Beginning of Anheuser-Busch InBev

Originally called SABMiller India Ltd., Anheuser Busch InBev India Ltd. was formally founded in 1988 in Belgium. The company’s initial concentration was on creating and marketing a wide variety of drinks, with a particular focus on beer and soft drinks. It rapidly established itself in the Indian market by utilizing its wide range of brands, which paved the way for its future expansion and prosperity.

About the Company

Anheuser-Busch InBev, is a multinational brewing corporation that operates across multiple nations and continents. Prominent for its varied assortment of beer brands, such as Budweiser, Corona, and Stella Artois, Anheuser Busch Inbev serves a broad spectrum of global consumer interests. To remain competitive in the market, the company is dedicated to innovation and regularly releases new beer varieties and package designs. Strong brand awareness and market presence help Anheuser Busch Inbev maintain its dominant position in important beer markets throughout the world. The business also places a high priority on sustainability projects, funding water conservation and ecologically friendly brewing techniques. Anheuser Busch Inbev maintains its position as a dominant player in the global beer business by achieving consistent revenue growth and profitability through strategic acquisitions and a focus on financial performance.

| Company Name | Anheuser-Busch InBev India |

| Scrip Name | SAB Miller |

| Sector | Breweries & Distilleries |

| PAN Number | AAICS2238R |

| ISIN Number | INE038G01019 |

Incorporation Details of Anheuser Busch Inbev

| Anheuser Busch Inbev CIN Number | U65990MH1988PLC049687 |

| Anheuser Busch Inbev Registration Date | 18-Nov-1988 |

| Category/Sub-category of Anheuser Busch Inbev | Company limited by Shares |

| Anheuser Busch Inbev Registered Office Address | Unit No. 301-302, Dynasty Business Park B wing, Andheri Kurla Road, Andheri (East), Mumbai 400059 |

| Anheuser Busch Inbev Registrar & Transfer Agent Address | Link in Time Private Limited, C 101,247 Park, 1st Floor L.B.S Marg, Vikhroli West, Mumbai-400083 |

Anheuser-Busch InBev: Founder

When Anheuser-Busch was first established in the 1850s, it was just a modest neighborhood brewery. It was made into a nationwide presence by the combined efforts of Adolphus Busch, Eberhard Anheuser, and other staff. The founders were instrumental in transforming the brewery from a small local business to a significant participant in the US beer market.

Management of the Company

Sapna Taneja: Director

Rashmi Sharma: Director

Kartikeya Sharma: Director

Mahesh Kumar Mittal: Director

Shantanu Krishna: Director

Anheuser-Busch InBev: Business Overview

- Global Reach: Anheuser Busch Inbev maintains a robust global presence across multiple continents, boasting a diverse portfolio featuring renowned brands such as Budweiser, Stella Artois, and Corona.

- Product Diversity: In addition to its flagship brands, Anheuser Busch Inbev offers a wide range of local and regional favorites, catering to a variety of consumer preferences worldwide.

- Commitment to Innovation and Sustainability: The company prioritizes innovation and sustainability, investing in research and development to advance sustainable brewing practices and introduce new products.

- Strategic Mergers and Acquisitions: Anheuser Busch Inbev growth strategy includes strategic acquisitions, both large-scale international breweries and craft beer labels, enabling market expansion and product diversification.

- Efficient Supply Chain and Distribution: With a vast and efficient supply chain and distribution network, Anheuser Busch Inbev effectively serves its global customer base, ensuring timely delivery and availability of its products.

- Marketing Excellence and Sponsorships: Renowned for its impactful marketing initiatives, including notable advertising campaigns and sponsorships of major sporting events, Anheuser Busch Inbev enhances brand visibility and recognition on a global scale.

