Table of Contents

ToggleSBI Mutual Fund- About

The State Bank of India (SBI), the Indian multinational public sector bank and financial services created SBI Mutual Fund, an Indian asset management company that was incorporated in 1987 and has its corporate headquarters in Mumbai, India. The European asset management firm Amundi and State Bank of India have partnered to form SBI Fund Management Limited (SBIFML).Throughout its history, SBI Mutual Fund’s performance has been reflected in its SBI mutual fund share price.

The Unit Trust of India (UTI), Government of India and Reserve Bank of India initiative, launched the mutual fund market in India in 1963. SBI Mutual Fund was India’s first non-UTI mutual fund, having been introduced on June 29, 1987.

Their goal has been to make mutual funds a respectable alternative for the majority of investors in the nation. In order to achieve this goal, they created cutting-edge, niche products and informed clients about the extra advantages of using mutual funds to invest in the capital markets. Currently,they actively manage investors’ assets through their knowledge of domestic mutual funds, offshore funds, alternative investment funds, and institutional investor portfolio management advisory services.

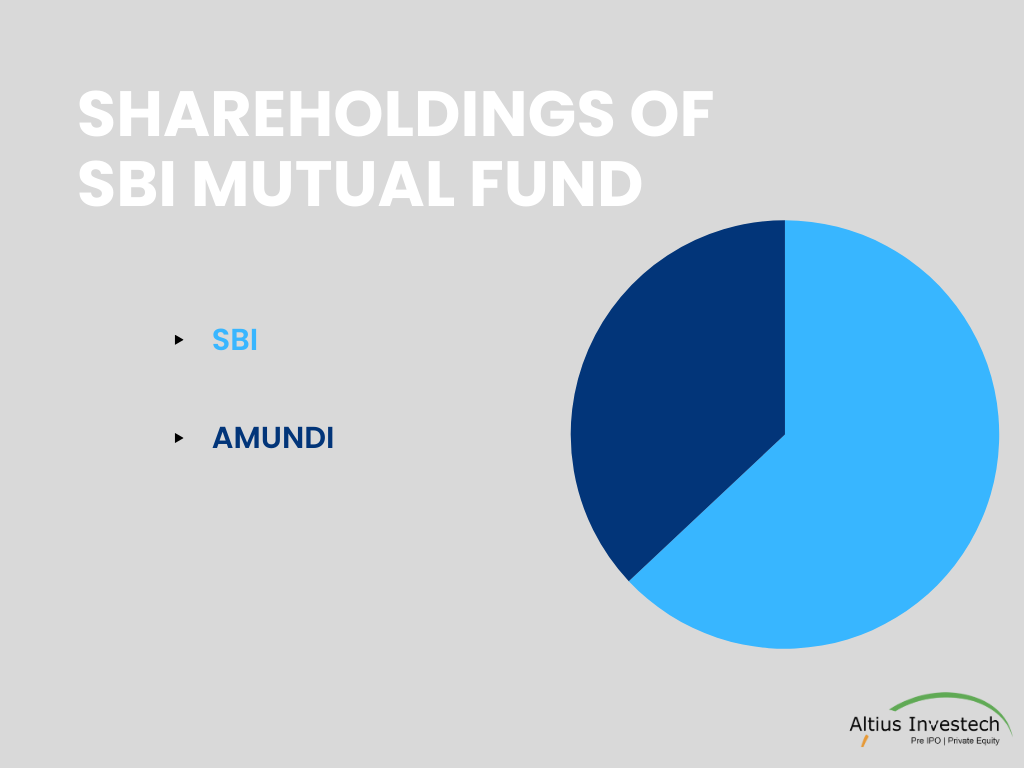

SBI currently holds 63% stake in SBIFML and the 37% stake is held by AMUNDI Asset Management through a wholly owned subsidiary, AMUNDI India Holding.

People of SBI Mutual Fund

Mr. Dinesh Kumar Khara: Chairman

After serving as Managing Director (Global Banking & Subsidiaries) at State Bank of India, Mr. Dinesh Kumar Khara is currently the Chairman of the SBI Mutual Fund. Throughout his more than 36 years in the business, he has held a number of positions at SBI, such as managing corporate banking, non-banking businesses, and international markets. With a broad experience in commercial banking, encompassing corporate and retail lending, deposit mobilization, and global banking operations, he oversaw eighteen regional rural banks. In addition to being a graduate of Delhi School of Economics and FMS (University of Delhi),Mr. Khara is certified by the Indian Institute of Bankers (CAIIB).

