InCred and Dhani, are two fintech lending companies. They have both raised public debt in the past and have grown their loan book size very aggressively in the last couple of years.

InCred share price has been close to 74/sh in the recent past, going up from 60Rs/sh when InCred first became available in the pre IPO space.

In this post we will do a deep dive in InCred’s business model and also compare the business model and financials with Dhani, which is a close competitor to InCred.

Dhani and InCred approach their businesses in quite different ways. While Dhani is focusing on retail-focused commerce and consumer finance, InCred has and continues to focus on diversified lending. Surprisingly, one single metric is greatly overweighted and outperforms the others. Let us investigate more.

Why incur debt, as well as the mechanics of ROA and ROE

Before we go into the mechanics of InCred and Dhani, let’s discuss why lending institutions need to raise loans in the first place. While equity raises receive a lot of attention, debt raises are rarely discussed, despite being a key role in the lending industry.

- Lenders (NBFCs or Banks) make money on the spread by borrowing (relatively) cheap capital and lending it out at a (relatively) higher rate to clients. This spread is also known as NIM (Net interest margin), which is calculated as Interest Income – Borrowing Cost.

- NIM in some sense is a top line metric. At a high level, lending institutions also deduct the following expenses prior to booking a profit – operating costs, losses and taxes.

- Profit is then calculated as a percentage of the loan book; this metric is known as Return on Asset (ROA). For example, the ROA would be 2% if the lending institution profited Rs. 2 for every Rs. 100 lent.

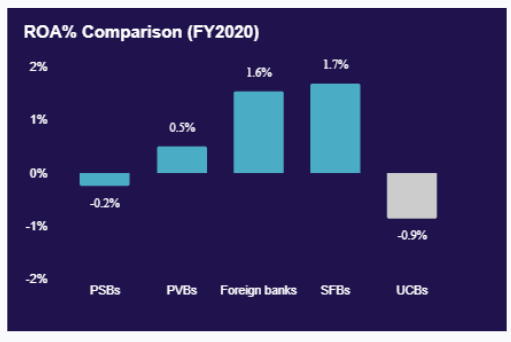

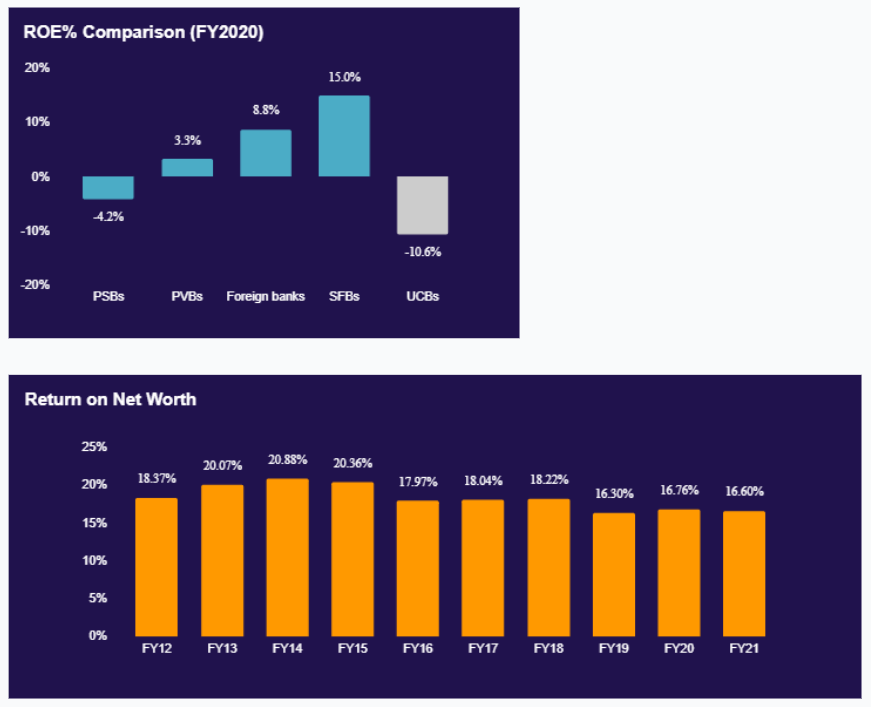

The following are the ROAs for various financial institutions for fiscal year 2020.

