About the Company

Arohan Financial Services Limited, established on September 27, 1991, is an unlisted public company. It operates as a public limited company and is situated in North Parganas, West Bengal. It is a non-banking financial company (NBFC), primarily operates in the microfinance sector, providing financial services to low-income individuals and micro-enterprises. Arohan Financial Services offers micro-loans, micro-insurance, and other financial products tailored to the needs of its target market. Its services aim to promote financial inclusion and empower underserved communities by providing them with access to credit and financial tools. Additionally, Arohan Financial Services may offer financial literacy and training programs to help clients better manage their finances and improve their livelihoods.

Company Highlights

| Headquarters | Kolkata, IN |

| Origin Country | India |

| Industry | Fintech, Financial Services |

| Founder | Vineet Rai |

| Founded | 2006 |

| Revenue | Rs 1,091 Cr. in FY23 |

| Total Funding | $25.9 m |

| Website | arohan.in |

Industry- Microfinance Industry

India is one of the most promising markets for microfinance in the world. Banks and microfinance institutions, are unveiling plans to meet the enormous demand for credit from the huge untapped market, both in urban and rural areas.

India is the largest microfinance market in the world, with the sector growing at an average rate of over 50 per cent. Consequently, it is attracting domestic and foreign investors and new players, who are hoping to practice profitable philanthropy. Close to two decades after its emergence in India, microfinance has matured from being a pure development activity to also being an economic driver at the grassroots level.

Thus, even the largest selling mobile phone maker, Nokia, is looking at microfinance as a major initiative to further increase mobile penetration in India. Increasingly, microfinance is perceived as an effective channel for ensuring financial inclusion of the low income population and those in the informal sector

Microfinance, or micro-credit, typically comprises very small-sized loans of about $100 extended to an individual or a group of individuals, which are called self-help groups (SHGs). Borrowers are generally from the weaker sections of society. The Reserve Bank of India (RBI), the country’s central bank, has urged banks to opt for the SHG model to lend to over 30 million small and micro units, to ensure they have easy access to funds.

According to the Intellecap study, the market size for microfinance in India is in the range of 58 to 77 million clients, assuming the entire poor population of the country represents potential clientele. This translates to an annual credit demand of $5.7 to $19.1 billion, assuming loan sizes range between $100 and $250.

One reason that microfinance is a much sought after business is the higher interest rates charged for loans by MFIs at 24 per cent, the interest rates are much higher than the average interest rates of about eight to 12 per cent enjoyed by middle class borrowers.

However, they are still cheaper than the rates charged by local moneylenders, which can be as high as 500 per cent. Hence, MFIs are the preferred option for the poor, who need very small-sized loans and convenient repayment options.

Arohan Financial Services – Operational Model and Revenue Model

Arohan’s business operations are focused on low-income households that have limited or no access to formal financial institutions. Their goal is to provide these households with support for their financial needs. Target customers are women with an annual household income of INR 200,000 or less in urban areas and INR 125,000 or less in non-urban areas. They predominantly provide core financial loans to groups consisting of three to five women. A center typically has between eight and 30 members in total. They offer collateral free loans to customers who are willing to borrow in a group and agree to accept joint liability for the group’s loans, which is referred as the joint liability group model (“JLG model”). JLG model enables customers, who typically do not have sufficient collateral, to gain access to formal credit. JLG model also provides a community support system for customers, regardless of their financial circumstances.

Management of the Company

Manoj Kumar Nambiar, Managing Director & Board Member

Manoj Kumar Nambiar is the Managing Director of Arohan, bringing extensive experience in business development, consumer banking, finance, and microfinance. With a background in mechanical engineering and management studies, he has completed specialized courses from Harvard Business School, INSEAD, and IMD Lausanne. Nambiar has held key roles in prominent organizations like Xerox India Limited and ANZ Grindlays Bank. He actively contributes to the microfinance sector, serving on the governing board of MFIN and leading initiatives in Assam. His leadership is integral to Arohan’s strategic growth.

