NSE Business Model Explained

For all the wrong reasons, the National Stock Exchange of India (NSE) has been in the news. The co-location scam derailed the NSE’s 2016 IPO filing with SEBI, and now there’s a scam involving a CEO and an anonymous Himalayan Yogi – odd to say the least.

Given the excitement, we thought it was a good opportunity to discuss something considerably less magical but as intriguing – NSE’s business strategy! The NSE has been in operation since 1994 and is India’s largest stock exchange.

This week’s newsletter delves into the stock exchange industry, the NSE’s extremely fortunate position, and how the NSE is benefiting on an unprecedented wave of shifting investor profiles. Let’s get started.

Content Bank

Scams or not, business is booming!

What then is driving this massive increase?

NSE Overview, AKA Competition is for Losers!

Let’s start with the fundamentals.

What exactly does NSE do?

NSE is a stock exchange; shares of a company can be listed on an exchange like NSE. The NSE has 2000 firms listed on it (of course, the first time you list, you file an IPO – Initial public offering).

Debt instruments can also be traded on the exchange; for example, we recently published an analysis of NCD listings for Dhani and InCred (read it here).

Anyone with a demat account can buy and sell these products (shares, NCDs) after they are posted on the exchange. The exchange facilitates these buy/sell transactions through intermediaries known as members (e.g. Zerodha).

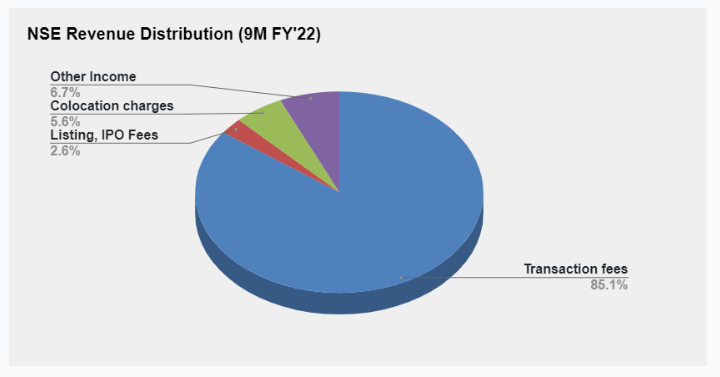

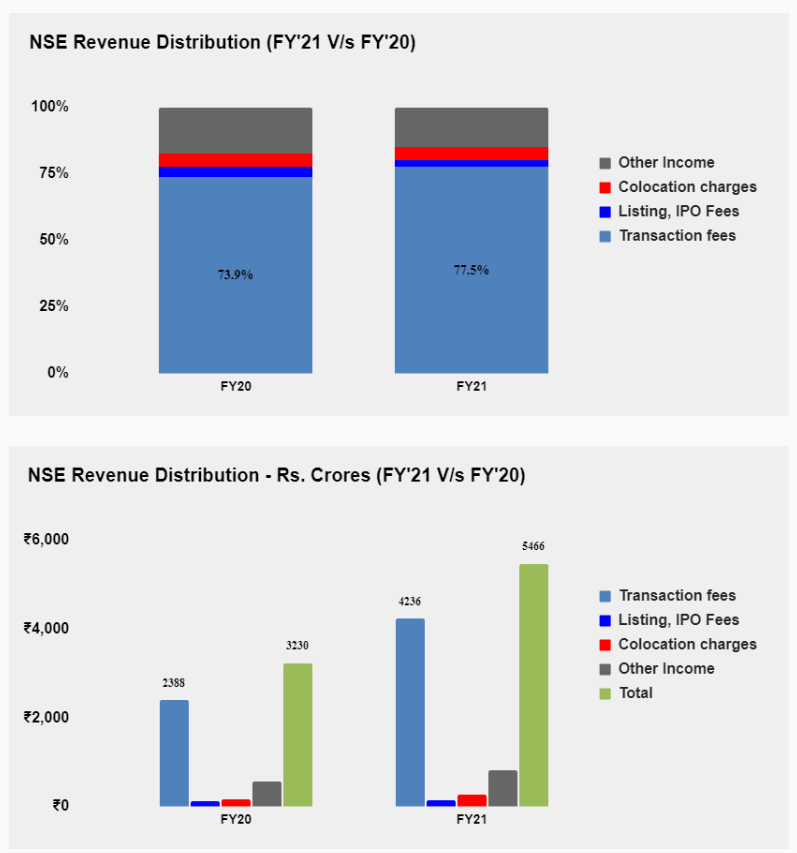

With that in mind, let us examine NSE’s revenue sources. The graph below depicts the revenue distribution across different verticals.

