We had first invested in HDB Financials Pre-IPO Shares at around Rs. 225/share on Feb’2017 and since then here is how the price graph has moved:

Jan 2019 – Rs. 325/share

April 2020 – Rs. 650/share

November 2021 – Rs. 990/share

Aug 2022 – Rs. 635/share

This translate to a CAGR of roughly around 23.06%+

Now let’s have a look at company’s business model, Financials, Valuation, Latest News and FAQs.

About the Company: HDB Financial Services

HDB Financial Services (HDBFS) is a leading Non-Banking Financial Company (NBFC) that caters to the growing needs of an aspirational India, serving both Retail & Commercial Clients. It is a Systemically Important Non-Deposit taking Non-Banking Financial Company (‘NBFC’)

Incorporated in 2008, they are a well-established business with strong capitalization. HDBFS is accredited with CARE AAA & CRISIL AAA ratings for its long-term debt & Bank facilities and an A1+ rating for its short-term debt & commercial papers, making it a strong and reliable financial institution.

Website:

Products of the Company:

The current product portfolio consists of three main categories i.e. Loans, Fee-based products, and BPO services

Consumer Loans:

The Company provides White loans (Washing Machine and Refrigerator), Brown loans (such as televisions, audio equipment, and similar household appliances, etc.) and digital products (such as Mobile Phones, Computer and Laptops). The company also provides loans for household purposes.

Consumer Loans Portfolio includes:

-

- Gold loan

- Consumer Durable loan

- Auto loans

- Personal loans.

- Loan against Mfs.

2. Asset Finance:

The company provides loans to purchase a new and old vehicle or the vehicles which generate income for the borrowers such as Truck, Tractors etc.

3. Fee-based products:

The company is registered Corporate Insurance Agents which sells Life and General insurance products of HDFC Life and HDFC Ergo to the clients.

4. BPO Service:

Collection Service- The company has a contracted with HDFC bank to collect dues from the borrowers. The company has set up 15 call centers across the country with a capacity of 5000 seats.

5. Infrastructure:

As of March 31, 2021, HDB has 1,319 branches in 959 cities in India. The Company’s data centers are located in Bengaluru and Mumbai with centralised operations based out of Hyderabad, Chennai, and Noida. In a quest to strengthen its internal processes, the Company has further implemented a quality management system for its centralised operations.

6. Enterprise Loans:

Small and Medium Enterprise needs funding either for Working Capital, buying a new bid, or seing up a new plant. The company oers secured and unsecured loans to these SMEs

Strengths of HDB Financials

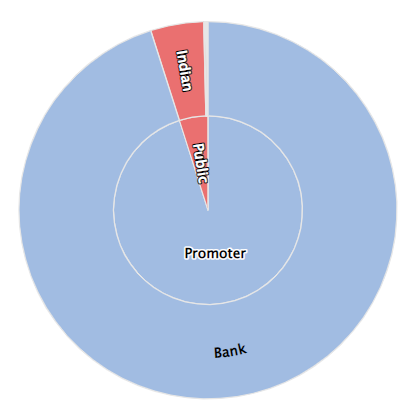

1. HDFC Bank Holds Majority Shareholding :

The company complements the parent’s product portfolio and distribution network, and supports collection activities for the retail portfolio. The company also receives regular funding support from its parent—Rs 3,480 crore has been infused cumulatively.

2. Established presence in the retail finance segment :

HDB Finance has emerged as one of the larger players in the retail financing space, over the past few years. The overall assets under management (AUM) stood at Rs 61,561 crore as on March 31, 2021 registering a growth of ~5% y-o-y, from Rs 58,833 crore a year ago. However, disbursements for fiscal 2021 declined by ~16% on y-o-y basis to Rs 24,990 crore from Rs 29,853 crore in last fiscal. The slowdown in growth was largely due to cautious approach adopted by the company in certain segments on account of Covid-19 pandemic.

3. HDB Finance’s loan book has diversified over the years, with increased presence in commercial vehicle/construction equipment (CV/CE) financing and business loans. As a result, the share of loans against property (LAP) declined to 29% as on March 31, 2021, as compared to 41% as on March 31, 2018. Whereas, that of CV/CE loans and Business loans rose to 43% and 24%, respectively, from 35% and 20%, respectively.

4. Healthy capital position :

Capitalisation remains healthy, as reflected in Tier-1 capital adequacy ratio (CAR) of 13.4%, and overall CAR of 18.9% as on March 31, 2021. Net worth stood at around Rs 8,446 crore as on March 31, 2021 against Rs 8,018 crore as on March 31, 2020, while gearing stood stable at ~6.0 times. Cushion for asset side risks was adequate, as reflected in net worth coverage for net non-performing assets (NPAs) at around 4.5 times as on March 31, 2021.

