In the ever-evolving landscape of finance, Tata Capital stands as a stalwart, providing a comprehensive array of financial products and services. As a subsidiary of the esteemed Tata Group, Tata Capital has carved a niche for itself in the financial domain. Let us delve into the various facets of this financial powerhouse.

Origins and Legacy:

Established in 2007, Tata Capital is a part of the Tata conglomerate, a name synonymous with trust and excellence for over a century. Rooted in the principles of integrity and innovation, Tata Capital has grown to become a formidable player in the financial services sector.

Diverse Financial Offerings:

Tata Capital caters to a wide spectrum of financial needs, offering a diverse range of products and services. From retail finance and wealth management to corporate finance and infrastructure finance, Tata Capital has positioned itself as a one-stop solution for individuals and businesses alike.

To know more about Tata Capital Finances on our platform Altius Investech. Click here- https://trade.altiusinvestech.com/companies/Tata%20Capital%20LtdRetail Finance:

- Home Loans

- Personal Loans

- Car Loans

- Consumer Durable Loans

Wealth Management:

- Investment Advisory

- Portfolio Management

- Estate Planning

Corporate Finance:

- Working Capital Loans

- Term Loans

- Structured Finance

Customer-Centric Approach:

Tata Capital’s success is deeply rooted in its customer-centric philosophy. With a commitment to understanding and addressing the unique financial needs of its customers, the company has built enduring relationships. Transparent processes, quick approvals, and personalized solutions are the hallmarks of Tata Capital’s customer service.

Innovation in Finance:

In a rapidly changing financial landscape, innovation is the key to staying ahead. Tata Capital has embraced technology to streamline processes and enhance customer experience. Digital platforms, online loan applications, and AI-driven solutions are some of the ways Tata Capital is leading the charge in financial innovation.

Global Presence:

Tata Capital’s reach extends beyond borders, with a growing global presence. Through strategic partnerships and a robust international strategy, the company is expanding its footprint and contributing to the global financial landscape.

To know more about Tata Capital Financial performance on our platform Altius Investech. Click here-

Financial Performance and Growth Metrics

Strong Disbursals Growth:

- Recorded a robust 35% Year-on-Year (Y-o-Y) growth in disbursals during H1 FY24.

- The Retail portfolio exhibited remarkable growth, soaring by 41% Y-o-Y over the same period.

Granular Loan Book Composition:

- The loan book structure remains granular, with Retail and Small & Medium Enterprises (SME) contributing over 85%.

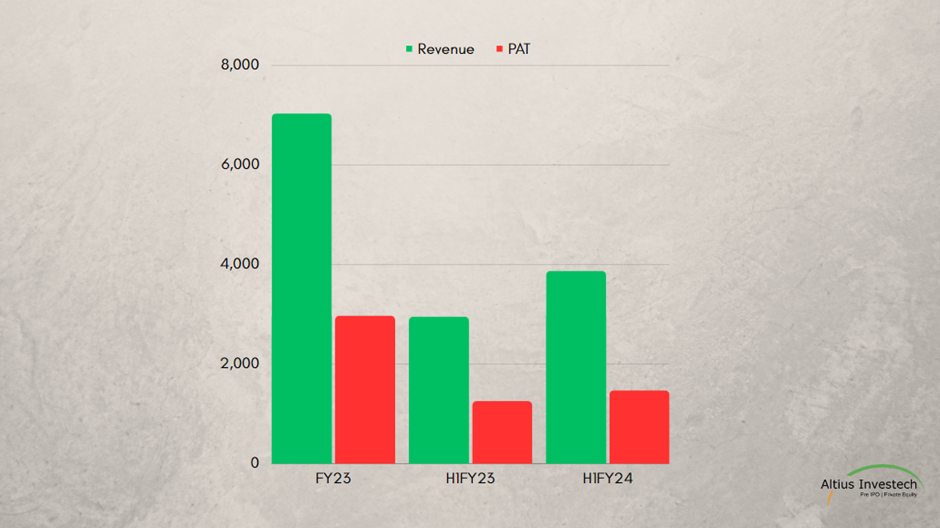

Revenue Growth:

- Net Interest Margin (NIM) and Other Revenue witnessed a significant uptick, rising by 31% Y-o-Y to INR 3,874 Crores during H1 FY24.

Low Credit Costs:

- Despite ongoing challenges, credit costs (NPA) remained low at 0.3% in H1 FY24.

