India Exposition Mart Ltd (IEML) is one of the leading venue planners and providers in India that offers technology driven, world- class facilities and safety standards suitable for hosting international business-to- business exhibitions, conferences, congress. product launches, and promotional events, amongst others. It is amongst the largest integrated exhibitions and conventions venues in India. IEML is located in Greater Noida, a prominent MICE destination in India. It has approximately 15 years of operating experience in the management and organization of exhibitions and trade fairs.

Content Bank

Company background – India Exposition Mart Ltd

Investment Rationale – India Exposition Mart Ltd

Financial Performance – India Exposition Mart Ltd

Pros of Investing in India Exposition Mart pre-IPO Shares

Cons of Investing in India Exposition Mart pre-IPO Shares

IPO Synopsis – India Exposition Mart

Company background – India Exposition Mart Ltd

- IEML has been active since 2006 with its “India Expo Centre & Mart” brand and some of the marquee events organised by it represent, in many cases, the leading exhibitions for the relevant sector. This contributes to ensuring a significant degree of recognisability

compared to its competitors - By virtue of having more than 15 years of experience in the Indian exhibition markets, IEML is well positioned to be able to identify and respond to the needs of participants in different markets/sectors by offering advanced and up to date solutions for the majority of the events in the organized events business line.

- IEML is strategically located at Greater Noida which is a prominent MICE destination in India. Much of IEML’s popularity as a preferred organiser for hosting large format exhibitions can be attributed to the geographical position and infrastructure of Greater

Noida and its surrounding region. - As on December 31, 2021, IEML has 24 venue booking contracts with exhibition organisers for FY22. Further, it has an order book aggregating to a value of Rs1,215.23mn from different exhibitions. IEML’s investment in the infrastructure and services provided at

the India Expo Centre & Mart, together with the quality of services it offers to the exhibition organisers, has contributed to developing long-term relationships. - IEML’s Key Managerial Personnel (KMP) bring substantial experience and in-depth knowledge of exhibition operations and management. IEML’s management’s capabilities, strong reputation, extensive network of industry relationships, and wide-ranging experience in the exhibition industry will continue to help it to grow, modernize, and develop further.

- IEML is well connected and associated as a member with renowned Indian and global associations in the exhibition ecosystem. Memberships with such leading global and national industry associations enable it to qualify for and be eligible to organise and manage certain government of India events. IEML’s membership in these associations further help it to leverage its visibility amongst its clients and provides it with a platform for networking and consensus building within and across sectors.

- Website: indiaexpomart.com

Investment Rationale – India Exposition Mart Ltd

1. Established track record and brand recognition

IEML has been active since 2006 with its “India Expo Centre & Mart’ brand and some of the marquee events organised by it represent, in many cases, the leading exhibitions for the relevant sector. This contributes to ensuring a significant degree of recognis ability compared to its competitors.

For example: Auto Expo – The Motor Show, IHGF Delhi Fair and Elecrama; important events in the respective sectors; were hosted by IEML. IEML has also received various awards including the “Best Stand-Alone Convention Centre’ by Ministry of Tourism, Government of India, ‘Brand Excellence in Hospitality Sector’ by ABP News, ‘Brand Excellence Award in MICE Industry’ by ET Now and ‘Best Exhibition Centre’ by Safari India South Asia Travel.

2. Domain knowhow and execution track record

By virtue of having more than 15 years of experience in the Indian exhibition markets, IEML is well positioned to be able to identify and respond to the needs of participants in different markets/sectors by offering advanced and up to date solutions for the majority of the events in the organised events business line. Furthermore, the know-how developed over the years by IEML’s management team allows it to anticipate industry trends, constantly adapt to various sectoral needs and update its portfolio of exhibitions. IEML organizes exhibitions that cover a wide range of products and commercial sectors, including automobiles, food, jewellery and fashion, tourism, wellness and sports, hospitality and green technologies.

3. World class infrastructure and onsite amenities

IEML is strategically located at Greater Noida which is a prominent MICE destination in India. Much of IEML’s popularity as a preferred organiser for hosting large format exhibitions can be attributed to the geographical position and infrastructure of Greater Noida and its surrounding region. IEML’s Expo Centre and Mart is well connected by road, metro, rail and air. Its amenities and services at the Expo Centre & Mart include 360 degree road access with 12 entry and exit gates, large open exhibition space with load bearing and other support facility for holding heavy machinery, helipad, banking and foreign exchange Services, high security centrally air-conditioned halls, housekeeping, internet, security, ATM, onsite bank, guest house, cafeteria, uninterrupted power supply, fire safety, parking, multiple branding storage and warehousing, in-house parking for 2,000 cars with adjacent parking for 10,000 cars and 24X7 top class security surveillance. IEML also has the ability to host multiple events and

large conferences simultaneously.

4. Strong relationships with exhibition organizers

As on Dec 31, 2021, IEML has 24 venue booking contracts with exhibition organisers for FY22. Further, it has an order book

aggregating to a value of (R$1,215.23mn from different exhibitions. IEML’s investment in the infrastructure and services provided at the India Expo Centre & Mart, together with the quality of services it offers to the exhibition organisers, has contributed to developing long-term relationships with exhibition organisers(These long-term relationships and contracts which typically cover two or more editions of exhibitions enable IEML to generate revenue streams which are predictable and allow IEML to plan future expenditure and investment.

