Mukesh Ambani’s group (Reliance Industries Ltd.) eventually halted its quest of the television broadcast rights to India’s top cricket league, which Walt Disney Co. had obtained for $3 billion, since the Indian conglomerate saw minimal long-term economic potential from the legacy platform.

According to a person familiar with the group’s strategy, the joint venture between Ambani’s Reliance Industries Ltd. and US media giant Paramount Global is instead focused on winning the rights to digitally stream the lucrative Indian Premier League, betting that its advertising revenue will be four times that of TV in five years. According to the individual, who did not want to be identified because they were discussing private considerations, television will struggle to deliver double-digit growth.

While Viacom18 Media Pvt., the Ambani-Paramount joint venture, bid for TV rights in the early rounds of the auction, this individual claimed the company’s priority was always to gain digital rights. A Reliance Industries official declined to comment on the auction plan.

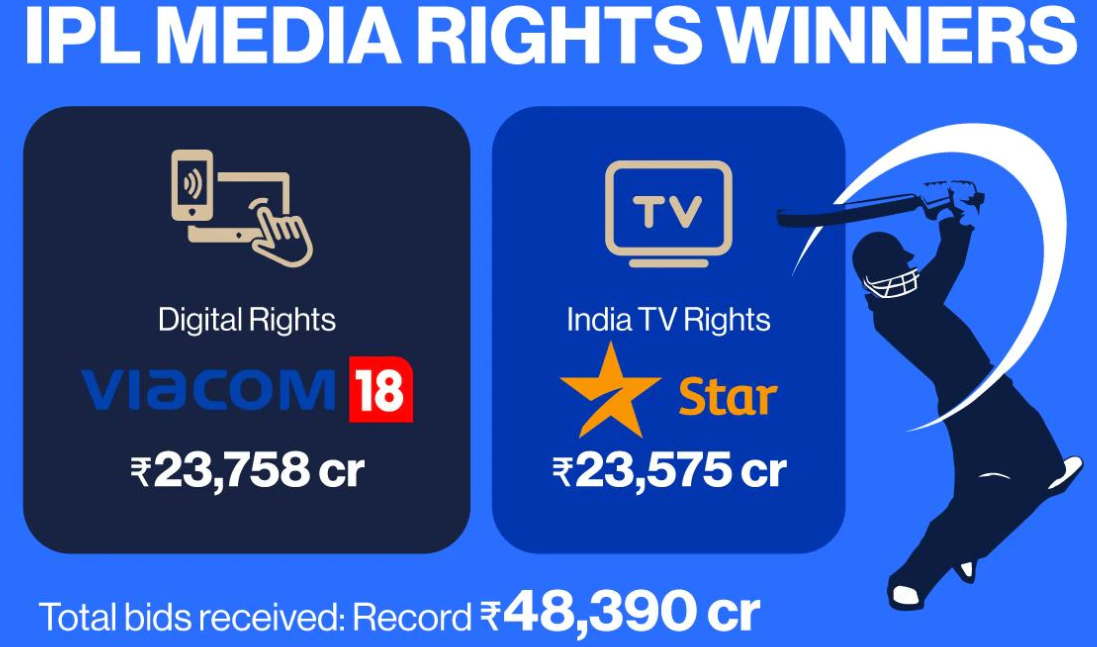

Viacom18 spent 238 billion rupees ($3.1 billion) for the rights to stream the IPL competition, one of the world’s most-watched sporting events, nearly as much as Disney. The decision is consistent with Ambani’s goals for his digital unit, Reliance Jio Infocomm Ltd. The billionaire, who is now India’s richest man, wants to build a consumer ecosystem that combines entertainment and e-commerce in order to attract local customers who are becoming increasingly reliant on their smartphones.

The decision to sell television rights saved Reliance billions of dollars, monies that might be used to strengthen the conglomerate’s chances in the impending 5G spectrum auction in India. A popular cricket telecast, which can attract millions of new members, transmitted over a fast wireless network can be a powerful combination for boosting Jio.

In a separate interview, Jay Shah, the head of India’s Board of Cricket Control, stated that the country might have 900 million internet users in five years, highlighting the potential of digital rights. While television was once the primary source of entertainment in Indian middle-class homes, a significant shift toward online streaming has occurred in recent years, a tendency accentuated by the pandemic.

According to this source, Reliance would use its IPL rights as a tactical asset to develop out streaming and digital platforms such as Voot and Jio. Viacom18 has previously obtained media rights to soccer, badminton, tennis, and basketball games, giving them a diverse sports portfolio.