Board Committee

| Name | Designation / Nature of Directorship |

| Mr. Rajat Mohan Nag | Chairperson, Independent Director |

| Mr. Sumantra Banerjee | Member, Independent Director |

| Mr. Piyush Goenka | Member, Non-Executive Director |

| Mr. Dinesh Kumar Mittal | Member, Independent Director |

| Mr. John Arunkumar Diaz | Member, Independent Director |

| Mr. Ulhas Sharadkumar Deshpande | Member, Independent Director |

Product and Services

Core Product

- Saral Loan: Arohan’s flagship product, ‘Saral,’ maintains a prominent position in the company’s portfolio, targeting women residing in low-income areas who typically engage in trade and services. With Saral loans, Arohan predominantly extends financing to groups comprising three to five women, utilizing the Joint Liability Group (JLG) model for disbursements. This product caters specifically to economically active women in low-income regions involved in trade and services. Saral loan amounts range from INR 25,000 to INR 75,000, with terms spanning 24 to 30 months.

- Loan Size: INR 25,000-75,000

- Rate of Interest: 24.50%

- Loan Tenure:24-30 months

2. Bazaar Loan: Arohan’s ‘Bazaar’ product is an individual loan offering designed to fulfill the working capital requirements of small businesses situated in authorized marketplaces or clusters of shops organized by Traders’ Associations. The borrowers of Bazaar loans are primarily men engaged in small trading and micro-enterprises. Bazaar loan amounts typically vary from INR 25,000 to INR 1,50,000, with repayment terms spanning 18 to 24 months.

- Loan Size: INR 25,000-1,50,000

- Rate of Interest: 26%

- Loan Tenure: 18-24 months

Secondary Product

Cross sell product: Arohan employs cross-selling strategies by utilizing its in-house developed Technology Platform known as ‘ApnaBazaar.’ This platform provides a comprehensive range of products accessible to all Field Staff via their mobile or tablet devices. Through ‘ApnaBazaar,’ both customers and field staff can view product availability at specific locations, place orders, and obtain estimated delivery schedules.

- Loan Tenure: 3-24 months.

Other Product

In order to ensure financial safety net for its customers, Arohan offers life and health insurance policy products that are issued by certain insurance companies, with whom the Company has entered into tie-ups. Arohan has also partnered with insurance companies to provide health insurance and hospital cash benefits to customers in case of the unfortunate incident of illness resulting in hospitalization of the customer or her spouse.

| Product Category | Name of Loan/Product | Maximum Amount of Loan / Credit Limit /Insurance Coverage | Term(Months/Week) |

| Insurance (offered through tie-ups with certain Indian insurance companies) | Term Life Insurance | Coverage is equal to loan amount disbursed to customer | Loan Term + 2 Months |

| Insurance (offered through tie-ups with certain Indian insurance companies) | Health Insurance | INR 500/ INR 1,000/ INR 1,500 per day for normal hospitalisation up to 30 days and INR1,000/ INR 2,000/ INR 3,000 day for ICU hospitalisation up to 20 days in a year. Riders include Critical Illness benefit of INR 50,000 and Personal Accident benefit of INR 100,000 or INR 200,000. | 12/24 Months |

| Insurance (offered through tie-ups with certain Indian insurance companies) | Dwelling Insurance | Upto INR 1 lakh depending on extent of damage caused to the house | 12 Months |

| Loans to Small MFIs | Term Loans | INR 25 Cr | 12-36 Months |

Other Initiatives from Arohan Microfinance

Apart from offering the financial products listed above, Arohan Financial Services Limited also undertakes financial literacy and Corporate Social Responsibility (CSR) initiatives.

- The financial literacy programme looks to empower participants by helping them manage their household income efficiently. It also inculcates the ability to manage financial risks and make good financial decisions.

As part of the CSR programme, the MFI arranges for the following:

- Skill development and education of the underprivileged youth

- Women’s welfare and health awareness camps

- Natural disaster relief operations

- Eco sustainability initiatives such as provision of water sanitation units and bio gas energy generation equipment

Key Strength

- Substantial operational scale:

- Arohan Financial Services Limited is a leading Non-Banking Financial Company (NBFC) in India’s microfinance sector, with over 18 years of experience.

- Operating across 15 states with 939 branches, Arohan Financial Services serves approximately 2.12 million borrowers as of September 30, 2023.

- Despite sluggish growth in FY21 and FY22, Arohan Financial Services experienced a significant uptick in disbursements, reaching ₹5,299 crore in FY23 and ₹3,096 crore in H1FY24.

- Arohan Financial Services Limited’s Assets Under Management (AUM) grew by 30% year-on-year, reaching ₹6,023 crore as of September 30, 2023.