Mr. Shamsher Singh :Managing Director and CEO

Since November 2, 2022, Mr. Shamsher Singh, Deputy Managing Director of the State Bank of India (SBI), has been deputed to SBI Funds Management Limited. He has over 32 years of experience and was the Chief General Manager of SBI’s Ahmedabad Circle, where he oversaw more than 1400 branches, drove company expansion, and made sure regulations were followed. He oversaw the retail business activities in Gujarat, Daman and Diu, and the Union Territories of Dadra and Nagar Haveli.

Mr. D. P. Singh : Joint CEO and Deputy Manager Director

Mr. Denys de Campigneulles :Deputy Chief Executive Officer

On deputation from Amundi Group, Denys De Campigneulles has been the Deputy Chief Executive Officer of SBI Funds Management Limited (SBIFML) since March 2020. His previous positions included Chief Investment Officer of LCL Bank in Paris, Head of Fixed Income Business Development & Investment Specialists with Amundi in Paris, Deputy CEO Asia for Amundi in Hong Kong, and Chief Investment Officer of NH-Amundi in South Korea. He has over 35 years of extensive experience in the financial services industry. Before taking on these posts, he worked for Credit Lyonnais, Banque Bruxelles Lambert, and Amundi in a variety of senior investment capacities in London and Paris.

In addition to the aforementioned leadership group, important individuals holding significant positions at SBI Mutual Funds includes:

Independent Director :

Mr. Moiz Miyajiwala, Mrs. Sudha Krishnan, Mr. Shekhar Bhatnagar, Mr. C. N. Ram and Dr. T.T. Ram Mohan

Associate Director :

Mr.Fathi Jerfel, Mr. Ashwini Kumar Tewari and Mr. Oliver Mariee

Chief Investment Officer :

Mr. Rajeev Radhakrishnan and Mr. Rama Iyer Srinivasan

Categories of SBI Mutual Fund Category

SBI Small Cap Fund

All equities outside of the top 250 stocks (by market capitalization) are included in the small cap category, which is where these mutual funds choose stocks to invest in. Ideal For: Those seeking extremely high returns on their investments over a minimum of three to four years. These investors should also be prepared for the potential for greater losses on their investments at the same time. Fund Manager: Rama Iyer Srinivasan. Risk Involved: Very High. Return on Investment: 3 years, 30%(approx).

SBI Mid Cap Fund

These mutual funds choose mid-cap equities, usually those with market capitalization between 100 and 250, for investment purposes.While smaller stocks could have more growth potential, larger stocks are generally thought to be less hazardous. Ideal for: Investors looking for potential high returns in SBI mutual fund share price with a commitment to hold their investments for a minimum of three to four years. These investors should also be prepared for the risk of suffering modest losses on their investments at the same time. Fund Manager: Sohini Adani. Risk Involved: Moderate. Return on Investment: 3 years, 27%(approx).

SBI Large Cap Fund

The top 100 stocks listed on the Indian markets (with the highest market capitalization) are the stocks that these mutual funds choose to invest in. While smaller stocks could have more growth potential, larger stocks are generally thought to be less hazardous. Ideal for: Investors aiming for substantial returns in SBI mutual fund share price, with a commitment to a minimum three to four years investment horizon These investors should also be prepared for the risk of suffering modest losses on their investments at the same time. Fund Manager: Saurabh Pant. Risk Involved: Moderate. Return on Investment: 3 years, 22% (approx).

SBI Dividend Yield Fund

These mutual funds invest in equities and employ a strategy that maximizes dividend income on those investments. Ideal for: Investors aiming for greater returns in SBI mutual funds share price through selective wagering and in-depth understanding of macro trends. Despite the fact that the market is doing better overall, these investors should also be prepared for the prospect of suffering moderate to significant losses on their assets. Fund Manager: Rohit Shimpi. Risk Involved: Very High. Return on Investment: 3 years, 25%(approx).

