Founded by Kamesh Goyal, Digit is a leading general insurance company offering a range of services, including car, travel, home, commercial vehicle, and shop insurance. The company has garnered support from prominent investors such as Fairfax Financial Holdings, A91 Partners, Faering Capital, and TVS Capital Funds, solidifying its position in the insurance sector.

Digit Insurance – Company Highlights

| Legal Name | Go Digit General Insurance Ltd |

| Headquarters | Bangalore, Karnataka, India |

| Founding Date | 2017 |

| No. of Employees | 501 to 1000 |

| Founder | Kamesh Goyal |

| Website | godigit.com |

Digit Insurance – About

Digit Insurance, headquartered in Bengaluru, is a prominent general insurance and financial services company. Committed to simplifying insurance for the general public, Digit General Insurance offers a variety of plans, including:

- Go Digit Health Insurance

- Go Digit Car Insurance

- Digit 2-Wheeler Insurance (GoDigit Bike Insurance for bikes)

- Go Digit Commercial Vehicle Insurance

- Go Digit Travel Insurance

Their mission is to make insurance accessible and straightforward for all.

Digit Insurance – Founder and Team

Kamesh Goyal

Kamesh Goyal, the Founder and Chairman of Digit Insurance, brings a wealth of experience to the table. Before establishing Digit, he held key roles at Allianz Insurance, where he served as the Head of Asset Management and Group Planning and Controlling, along with being the Regional Chief Executive Officer.

Prior to that, Goyal showcased his leadership at Bajaj Allianz, where he held various positions, including Chief Executive Officer, Chief Operating Officer, and Country Manager. His journey in the corporate world began as a Manager at KPMG, India.

Educationally, Goyal holds a B.A. LLB degree and earned his Master’s in Business Administration from Delhi University, reflecting his commitment to continuous learning and excellence.

Philip Varghese

Philip Varghese currently serves as the Executive Director of Digit Insurance. Philip started as the Manager of Projects at Allianz after his brief stint at Alpic Finance. He then served as the Senior Manager of Property Underwriting, CIO, and CIO & Head Direct at Bajaj Allianz General Insurance. Varghese then joined Bajaj Allianz Life, where he served as a CEO and COO before joining as the Board Member of Allianz Technology. Philip eventually joined Digit Insurance at a very early stage, when he teamed with the founder of Digit.

Vijay Kumar

Vijay Kumar, who served as the CEO and Principal Officer at Digit Insurance, played a pivotal role since the company’s inception in 2017. With a diverse career that includes key leadership positions at renowned companies like Maruti Udyog Ltd, Hyundai Motor India Ltd., and Bajaj Allianz, Vijay Kumar brought valuable experience to Digit.

Effective April 20, 2022, the mantle of MD and CEO will be taken up by Jasleen Kohli, succeeding Vijay Kumar. His journey at Digit Insurance will conclude upon his superannuation on April 19, 2022. We thank Vijay Kumar for his dedicated service, and look forward to the continued success under Jasleen Kohli’s leadership.

Jasleen Kohli

Effective from April 20, 2022, Jasleen Kohli takes the helm as the MD and CEO of Digit Insurance. Having been an integral part of Digit since its inception, Kohli served as the Chief Distribution Officer (CDO) and holds the distinction of being the company’s first employee.

In her role as CDO, Jasleen oversaw all sales and distribution channels at Digit. With an impressive career spanning approximately 19 years in the life and general insurance industry, she brings a wealth of experience to her new position. Prior to joining Digit, Kohli served as a Director at Allianz Technology. At 42, Jasleen Kohli becomes one of the youngest CEOs in the insurance industry. Her appointment marks a significant milestone in Digit Insurance’s leadership transition, and we anticipate continued success under her guidance.

Digit Insurance – Business Model

Digit Insurance adopts a business model similar to traditional insurance companies, but with a disruptive twist. The company’s mission is to introduce innovative products and services, redefining the Indian general insurance sector. Armed with a general insurance license, Digit extends beyond the usual car and home insurance offerings to provide unique coverage for jewellery and mobile devices.

Setting itself apart, Digit Insurance operates digitally, leveraging technology to enhance the insurance experience. The company strategically forges beneficial partnerships with various entities as part of its business strategy.

In response to the evolving needs, Digit Insurance launched the Go Digit Covid insurance, a specialized health insurance policy tailored to cover hospitalization and treatment costs for individuals registered with Digit who have contracted Covid-19. This initiative showcases Digit’s commitment to addressing contemporary challenges and providing comprehensive solutions.

Digit Insurance – Funding and Investors

In 2021, Digit Insurance achieved unicorn status, raising a substantial $530.8 million across eight funding rounds. The latest funding, on January 18, 2022, saw contributions from Wellington Hadley Harbor and Ithan Creek Master Investors, securing an impressive $70 million.