- Sufficient capitalization:

- Arohan Financial Services Limited maintains a healthy capitalization profile, supported by regular equity infusion from investors.

- In FY23 and Q1FY24, Arohan Financial Services Limited raised ₹248 crore and ₹266 crore of capital, respectively, through Compulsorily Convertible Preference Shares (CCPS), demonstrating investor confidence in the company’s growth prospects.

- This capital infusion has led to an improvement in gearing ratios, from 4.7x in FY22 to 3.7x in FY23 and further to 3.1x in H1FY24.

- Tangible net worth (TNW) has also seen significant improvement, rising from ₹883 crore in FY22 to ₹1,217 crore in FY23 and ₹1,645 crore in H1FY24.

- As a result, Arohan Financial Services Limited’s capital adequacy ratio (CAR) stood at 31.80% in H1FY24, well above the minimum statutory requirement of 15%.

- Varied funding composition:

- Arohan Financial Services Limited (AFSL) maintains a diversified funding profile, leveraging a mix of equity, long-term loans, bank borrowings, and debentures.

- As of September 30, 2023, Arohan Financial Services Limited has established funding relationships with over 37 lenders, showcasing a broad base of financial support.

- The funding profile is primarily composed of term loans, constituting 67% of the total, followed by pass-through certificates (PTCs) and assignments at 16%.

- Subordinated debt accounts for 8% of the funding profile, while non-convertible debentures (NCDs) and external commercial borrowings (ECBs) each contribute 7% and 1%, respectively.

- Cash credit (CC) makes up the remaining 1% of the funding sources.

- In H1FY24, Arohan Financial Services Limited successfully raised ₹2,313 crore from lenders, with ₹823 crore generated through securitization and direct assignment (DA) transactions.

Key weaknesses

- Moderate profitability, albeit improving:

- Losses in FY21 attributed to COVID-19, AFSL exhibited enhanced profitability, with return on total assets (RoTA) reaching 1.17% in FY22.

- The company experienced further improvement in RoTA, reaching 1.29% in FY23 and notably rising to 4.06% in H1FY24, driven by increasing lending rates.

- Despite these improvements, operational expenditure (opex) costs remain high at 6.5% as of September 30, 2023, primarily due to branch expansion initiatives.

- Business operations are prone to significant risks stemming from events:

- Arohan Financial Services Limited’s business operations face significant vulnerability to event-based risks, including socio-political disruptions, regulatory uncertainties, and natural disasters.

- The unsecured nature of the company’s portfolio leaves it without recourse in the event of borrower defaults.

- Regional concentration of the portfolio:

- The top three states for outstanding microfinance institution (MFI) loans are West Bengal, Bihar, and Uttar Pradesh, with a combined concentration of 65% as of September 30, 2023.

- This concentration figure remained stable compared to the previous year, where it stood at 66% as of June 30, 2022.

- West Bengal retains the highest exposure among these states, comprising 26% of the total MFI loan portfolio.

- Arohan Financial Services Limited operates in 15 states, offering various products including microfinance loans and corporate advance.

Competitors of Arohan Financial Services

- Fincare Small Finance Bank: Micro-finance bank

| Founded Year | Funding | Location | Investors |

| 2007 | $195M | Bengaluru (India) | TA, HDFC and others |

- AU Small Finance Bank : Small finance bank

| Founded Year | Funding | Location | Investors |

| 1996 | $130M | Jaipur (India) | Temasek, IFC and others |

- Ujjivan Small Finance Bank: Small finance bank

| Founded Year | Funding | Location | Investors |

| 2005 | $154M | Bengaluru (India) | Sequoia Capital, IFC and others |

- Jana Small Finance Bank: Microfinance bank

| Founded Year | Funding | Location | Investors |

| 1999 | $782M | Bengaluru(India) | TPG, Morgan Stanley and others |

- Utkarsh Small Finance Bank: Small finance bank

| Founded Year | Funding | Location | Investors |

| 2009 | $53.5M | Varanasi (India) | Aavishkaar Capital, Goodwell Investment and others |

Arohan Awards

2023

- ‘Microfinance Company of the Year’ Award at the 3rd ANNUAL BFSI TECHNOLOGY EXCELLENCE Awards programme, organised by Quantic.

- Best Risk Management Initiatives Award by AMFI West Bengal.