5. Professional and experienced management with strong and independent Board:

IEML’s Key Managerial Personnel (KMP) bring substantial experience and in-depth knowledge of exhibition operations and management. While some of its KMP have been with IEML for more than 15 years, it has also brought in other experienced professionals. IEML’s management’s capabilities, strong reputation, extensive network of industry relationships, and wide-ranging experience in the exhibition industry will continue to help it to grow, modernize, and develop further.

6. Well-connected into the Indian and Global exhibition ecosystem:

IEML is well connected and associated as a member with renowned Indian and global associations in the exhibition ecosystem. A few of its significant associations include UF|- The Global Association of the Exhibitions Industry, Confederation of Indian Industry, International

Congress and Convention Association, India Convention Promotion Bureau, Entertainment Management Association, Indian Exhibition Industry Association, Federation of Indian Chambers of Commerce and Industry, PHD Chamber of Commerce and Industry and the Associate Chambers of Commerce and Industry of India) Memberships with such leading global and national industry associations enable it to qualify for and be eligible to organise and manage certain government of India events. IEML’s membership in these associations further help it to leverage its visibility amongst its clients and provides it with a platform for networking and consensus building within and across sectors.

Financial Performance – India Exposition Mart Ltd

| Particulars | FY2022 (in Rupees) | FY2021 (in Rupees) |

| Revenue | 42.87 Cr. | 13.30 Cr. |

| Reserves | 98.46 Cr. | 98.57 Cr. |

| PBT | -0.41 Cr. | -19.08 Cr. |

| PAT | -0.76 Cr. | -16.38 Cr. |

| EPS | -0.24/Sh | -2.22/Sh |

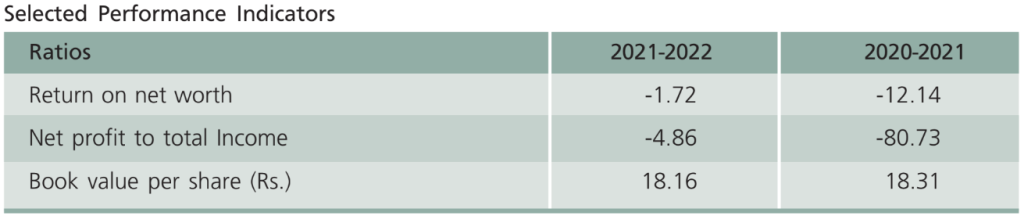

During the Financial Year (FY) 2021-22, the Company has achieved a total income of Rs 47.7 Cr. as compared to Rs 20.3 Cr. in FY 2020-21.

The profit before tax and Extraordinary Items for FY 2021-22 stood at Rs 3.08 Cr. compared to Rs (20.4 Cr.) achieved in FY 2020-21.

The profit after tax stood at Rs. (0.77 Cr.) for FY 2021-22 as compared to Rs. (16.3 Cr.) for the previous year.

Pros of Investing in India Exposition Mart pre-IPO Shares

- World-class infrastructure and onsite amenities, as well as the ability to provide a variety of services required for exhibitions

- Strong connections with exhibition organisers

- The Indian and global exhibition ecosystems are well-connected.

Cons of Investing in India Exposition Mart pre-IPO Shares

- It relies on a few key shows for a significant amount of its revenue, therefore any loss of business from these key exhibition organisers could have a material unfavourable effect.

- Refunds may be required for events that are cancelled or postponed.

- Its operating market is highly competitive and undergoing fast transformation.

- Significant power requirements for ongoing business operations, therefore any disruption to operations caused by a power outage or any irregular or significant increase in power tariffs may have a negative impact.

- The firm is obliged by government or regulatory agencies to get and renew certain licences and permissions, and failure to obtain or renew them on time may have a negative impact.

IPO Synopsis – India Exposition Mart

India Exposition Mart Ltd, an integrated exhibitions and conferences venue, has filed preliminary documents with SEBI to raise Rs.600 crore through an IPO. The offering consists of a fresh issue of up to Rs.450 crore in equity shares and an offer-for-sale (OFS) of up to 1.12 crore equity shares by existing shareholders.

Vectra Investments, MIL Vehicles & Technologies, Overseas Carpets, RS Computech, Navratan Samdaria, Dinesh Kumar Aggarwal, and Pankaj Garg are among the OFS participants.

The corporation may explore a private placement of equity shares worth up to Rs.75 crore, which would reduce the amount of the real issuance.

Emkay Global Financial Services is the sole book-running lead manager for the offer, and Kfin Technologies is the registrar.

Objective of the Issue:

The revenues from the Rs.450-crore new issuance will be utilised for:

- approximately Rs.316.91 crore to meet capital expenditure requirements for expanding its existing infrastructural facilities,

- Rs.17 crore for debt repayment and general company purposes

FAQs – India Exposition Mart

How can I buy India Exposition Mart Pre-IPO Shares?

To invest in India Exposition Mart Pre-IPO Shares – Click Here

What is India Exposition Mart Pre-IPO Shares price?

The current market price of India Exposition Mart Pre-IPO Shares is 159/share (as of Sept’2022)

Is it possible to buy India Exposition Mart Pre-IPO Shares before listing?

Yes, you can buy India Exposition Mart Pre-IPO Shares from Altius Investech, they deal in 130+ pre-IPO shares including India Exposition Mart.

Also Read: Utkarsh, Fincare IPOs are around the block, Should you invest?