Weakness of HDB Financials

Ability to maintain asset quality metrics given the current challenging environment to remain monitor-able: Overall asset quality remains adequate, though gross NPAs have risen to 4.5% as on March 31, 2021 from 3.9% as on March 31, 2020 (Pro-forma at 5.9% as on December 31, 2020).

The increase in gross NPAs was mainly account of challenging macro environment. The Gross NPA from loans against property (LAP) segment, CV/CE segment and business loans segment were 5.6%, 4.6% and 3.3%, respectively, as on March 31, 2021 (4.6%, 4.8% and 1.4%, respectively, a year ago).

Insights

Loan disbursements during the year (2021-22) were ` 29,033 crore as against ` 24,990 crore in the previous year.

The Assets under Management (AUM) of the Company as at March 31, 2022 stood at ` 61,444 crore as against ` 61,561 crore in the previous year.

The Company has continued to focus on diversifying its products and expand its distribution while augmenting its digital infrastructure and offerings to effectively deliver credit solutions to its market.

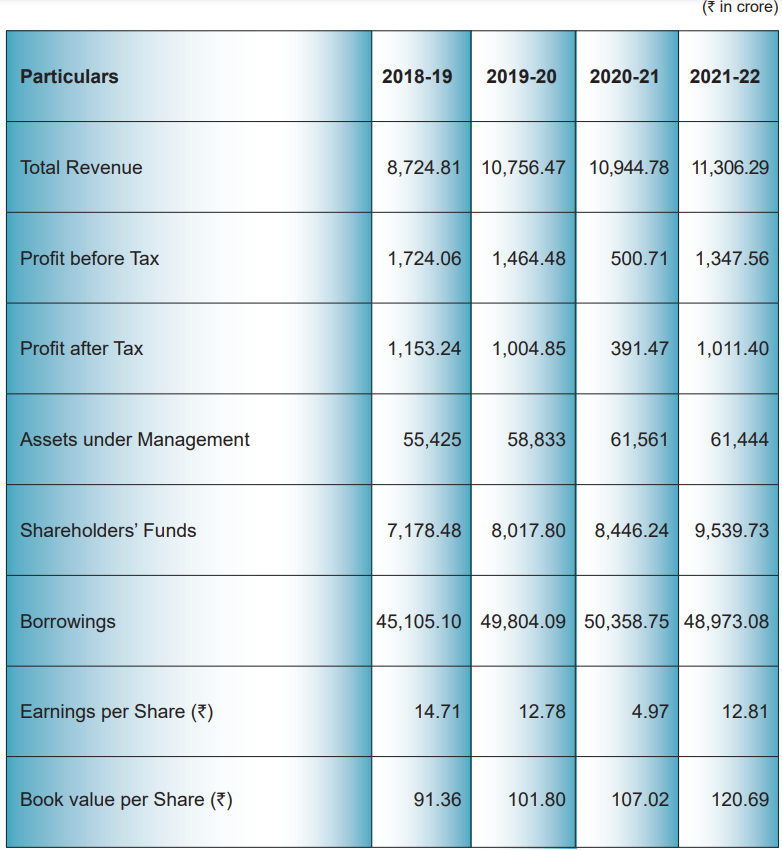

The total Revenue of the HDB Financials has increased from Rs.10,944.78 Cr. in the FY2020-21 to Rs.11,306.29 Cr. in the FY2021-22, which is a growth of around 3.3%.

Profit after Tax(PAT) of HDB Financials has been increased by 158.35% from Rs.391.47 Cr. in the FY2020-21 to Rs.1011.40 Cr. in the FY2021-22.

Financials Of HDB Financials

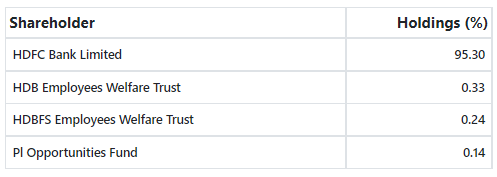

Shareholding Pattern

Valuation

Currently, HDB Financials Pre-IPO Shares are available at Rs. 635 per share. And, book value of the HDB Financial is Rs. 120.69 per share. So, P/B is 5.2x.

The nearest peer in the listed segment is Bajaj Finance which is currently trading at P/B of 10.21x.

Latest News about HDB Financials Pre-IPO Shares

HDFC Bank to consider IPOs for HDFC Sec, HDB Financial Services after merger

RBI may allow NBFCs to issue credit cards: Report

FAQs about HDB Financials Pre-IPO Shares

How can I buy HDB Financials Pre-IPO Shares?

To invest in HDB Financials Pre-IPO Shares – Click Here

What is HDB Financials Pre-IPO Shares?

The current market price of HDB Financials Pre-IPO Shares is 635/share (as of Aug’2022)

Is it possible to buy HDB Financials Pre-IPO Shares before listing?

Yes, you can buy HDB Financials Pre-IPO Shares from Altius Investech, they deal in 130+ pre-IPO shares including HDB Financials services.

Also Read: All You Need To Know About Studds Pre-IPO Shares!