- AMFI Awards, 2023 for Technology Innovations

- SKOCH Order of Merit Awards for Innovation in Lending (ArohanPrivilege), Solution in Lending (Nirnay), and Solution in Financial Inclusion Programme

- Head of Human Resources, Admin, Training & CSR at Arohan has been awarded for “Outstanding contribution during COVID in motivating staff and client” at UPMA’s Vth State Conference

- Two Modern Governance Top 100 Awards in the categories Boards & Governance Innovator and ESG, Diversity & Climate Trailblazer.

2022

- Top 25 Safest Workplaces in India by KelpHR

- “Microfinance Company of the Year” at the 3rd Annual BFSI Technology Excellence Awards programme 2022

- New Code of Work Awards 2021 in the Large Enterprise Category by PeopleStrong

- India’s Best Workplaces in BFSI 2022 – by Great Place to Work® Institute

- Great Place to Work-Certified™ thrice in a row, by the Great Place To Work® Institute

2021

- 2021 Modern Governance 100 recipients in the Audit Excellence, Risk & Compliance Visionary and ESG & Diversity Trailblazer categories by Diligen

- Ranked among India’s 30 Best Workplaces in BFSI 2021

- Ranked amongst Best Workplaces in Microfinance, India 2021

- New Code of Work Awards 2021 in the Large Enterprise Category by PeopleStrong

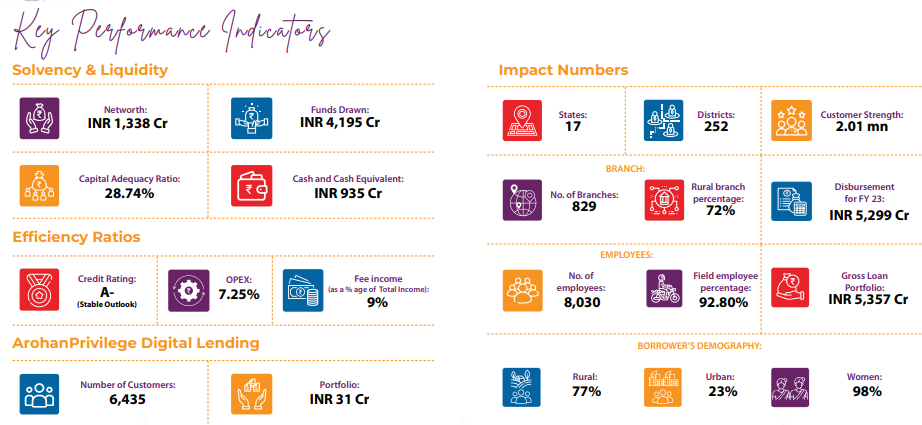

Arohan Financial Services: Key Performance Indicator

Arohan Financial Services secures Rs 730 crore through a share sale to private equity investors.

Arohan Financial Services recently completed a share sale, raising a total of Rs 730 crore from private equity investors. Notably, American asset manager Nuveen and Dutch development bank FMO contributed Rs 165 crore each to the investment, while Piramal Alternatives and a European development financial institution invested Rs 200 crore each. This injection of funds signifies strong investor confidence in Arohan’s growth prospects and underscores its position as an attractive investment opportunity in the financial services sector. (News as of April 23)

Arohan Financial Services recognized with Gold Standard Certification for Client Protection Principles.

On February 2024, Arohan Financial Services Earns Gold Standard Certification for Client Protection Principles” Arohan Financial Services Limited, a leading NBFC-MFI, has achieved the prestigious GOLD Standard in Client Protection Principles from the MFR Certification Committee. This recognition underscores the company’s commitment to upholding rigorous standards in client protection, with a compliance rate of 99.1% across various indicators. Sharoni Pal, Head of Central Operations, expressed pride in the achievement, highlighting Arohan’s dedication to transparency and governance. Established in 2006, Arohan aims to impact 28 million lives by 2028 through sustainable financial services.

Digital Transformation: Arohan MFI Expands Lending Reach through Apna Arohan App.

(News as of November 23) Arohan Financial Services is ramping up digital lending, leveraging the ‘Apna Arohan’ app launched 18 months ago. With Rs 104 crore disbursed digitally and a Rs 160 crore target this year, the approach promises a 99% repayment rate and quicker disbursements. Digital lending, available to individuals across 18 states, offers slightly lower interest rates compared to traditional routes. The MFI disburses Rs 500-600 crore monthly, with digital lending expected to contribute 2-3% of total exposure soon. As of September 30, 2023, total disbursements reached Rs 6,023 crore, with a net worth of Rs 1,730 crore. Despite COVID challenges, the MFI maintains a 98% collection efficiency ratio.

