In the fast-evolving landscape of Indian startups, financial technology firm InCred has marked its territory as the country’s second unicorn in 2023. This achievement comes on the heels of a successful funding round that raised a whopping $60 million, propelling InCred’s valuation to an impressive $1.04 billion. Let us delve into the details of this significant milestone and the key players who fueled InCred’s ascent to unicorn status.

The Funding Triumph

InCred’s journey to unicorn status was paved by a funding round that garnered $60 million, or approximately ₹500 crore. Renowned figures in the investment realm led the charge, with Ranjan Pai of MEMG contributing $9 million and Ravi Pillai, the chairman of RP Group of Companies, injecting $5.4 million into the venture. Notably, Ram Nayak, Global Co-Head of the Investment Bank and Head of Fixed Income & Currencies at Deutsche Bank, showed confidence in InCred by investing $1.2 million.

InCred Board Approves Special Resolution for Equity Share Issuance

In a significant move, the board of directors at InCred has successfully passed a special resolution aimed at issuing 3, 70, 37,037 equity shares. These shares, each with a face value of Rs 10, will be offered at a premium of Rs 125 per share, resulting in a total consideration of Rs 500 crore.

The decision was formalized through regulatory forms filed with the Registrar of Companies. This strategic step underscores InCred’s commitment to strengthening its financial position and capital base, paving the way for potential growth and expansion opportunities.

Unicorn Status Unveiled

Following this funding triumph, InCred’s valuation surged past the coveted $1 billion mark, officially anointing the company as the second unicorn of the year in India. The unicorn status was preceded by e-commerce platform Zepto, making InCred a noteworthy addition to the exclusive unicorn club.

Strategic Allocation of Funds

InCred CEO Bhupinder Singh expressed gratitude for the overwhelming support from investors and outlined the strategic allocation of funds. The newly acquired capital is earmarked for the expansion of InCred’s business verticals, including consumer loans, student loans, and lending to micro, small, and medium enterprises (MSMEs). The company aims to capitalize on these opportunities, fortify its balance sheet, and pave the way for the next phase of expansion.

Merger and Milestones

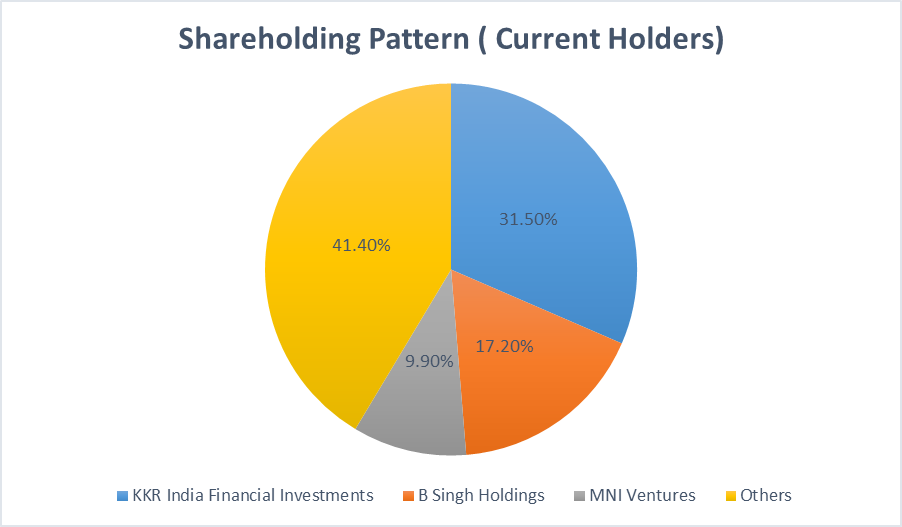

InCred’s journey to unicorn status is not without its strategic moves. In 2022, InCred Finance and KKR India Financial Services joined forces, creating a joint entity under the brand name InCred Finance. The company proudly highlighted its achievement of building a loan portfolio totaling ₹7,500 crore within six years, showcasing a remarkable compound annual growth rate of over 50% in the last three years.

Navigating Challenges in 2023

Amidst a challenging funding climate in 2023, InCred stands out alongside Zepto as the sole company to attain unicorn status. While many ventures grapple with uncertainties, InCred’s successful funding round underscores resilience and investor confidence in the fintech sector.

Conclusion

InCred’s ascent to unicorn status is not just a financial triumph but a testament to the fintech sector’s resilience and potential in India. As the company strategically deploys its funds to fuel expansion, the unicorn status signals a new chapter in InCred’s journey, solidifying its position in the dynamic landscape of Indian startups.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/