Transaction Fees: Not surprisingly, the largest component of NSE’s revenue comes from transactions. Every time there is a trade on NSE, the exchange makes a commission (isn’t that a wonderful business model!).

Listing and IPO Fees: Besides transactions, NSE gets paid to have companies listed on the exchange plus every time a company IPOs.

Co-Location charges: This is a service provided by NSE, where high frequency traders can co-locate their terminals in NSE’s premises and receive market feed a split second earlier for a fee.

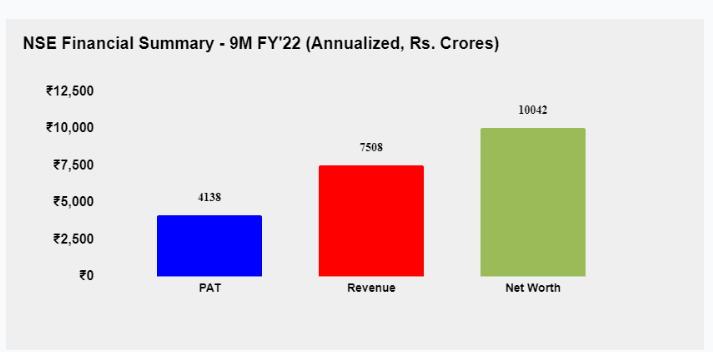

How large is NSE’s business?

To understand this, let’s quantify a few financial metrics for NSE.

With Rs. 4K+ crores in profit and a net worth of Rs. 10K+ crore, NSE is meaningfully large. Which takes us to the next obvious question.

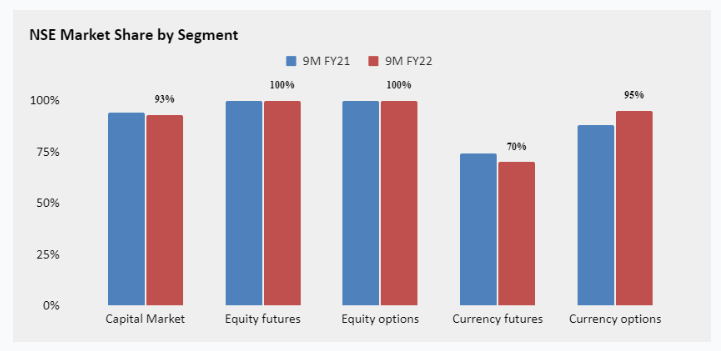

Who is NSE’s competition?

The chart below demonstrates that there is no competition! NSE is pretty much a monopoly in the derivatives segment. For context, futures and options are highly leveraged and risky instruments with significant upside and downside. We’ll discuss options and leverage in later sections.