SBI Contra Fund

When it comes to investing in stocks, these mutual funds take a contrarian stance when it comes to buying and selling. The basic premise is that investor herd mentality frequently results in extremely expensive or extremely cheap investments. Ideal for: Investors who are well-versed in macrotrends and who would rather make strategic wagers in order to outperform other equity funds in SBI mutual funds share price. Even while the market is doing better overall, these investors should also be prepared for the prospect of moderate to large losses on their assets. Fund Manager: Mr Dinesh Balachandran. Risk Involved: Very High. Return on Investment: 3 years, 25%(approx)

SBI Flexi Cap Fund

These mutual funds are dynamic, open-ended equity funds that make investments in small, mid, and large-cap stocks, among other market capitalizations. Ideal For: Those intending to invest for a minimum of five years and anticipating returns from fixed income choices in addition to gains that exceed inflation comfortably in SBI mutual fund share price. However, these investors also need to be ready for potential ups and downs in their portfolios. Fund Manager: Anup Upadhyay. Risk Involved: Very High. Return of Investment: 3 years, 15%(approx).

| Categories | Risk Involved | Return on Investment (in 3 years) |

| Small Cap Fund | Very High | Approx 30% |

| Mid Cap Fund | Moderate | Approx 27% |

| Large Cap Fund | Moderate | Approx 22% |

| Dividend Yield Fund | Very High | Approx 25% |

| Contra Fund | Very High | Approx 25% |

| Flexi Cap Fund | Very High | Approx 15% |

Overview of SBI Mutual Fund Categories

In conclusion, SBI mutual funds share price offer various options for investors with different risk appetites and investment goals. Small-cap and dividend yield funds promise potentially high returns but come with very high risk. Mid-cap, large-cap, and contra funds offer moderate to high returns with corresponding risk levels. The flexi cap fund provides a dynamic strategy across market sizes, suitable for long-term growth and income. Investors should assess their risk tolerance and investment horizon before choosing the right SBI mutual fund for their needs.