Here is the interesting part – would you lend the entire Rs. 100 from investor capital/ equity?

Of course not, since no investor would want to make a 2% return on their investment after going through all the trouble of investing in a business that’s highly risky and competitive – a savings account or an FD will give them better returns at no risk. This is why the Rs. 100 should be a mix of debt and equity – the RBI rule is at least Rs. 15 of equity for every Rs. 85 in debt. This metric is called CRAR (Capital Risk Adequacy Ratio, though this definition is a simplified version).

Now, the Rs. 2 profit is on Rs. 15 equity or a 13.3% Return on Equity (ROE). Below are the ROEs for the banking institutions we looked at earlier, and for for the heavy weight HDFC Bank.

ROE is the key evaluation metric to assess the profitability of a financial institution, and the key to high ROEs is leverage. Hence, raising debt (at the right price) is very critical for financial institutions and has to be done consistently.

However, debt-raising requires a demonstration of ability to pay back. Unlike equity funding (more specifically early stage) that rewards growth, debt rewards asset quality. More on this shortly.

Overview: Dhani and InCred

Dhani’s Business

Dhani Loans and Services Limited (Dhani) is a non-deposit taking non banking finance company (NBFC). Erstwhile Indiabulls Consumer Finance Limited, it was rebranded Dhani in July 2020. The Dhani mobile app is a provider of subscription-based transaction finance.

Essentially, Dhani provides a credit line that users can leverage to make transactions and purchases. The app boasts of discounts on merchant partners and other benefits like free doctor consultation + medicines at attractive prices. Users pay a subscription fee to avail these services.

The credit line has a pay-in-3-months construct, so it is not like a conventional credit card. While this is marketed as credit at 0% interest, the subscription fee functions like the interest rate for Dhani. This product is targeted at underserved Indian consumers that may not qualify for a credit card today.

Website: https://www.dhani.com/

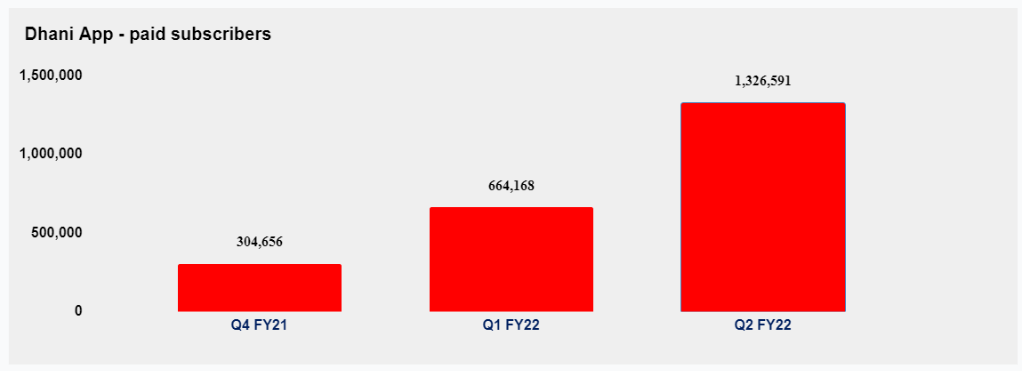

Below is a chart showing the total number of paying subscribers on the Dhani app – as of Q2’22, they had 1.3 Million paying subscribers.

Beyond the credit line product, Dhani offers personal, business and secured loans. Personal loans have ticket sizes of up to 15 lakhs and Business loans have ticket sizes of up to 40 lakhs. Secured loans include mortgage and loan against property.

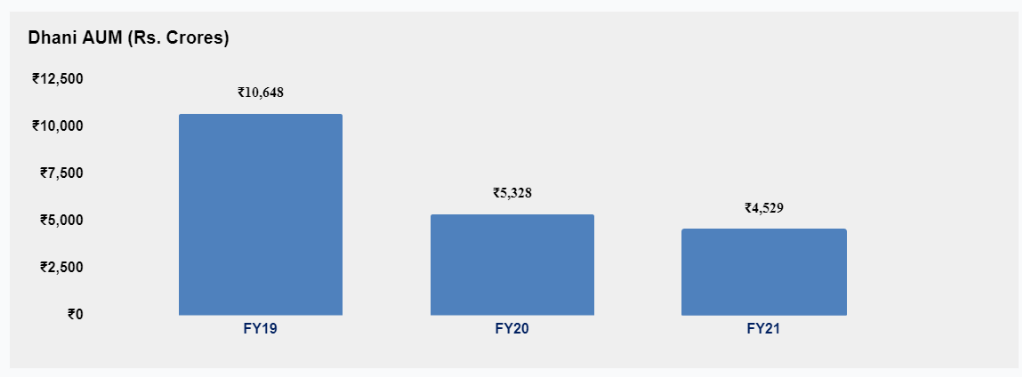

Here is a view of the company AUM over the last 3 years.

