About the Company

Manjushree Technopack Limited, recognized as India’s largest rigid plastic packaging company, was established in 1983 by Vimal Kedia and Surendra Kedia. In 2018, Advent International acquired a 77% stake in the company, further bolstering its growth trajectory. With an impressive converting capacity of over 1,75,000 MT annually, Manjushree Technopack Limited caters to the stringent packaging needs of top global FMCG companies across diverse industries. The company operates nine manufacturing plants strategically located across the country, including in Amritsar, Baddi, Pantnagar, Guwahati, Manesar, Silvassa, and Karnataka. In June 2020, Manjushree expanded its operations with the commissioning of its first recycling plant in Bidadi, Karnataka, demonstrating its commitment to sustainability.

In a significant development in September 2020, Manjushree Technopack Limited advanced its position by acquiring the B2B business of Pearl Polymers Ltd. through a Business Transfer Agreement. This strategic maneuver is poised to substantially bolster Manjushree Technopack Limited’s market presence, particularly in the FMCG, pharmaceutical, and liquor segments. Upon securing the necessary regulatory approvals, Manjushree Technopack Limited will seamlessly integrate four of Pearl Polymers’ manufacturing units into its operations, further cementing its leadership in the packaging industry.

| Company Name | Manjushree Technopack Limited |

| Company Type | Unlisted Public Company |

| Industry | Packaging |

| Founded | 1983 |

| Headquarters | Bangalore, India |

| Services | Design Innovation, Packaging Product, Post Molding Operations |

| Website | www.manjushreeindia.com |

Services

Manjushree Technopack Limited provides end-to-end packaging solutions, beginning from the creation of sustainable packaging designs to ensuring rapid time-to-market delivery. Their offerings encompass a diverse array of catalog design options for bottles and containers. Additionally,Manjushree Technopack Limited boasts an extensive collection of promotional packaging designs, complemented by the flexibility of white labeling.

Product

Polyethylene terephthalate (PET) jars and bottles, multilayer containers, PET hot-fillable bottles, and food, beverage, pharmaceutical, cosmetic, agricultural chemicals, and allied sectors.

Subsidiary Companies

| Name | State | Incorporation Year | Paid Up Capital |

| MTL New Initiatives Private Limited | Karnataka | 2020 | 1.00 Lakhs |

Founder of the Company

Vimal Kedia and Surendra Kedia

Manjushree Technopack Ltd. was founded in 1983 by Vimal Kedia and Surendra Kedia, who laid the foundation of the company with a vision to provide innovative packaging solutions. Their entrepreneurial spirit and dedication to excellence propelled the company forward in its initial years. As the business expanded and evolved, the second generation of the Kedia family, represented by Rajat and Ankit Kedia, joined forces to further strengthen and grow the company. Together, the family members worked collaboratively to build Manjushree Technopack into India’s largest rigid plastics packaging solutions provider. Their combined expertise, passion for innovation, and commitment to customer satisfaction have been instrumental in shaping the success and growth of the company over the years. The seamless integration of multiple generations within the leadership of Manjushree Technopack reflects a strong sense of family values and continuity in driving the company’s vision forward.

Management of the Company

Shweta Jalan: Director

Ms. Shweta Jalan, Managing Partner and India Head at Advent International, brings over 21 years of Private Equity experience. She joined Advent in 2009 after working with ICICI Venture and Ernst & Young. Ms. Jalan serves on the Board of Directors for several companies, including Manjushree Technopack Limited. With expertise in sourcing and negotiating transactions across diverse sectors, she offers invaluable counsel on investment management and successful exits, enhancing the growth and success of the companies she serves.

Thimmaiah Napanda P : MD and Chief Executive Officer

With over three decades of experience,Thimmaiah Napanda P. has held numerous leadership positions, including more than 15 years as a business leader in renowned multinational corporations. Prior to his tenure at Manjushree Technopack Limited, he served as the Vice President, Managing Director, and CEO at Meritor, Inc. Mr. Thimmaiah has also held leadership roles at Honeywell Turbo Technologies, Cummins, Tata Cummins, and BEML.