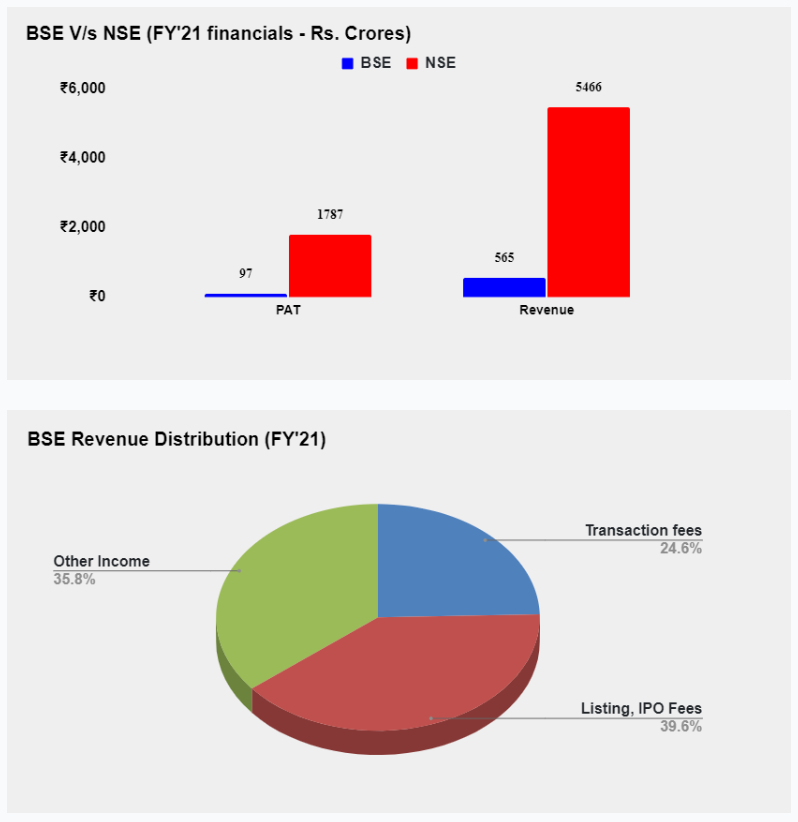

India’s other popular exchange, BSE, is miniscule in comparison to NSE, with the latter doing ~10X as much revenue as the former. Also, the proportion of transaction revenue for BSE is much lower than for NSE.

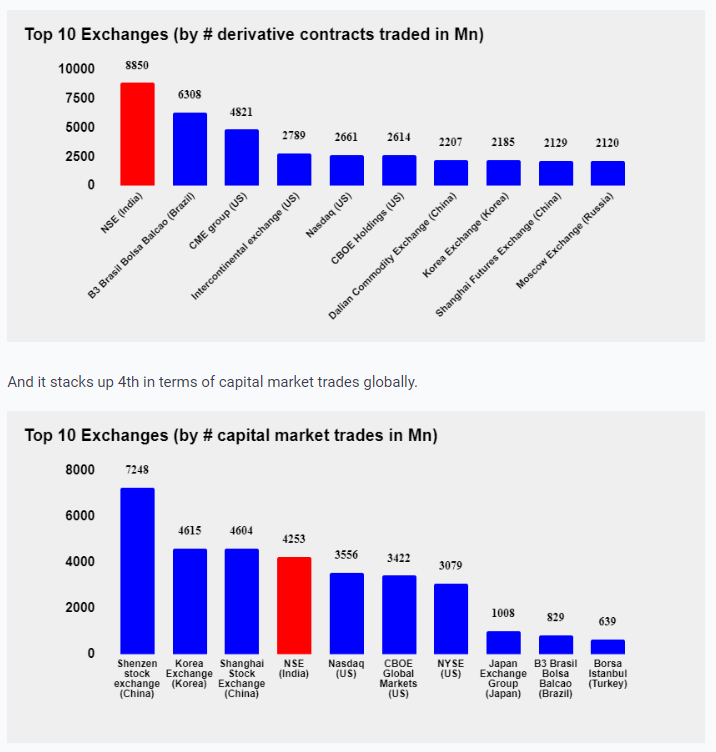

Interestingly, when it comes to the amount of deals, the NSE not only leads in India but also globally. In terms of derivative contract volumes, the NSE leads the world.

