Current Status of the NSE IPO

COMPANY OVERVIEW

The National Stock Exchange of India Ltd. (NSE) is the leading stock exchange in India and the second largest in the world by nos. of trades in equity shares from January to June 2018, according to World Federation of Exchanges (WFE) report. NSE launched electronic screen-based trading in 1994, derivatives trading (in the form of index futures) and internet trading in 2000, which were each the first of its kind in India.

NSE is planning for an IPO which will value the company at ~INR 2,00,000 crores. The offer will be made majorly through offer for sale by existing shareholders including SBI, LIC, stock holding etc.

IPO PLANS

NSE had first filed DRHP for an IPO in December 2016 which was about to be approved, but just after two months of filing the papers, Ajay Tyagi took charge as the chairman of SEBI. He immediately ordered the exchange to withdraw its offer documents since it got embroiled in the Algo Trading Scandal. An investigation was ordered and it was alleged that there was a data theft & preferential access was given to certain parties due to lapses in the co-location systems at NSE servers.

In April 2019, SEBI had barred the NSE from accessing the capital markets for a period of six months.

In May 2019, charges were framed against senior NSE officials and the exchange was ordered to pay INR 1000 crores disgorgement amount for the above mentioned charges. During the same month, NSE challenged SEBI’s INR 1000 crores penalty at Securities Appellate Tribunal (SAT)

In Jan 2020, NSE’s MD and CEO Vikram Limaye told PTI that they have approached SEBI to seek its approval for its IPO and after that they will start the process of appointing the merchant bankers for filing the draft prospectus for the IPO. He also told that he is hoping the exchange to float the IPO by Sep’20.

In Feb 2021, Madras high court received a petition seeking a stay on NSE’s IPO. However the court observed that the petition was premature as the question of its permission did not arise since NSE had not re applied for its IPO then.

As per an article published in Economic times in Dec’21, NSE has not yet taken clearance or moved to file its DRHP. Experts are also in the opinion that NSE IPO might can be pushed back again to fast track the Initial offers of LIC. However there are a lot of chances that we can see the bourse coming with an IPO in the third quarter of 2022.

LEGAL OPINION

Legal opinions in against of NSE IPO is that IPO should not be allowed unless the NSE fully complied with the final SEBI verdict in the Algo trading matter and fill the compliance gaps.

Legal opinions in favour of NSE IPO is that even though the Algo scam matter is still sub-judice, there is no stay order given by a court on its proposed share sale. In addition, senior NSE officials who were charged by SEBI in the scam are out of the exchange.

FINANCIAL PERFORMANCE

FY 21-22 earnings update :

- Adding another feather in the cap, the National Stock Exchange (NSE) has reported its earnings for the year ended March 31, 2022. The leading exchange continues to impress investors.

- On a consolidated basis, NSE reported a net profit of Rs 5,198 crore for the financial year 2021-22, a rise of over 45 per cent compared to a profit after tax (PAT) of Rs 3,573 crore in the previous financial year.

- The leading domestic exchange reported a 53 per cent jump in the Total revenue to Rs 9,500 crore during the year. It had reported a total income of Rs 6,202 crore in the previous fiscal.

- Among the income, transaction charge continues to be the main component, giving out a share of 6,965 core. Listing services contributed Rs 184 crore, Colocation charges brought Rs 443 core and treasury income yielded Rs 423 crore during the year.

- The operational income of NSE rose 59 per cent to Rs 8,929 crore, while the ratio of operating income and total income improved to 94 per cent from 91 per cent earlier.

NSE enjoys a leading market share (by total turnover) of 94% in the Equity Cash market, 100% in Equity Futures, 100% in Equity Options, 74% in Currency Futures and 68% in Currency Options.

PERFORMANCE IN UNLISTED SPACE

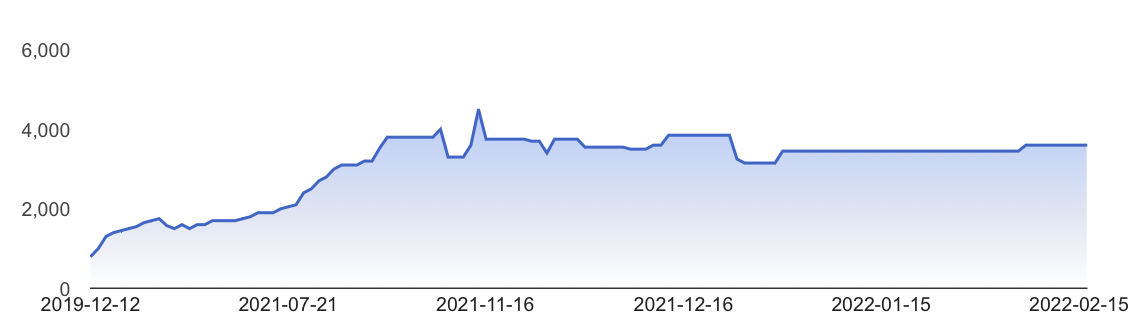

NSE is trading at a price range of 3600-4000 in the month of Feb’22 in the unlisted space. Prices have surged tremendously since dec’19 from just INR 800 to INR 4000 which is 5 times ROI in just 2 years with a CAGR of ~125% (as shown in Fig.1). The only hurdle Investors face investing in this script is that it takes around 3-4 months to get shares credited in their demat with a lot of document checks. Even after so many hurdles in coming up with NSE IPO, Investors have not lost hope. However, if we see a longer price history, the shares were available initially @INR 2000/share in 2015 then it went upto 3000 in 2017 before going for a split of 10:1 & Bonus of 1:10 due to which the price dropped to INR 400 and the rest is history.

NSE is trading at a price range of 3600-4000 in the month of Feb’22 in the unlisted space. Prices have surged tremendously since dec’19 from just INR 800 to INR 4000 which is 5 times ROI in just 2 years with a CAGR of ~125% (as shown in Fig.1). The only hurdle Investors face investing in this script is that it takes around 3-4 months to get shares credited in their demat with a lot of document checks. Even after so many hurdles in coming up with NSE IPO, Investors have not lost hope. However, if we see a longer price history, the shares were available initially @INR 2000/share in 2015 then it went upto 3000 in 2017 before going for a split of 10:1 & Bonus of 1:10 due to which the price dropped to INR 400 and the rest is history.

With the capital markets getting broad based, All intermediaries including NSE should see massive growth in their volumes. The Indian growth story is just getting started and NSE seems to be a great way to ride this wave.

If you are looking to invest in NSE ( National Stock Exchange) unlisted shares kindly visit: Altius Investech

Get in touch with us

To know more about NSE IPO Prospects. Click- https://altiusinvestech.com/blog/nse-ipo-insights-and-expectations/

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/