Arohan Financial Services: IPO Plans

Arohan Financial Services Ltd is planning to resume its efforts towards an initial public offering (IPO) following the General Elections in India. This decision is influenced by the expectation of improved market conditions post the elections, which would likely result in better pricing for the IPO. Additionally, the company aims to leverage its FY24 financial numbers to enhance its attractiveness to potential investors during the IPO process.

Furthermore, the CFO of Arohan Financial Services, Milind Nare, mentioned the company’s openness to raising funds from institutional investors with a strategic investment focus. This indicates a willingness to explore alternative funding options beyond the IPO route if favorable terms are offered by interested investors.

In terms of business growth and expansion, Arohan Financial Services is demonstrating a robust trajectory. The company is on track to achieve approximately 35% year-on-year growth in assets under management (AUM) by the end of the financial year, indicating strong performance and demand for its financial services.

Moreover, Arohan Financial Services is strategically expanding its branch network, with plans to penetrate into south India. This expansion initiative aims to capitalize on new customer acquisition opportunities in previously untapped geographies. The company’s decision to focus on branch expansion underscores its commitment to driving growth and expanding its market reach.

Overall, the conclusion drawn is that Arohan Financial Services is poised for significant growth and is strategically positioning itself to capitalize on market opportunities, both in terms of fundraising and business expansion.

Share Price of Arohan Financial Services (as on 15.02.2024)

- The buy price varies based on quantity, ranging from 215 for quantities between 100 – 250 shares to 206 for quantities between 2501 – 4166 shares, with corresponding rates per share.

- The 52-week high is 206, and the 52-week low is 115, indicating the range of fluctuations in the share price. Additionally, the sell price is fixed at 140.

Currently Arohan Financial Services Share Price is trading at around Rs. 209/share. CLICK HERE to Invest.

Financial Metrics for Arohan Financial. (as on 15.02.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 44.21 |