SBI Mutual Fund Financials

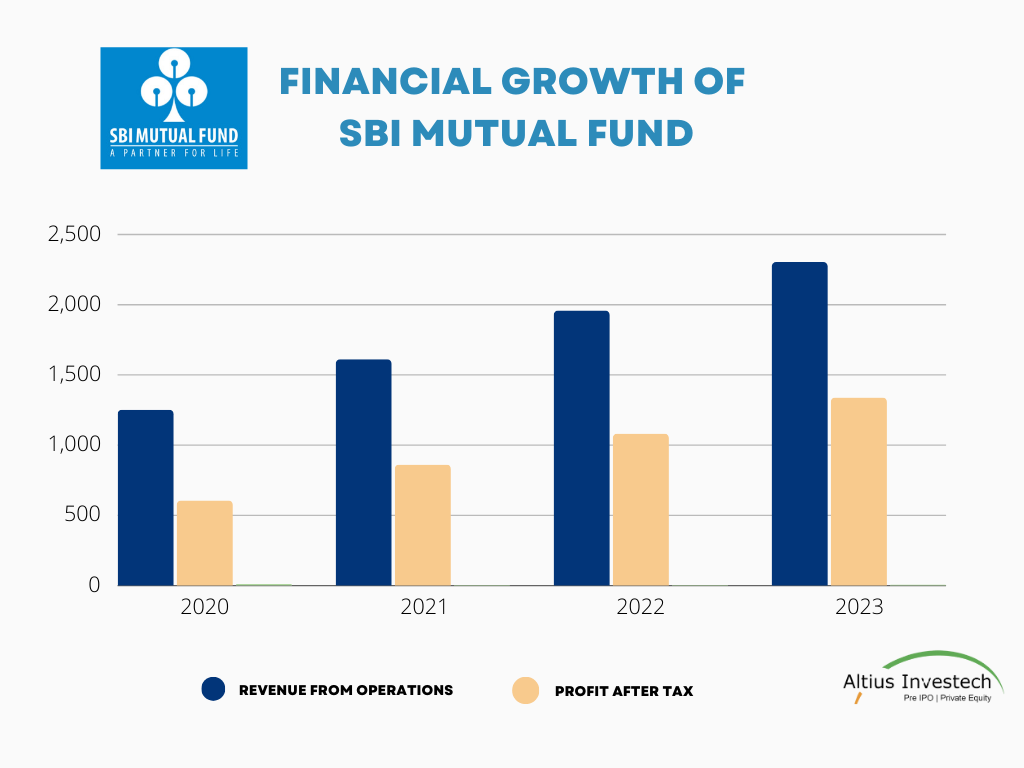

₹ in crores

| Particulars | FY23 | FY22 | FY21 | FY20 |

| Revenue from operations | 2,303.3 | 1,958 | 1,611 | 1,252.3 |

| Profit After Tax (PAT) | 1,339.7 | 1,082.4 | 862.6 | 605.8 |

| Earning Per Share (EPS) | 26.62 | 21.56 | 17.24 | 12.12 |

Dividend History : SBI Mutual Fund

SBI Mutual Fund has announced an interim dividend of 3.50 per equity share for the fiscal year ending March 31, 2023. This is an increase from the previous year’s payout of 3 per equity share.

Interestingly, SBI Mutual Fund decided not to declare a final dividend for the same time. This choice emphasizes the business’s dedication to sound financial management and shows that it is focused on maximizing investment returns.

Operational Metrics for SBI AMC

Throughout the year, the company managed the following mutual fund assets:

₹ in crores

|

Particulars |

F.Y 2022-2023 |

F.Y 2021-2022 |

Growth percentage |

|

Total Asset Mobilized |

25,83,924

|

19,72,517

|

31% |

|

Total Redemption |

25,41,903

|

18,90,599 |

34.45% |

|

Net Inflow |

42,021 |

81,918

|

Decrease of 48.70% |

|

Average AUM Rank |

1st |

1st |

|

|

Market Share % |

17.70% |

16.86% |

4.99% |

|

Monthly SIP Value |

2,306 |

1,908 |

20.86% |

Mutual Fund Performance Analysis

- Asset Mobilization: In the fiscal year 2022-2023, total assets mobilized increased to ₹25,83,924 crore, marking a significant 31% growth compared to ₹19,72,517 crore in the previous fiscal year.

- Redemption: Total redemptions also increased to ₹25,41,903 crore in FY 2022-2023, reflecting a growth of 34.45% from ₹18,90,599 crore in FY 2021-2022.

- Net Inflow: Despite the increase in asset mobilization and redemptions, the net inflow decreased substantially by 48.70%, falling to ₹42,021 crore in FY 2022-2023 from ₹81,918 crore in FY 2021-2022.

- Average AUM Rank: The mutual fund maintained its top position in terms of Average Assets Under Management (AUM) ranking, securing the first position in both fiscal years.

- Market Share: There was a notable increase in market share percentage, reaching 17.70% in FY 2022-2023, compared to 16.86% in FY 2021-2022, representing a growth of 4.99%.

- Monthly SIP Value: The monthly Systematic Investment Plan (SIP) value also experienced growth, rising by 20.86% from ₹1,908 crore in FY 2021-2022 to ₹2,306 crore in FY 2022-2023.

Overall, while the mutual fund witnessed significant growth in asset mobilization, redemptions, market share, and SIP value, the decrease in net inflow suggests a need for further analysis to address factors contributing to this decline and to strategize for improved performance in the future.

Overview of financials

- Profit and cash improved, showing the company is doing well financially.

- Plans are in place to grow more by expanding into new markets and using new technology.

- They will introduce new products to attract more customers.

- They aim to reach more people in smaller cities to grow their business.

- The company is also investing in new ways to make money, like alternative investments.

- They’re also looking at getting more investors from other countries to help grow their business.

- Overall, the company is in good shape financially and has plans to keep growing.

SBI Mutual Fund Share Price

2.Market Range: Essential market indicators are provided, including the 52-week high and low for SBI Mutual Fund share price. The 52-week high stands at 1495, while the low is recorded at 889. Additionally, the current sell price for SBI Mutual Fund shares is set at 1350. These figures offer investors valuable insights into the historical range and current market sentiment regarding SBI Mutual Fund shares.

SBI Mutual Fund’s Digital Endeavors

New Features:

- UPI Autopay for SIP registration.

- IMPS facility added to Smart Code.

- Introduced % based Top Up SIP.

Mitra App Enhancements:

- Knowledge base expanded.

- Extended to Regional Rural Banks.