Scams or not, business is booming

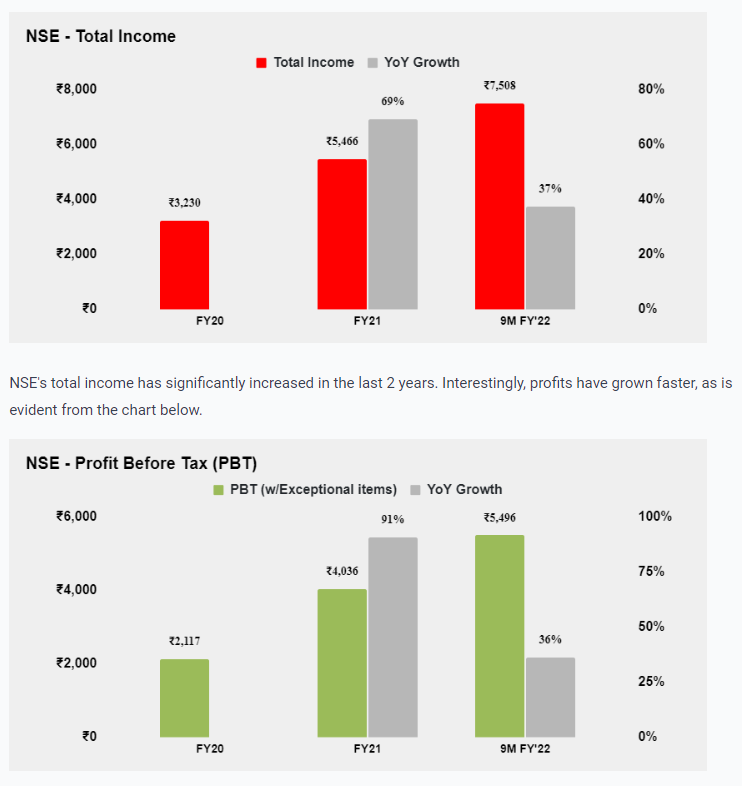

In this section, let’s dig deeper into NSE’s financial trends and economics, starting with the former.

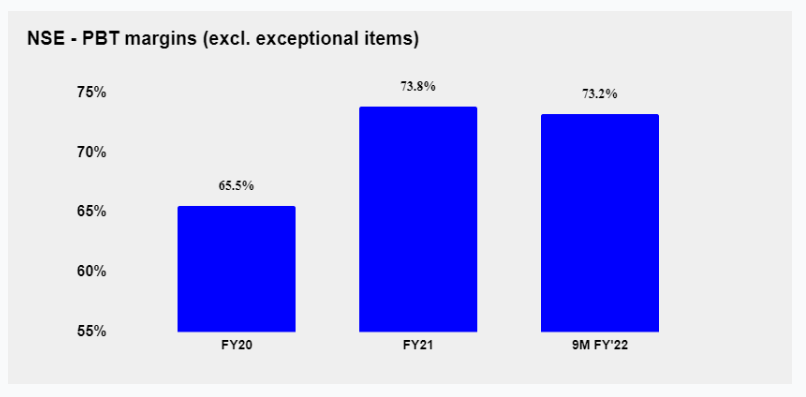

This has expanded NSE’s PBT margins by ~800bps! A 65%+ PBT margin is an exceptionally high number to start with, and an 800 bps increase on that base number is outstanding.

There are two trends here that we’re curious to unpack:

