Gopal Namkeen aspires to be India’s most trusted FMCG brand, leaving an enduring impression on millions of taste buds.

Company Information

Bipinbhai Hadvani, the Chairman and Managing Director of Gopal Snacks Limited, boasts an impressive 29 years of experience in the Snacks Industry. The company’s journey commenced with the local supply of Namkeen and Snacks in Rajkot, gradually expanding to a reputable stature. Presently, Gopal Snacks Limited holds a robust market presence, offering a diverse range of savory products under the esteemed brand ‘Gopal.’ This includes ethnic snacks, western snacks, snack pellets, fast-moving consumer goods, and packaged sweets.

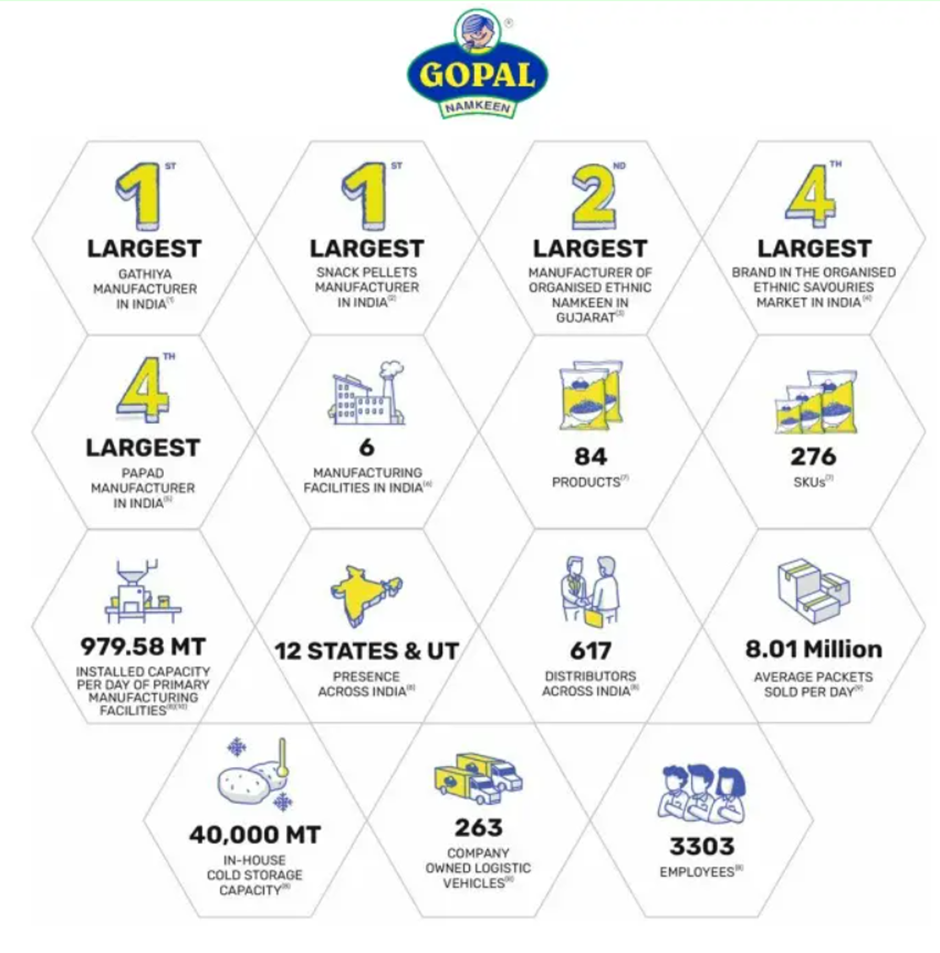

Gopal Namkeen aspires to establish itself as India’s most trusted FMCG brand, aiming to create a lasting impact on the taste buds of millions. Notably, Gopal takes pride in its position as the fourth-largest brand in the organized sector of ethnic savories, including gathiya, based on market share in India. Additionally, it holds the distinction of being the largest manufacturer of gathiya and snack pellets in India in terms of volume for the Fiscal year 2023, as reported by F&S.

Basic Details

Legal Name- Gopal Snacks Limited

Headquarters- Rajkot, Gujarat, India

Business Model- B2C, D2C

Founding Date- 1999

No. of Employees- 501 to 1000

From Rs 4,500 to Rs 1,300 Crore: “The Incredible Rise of Gopal Snacks under Bipin Hadvani’s Leadership”

Bipin Hadvani, the founder of Gopal Snacks based in Rajkot, Gujarat, began his entrepreneurial journey in 1994, inspired by his father’s valuable advice to expand the business rather than raising prices. Starting with a small namkeen venture in collaboration with a relative, Hadvani faced challenges due to divergent business styles, leading to a split in 1994. Undeterred, he, along with his wife Daxa, founded Gopal Snacks, manufacturing traditional Gujarati snacks.