Anheuser-Busch InBev: Product

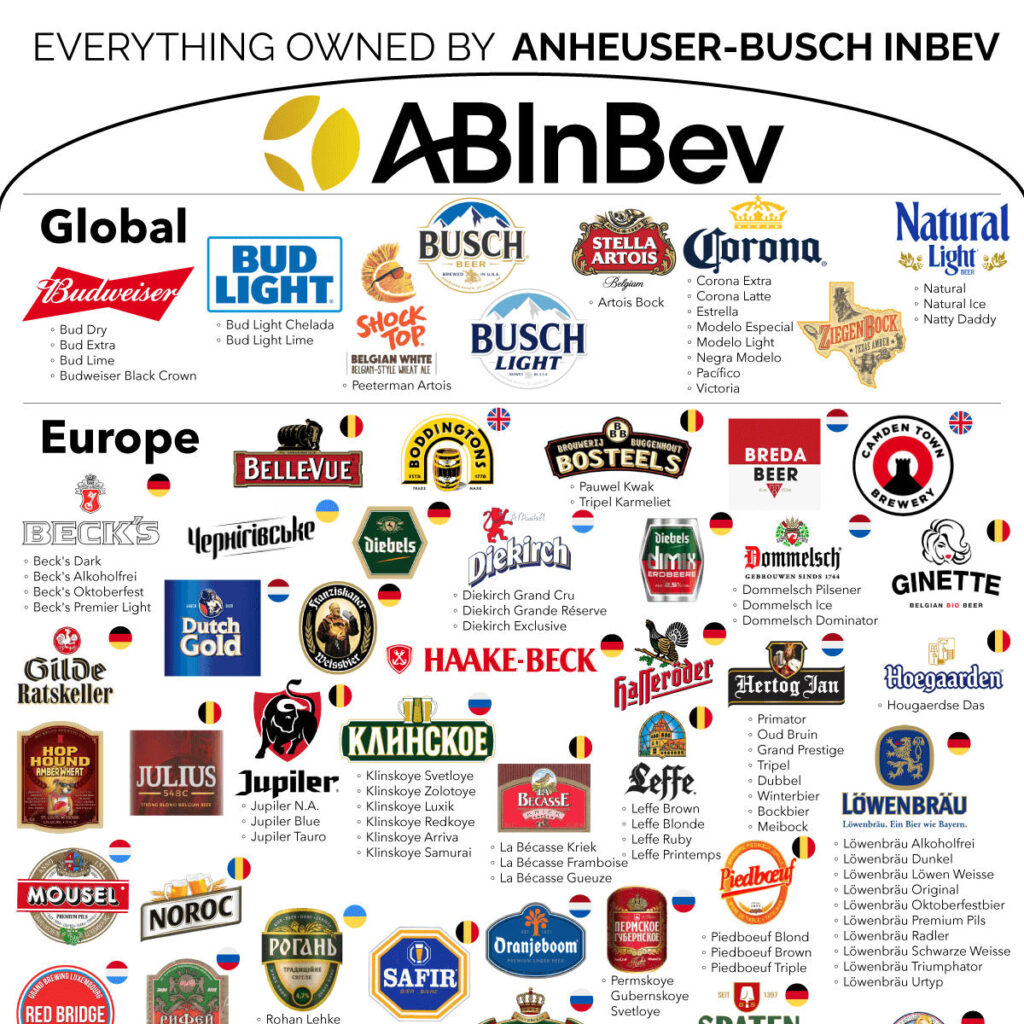

What does Anheuser-Busch InBev Own?

Anheuser Busch Inbev owns a large number of popular beer brands around the world, including:

