Content Table

Why there is a need of a Structured Products?

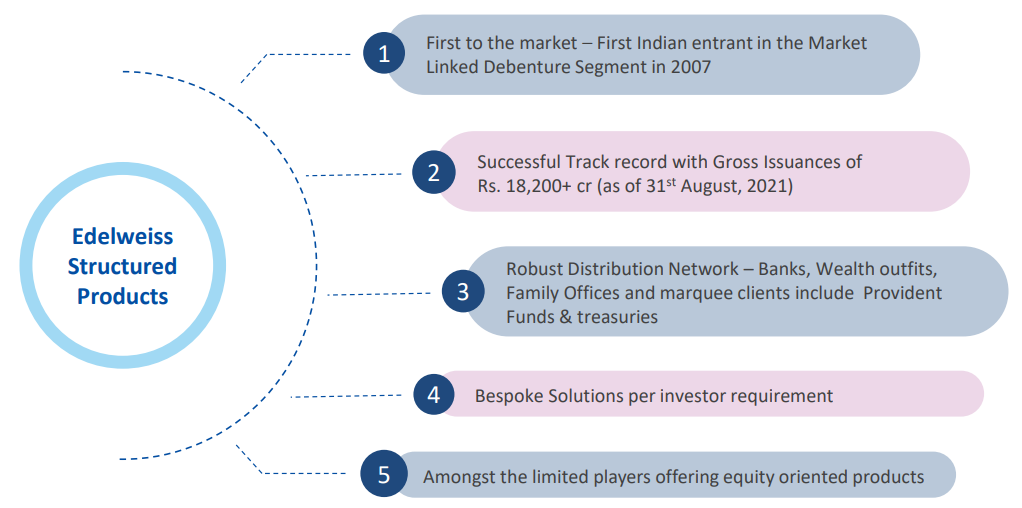

Edelweiss – One of India’s leading structured solution architects

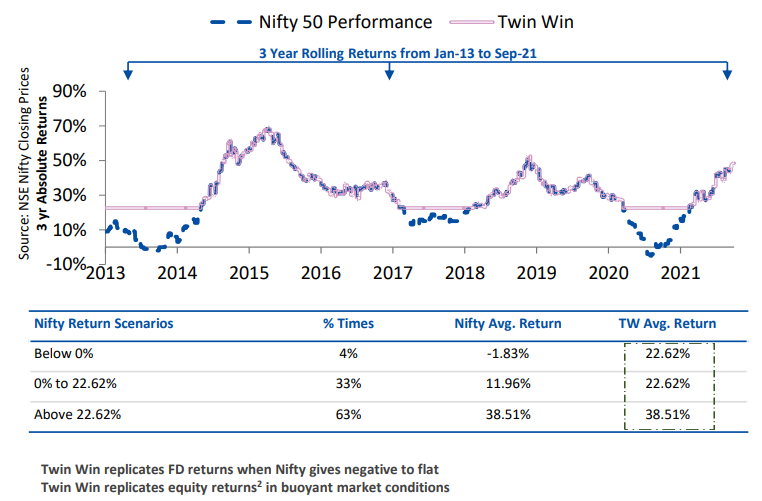

Historically – 63% times, Twin Win has given equity returns

What are Structured Products?

- Structured products are pre-packaged investments that normally include assets linked to interest plus one or more derivatives.

- These products may take traditional securities such as an investment-grade bond and replace the usual payment features with non-traditional payoffs.

- Structured products can be principal-guaranteed that issue returns on the maturity date.

- The risks associated with structured products can be fairly complex—they may not be insured by the FDIC and they tend to lack liquidity.

Why there is a need of a Structured Products?

- With low interest rates on fixed return investments the quest for a positive real returns are a challenge.

- Structured Products are inflation efficient investments versus traditional fixed income.

- Provide tailor made solutions to investors.

- Cornerstone for asset allocation enabling diversification.

- Prior due diligence of issuer by an independent trustee, regulated by SEBI & RBI.