Founder and Chairman Kamesh Goyal announced a significant fundraising round in July 2021, aiming to raise up to $200 million. Leading this initiative were Sequoia Capital India, IIFL Alternate Asset Managers, and existing investor Faering Capital, contributing to a total capital infusion of $442 million. This marked one of the largest funding rounds in the history of the Indian insurance industry, valuing Digit Insurance at $3.5 billion.

Even before the completion of the $200 million round, Digit secured an additional $16.30 million (Rs 121 crores) in August 2021. This round, led by TVS Growth Fund and high-net-worth individuals, involved the issuance of 38,47,427 equity shares at Rs 314 per share, pending regulatory filings.

As of January 2022, Digit Insurance boasts a valuation of $3.54 billion and has garnered support from four lead investors, including recent additions IIFL Asset Management and Faering Capital.

| DATE | TRANSACTION NAME | MONEY RAISED | LEAD INVESTORS |

| January 18, 2022 | Venture Round | $70 million | Wellington Hadley Harbor and Ithan Creek Master Investors |

| August 26, 2021 | Venture Round | $16.09 million | TVS Capital Funds |

| July 2, 2021 | Venture Round | $200 million | Sequoia Capital India, IIFL Alternate Asset Managers, Faering Capital and more |

| January 16, 2021 | Venture Round | $18.77 million | A91 Partners, TVS Capital, Faering Capital |

| January 21, 2020 | Venture Round | $84 million | A91 Partners, Faering Capital, TVS Capital Funds |

| June 5, 2019 | Venture Round | $50 million | Fairfax Financial Holdings |

| July 3, 2018 | Venture Round | $45 million | Fairfax Financial Holdings |

| June 1, 2017 | Venture Round | $47 million | Fairfax Financial Holdings |

Digit Insurance IPO

Go Digit General Insurance had filed draft documents for its IPO in August,2022, to raise ₹1,250 crore from a fresh issue of shares and an offer for sale of 109.4 million equity shares. The offer document was kept in abeyance by the regulator and later returned.

Go Digit Insurance, a major player in India’s general insurance sector, has refiled draft papers for a $440 million,as on 31March,2023, initial public offering (IPO) following the resolution of concerns raised by the market regulator.

Backed by Canadian billionaire Prem Watsa’s Fairfax Group and TVS Capital Funds, Go Digit’s IPO plans were initially halted by the Securities and Exchange Board of India (SEBI) in September due to compliance issues related to share issuances. After a review restart in September, another setback occurred in January when SEBI raised compliance concerns regarding employee stock plans.

In response, Go Digit Insurance modified its employee stock appreciation rights scheme to stock option plans, addressing SEBI’s concerns. This change, approved through a special resolution on March 27, enabled the resubmission of IPO papers. The company, valued at $3.5 billion by Sequoia Capital, intends to utilize the IPO proceeds to maintain its solvency ratio.

Digit Insurance – Growth and Revenue

Digit Insurance showcased robust performance, experiencing a significant 31.9% growth and generating premiums totaling $186 million from April to December 2020. Since its inception, the company boasts a customer base exceeding 1.5 crore.

Following a successful funding round in July 2021, where Digit decided to raise $200 million, the total funds raised reached an impressive $442 million. In 2020, the company expanded its business by 30%, attributing its growth to two key products: Covid health insurance and fire insurance. These offerings contributed to a substantial increase in premium collections.

Digit Insurance’s gross written premiums have consistently risen since its inception, reaching Rs 5268 crore in the financial year 2021-2022. The company’s strategic focus on innovative products and sustained growth positions it as a key player in the insurance industry.

While reports indicate a sluggish performance in the vehicle insurance sector, 2021 is poised to bring a return to normalcy with anticipated growth. The industry faced challenges during the Covid-19 pandemic, witnessing a decline in interest rates. However, amidst the pandemic’s uncertainties, there was a notable surge in the purchase of Covid health insurance, unexpectedly boosting the overall insurance sector.

The broader insurance industry experienced a modest 5% growth in the wake of the pandemic. In contrast, Digit Insurance emerged as a standout performer, showcasing an impressive 44% growth despite the challenging circumstances. This resilience positions Digit Insurance as a notable player in the insurance landscape.

To access Go Digit Financials on our platform Altius Investech. Click here- https://trade.altiusinvestech.com/companies/Go%20Digit%20General%20Insurance%20Ltd

Joined the Unicorn Club with a $1.9B Valuation

In a landmark achievement, Digit Insurance became the first Indian startup to join the coveted Unicorn Club in 2021, propelled by a successful undisclosed investment round. The company’s innovative response to the pandemic included the introduction of a unique COVID-19 product, a Fixed Benefit cover for the virus, reaching over 20 lakh Indian lives through its Digit Group Illness Insurance offering.