- Beck’s

- Budweiser

- Busch

- Corona

- Elysian

- Franziskaner

- Goose Island

- Löwenbräu

- Michelob

Budweiser

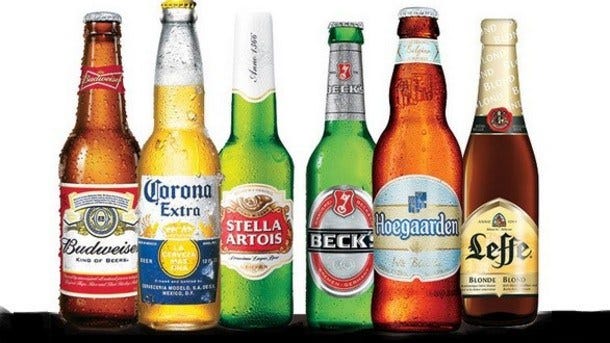

Budweiser is the flagship brand of Anheuser-Busch beers. The name came from the Budweis region of Bohemia, which is now known as České Budějovice in Czechia. That location is where the beer was originally brewed. For decades, the brand’s Bud Light had been the best-selling beer in America, though the top spot in beer sales was taken over by Modelo Especial in 2023.

Domestic and Global Beer Brands owned by Anheuser-Busch InBev:

| Budweiser | Bud Dry, Bud Extra, Bud Lime, Budweiser Black Crown |

| Bud Light | Bud Light Chelada, Bud Light Lime |

| Busch | – |

| Busch Light | – |

| Corona | Corona Extra, Corona Latte, Estrella, Modelo Especial, Modelo Light, Negra Modelo, Pacífico, Victoria |

| Natural Light | Natural, Natural Ice, Natty Daddy |

| Shock Top Belgian | Peeterman Artois |

| Stella Artois | Artois Bock |

| Ziegenbock | – |

Principal Business Activities of the company

| Name and Description of main products/services | NIC Code of the Product/Services | % to total turnover of the Company |

| Beer | 15531 | 100% |

Anheuser-Busch InBev : Competitors

Anheuser-Busch InBev (AB Inbev) faces competition from several key rivals in the beverage industry:

- Pabst Brewing: A private company producing and selling beers. Founded in 1844, it operates primarily in the United States and competes in the beer market segment.

- Carlsberg: A public brewery company with a large portfolio of beer brands. Established in 1847, it operates globally and competes with Anheuser Busch Inbev in various markets.

- Heineken: A global brewer and distributor of beer and cider. Founded in 1864, it is publicly traded and competes with Anheuser Busch Inbev on an international scale.

- Constellation Brands: A public company producing and marketing beer, wine, and spirits. Founded in 1945, it competes with Anheuser Busch Inbev in the alcoholic beverage market, particularly in the United States.

- Molson Coors: A public beer company distributing and brewing various beer brands. Established in 1786, it competes with Anheuser Busch Inbev in the beer market, particularly in North America.

These competitors operate globally and pose challenges to Anheuser Busch Inbev in different market segments. While Anheuser Busch Inbev leads in revenue and valuation, each competitor has its unique strengths and market presence, contributing to a dynamic and competitive landscape in the beverage industry.

Anheuser-Busch InBev’s Market Dominance Fueled by Premium Brands in India

Anheuser Busch Inbev asserts its market dominance and consistent market share growth, driven by the increasing demand for its premium brands. India, the fourth largest market for Budweiser by volume, plays a significant role in the company’s global operations. Notably, Anheuser Busch Inbev generated nearly a third of its sales from premium brands in India two years ago, highlighting the success of its optimization strategy in the Indian market.

Celebrity Alliance: Aryan Khan Launches Business Venture with Anheuser Busch Inbev India Partnership

Shah Rukh Khan’s son, Aryan Khan, is venturing into the business world by launching a premium vodka brand in India, with plans to expand into other consumer segments later. Teaming up with partners Bunty Singh and Leti Blagoeva, Aryan has formed Slab Ventures, which has partnered with Anheuser-Busch InBev for distribution and marketing. The venture aims to target affluent consumers and diversify into other premium segments, including alcoholic and non-alcoholic beverages, apparel, and accessories.