Edelweiss – One of India’s leading structured solution architects

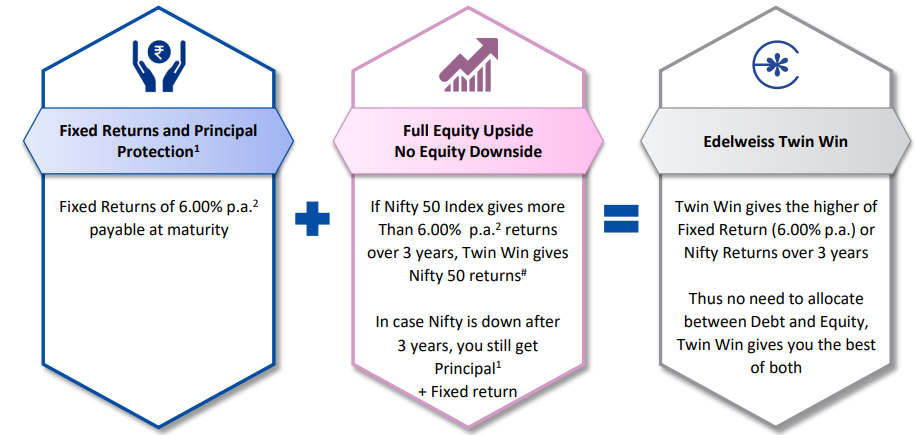

What is Edelweiss Twin Win?

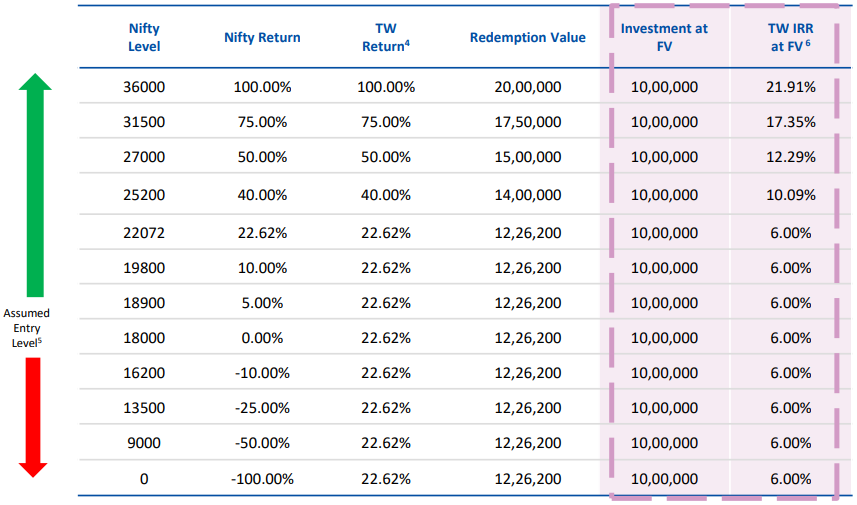

Twin Win – Return Scenarios

Historically – 63% times, Twin Win has given equity returns

Twin Win Idea – Details

| Details | Twin Win |

| Issuer | ECAP Equities Ltd. |

| Credit Rating | Minimum of PP-MLD-(A+) |

| Secured | Yes, secured by 1x cover on Principal & Coupon against balance sheet assets |

| Minimum Investment Amount ( Per Client) | ₹ 10,00,000/- |

| Listing | Unlisted. |

| Principal Protection | Principal Amount is protected at maturity, to the extent of Face Value |

| Tenor in Months | 36/42 Months |

| Entry Level | Average of Official Closing Level of Nifty 50 as on primary trade date & F&O expiry of next 5 months |

| Exit Level | Average of Official Closing Level of Nifty 50 as on NSE F&O Expiry of 31st to 36th month from primary trade date |

| Return Profile | Maximum of 6.00% IRR or Nifty Underlying Performance |

General Risk Factors

1. Interest Rate Risk

Rise and fall in the interest rates influence the valuation of the investment, thus may result in mark to market loss during the tenor of the investment.

2. Liquidity Risk

- MLDs are issued for a fixed tenor with no interim exit options for the investor built in.

- While the MLDs are listed, there is no assurance that liquidity will be available on the same if there are no active buyers and sellers.

3. Repayment Risk

- Principal amount, and any other amounts that maybe due in respect of the debentures is subject to the credit risk of the Issuer.

- In the event that bankruptcy or similar proceedings, the investor may stand to lose the entire invested Principal, or the due amount may not be made or may be substantially reduced or delayed.