Five Star Business Finance Limited is a unicorn in their industry. Despite being supported by big names like Matrix, Sequoia, and TPG, they’re not well-known. The company was valued at $1.4 billion earlier this year, while the DRHP filed earlier this month is said to be worth at $3 billion or more.

Five Star is a non-banking financing organisation that primarily focuses on business loans to underprivileged, first-time credit borrowers. Their target demographic is anticipated to have a Rs. 80 Trillion credit gap, which they have successfully addressed. Interestingly, there are a number of other participants in this segment, but none have been as successful as Five-Star. Let us investigate why.

Our update for this week goes deeper into the MSME opportunity and the Five Star playbook. Read on to learn more.

Content Bank

Why is this definition even important though?

The Five Star strategy – Loan Against Property (LAP)

What makes the Five Star playbook work?

The MSME opportunity

Let’s begin by delving deeper into the MSME opportunity, including sub-segments, characteristics, and the credit gap.

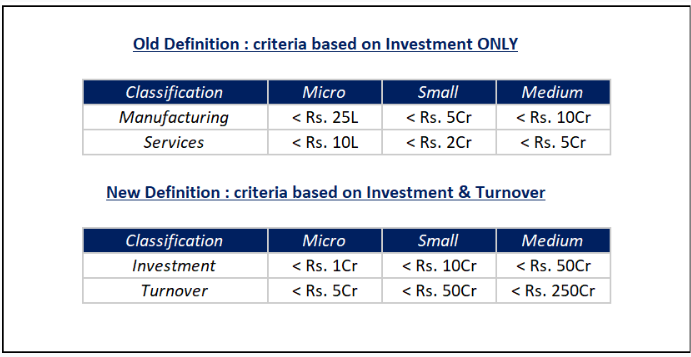

First, let’s define MSMEs (Micro, Small, and Medium Enterprises). Previously, MSMEs were classified based on investment and Manufacturing vs. Services. Now, the classifications are based on investment and turnover + are the same for Manufacturing and Services. Enterprises with high turnover may previously exhibit lesser investment and be classed as micro businesses. Still, the new definition will not allow for such misclassification and is expected to be more accurate.

Why is this definition even important, though?

For one, banks have priority sector limits (PSL), as part of which they are mandated to extend a certain portion of their loans to micro businesses. In addition, banks lend to NBFCs, and bank loans to NBFCs (including Five Star) further lent to Micro businesses also fall under the PSL limit. So PSL limits and an accurate MSME definition benefits lenders like Five Star. Let’s look at a few numbers related to MSMEs in India.

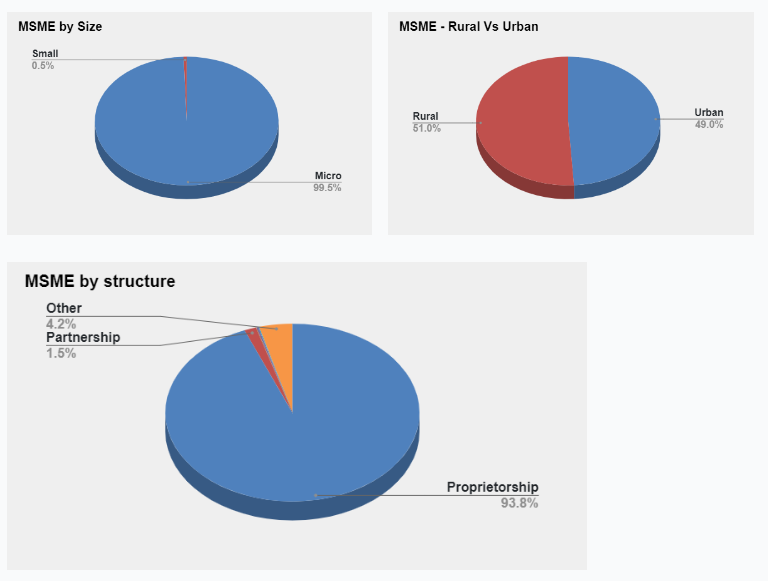

Firstly, the charts below clearly show that most businesses in India are Micro businesses and structured as sole proprietorships.