Anheuser-Busch InBev’s Rs 400 Cr Investment & Premium Brand Surge in Karnataka

During a meeting at the World Economic Forum in Davos, Ab InBev announced plans to invest Rs 400 crore in expanding its brewery operations in Karnataka. With Bengaluru as its India hub, Anheuser-Busch InBev oversees 500+ global and local beer brands. Operating a modern brewery in Mysuru and a global capability center in Whitefield, the company employs 5,000 professionals. Notably, premium brands now account for two-thirds of Anheuser-Busch InBev’s total sales in India, up from one-third three years ago, marking a significant market shift.

Anheuser-Busch InBev’s Diversification Strategy in India

Anheuser-Busch InBev, renowned for beer brands like Budweiser and Corona, is expanding beyond beer categories in India. With a focus on gin, rum, whiskey, and non-alcoholic products, the company aims to capitalize on market growth. Since 2021, it has introduced products like Budweiser Magnum Double Barrel Whiskey and Hoegaarden gin variants. This diversification strategy, built on a consumer-centric approach, aims to strengthen market presence in existing markets like Telangana and Maharashtra while entering new markets like Mumbai and Pune. Supported by 10 manufacturing units and a robust distribution network Anheuser-Busch InBev is poised for strategic expansion beyond its traditional beer offerings.

Key Strength

- Market Leadership: Anheuser-Busch InBev holds a prominent position as one of the world’s largest beer companies, boasting a vast portfolio of over 500 beer brands and a substantial global presence.

- Iconic Brands: With ownership of renowned beer labels like Budweiser, Stella Artois, and Corona, Anheuser-Busch InBev possesses a strong brand portfolio recognized globally, fostering a loyal customer base.

- Product Diversity: Anheuser-Busch InBev offers a diverse range of products, including global, local, and craft beers, addressing various consumer preferences across diverse markets.

- Global Distribution Network: Leveraging an extensive distribution network, Anheuser-Busch InBev effectively reaches customers in numerous countries, ensuring widespread accessibility of its products.

- Economies of Scale: As a multinational corporation, Anheuser-Busch InBev benefits from economies of scale in production, distribution, and marketing, enhancing operational efficiency and competitiveness.

- Innovation and Development: Anheuser-Busch InBev prioritizes innovation, regularly introducing new products and variants to meet evolving consumer demands and expand market share.

- Strategic Acquisitions: Through strategic acquisitions like SABMiller, Anheuser-Busch InBev has significantly expanded its market presence and product offerings, driving growth and market dominance.

- Effective Marketing: Recognized for its impactful marketing campaigns and sponsorship agreements, particularly within major sporting events, Anheuser-Busch InBev strengthens brand visibility and consumer engagement.

- Sustainability Commitment: Anheuser-Busch InBev’s dedication to sustainability, encompassing initiatives in water stewardship, renewable energy, and responsible sourcing, not only enhances its corporate image but also improves operational efficiency.

- Shareholding Structure: Anheuser Busch InBev India Share ‘s major shareholders include AB Inbev Asia B V with 63%, Anheuser Busch Inbev Breweries Private Limited with 34.77%, and Sabmilier India Holdings with 1.36%. One key strength of the company lies in its diversified portfolio of iconic beer brands.

Key Weaknesses

- Complex Organizational Structure: The extensive size and global reach of Anheuser-Busch, resulting from numerous mergers and acquisitions, may lead to a convoluted management structure, potentially causing delays in decision-making and operational inefficiencies.

- Regulatory Challenges: Operating across diverse regulatory landscapes exposes Anheuser-Busch InBev to regulatory risks, especially concerning alcohol-related regulations, which could impact its operations.

- Alcohol Focus: The company’s heavy reliance on alcoholic beverages, primarily beer, could pose a vulnerability in markets where there’s a shift towards healthier or non-alcoholic alternatives.

- Market Saturation: Saturation in key beer markets presents challenges for growth and intensifies competition, posing a hurdle for Anheuser-Busch InBev’s market expansion efforts.

- Brand Management: While boasting a broad brand portfolio, effectively managing and marketing numerous brands can be complex, potentially leading to diluted marketing efforts and weakened brand equity.