| Price to Sales Ratio (P/S) | 2.34 |

| Price to Book Value (P/B) | 2.31 |

| Industry PE | 22.66 |

| Face Value | ₹ 10 |

| Book Value | ₹ 89 |

| Market Cap | ₹ 2496.25 Cr |

| Dividend | 0 |

| Dividend Yield | 0% |

Insights of Arohan Financial Services

Shareholdings of Arohan Financials

| Shareholding Above 5% | Holding % |

| Aavishkaar Venture Management Services Private Limited | 20.61 |

| Aavishkaar Goodwell India Microfinance Development Company | 15.43 |

| Intellectual Capital Advisory Services Pvt Ltd | 14.93 |

| TANO India Private Equity Fund II | 14.07 |

| Maj Invest Financial Inclusion Fund II KS | 12.82 |

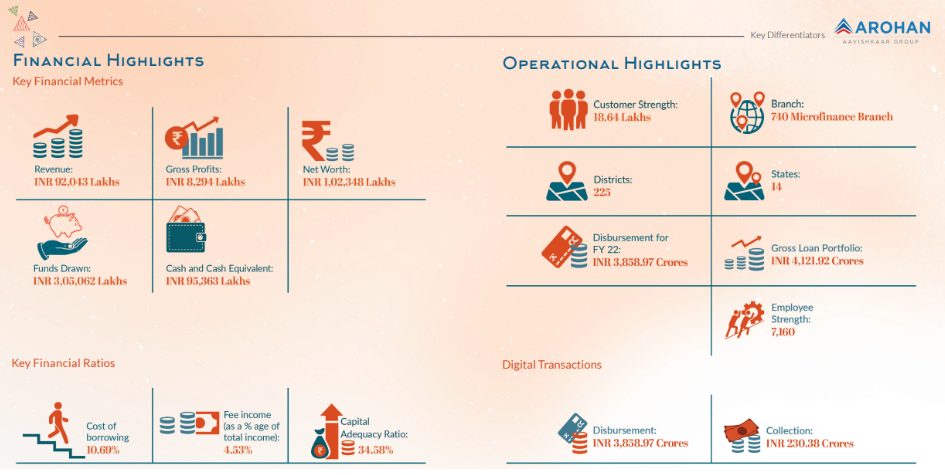

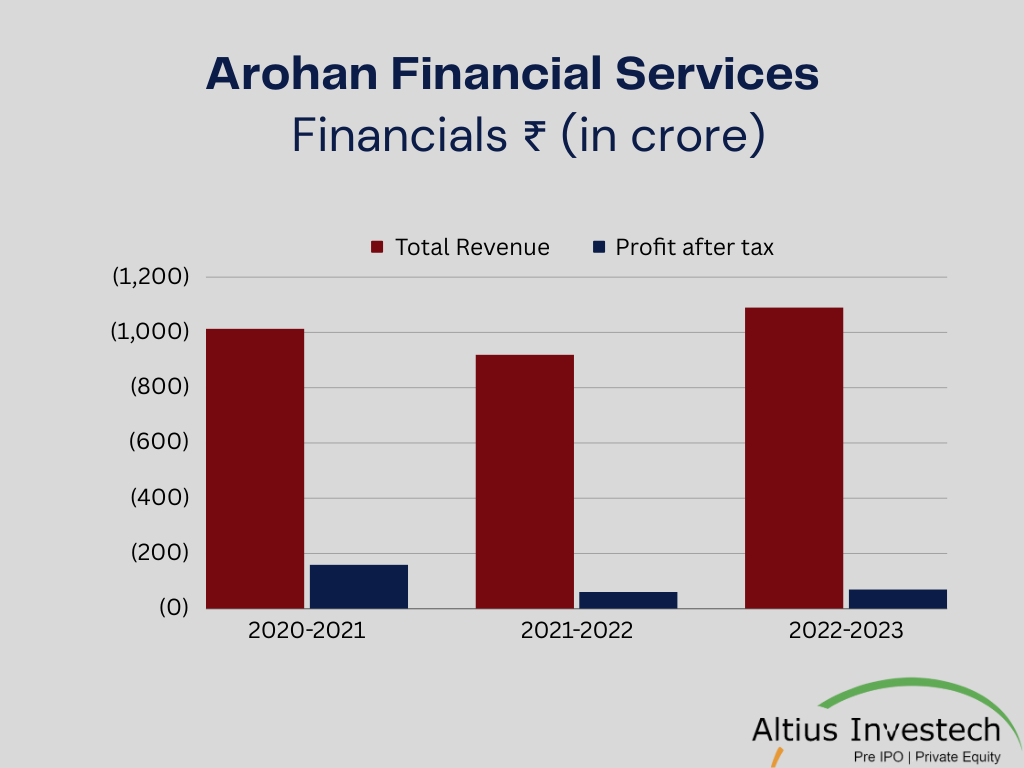

Financials

₹ (in crore)

| Particulars | FY 2022-2023 | FY 2021-2022 | FY 2020-2021 |

| Total Revenue | 1,091 | 920 | 1,014 |

| Profit After Tax | 71 | 61 | (160) |

| Earning Per Share | 6.05 | 5.22 | (14.56) |

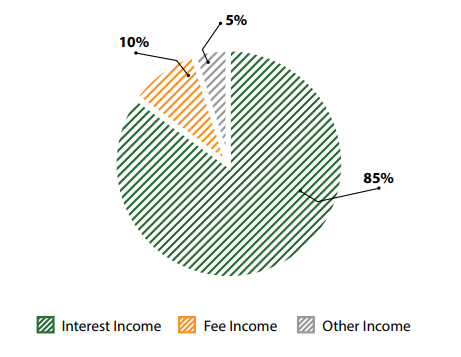

Revenue

Break-up of Revenue for FY 2023

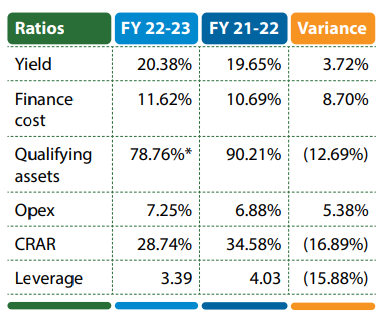

FY 2023 observed a growth in the average AUM during the previous financial year, thus resulting in the Revenue growing by 19% from FY 2022 to FY 2023.