- Collection efficiencies and superior asset quality played pivotal roles in maintaining this low credit cost.

Robust Return on Equity (RoE):

- Demonstrated a strong RoE of 17% during H1 FY24, indicating the company’s efficient use of equity capital.

Continuous Loan Book Expansion:

- The loan book expanded by an impressive 32% Y-o-Y, reaching INR 1,35,521 Crores.

- On a quarterly basis, the loan book showed a 6% Quarter-on-Quarter (Q-o-Q) increase.

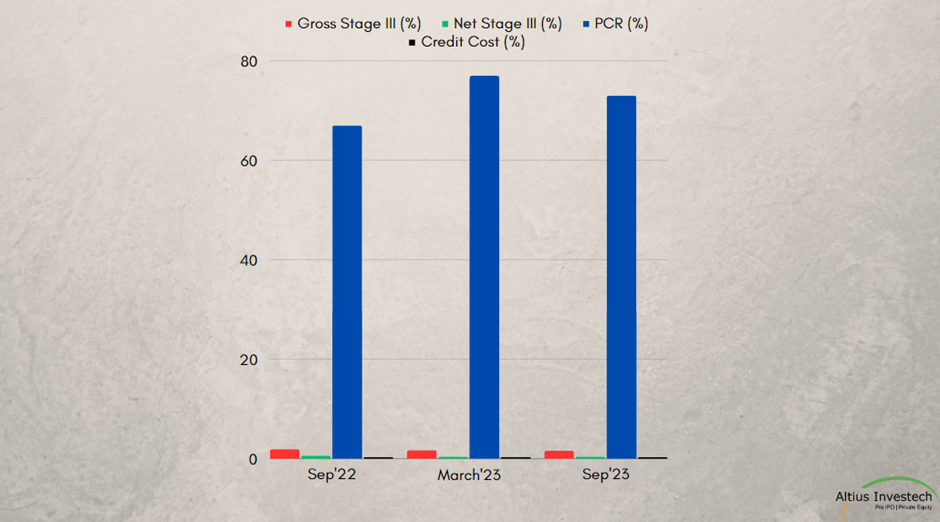

Asset Quality Metrics:

As of September 2023, asset quality remained best in class:

- Gross Non-Performing Assets (GNPA) at 1.6% (Sep’22: 1.9%)

- Net Non-Performing Assets (NNPA) at 0.4% (Sep’22: 0.6%)

- Provision Coverage Ratio (PCR) at an impressive 73% (Sep’22: 67%); among the highest in the industry.

Digital Business Growth:

- Digital business experienced exponential growth, surging by 4.3 times during H1 FY24.

- Ongoing investments in core systems and technologies underscore the commitment to delivering a best-in-class customer experience.

Strategic Technological Focus:

- The company is actively strengthening core technologies and digital capabilities.

- Leveraging partnerships and participating in ecosystem activities to expand distribution, target new segments, and improve cross-selling initiatives.

Digitization of Collections Processes:

- Placing a high focus on digitizing collections processes to enhance efficiencies and maintain superior asset quality.

- A noteworthy 92% of collections are conducted through digital channels.

Provisions and Regulatory Compliance:

- Total loan loss provisions stood at 2.3% of the loan book as of September 2023.

- This provision level is 2.2 times higher than the requirements stipulated by the Income Recognition and Asset Classification (IRAC) norms.

Asset Quality

Liability Mix

Diversified Funding Mix:

- Utilizes a mix of funding sources, including External Commercial Borrowings (ECBs) and public Non-Convertible Debentures (NCDs).

- Enhances financial flexibility and resilience through a diverse range of capital channels.

Capital Raising Strategy:

- Implements a well-articulated plan for capital raising.

- Focuses on acquiring more granular and sticky liabilities to ensure stability and long-term financial sustainability.

Adequate Liquidity Management:

- Maintains sufficient liquidity levels to support day-to-day operations and meet financial obligations.

- Ensures a robust financial position by having readily available funds for unforeseen circumstances.

Well-Managed Asset Liability Management (ALM):

- Demonstrates effective management of Asset Liability Management (ALM).

- Balances the maturity profiles and cash flows of assets and liabilities to minimize risks and optimize overall financial performance.