Competitors of Manjushree Technopack Limited

- HLL Lifecare Limited

| Founded Year | Main Activities | Location |

| 1966 | Plastics Product Manufacturing | Medical Equipment and Supplies Manufacturing | Thiruvananthapuram; Kerala |

- Polyplex Corporation Ltd.

| Founded Year | Main Activities | Location |

| 1984 | Artificial and Synthetic Fibers and Filaments Manufacturing | Plastics Packaging Film and Sheet (including Laminated) Manufacturing | Uttarakhand |

- Jindal Poly Films Ltd.

| Founded Year | Main Activities | Location |

| 1974 | Unlaminated Plastics Film and Sheet (except Packaging) Manufacturing | Uttar Pradesh |

- Sabic Innovative Plastics India Pvt. Ltd.

| Founded Year | Main Activities | Location |

| 2007 | Plastics Product Manufacturing | Vadodara; Gujarat |

- Garware Polyester Ltd.

| Founded Year | Main Activities | Location |

| 1957 | Plastics Product Manufacturing | Aurangabad; Bihar |

Advent International Explores Strategic Options for Manjushree Technopack Limited, Eyeing $1 Billion Valuation

Advent International considered strategic options for Manjushree Technopak, India’s leading plastic packaging firm, aiming for a valuation of up to $1 billion. These options include selling a controlling stake or pursuing an IPO. Since Advent’s investment in 2018, Manjushree has expanded its operations through acquisitions and ESG initiatives like recycled resin plants. Advent International, a global private equity investor, has a diverse portfolio across various sectors and countries, with assets under management totaling $95 billion as of March 2023. , Manjushree Technopak Limited’s current market value of ₹1759.85 crore appears to be below the anticipated valuation of up to $1 billion. This suggests a potential undervaluation of the company. With Advent International considering strategic options to enhance its valuation, including a potential sale or IPO, investors may view Manjushree Technopak as an opportunity for growth and value appreciation.

Manjushree Technopack Limited Secures Packaging Excellence at PrintWeek Awards 2023

Manjushree Technopack Limited (MTL) Triumphs as Packaging Company of the Year at PrintWeek Awards 2023. Recent investments in recycling division underscore commitment to sustainability. With over 95% ownership by Advent International, Manjushree Technopack Limited expands with world-class facilities like the Bidadi factory. Leading in PCR HDPE and PP Grades, MTL maintains top position in rigid plastics packaging with a capacity of 2,00,000 MT per annum and Rs. 2,600-crore turnover.

Manjushree Technopack Limited Leads the Charge for Sustainable Packaging Innovation

As of November 2023, Manjushree Technopack Limited, India’s leading rigid plastics packaging provider backed by Advent International, is focused on sustainability and innovation in the FMCG, food, and beverage sectors. With significant converting capacity and a commitment to eco-friendly packaging, they’re pioneering the use of 100% rPET in food applications. They advocate for government support, such as PLI schemes, to boost investments in sustainable packaging. Their ESG initiative, ‘Born Again,’ emphasizes recycled materials and green practices, with plans for geographical expansion and acquisitions to meet growing demand. With cutting-edge technologies and ongoing developments, including the establishment of an Innovation Hub, Manjushree Technopack Limited is poised for continued growth and leadership in the packaging industry.

Manjushree Technopack Limited’s Journey in the Rigid Plastic Manufacturing Industry.

According to the Annual Report 2020-2023, Manjushree Technopack Limited, faced significant challenges amidst fluctuating raw material prices and supply chain disruptions. Despite these obstacles, the company demonstrated resilience and adaptability, leveraging its expertise and strategic planning to mitigate impacts on production and profitability. Throughout this period, Manjushree remained committed to innovation and sustainability, investing in cutting-edge technology and research to meet market demands while reducing environmental impact.

Expansion Through Acquisition

Manjushree Technopack Limited acquired two manufacturing units at Jalgaon, Maharashtra from Hitesh Plastics Private Limited on FY 2022. Caps and closures were added to its portfolio, providing these products to a wide range of customers.

Company’s Interim Dividend Announcement

The board declared an interim dividend of Rs. 11.50 per share, totaling Rs. 15.57 crores on FY 2022-2023, which was distributed on time.