The shrinking AUM is potentially due to Dhani doubling down on the transaction finance business. Another significant driver of this reduction is securitization of its loan book, which the company does from time to time to meet/ manage funding requirements.

InCred‘s Business

Similar to Dhani, InCred Financial services limited is also a non-deposit taking NBFC. InCred was established with the aquisition of an existing NBFC called Visu Leasing and Finance private limited in 2016. The Company was founded by Bhupinder Singh, a highly respected financial services executive and the ex-head of the Corporate Finance division of Deutsche Bank.

It is a fintech company built with the goal of leveraging technology to drive seamless borrowing experiences using a wide variety of unconventional data to underwrite customers excluded by traditional lenders.

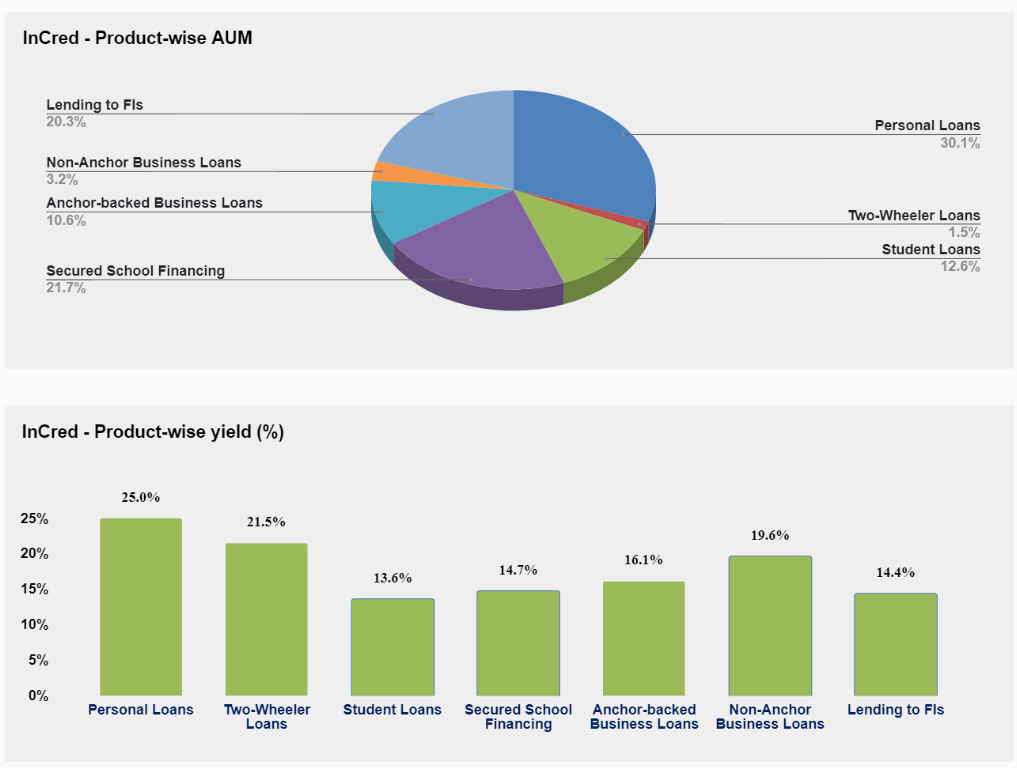

The Company runs a highly diversified loan portfolio across Personal loans, student loans, MSME loans and Two-wheeler financing (being phased out).

Here are some numbers on the business that shows its diversification across different product offerings.

So who scores better in the debt game?

We’ve established that increasing debt is critical to making economics work in the lending industry. This is more crucial for NBFCs than for banks because banks have access to deposits (i.e. very low cost debt). Unfortunately, most NBFCs are not in this category.

We’ve given out five separate factors that we’ll use to assess the attractiveness of an institution’s debt offering in this section.