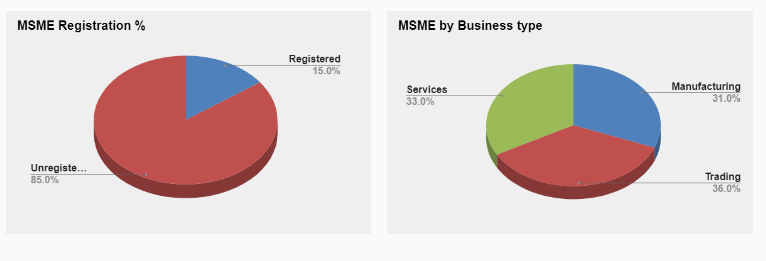

Secondly, the majority of MSMEs are unregistered and operate in non-manufacturing businesses.

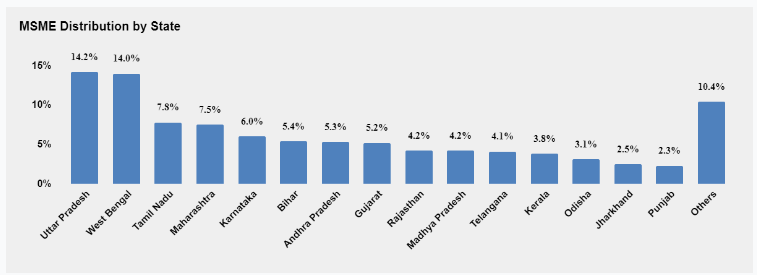

Thirdly, ~50% of businesses are concentrated in 5 states.

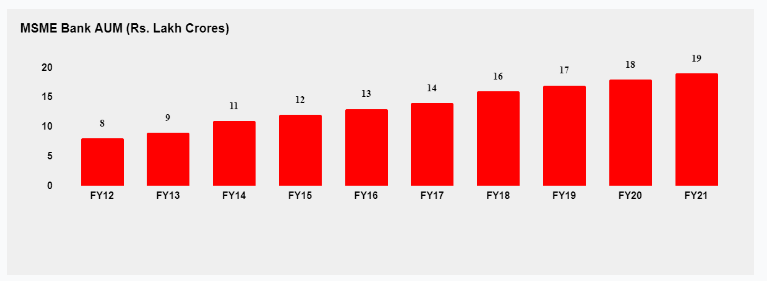

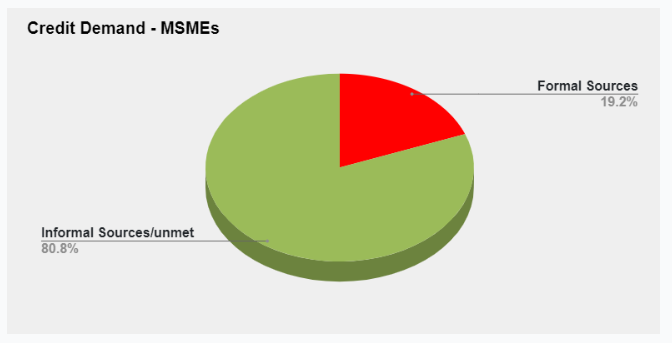

Total MSME AUM today is ~Rs. 19 trillion….

…but this is only 19% of the credit demand for this segment! The remaining 81% or ~Rs. 80 Trillion is unmet or partially met via informal sources. This is a massive opportunity.

The Five Star Business Finance strategy – Loan Against Property (LAP)

Five Star Business Finance Limited has grown its business by focusing on micro-enterprises, the country’s largest category of MSMEs. This area, as we showed in the previous section, is highly underserved and has a big credit gap. Five Star offers loans with ticket amounts ranging from Rs. 1 to 10 lakhs and terms ranging from 5-7 years.