Despite initial struggles and brand loyalty issues, Hadvani persevered by personally interacting with the market, maintaining product quality, and avoiding price hikes. In 2008, faced with challenges from an out-of-city manufacturing plant, he made the tough decision to close it, rebranding the company to Gopal Snacks. The subsequent years saw remarkable growth, with revenue reaching ₹620.81 crore in FY17.

Gopal Snacks capitalized on changing consumer preferences, with a shift towards branded products and the decline of smaller, unbranded traditional snack shops. Hadvani’s understanding of regional tastes further contributed to the brand’s success.

From FY17 to FY22, the company experienced rapid growth, doubling its revenue to ₹1,306 crore. Gopal Snacks now boasts seven plants across Gujarat, Maharashtra, and Rajasthan, a diverse product portfolio with over 60 items, and a vast distribution network spanning 11 states, 750 dealers, and 7 lakh retailers. The brand also exports to more than 70 countries, producing a staggering 1 crore packs daily.

In response to market dynamics, Hadvani diversified Gopal Snacks into multiple categories, including chips, wafers, corn snacks, pellets, spices, flour, and even washing bars. While chips now contribute seven percent to sales, 80 percent of Gopal’s overall sales are still rooted in Gujarat.

However, marketing experts caution against excessive diversification, emphasizing the importance of maintaining focus on the core traditional Gujarati namkeens. Despite challenges, Hadvani remains true to his father’s wisdom, prioritizing business expansion over short-term gains. The brand’s success story reflects a blend of entrepreneurial grit, market understanding, and strategic adaptation to evolving consumer trends.

https://trade.altiusinvestech.com/companies/Bikaji%20Foods%20International%20Ltd - AltiusInvestech invested in a similar company 3-4 years back, named- Bikaji Food International Ltd. The company received it's IPO in 2022. Click here to know more.

“Gopal Snacks IPO: Tasty Bites Headed to IPO Spotlight“

Gopal Snacks Limited, a well-known Rajkot-based snack company celebrated for its delicious range of ethnic namkeen and western snacks, is making strides towards a public market debut. The company has officially submitted its Draft Red Herring Prospectus (DRHP) to SEBI on November 21, 2023 showcasing its plans to raise capital through an upcoming initial public offering (IPO).

The IPO consists of only an offer-for-sale (OFS) of Rs 650 crore worth of shares by shareholders, including promoters, and there is no fresh issue component.

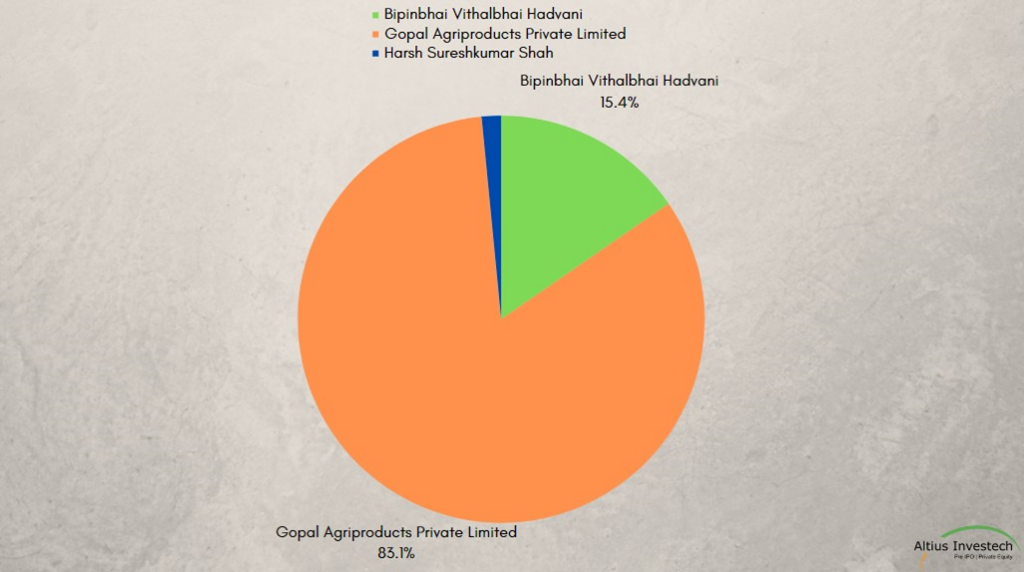

Stakeholder Breakdown

The Offer for Sale in the Gopal Snacks IPO comprises up to INR 100 crore by Bipinbhai Vithalbhai Hadvani, up to INR 540 crore by Gopal Agriproducts Private Limited (Promoter Selling Shareholders), and up to INR 10 crore by Harsh Sureshkumar Shah (Other Selling Shareholder). Moreover, eligible employees have the opportunity to participate in the Gopal Snacks IPO.

Book-Building Dynamics

The book-building procedure is followed in the offering. Retail individual investors will receive at least 35% of the net offer, non-institutional investors will receive 15%, and qualified institutional buyers will receive no more than 50%. The goal of this strategic allocation is to guarantee a varied and well-balanced investment environment.