To spice things up, let’s compare InCred and Dhani across these five characteristics.

1. ALM – Asset Liability Management

Asset-liability mismatches are critical and have the potential to devastate financial institutions. In fact, asset-liability mismatches are more harmful than credit losses.

ALM requires ensuring that asset cashflows (cash inflows from loans or receivables) are greater than liability outflows (cash outflows from borrowings or payables). As an NBFC with numerous tenor loan products and borrowings, ALM must be monitored on a monthly basis, which makes it challenging.

Compare the asset-liability mismatches for InCred vs Dhani to find who performs better in terms of ALM.

Both institutions have an Asset Liability Committee (ALCO) that focuses on managing ALMs and do a good job of ensuring that there aren’t any mismatches. That said, InCred clearly has a stronger buffer for most durations compared to Dhani (except for the 6-12 months bucket).

ALM Score: InCred = Dhani

2. Diversification

Diversification in lending is critical and provides defensibility in asset worsening scenarios. There are multiple dimensions to assess diversification along –

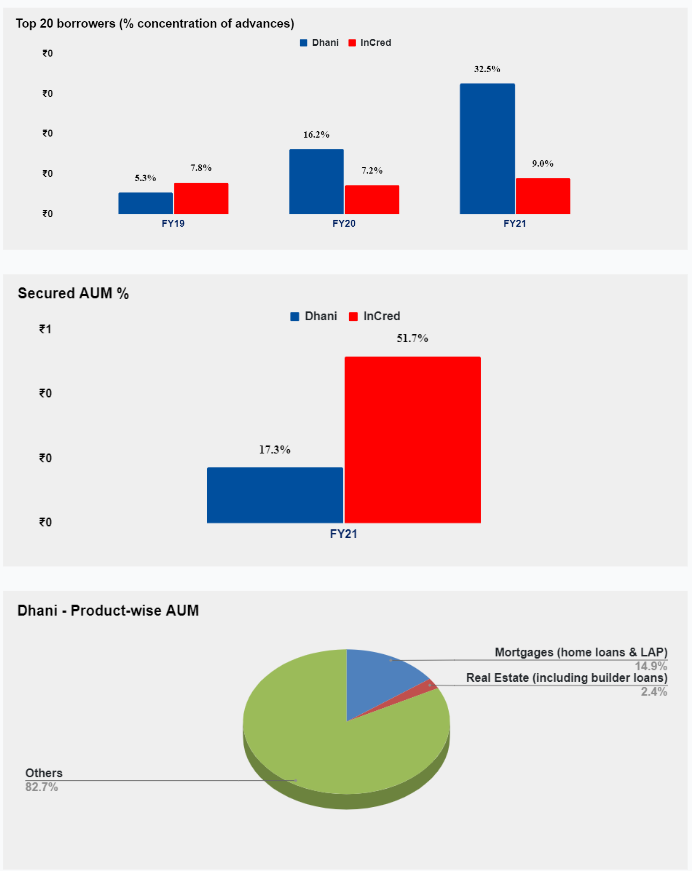

- Concentration of advances – measured as the % of advances with the top 20 borrowers, the lower the better.

- Portfolio diversification across different product categories – this creates defensibility in worsening scenarios, specifically if you lend to uncorrelated segments. Also, having multiple products gives the institution the flexibility of expanding more resilient segments while shrinking less resilient ones.

- Secured portfolio – Secured portfolios are more resilient in worsening scenarios due to collateral.

Let’s evaluate InCred and Dhani across these dimensions of diversification.

InCred has a more diversified portfolio on product offerings (as we’d seen earlier), has a much lower top 20 borrower concentration and a higher % of secured AUM. Clearly, InCred scores higher than Dhani on this parameter.

Diversification Score: InCred > Dhani

3. General financial health

To evaluate this parameter, let’s just compare the profitability of these businesses. Clearly, healthy and consistent profitability is a key parameter to assess the institutions “ability to repay” any debt burden.

InCred has managed to consistently remain profitable over the last 3 years. On the contrary, Dhani has booked losses over the last 2 years.