However, this area has its challenges, with three major ones highlighted. –

- Because most of this segment has no credit bureau presence and limited/no income papers, it is difficult to assess the business’s ability to repay the loan using traditional underwriting approaches.

- This sector consists primarily of service-oriented enterprises with no collateral to offer.

- This segment is not resilient to macroeconomic worsening and is likely to see high NPAs during downturns.

Let’s find out how Five Star tackles each of these.

To tackle #1 – Five Star has built a robust underwriting process to evaluate business cashflows – via a process that is largely non-digital in nature. Every loan involves a personal discussion to evaluate business cashflows. This approach is robust, but how does Five Star manage the high operating costs associated with such a process?

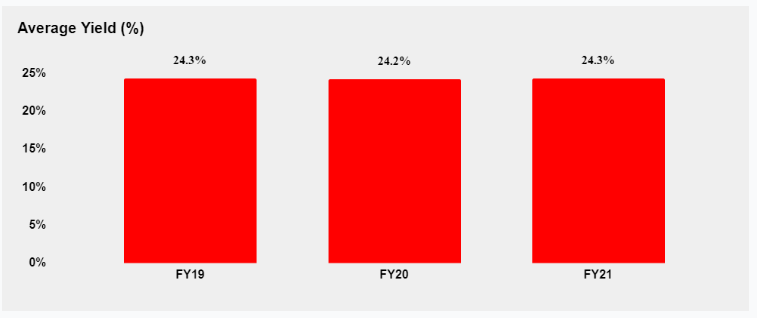

The answer is simple – they price for it and given the underserved nature of this business, they have the pricing power to do so.

How does Five Star tackle #2 and #3?

They do this by collateralizing the customer’s residential property. More specifically, Five Star only allows self-occupied residential property (SORP) as collateral. It is intuitive that a self-occupied property as collateral can not only be a powerful driver of customer willingness to repay the loan but is also a great way of defending against losses in macroeconomic worsening scenarios.

To understand the efficacy of this approach, let’s look at two data points.

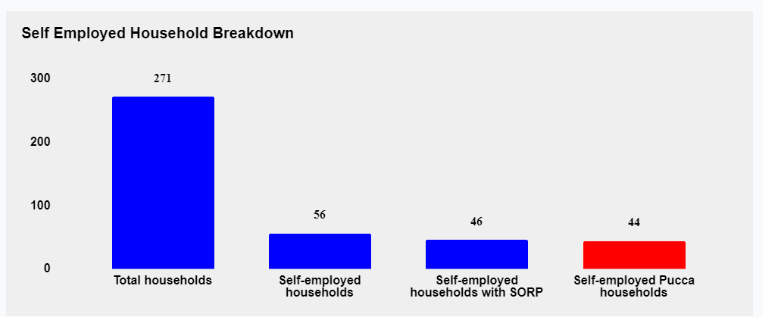

First, how many self-employed households have a self-occupied residential property?

Interestingly, this number is ~44 Million. Assuming a Rs. 5Lakh lending opportunity to each of these households, we arrive at a Rs. 22 Trillion opportunity!

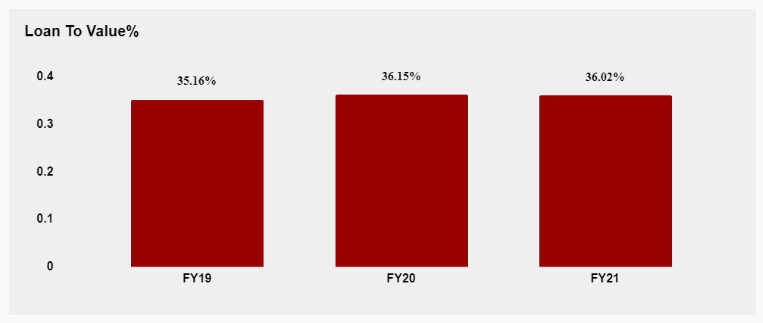

Second, how defensible is Five Star’s lending?