1. What’s driving NSE’s massive revenue increase

2. Why have NSE’s margins expanded so much

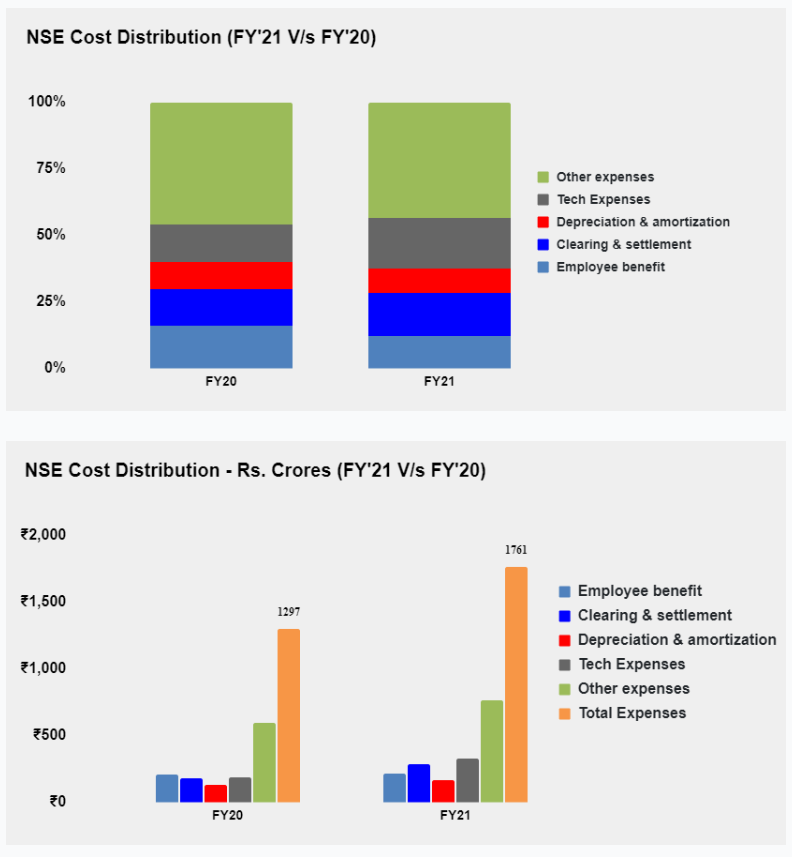

To answer these questions, let’s start with a cost breakdown comparison between FY’21 and FY’20. Firstly, the cost mix has pretty much remained the same.

Secondly, FY’21 v/s FY’20 revenue increased at a much faster rate than costs did for the same time period. The former increased by ~70%, while the latter by ~35%, clearly demonstrating that NSE has scaled revenues with much higher contribution margins.

As a next step, let’s look at the components of this revenue.

Clearly, this revenue increase is largely driven by an increase in transaction fees. But NSE’s marketing spend as a % of revenue has reduced from 0.6% in FY20 to 0.3% in FY21 – these numbers at an absolute are also really low.

What then is driving this massive increase?

The new investing wave in IndiaThe profile of investors and investment behavior in India is undergoing a massive change. Honestly, massive might be a bit of an understatement here.

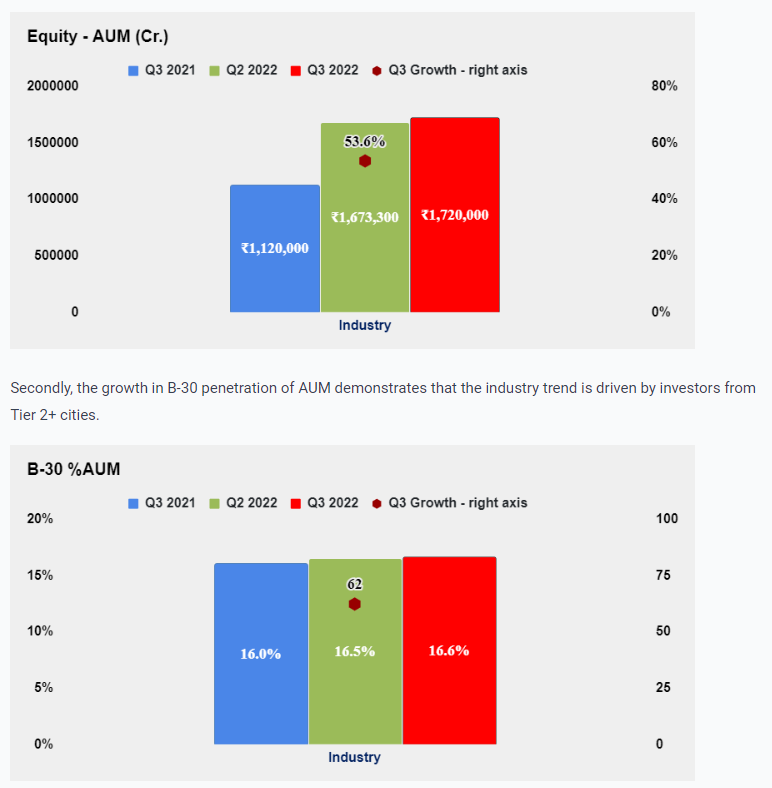

Firstly, mutual fund investments in equity have increased by >50% in the last year. This is a huge number when we are talking about growth for the overall industry!

Thirdly, this new MF investor is highly risk-taking – equity MF growth is fueled by small cap, flexi cap and sectoral funds – all three being risky categories.

Are we seeing the same trend with equity trading/ investment? Let’s find out.

To start with, let’s look at the total number of demat accounts in India – they have doubled in FY21!