Financial Health Score: InCred > Dhani

4. Asset quality

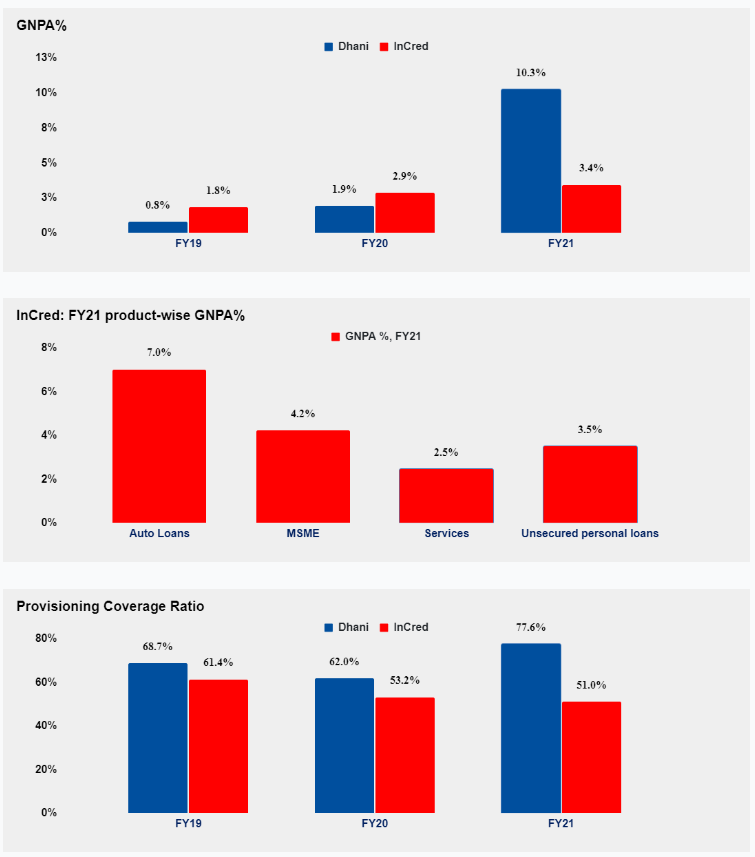

For this parameter, let’s assess the quality of the loan book. This metric speaks to the strength of each of the business’s underwriting and collection policies. To evaluate this, let’s look at the NPAs and provisioning for both companies.

Based on these, it appears InCred’s asset quality is better than Dhani’s (of course, the target segments aren’t directly comparable). Additionally, InCred has managed to keep delinquencies low across all product segments. That said, Dhani has ensured conservative provisioning levels which is a plus. Overall, InCred clearly comes out on top in our opinion.

Asset Quality Score: InCred > Dhani

InCred is clearly better managed and scores higher than Dhani across most parameters. Based on this framework, it appears that InCred’s is the less risky NCD offering to invest in. This is baked into the NCD pricing – InCred NCDs yield upto 9.65% whereas the Dhani NCDs yield upto 11%.

Despite the higher pricing, would you lend money to Dhani – an unprofitable business with double digit NPAs? It does seem rather risky.

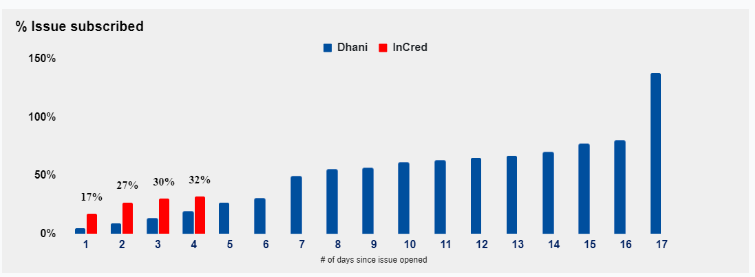

Here’s what the market did though – Dhani’s issue was oversubscribed 1.38X. What explains this?

5. Past track record with NCDs

Clearly, this is a space where Dhani scores above InCred. Dhani (and erstwhile Indiabulls) has a longer history of debt raises via NCDs and a track record of meeting all its debt obligations – this is Dhani’s 4th public NCD offer. This carries significant weightage in terms of building credibility in the market.

In comparison, this is InCred’s first public NCD.

This doesn’t mean the market won’t weigh the other 4 parameters positively for InCred. In fact, early subscription data on InCred shows they’re doing quite well v/s Dhani.

What do you think about our choice of parameters to evaluate a financial entity’s debt offering? Is the market right in attaching such a significant weightage to parameter #5?