- New Reports & Insights for Finding Customers.

YONO Engagement:

- Increased customer engagement through campaigns.

- SBI Branch Portal’s Redesigned Mutual Fund Experience.

SBI Net Banking Update:

- Experience investing in mutual funds under CUG testing

SBI Mutual Fund’s Future Plan Overview

Business Development and Market Dynamics:

- Despite ongoing uncertainties, we anticipate a dynamic year ahead for the industry with both asset growth and margin pressures.

- Focus remains on business development, market making, and cost optimization amidst high inflation and geopolitical turbulence.

- Investments in technology will be prioritized to ensure data security.

Product Innovation:

- Emphasis on introducing innovative funds, particularly thematic and passive options, while evaluating opportunities in alternatives like PMS & AIF.

- Expansion of international offerings and solution-oriented fund of funds is on the agenda.

Market Penetration:

- Targeting deeper market penetration, especially in Tier II and beyond cities, through enhanced engagement with existing distribution networks and cultivating new distributors.

Growth in Alternatives:

- Continuing focus on growing the alternative business, scaling existing funds, and launching new strategies.

International Investor Engagement:

- Exploiting the growing demand for investment in India, leveraging initiatives like GIFT CITY to attract overseas investors.

Digital Enhancement:

- Continuous efforts in upgrading digital infrastructure to enhance investor experience and partner engagement through the launch of new tools and platforms.

SBI Mutual Fund- IPO Plans

The IPO plan for SBI’s Mutual Fund unit, set to raise $1 billion, is now abandoned, as announced by SBI Chairman Dinesh Khara in August 2023, despite its initial proposal in December 2021. In August 2023, SBI Chairman Dinesh Khara announced during a post-earnings media briefing on Friday that the bank’s planned initial public offering (IPO) for its mutual fund unit is now “out of focus.” On December 15, 2021, SBI initially announced that it planned to go public with the mutual fund subsidiary in an effort to raise $1 billion. SBI owns 62.6% of the SBI Mutual Fund, with Amundi Asset Management, a top French insurer, holding the remaining 36.8%.

Comparison of SBI Mutual Fund and HDFC AMC Mutual Fund

SBI Mutual Fund holds the top position in equity assets, boasting Rs 1.94 lakh crore in assets, while HDFC Asset Management Company follows closely behind with Rs 1.54 lakh crore. In terms of debt assets, HDFC Mutual Fund leads with Rs 1.99 lakh crore in assets, while SBI Mutual Fund holds the second position with Rs 1.63 lakh crore.

| Particulars | SBI Mutual Fund | HDFC Mutual Fund |

| Category | Unlisted | Listed |

| Asset | ₹1.94 lakh crore | ₹1.54 lakh crore |

| Debt asset | ₹1.63 lakh crore | ₹1.99 lakh crore |

SBI Mutual Fund NFO

SBI Mutual Fund has launched two new offerings: the SBI Energy Opportunities Fund, focusing on long-term capital appreciation in energy sectors, and the SBI Nifty50 Equal Weight Index Fund, aiming to replicate returns of the NIFTY50 Equal Weight index. Both schemes come with no guaranteed outcomes.

Conclusion: SBI Mutual Fund Report Overview

- Financial Health: SBI Mutual Fund demonstrates strong financial performance with revenue and profit growth over recent years.

- Diverse Offerings: Offers a range of mutual fund categories catering to different risk appetites and investment goals.

- Digital Enhancements: Implemented various digital initiatives to enhance customer experience and engagement.

- Future Plans: Focused on business development, innovation, market expansion, and digital enhancement for sustained growth.

- IPO Plans: Decision to abandon the IPO plan signals a shift in strategic focus.

- Comparison with HDFC AMC: Holds competitive position in equity assets, while HDFC leads in debt assets, reflecting a balanced competition.

In summary, SBI Mutual Fund’s solid financials, diverse offerings, digital initiatives, and strategic direction position it for continued success in the mutual fund industry.

Currently SBI Mutual Fund Share Price is trading at around Rs. 1455/share – Click Here to invest

To Download Altius’s Official App From Appstore/Play store – Click Here

In case you need any personal assistance, you can reach out to us at +91 82406 14850

Also Read: Latest Announcements in Pre-IPO Market