- Changing Consumer Preferences: Increasing consumer interest in health and wellness, including a shift towards low-alcohol or alcohol-free beverages, presents a challenge to traditional beer products.

- Economic Vulnerability: Economic downturns can adversely affect the alcoholic beverage industry, leading to reduced consumer spending on premium beers, thus impacting Anheuser-Busch InBev’s revenue.

- Supply Chain Complexity: Managing a global supply chain entails logistical complexities, including susceptibility to disruptions in raw material supply or geopolitical events, which could disrupt operations.

Financials

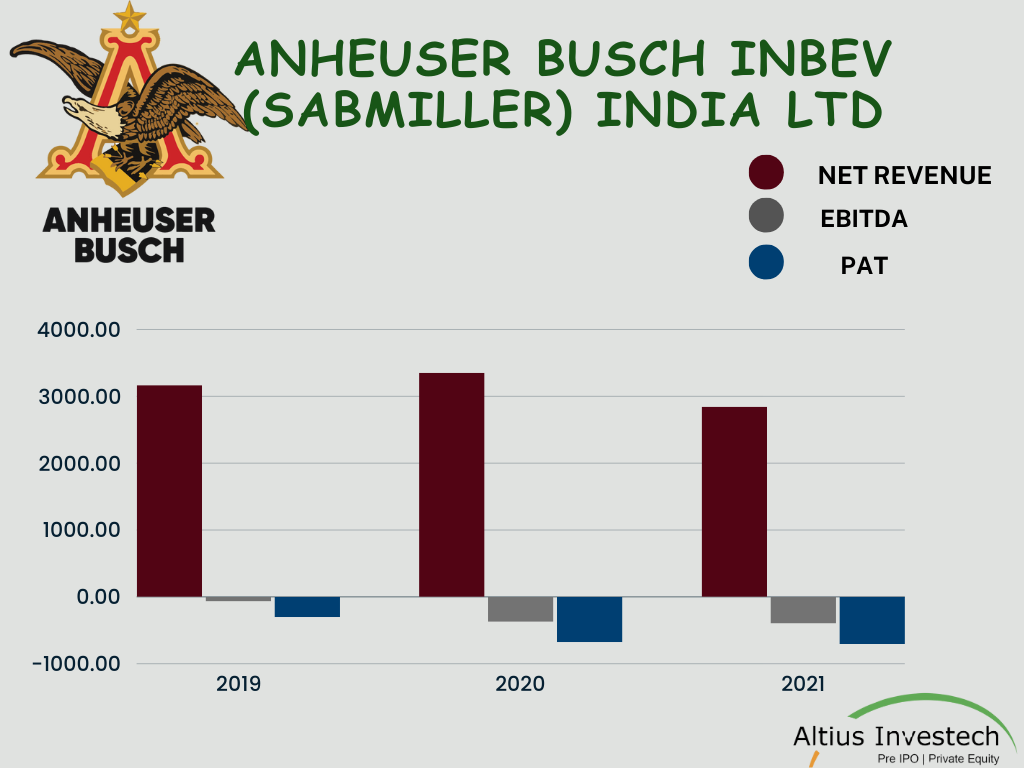

₹(in crore)

| Particulars | FY 2019 | FY 2020 | FY 2021 |

| Net Revenue | 3,167.20 | 3,354.50 | 2,845.30 |

| EBITDA | -67.90 | -372.50 | -397.60 |

| Profit After Tax | -304.60 | -677.30 | -705.30 |

In 2018, the company undertook a significant strategic decision by liquidating its associate company, Anheuser Busch InBev Breweries Private Limited. This move likely had profound implications for the company’s operations and financial standing.

Over the three fiscal years from 2019 to 2021, the company’s financial performance exhibited varying trends. Net revenue experienced a minor fluctuation, with a 5% increase from FY 2019 to FY 2020 followed by a 16% decrease in FY 2021. However, EBITDA showed a more pronounced negative trend, with losses widening by 485% from FY 2019 to FY 2021. Similarly, the profit after tax (PAT) saw a significant deterioration, with losses escalating by 132% over the same period.

