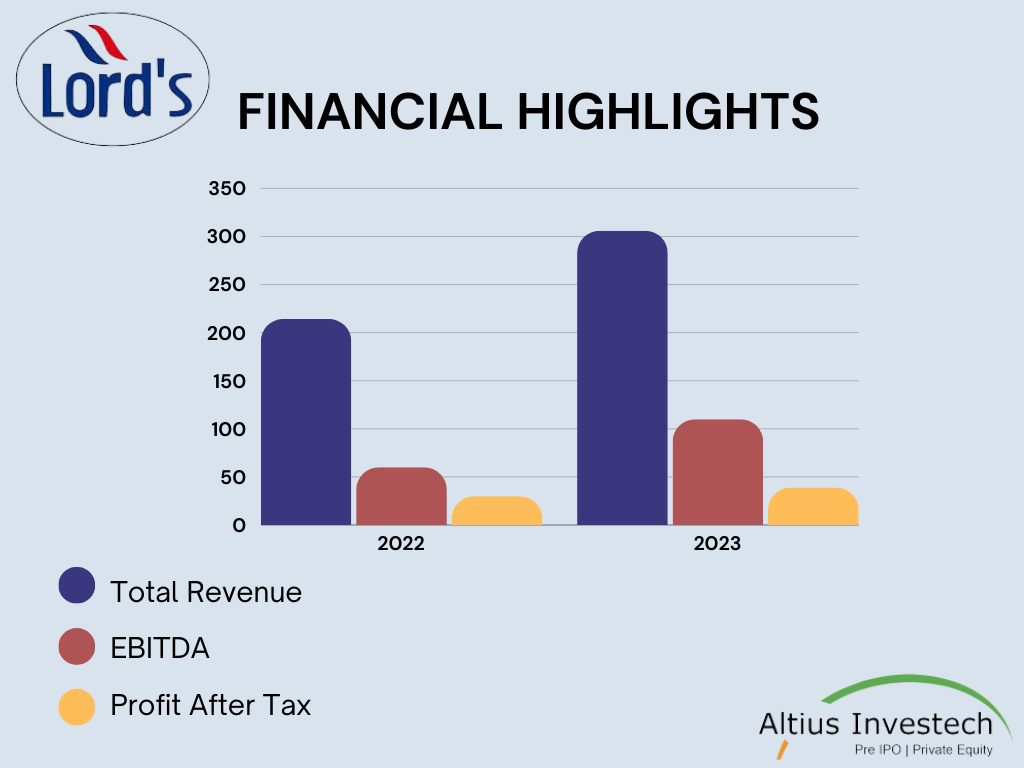

Financial Highlights

₹ in crores

| Particulars | FY 2023 | FY 2022 | Y-o-y growth |

| Total Revenue | 306.50 | 214.24 | 43% |

| EBITDA | 21.84 | 12.74 | 71% |

| Profit After Tax (PAT) | 4.64 | 4.21 | 10% |

Conclusion

- Company Overview: Lord’s Mark Industries, founded in 1998 in Mumbai, began as a trader of Computer Continuous Paper Stationery and Copier Paper under the brand name “SAPPHIRE”. Over the past 25 years, it has diversified into multiple sectors including Paper manufacturing, Pharma, Renewable energy, and LED. The company operates pan-India and serves clients like Coal India, Life Insurance Corporation of India, and Indian Railways among others.

- Product Portfolio Overview: 1. Diagnostic And Medtech Division– Offers diagnostic products, holistic hygiene products, and surgical items, 2. Renewable Energy Division: Distributes solar-based products, promoting green environment initiatives, 3. Paper Division: Specializes in manufacturing various paper products including Computer Continuous Paper Stationery and copier paper.

- Key Clients: Includes prominent names like Indian Railways, Indian Oil, and LIC.

- Industry Overview: India’s manufacturing sector is vital, witnessing growth with initiatives like “Make in India”.

- IPO Plans: Planning to go public in the first half of 2024 to raise funds for subsidiary development and innovation.

- Strengths: Experienced leadership, diversified business profile, reputed customer base, healthy order book position, and comfortable capital structure.

- Weaknesses: Modest scale of operations, low profitability margins, working capital-intensive operations, and exposure to tender-based business risks.

- Recent News: Initiatives include launching the E Smart Clinic project, world-class diagnostic testing kits, and targeting exports to SAARC countries.

- Financial Metrics: Indicates healthy growth in total revenue, EBITDA, and Profit After Tax (PAT).

- Conclusion: Despite challenges, Lord’s Mark Industries stands poised for long-term success with its diversified portfolio, strategic vision, and commitment to innovation and sustainability.

ALSO READ OUR OTHER BLOGS

GET IN TOUCH WITH US:

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/