Very defensible, the chart below shows the loan amount as a % of the collateral value (called LTV or Loan To Value), and this number is ~35%!

What makes the Five Star playbook work?

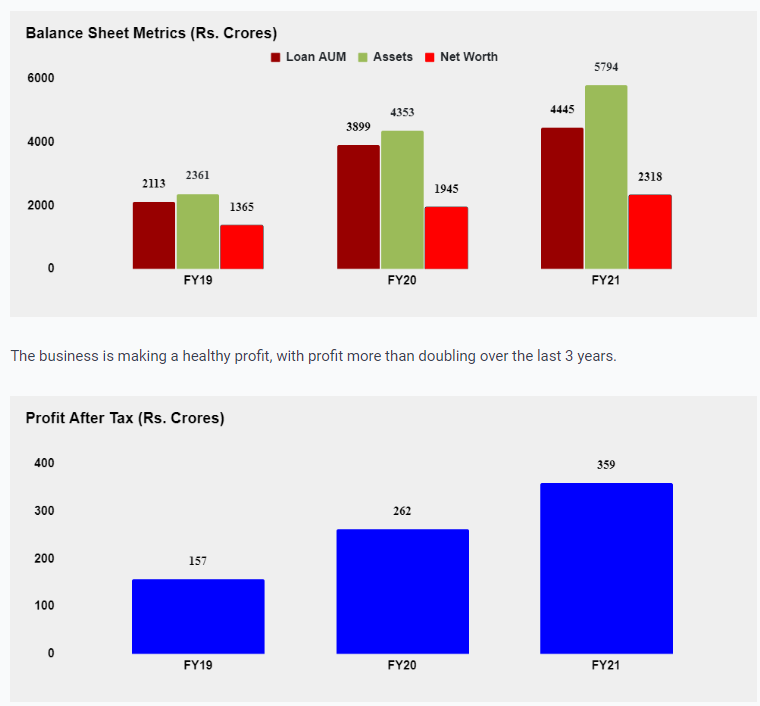

Let’s first build an understanding of the business’s key financials. As of March 2021, the business has a loan AUM of ~4500 Crores, and all balance sheet metrics have almost doubled over the last 3 years.

How has Five Star managed to grow so fast and be profitable? There are two potential reasons.

#1 – The digital-only, unsecured loan approach doesn’t seem to work well in this segment.

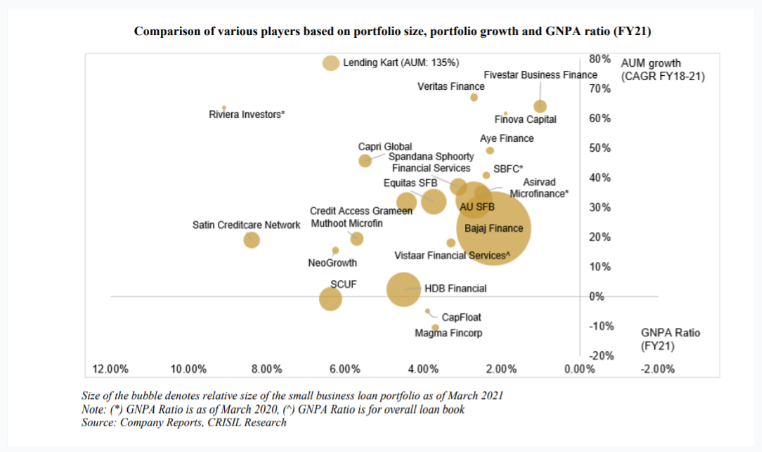

Let’s compare Five Star with the other players in this space.