Expansion Strategy: Company’s Acquisition Journey Across India

After the acquisition of National Plastics in FY20, the company acquired the B2B business of Pearl Polymers Limited (PPL), Classy Kontaines (CK), and Hitesh Plastics Private Limited (HPPL), thereby expanding its presence at Jigani, Karnataka; Guwahati, Assam; Pantnagar, Uttarakhand; Baddi, Himachal Pradesh; Vizag, Andhra Pradesh; Kanpur, Uttar Pradesh; Amritsar, Punjab; and Jalgaon, Maharashtra. With the consummation of these transactions, Manjushree Technopack Limited has reinforced its leadership position pan India and gained access to marquee clientele in the food, beverage, Agri, paint, and liquor segments.

IPO Listing and Delisting of Manjushree Technopack Limited

Manjushree Technopack Ltd made its initial public offering (IPO) debut on January 31, 2008, with the issue closing on February 6, 2008. The company offered its shares at an offer price of ₹45 per share, raising ₹3.3 crore through the public issue. The listing date was on February 28, 2008, with the stock opening at ₹48.00 per share and reaching a high of ₹66.00 during the trading session. Despite a strong listing, the company’s shares closed at ₹52.70. The holding period return on offer price and listing price stood at 894.00% and 831.88%, respectively. However, on March 24, 2015, Manjushree Technopack Ltd voluntarily delisted from the stock exchanges as per SEBI regulations 2009.

Financials

₹(in crores)

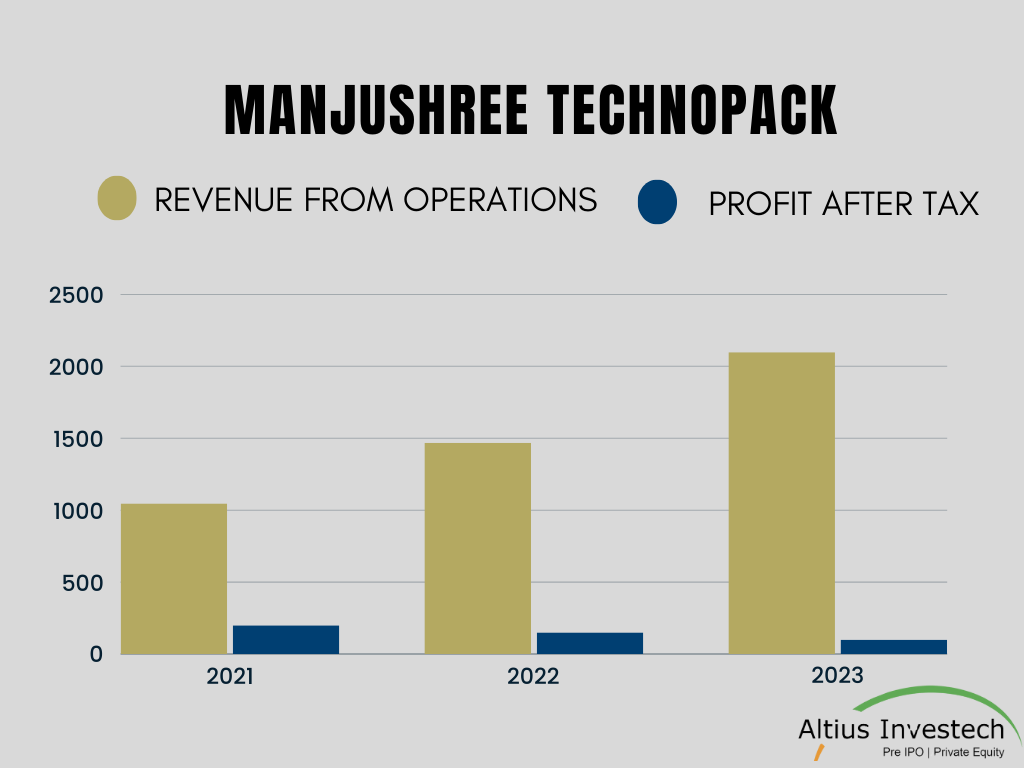

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Revenue from Operations | 2097.34 | 1467.52 | 1046.83 |

| Profit After Tax | 59.23 | 70.82 | 91.15 |

| Earning Per Share | 43.72 | 52.58 | 66.80 |

The financial performance of the company witnessed steady growth over the past three fiscal years. Revenue from operations showed a consistent upward trend, increasing from ₹1,046.83 crores in FY 2021 to ₹2,097.34 crores in FY 2023. Despite this revenue growth, there was a decline in Profit After Tax (PAT) from ₹91.15 crores in FY 2021 to ₹59.23 crores in FY 2023. Earnings Per Share (EPS) also experienced a decline over the same period, decreasing from ₹66.80 in FY 2021 to ₹43.72 in FY 2023. While revenue growth remained strong, the decline in profitability metrics suggests potential challenges in cost management or other operational aspects that need to be addressed.