Product Prowess

The company offers an amazing selection of 84 goods with 276 SKUs under the “Gopal” brand. These consist of quick-moving consumer commodities including soan papdi, noodles, rusk, papad, and spices. The product line includes western snacks like wafers, extruded snacks, and snack pellets in addition to traditional snacks like namkeen and gathiya.

Nationwide Presence

Products from Gopal Snacks were offered in ten states and two Union Territories as of September 30, 2023. The company’s market reach and accessibility are reinforced by its strong network of 617 distributors and 3 depots. In the consuming business, a wide network is essential, and Gopal Snacks IPO excels in this regard.

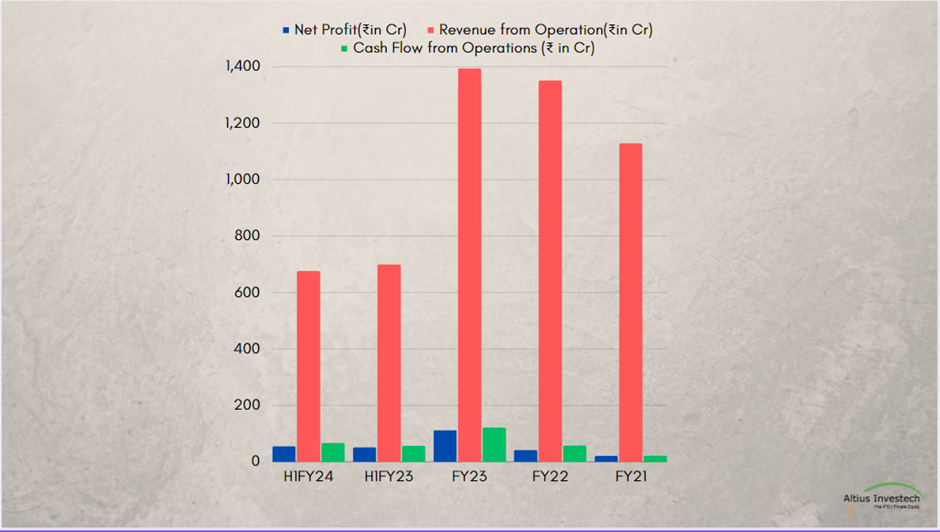

Financial Performance

| Period | Net Profit (₹in Cr) | Revenue from Operations(₹ in Cr) | Cash Flow from Operations(₹ in Cr) |

| H1FY24 | 55.57 | 676.2 | 67.59 |

| H1FY23 | 51.96 | 699.3 | 57.55 |

| FY23 | 112.37 | 1394.65 | 121.52 |

| FY22 | 41.54 | 1352.16 | 58.59 |

| FY21 | 21.12 | 1128.86 | 22.43 |

Industry Accolades

Among major snack companies in India, Gopal Snacks led the field in Fiscal year 2022 with the highest return on equity, return on capital utilized, and fixed asset turnover ratio. This put the business ahead of rivals such as Haldiram, Bikanervala Foods, Bikaji Foods, and others.

Market Outlook

The Indian savory snacks market, including both western snacks and ethnic savories like gathiya, was valued at INR 79,600 crores in Fiscal 2023. Projections indicate a promising 11% CAGR, reaching INR 1, 21,700 crores by Fiscal 2027.

The organized market currently commands a substantial 57% market share and is poised to grow at an impressive 11.7% CAGR from Fiscal 2023 to 2027.IntensiveFiscal Services Private Limited, Axis Capital Limited, and JM Financial Limited are the appointed book-running lead managers, while Link Intime India Private Limited takes charge as the registrar of the offer. The equity shares are set to be listed on both the BSE and NSE, opening doors for investors to partake in the exciting journey of Gopal Snacks IPO

Click here to read about Sugar Cosmetics.

Strengths of Gopal Snacks

- Variety: Gopal Snacks offers a wide range of snacks, from traditional Indian snacks like samosas and kachoris to modern favorites like flavored potato chips. They have something for everyone’s taste buds.

- Quality Ingredients: Gopal Snacks takes pride in using high-quality ingredients to ensure the best taste and freshness in their snacks. You can trust that you’re getting a delicious and satisfying snack every time.

- Customer Service: Gopal Snacks is known for their excellent customer service. They value their customers and strive to provide a positive experience, whether it’s in-store or online.

Weaknesses of Gopal Snacks

- Oiliness: Some people may find that Gopal Snacks’ snacks are a bit too oily. While this can add to the flavor and crispiness, it might not be everyone’s preference.

- Saltiness: Similarly, some snacks from Gopal Snacks may be on the saltier side, which can be a drawback for those who prefer less salt in their snacks.

- Limited Availability: Depending on your location, you might find that Gopal Snacks is not readily available everywhere. This can be a downside if you’re craving their snacks but can’t easily find them nearby.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/