Expenditure

Interest expenses have increased by 8.7% y-o-y in line with an increase in borrowings. With the employee count increasing from 7,160 in FY 2022 to 8,030 in FY 2023, the employee costs also increased from INR 210 Cr in FY 2022 to INR 246 Cr in FY 2023 showing a 17% increase over the previous year. The administrative costs have increased marginally by 4%, from the previous year mainly due to expansion of branch network.

Loan Portfolio

Arohan recorded a 30% growth in the Gross Loan Portfolio from the previous year and crossed the INR 5,357 Cr mark. This was a result of the growth in business in the second half of FY 2023.

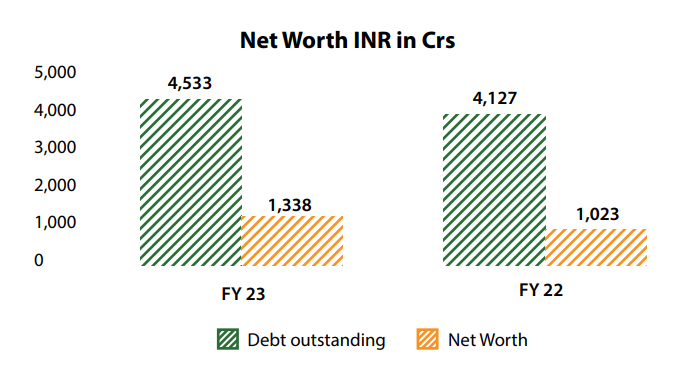

Net Worth

The Outstanding Borrowing and Net Worth have increased by 10% and 31% respectively in FY 2023 over FY 2022 due to the growth in business and CCPS infusion by new investors for INR 248 Cr.

Overview of CCPS Allocation and Conversion Mechanisms.

| Teachers Insurance and Annuity Association of America (TIAA) | Nederlandse Financierings-Maatschappij Voor Ontwikkelingslanden N.V. | |

| Number of CCPS | 1,85,00,412 | 1,07,10,765 |

New investors infused INR 248 Cr. through CCPS, with Teachers Insurance and Annuity Association of America (TIAA) contributing 63% and Nederlandse Financierings-Maatschappij Voor Ontwikkelingslanden N.V. contributing the remaining 37%.

Conversion Triggers and Terms.

There are three scenarios outlined for triggering the conversion of CCPS into equity shares:

- Scenario 1: Occurs when there is a full equity infusion including a Qualified Investment Raise by March 31, 2024.

- Scenario 2: Involves a full equity infusion without the Qualified Investment Raise by March 31, 2024.

- Scenario 3: If a full equity infusion has not occurred by March 31, 2024.

The conversions terms are:

- Scenario 1 Conversion: CCPS will be converted into equity shares to achieve a 25% per annum extended internal rate of return, subject to a pre-money valuation floor of ₹1,500 crores and a cap of ₹2,000 crores.

- Scenario 2 Conversion: CCPS will convert into equity shares at the higher of ₹1,500 crores pre-money valuation or 1.8x of the book value as of March 31, 2023, subject to a maximum cap of ₹2,000 crores.

- Scenario 3 Conversion: CCPS will be compulsorily converted into equity shares at a value equal to 1x of the book value as of September 30, 2022, certified by the statutory auditor.

Conclusion

- Financial Strength: Arohan Financial Services has strengthened its financial position with substantial capitalization, diverse funding composition, and sufficient operational scale. The company’s capital adequacy ratio (CAR) has significantly improved, providing flexibility for expanding its loan portfolio.

- Operational Performance: Despite facing challenges due to the COVID-19 pandemic and other regional constraints, Arohan Financial Services has demonstrated resilience and growth. The company’s assets under management (AUM) have shown robust quarter-on-quarter growth, indicating a strong demand for its financial services.

- Business Expansion: Arohan Financial Services is strategically expanding its branch network, aiming to penetrate new markets in south India. This expansion initiative reflects the company’s commitment to driving growth and expanding its market reach.

- Market Recognition: The company has received several awards and certifications, highlighting its commitment to client protection principles, innovation in lending, and corporate social responsibility.

- Investor Confidence: Arohan Financial Services recently completed a successful share sale, raising funds from private equity investors. This injection of funds signifies strong investor confidence in the company’s growth prospects.

- Share Price and Financial Metrics: The company’s share price has fluctuated within a certain range, with the buy price varying based on quantity. Financial metrics such as the price-to-earning ratio (P/E) and price-to-sales ratio (P/S) indicate the company’s valuation and performance relative to its industry peers.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/