Based on the charts below, total NSE turnover in the capital market has significantly increased (this represents total value of equity trades made at NSE).

Not only have demat accounts gone up, participation in the equity markets has significantly increased as well.

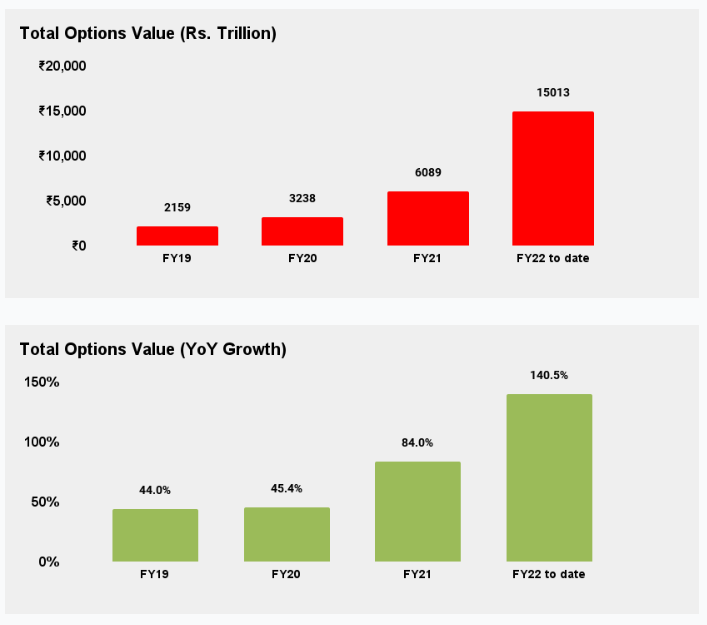

But let’s look at something even more interesting (and potentially a little worrying). The charts below show total value of derivatives traded at NSE. As you can see, derivative volumes have seen an exponential growth.

(Note that these numbers are much higher than the equity turnover numbers since the chart depicts underlying value of the options traded and not of the premium paid.)

Surprisingly, the vast majority of derivatives traded are options (see charts below). In India, option volumes have increased by a factor of five in the last three years.

Options are now regarded as extremely dangerous instruments that enable you to trade with enormous levels of leverage. Options can be used for hedging as well as speculation. This unprecedented growth in option trading volume reflects the high risk appetite of new investors entering the market.

(Options give investors – quite literally – the option to buy or sell a stock at an agreed-upon price and date. The former is a call option and the latter is a put option. So essentially if a stock is worth Rs. 100 today and you think the price is going to increase, instead of buying the stock you could pay, say, Rs. 10 and buy a call option – this gives you the right (not obligation) to buy the share at 105 six months from now. Now if the share price is at 115 six months from now, you break even. But if the price went up to Rs. 125 – you made Rs. 10 on a Rs. 10 investment! That’s a 100% return but would have only been a 25% return if you bought the stock. Of course, if the stock stayed below 105 you would have never executed the option and lost all money. So with options you can have complete loss of capital hence they are considered extremely risky.)

Summary

two things are taking place:

- India is witnessing a new breed of equities investors: equity mutual funds grew by more than 50% year on year in Q3 FY22, demat accounts more than doubled in FY21, and the NSE’s total equity turnover jumped by 70% in FY21.

- This new investor has a larger risk tolerance: Not only is the growth in equity mutual funds coming from riskier fund categories, but the value of options traded in the previous three years has more than fivefolded.

This flood of egalitarian engagement appears uncontrollable, unusual, and, in some ways, frightening. However, it is this wave that is propelling NSE’s profits.

As long as the NSE keeps its monopoly status, it makes more income and improves margins significantly without having to spend money to bring these investors/trades onto its platform – given that the larger industry (AMCs, fintechs like Groww, Zerodha, Upstox, etc.) does so for them. The concern is how long such expansion can be maintained.

Is the current surge in investor engagement in riskier equities instruments a positive sign? Do you believe such expansion is sustainable?

On the other hand, we think the NSE’s business model is wonderful, and we’d want to see the exchanges business have a lower barrier to entry (think a parallel to the NUE licences to challenge NPCI).

What are your thoughts?

Invest in NSE unlisted shares