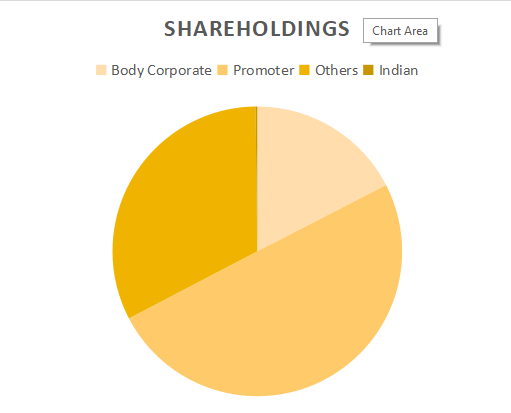

Shareholdings of Anheuser Busch Inbev (Sabmiller) India Ltd

| Shareholding Above 5% | Holding % |

| AB Inbev Asia B V | 63 |

| Anheuser Busch Inbev Breweries Private Limited | 34.77 |

| Sabmilier India Holdings | 1.36 |

| Austindia Pty Limited | 0.4 |

| Other | 0.47 |

Anheuser Busch InBev India Share ‘s major shareholders include AB Inbev Asia B V with 63%, Anheuser Busch Inbev Breweries Private Limited with 34.77%, and Sabmilier India Holdings with 1.36%.

Anheuser Busch Inbev India Share Price (as on 13.02.24)

- The buy prices range from ₹445 to ₹430 per share, depending on the quantity purchased.

- The 52-week high for this stock stands at ₹430, indicating significant fluctuation in value over the past year. The sell price remains fixed at ₹325 per share.

Currently Anheuser Busch Inbev India Share Price is trading at around Rs. 435/share. CLICK HERE to Invest

Financial Metrics for Anheuser Busch Inbev (as on 13.02.24)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | -57.72 |

| Price to Sales Ratio (P/S) | 5.24 |

| Price to Book Value (P/B) | 66.87 |

| Industry PE | 108.77 |

| Face Value | ₹ 10 |

| Book Value | ₹ 6.43 |

| Market Cap | ₹ 17568.94 Cr |

| Dividend | 0 |

| Dividend Yield | 0% |

Anheuser Busch Inbev IPO Plans

Anheuser-Busch InBev’s IPO plans for its Asian subsidiary, Budweiser Brewing Company APAC, were ambitious but ultimately suspended due to market conditions. Initially targeting a valuation of $70 to $80 billion, the company aimed to raise $8 to $10 billion, but institutional demand fell short. The IPO was intended to help Anheuser-Busch InBev address its significant debt, but the company faces challenges in China’s beer market, where competitors like Carlsberg and Heineken are gaining ground with premium offerings and strategic partnerships. As of now, there’s uncertainty about whether Anheuser-Busch InBev will proceed with the IPO or explore alternative strategies to address its financial challenges.

Conclusion

- Anheuser-Busch InBev (AB InBev) is a multinational brewing corporation with a storied history, originally founded as SABMiller India Ltd. in 1988.

- Despite facing setbacks such as the suspension of its IPO plans for its Asian subsidiary, Budweiser Brewing Company APAC, Anheuser-Busch InBev maintains a dominant position in the global beer market.

- Anheuser Busch InBev India Share fluctuates between ₹445 to ₹430 per share for buying, with a fixed sell price of ₹325.

- The company’s portfolio includes iconic brands like Budweiser, Corona, and Stella Artois, reflecting its commitment to product diversity and innovation.

- Anheuser-Busch InBev remains focused on sustainability initiatives and strategic expansion to navigate challenges and capitalize on emerging opportunities.

- With a strong market presence, resilient financial performance, and a dedication to growth, Anheuser-Busch InBev is poised for continued success in the dynamic beverage industry landscape.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/