Introduction

EPACK Durable Ltd. (EDL) holds the prestigious position of being the second-largest original design manufacturer (ODM) for room air conditioners (RACs) in India, as per the unit production figures reported during Fiscal 2023 by F&S. This achievement is emblematic of EDL’s commitment to customer-centric practices, anchored in a relentless pursuit of innovation and operational efficiency.

Evolution and Focus

Since its inception in 2003, EDL has undergone a noteworthy evolution. Originating as an original equipment manufacturer (OEM) for RAC brands, the company strategically transformed into an ODM partner for RACs, fueled by a dedication to product development and innovation. Recognizing an opportunity to augment value for customers, EDL expanded its manufacturing capabilities, delving into the production of essential RAC components such as sheet metal, injection-molded items, cross-flow fans, and PCBA components.

To know about the share price of HDB Financials on our platform Altius Investech. Click here- https://altiusinvestech.com/company/hdb-financial-servicesIssue Offer

| Issue Opens on | JAN 19, 2024 |

| Issue Close on | JAN 23, 2024 |

| Total IPO size (cr) | ₹640.05 |

| Fresh issue (cr) | ₹400.00 |

| Offer For Sale (cr) | ₹240.05 |

| Price Band (INR) | 218-230 |

| Market Lot | 65 |

| Face Value (INR) | 10 |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Diversification into Small Domestic Appliances (SDA)

Acknowledging the seasonality of RAC demand, EDL tactically diversified its operations into the small domestic appliances (SDA) market. The company now designs and manufactures a range of SDA products, including induction cooktops, mixer-grinders, and water dispensers. This strategic move underscores EDL’s commitment to both backward integration and the diversification of revenue streams.

Product Portfolio Overview

EDL’s comprehensive product portfolio can be categorized into three main segments:

A. Room Air Conditioners (RACs): EDL designs and manufactures complete RACs, encompassing window air conditioners (WACs), indoor units (IDUs), and outdoor units (ODUs). These components collectively form split air conditioners (SACs). The product specifications span from 0.75 ton to 2 tons, covering diverse energy ratings and refrigerant types. Additionally, the company produces split inverter air conditioners.

B. Small Domestic Appliances (SDA): EDL extends its expertise into SDA, crafting innovative solutions such as induction cooktops, mixer-grinders, and water dispensers.

C. Components: EDL manufactures an array of components crucial for RAC production, including heat exchangers, cross-flow fans, axial fans, sheet metal press parts, injection-molded components, copper fabricated products, PCBAs, universal motors, and induction coils. These components serve both captive consumption and as integral parts of the company’s offerings to customers.

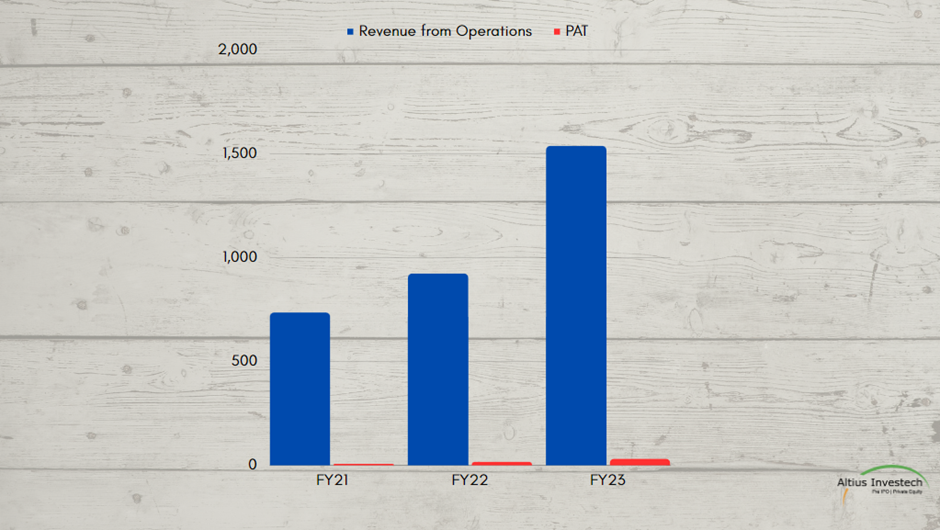

Financials (CONSOLIDATED)

₹ in Crores

| Particulars | FY23 | FY22 | FY21 |

| Revenue from Operations | 1538.83 | 924.16 | 736.24 |

| PAT | 31.97 | 17.43 | 7.8 |

Operational Expansion

EDL’s journey commenced with a single manufacturing unit in Dehradun, Uttarakhand, in 2003. Over time, the company expanded its footprint, establishing additional units in Dehradun and manufacturing facilities in Bhiwadi and Sri City.

Clientele

EDL’s esteemed clientele includes prominent names in the industry. For RACs, it serves companies such as Blue Star Limited, Daikin Air-conditioning India Private Limited, Carrier Midea India Private Limited, Voltas Limited, Havells India Limited, Haier Appliances (India) Private Limited, Infiniti Retail Limited, and Godrej and Boyce Manufacturing Company Limited. In the small domestic appliances segment, EDL caters to clients like Bajaj Electricals Limited, BSH Household Appliances Manufacturing Private Limited, and Usha International Limited, among others.

Workforce Strength

As of September 30, 2023, EDL takes pride in a dedicated workforce, boasting 807 employees on its payroll, supplemented by an additional 1165 contract labourers. This workforce forms the backbone of EDL’s operational excellence and commitment to delivering high-quality products to its discerning clientele.

Comparison With Listed Industry Peers (AS ON 31ST MARCH 2023)

| Name of the Company | EPS(Basic) | Total Income (in Cr) | RoNW |

| EPACK Durable Limited | 4.71 | 1538.83 | 14.68 |

| Peer Group | |||

| Amber Enterprises India Ltd | 46.66 | 6927.09 | 8.79 |

| PG Electroplast Limited | 35.78 | 2159.94 | 21.88 |

| Dixon Technologies (India) Ltd | 42.92 | 1219.20 | 22.36 |

Key Strategies

Broadening Product Range- EDL is actively enhancing its product offerings by expanding its existing portfolio. This strategic move aims to provide a more comprehensive range of solutions to meet evolving market demands.

Boosting Operational Efficiency– To ensure streamlined operations, EDL is committed to driving operational efficiencies. This involves expanding its integrated manufacturing capabilities and maintaining a steadfast focus on ongoing investments in research and development (R&D) infrastructure. These efforts are geared towards optimizing processes and staying at the forefront of technological advancements.

To know about the share price of Hexaware Technologies on our platform Altius Investech. Click here-https://altiusinvestech.com/company/buy-sell-hexaware-technologies-limited-market-unlisted-price-premium-Deepening Customer Engagement– EDL is dedicated to strengthening relationships with existing customers by increasing wallet share. Simultaneously, the company is actively pursuing opportunities to expand its customer base. This dual approach aims to foster long-term partnerships with current clients while tapping into new markets to fuel sustained growth.

Enhancing Supply Chain Control– In a bid to fortify its operations, EDL is exploring initiatives to bolster control over its supply chain. This strategic move involves implementing measures to ensure efficiency, reliability, and resilience within the supply chain, contributing to overall business stability and responsiveness to market dynamics.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.