Digit Insurance, operating for less than four years, marked several milestones:

- Attained unicorn valuation within this short timeframe.

- Impressive service to over 2 crore customers.

- Noteworthy 11X growth in the group health business, totaling Rs 170 crore.

- Sold over 79,536 health policies, covering 42.5 lakh lives from March 2020 to September 2021.

- Achieved a remarkable 44% growth, with a premium of Rs 3,243 crore as of March 2021.

- Crossed the $4 billion valuation mark by May 4, 2022.

Digit Insurance’s rapid success positions it as a pioneering force in the Indian insurance landscape, demonstrating robust growth and customer-centric innovation.

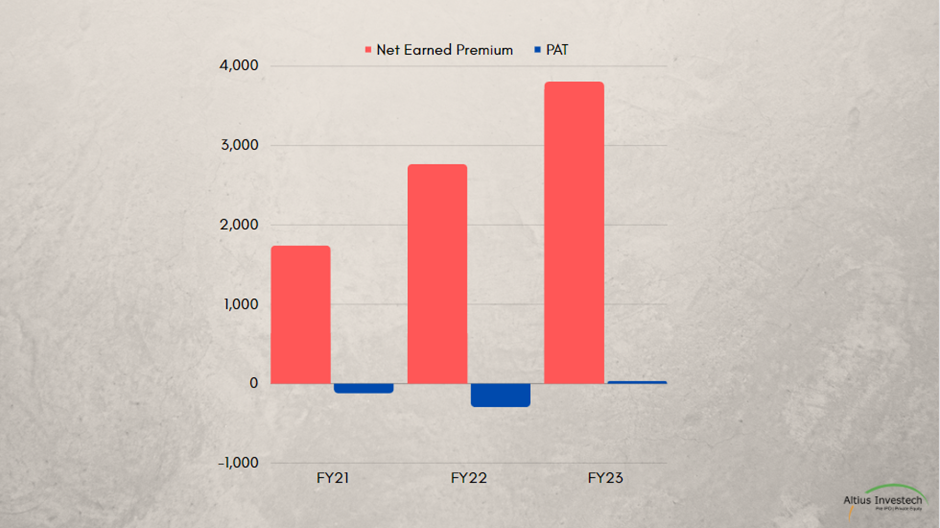

Digit Insurance- Financials

₹ in Crores

| Particulars | FY23 | FY22 | FY21 |

| Net Earned Premium | 3805.23 | 2766.84 | 1741.24 |

| PAT | 35.54 | (295.85) | (122.75) |

| EPS | 0.41 | (3.55) | (1.50) |

Digit Insurance – Awards and Achievements

Digit Insurance has garnered significant recognition for its excellence and innovation in the insurance industry. Some notable awards and achievements include:

- General Insurance Company of the Year at the 24th Asia Insurance Industry Awards in 2020.

- Insurance Startup of the Year – India award at the Insurance Asia Awards 2020.

- Asia’s Best General Insurance Company of the Year by Asia Insurance Review.

- Recognized as one of the Hottest Start-ups in India in 2019.

- Best General Insurance Company title at the CMO Confluence & Corporate Awards 2019.

- Ranked 5th among the LinkedIn Top Start-ups of 2018.

These accolades underscore Digit Insurance’s commitment to excellence and its impactful presence in the insurance landscape.

Digit Insurance – Competitors

To access Go Digit Financials on our platform Altius Investech. Click here-

https://trade.altiusinvestech.com/companies/Go%20Digit%20General%20Insurance%20Ltd

Digit Insurance faces competition from prominent players in the insurance sector, including Acko, Coverfox, and PolicyBazaar.

Acko:

- Founded in 2016, Acko is a Mumbai-based company operating in the insurance industry.

- A notable competitor of Digit Insurance.

Coverfox:

- Established in 2013 and headquartered in Andheri East, Maharashtra, India.

- Operates in the insurance sector, presenting strong competition to Digit Insurance.

PolicyBazaar:

- Founded in 2008, PolicyBazaar is headquartered in Gurgaon, Haryana, India.

- A significant rival for Digit Insurance in the insurance sector.

These competitors reflect the dynamic landscape of the insurance industry, where companies like Digit Insurance strive to distinguish themselves in a competitive market.

Conclusion

During the period from 2019 to 2020, Digit Insurance experienced an impressive 87% growth in premiums. This substantial increase underscores the company’s commitment to excellence and has garnered significant trust from its customers.

With a strong foundation of 1.4 crores existing customers, Digit Insurance is poised for continued success. Looking ahead, the company has set ambitious goals, aiming to surpass the Rs 6,500 crore mark in premium sales by October 2022, marking its fifth year of operation.

Digit Insurance’s dedication to providing quality service and building a robust customer base positions it as a key player in the insurance industry.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/