Manjushree Technopack Limited’s Share Price (as on 16.02.2024)

- The buy price varies based on quantity, ranging from 1340 for quantities between 36 – 71 shares to 1325 for quantities between 358 – 714 shares, with corresponding rates per share.

- The 52-week high is 1499, and the 52-week low is 999, indicating the range of fluctuations in the share price. Additionally, the sell price is fixed at 1175.

Currently Manjushree Technopack Limited Share Price is trading at around Rs. 1310/share. CLICK HERE to Invest

Financial Metrics for Manjushree Technopack Limited (as on 16.02.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 29.61 |

| Price to Sales Ratio (P/S) | 0.84 |

| Price to Book Value (P/B) | 1.84 |

| Industry PE | 35 |

| Face Value | ₹ 10 |

| Book Value | ₹ 704.44 |

| Market Cap | ₹ 1759.85 Cr |

| Dividend | 34 |

| Dividend Yield | 2.62 % |

Corporate Action of Manjushree Technopack Limited.

| Financial Year | Particulars | Record Date | Ratio/Rates/Amount | Remarks |

| 2023-24 | DIVIDEND | 03-Dec-2023 | 34 | Manjushree Technopack Ltd had declared interim dividend of Rs 34/shares. |

| 2023-24 | DIVIDEND | 19-May-2023 | 31.1 | Manjushree Technopack Ltd had declared interim dividend of Rs 31.10/shares. |

| 2022-23 | DIVIDEND | 23-Nov-2022 | 11.5 | Manjushree Technopack Ltd had declared interim dividend of Rs 11.50/shares. |

| 2021-22 | DIVIDEND | 30-Sep-2022 | 16.75 | Manjushree Technopack Ltd had declared interim dividend of Rs 16.75/shares. ( Record date is tentative.) |

Shareholdings of Manjushree Technopack Limited

| Shareholding Above 5% | Holding % |

| AI Lenarco MIDCO Ltd | 97.24 |

| Others | 2.76 |

Conclusion

- Financial Performance: Manjushree Technopack Ltd. witnessed steady revenue growth over the past three fiscal years, but there was a decline in Profit After Tax (PAT) and Earnings Per Share (EPS) during the same period.

- Share Price: The company’s share price has fluctuated between ₹999 and ₹1499 over the past year, with a current buy price ranging from ₹1325 to ₹1340 per share, and a fixed sell price at ₹1175.

- Financial Metrics: Key financial metrics include a Price to Earning Ratio (P/E) of 29.61, Price to Sales Ratio (P/S) of 0.84, and Price to Book Value (P/B) of 1.84. The company’s Market Cap is ₹1759.85 Cr.

- Dividend: Manjushree Technopack has declared interim dividends over recent years, with the latest being ₹34 per share in FY 2023-24.

- Shareholding: AI Lenarco MIDCO Ltd. holds a significant shareholding of 97.24%, indicating confidence in the company’s future prospects.

- IPO Success and Strategic Delisting: Manjushree Technopack Ltd witnessed a successful IPO in 2008 followed by a voluntary delisting in 2015, reflecting strategic shifts in ownership and adaptability to market dynamics.

- Undervaluation of Manjushree Technopak: Despite its stature as India’s leading plastic packaging firm, Manjushree Technopak Limited’s market value of ₹1759.85 crore appears to be below the anticipated valuation of up to $1 billion, signaling a potential undervaluation.

- Conclusion: While the company has shown promising revenue growth, addressing profitability concerns and maintaining shareholder value will be key priorities. Continued efforts to enhance operational efficiency and capitalize on growth opportunities will be essential for sustained success.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/