Financial Performance

₹ in Crores

| Particulars | FY23 | H1FY23 | H1FY24 | Y-o-Y Growth (H1FY23-H1FY24) |

| Disbursals | 74,995 | 33,018 | 44,618 | 35% |

| Loan Book | 1,19,950 | 1,02,572 | 1,35,521 | 32% |

| NIM+Other Revenue | 7,036 | 2,956 | 3,874 | 31% |

| Operating Expenses | 2,664 | 1,191 | 1,605 | 35% |

| Credit Cost | 582 | 147 | 173 | 17% |

| Profit before Tax | 3,790 | 1,618 | 2,095 | 29% |

| Profit after Tax | 2,975 | 1,258 | 1,474 | 17% |

| attribute to one-time items | 561 | 82 | – | – |

| attribute to core business operations | 2,414 | 1,176 | 1,474 | 25% |

Digital as a Business catalyst

- Achieved a commendable 1.6x Year-over-Year growth in web traffic by optimizing our webpages.

- Successfully provided enhanced pre-approved offers, surpassing 15 Lakhs offers monthly.

- Implemented digital tools and enablers to streamline and expedite customer on boarding, including Digital KYC and electronic repayment options.

- Established strategic partnerships across the lending value chain, covering business sourcing, embedded lending, processes, systems, and business enablers.

- Experienced significant growth in mobile app downloads, showcasing the popularity and accessibility of our services.

- Implemented segment-based customer and channel partner journeys, facilitating instant and paperless disbursement.

- Achieved an impressive milestone of over INR 1,500 Crores in business through cross-selling in the first half of FY24.

Financing green projects through Cleantech Finance

Establishment of Tata Cleantech:

- Tata Capital, in collaboration with IFC, founded Tata Cleantech in 2012 as a dedicated financing arm.

- The primary mission of Tata Cleantech is to focus on Green or Sustainable financing initiatives.

Global Recognition:

- Pioneer in India: Tata Cleantech holds the distinction of being the first Indian entity to join the esteemed Global Green Bank Network.

- International Collaboration: As part of this network, Tata Cleantech collaborates with National Green Banks worldwide, contributing to global sustainability efforts.

To know more about Tata Capital Finances on our platform Altius Investech. Click here- https://trade.altiusinvestech.com/companies/Tata%20Capital%20LtdUN Sponsored Partnership:

- Global Milestone: Tata Cleantech achieved global recognition by becoming the first private entity worldwide to partner with the UN Sponsored Green Climate Fund (‘GCF’).

- Solar Rooftop Market Development: This partnership is dedicated to developing the solar rooftop market, contributing to sustainable and climate-friendly solutions.

This collaboration underscores Tata Cleantech’s commitment to pioneering sustainable financing and making substantial contributions on both the national and global fronts.

Key Strengths of Tata Capital Limited

Diversified Portfolio:

- Offers a diverse array of financial services, ensuring adaptability to market changes.

- Presence in retail, wealth management, and corporate finance caters to a broad customer base.

Financial Robustness:

- Strong financial performance with a 35% Y-o-Y increase in disbursals and a 32% Y-o-Y growth in the loan book.

- Low credit costs, a robust 17% Return on Equity (RoE), and effective Asset Liability Management (ALM) contribute to financial strength.

Sustainability Focus:

- Active participation in sustainable and socially responsible initiatives.

- Aligns with Tata Group values, enhancing the company’s reputation and societal impact.

Key Weaknesses of Tata Capital Limited:

Economic Vulnerability:

- Susceptibility to external economic factors, including interest rate fluctuations and regulatory changes.

- Economic uncertainties can impact credit quality and overall financial stability.

Market Competition:

- Highly competitive financial sector necessitates continuous innovation.

- Investment in technology and market adaptation is crucial to staying competitive.

Cyclicality Dependence:

- Performance closely tied to economic cycles, particularly in retail and corporate finance sectors.

- Economic downturns can lead to increased default rates and slower loan disbursements, affecting profitability.

Sustainability and Social Responsibility

Tata Capital’s commitment extends beyond financial services. With a focus on sustainability and social responsibility, the company actively participates in initiatives that contribute to the well-being of society. From promoting financial literacy to supporting environmental causes, Tata Capital integrates social responsibility into its core business values.

Conclusion:

In the ever-evolving financial sector, Tata Capital stands tall, blending tradition with innovation. With a diverse portfolio, a customer-centric approach, and a commitment to social responsibility, Tata Capital continues to be a beacon of financial excellence. As we navigate the complex world of finance, Tata Capital remains a reliable ally, steering individuals, and businesses towards a secure and prosperous future.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/