There are the following categories of lenders in this visual –

1. Digital NBFCs doing unsecured loans with a largely digital approach to their underwriting – NeoGrowth, Lending Kart, Capital Float and Indifi Technologies

2. Larger NBFCs doing a mix of secured and unsecured, diverse set of loan products, including – Bajaj Finance, HDB and Hero Fincorp

3. Business loans backed by SORP-based lenders, including Five Star, Vistaar and Veritas Financial Services

4. Other players like SFBs who have exposure to business loans, and Microfinance institutions

The unsecured, pure digital lending approach hasn’t worked too well, given digital players haven’t been able to maintain asset quality as they’ve grown.

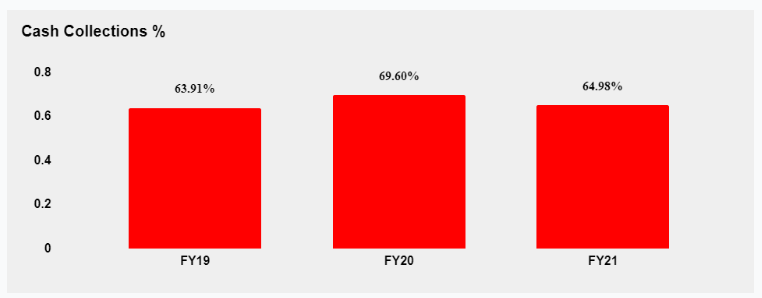

Beyond Five Star Business Finance’s secured loan approach, the company has taken a non-digital approach in key components of its business, including underwriting and collections – this approach has paid off well for the business.

#2 – Five Star’s business combines the pricing of an “unsecured” business with the downside protection of a “secured” mortgage business

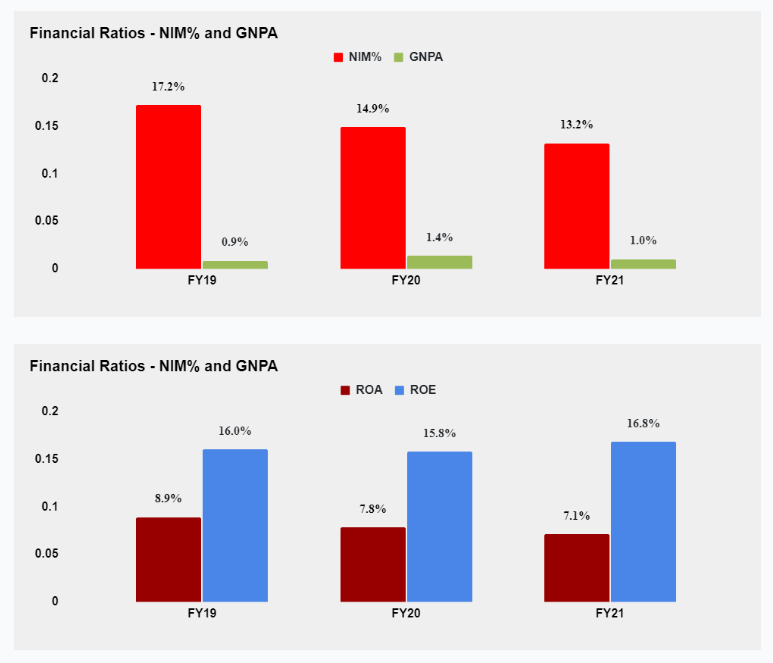

This is evident from the ratios below – Five Star has leveraged its pricing power to drive exceptionally high NIMs, at par with unsecured loans. At the same time, they can maintain exceptionally good asset quality due to their LAP-based secured lending approach. They’ve used this unique combination to deliver high returns on equity.

Underserved micro businesses are a massive credit opportunity! The conventional digital + unsecured lending playbook that has worked for thick-file salaried customers hasn’t been effective here. To win in this segment, it’s important to build business models with defensibility like Five Star’s LAP approach.

What do you think?