Small Finance Banks is a specific segment of banking created by RBI under the guidance of Government of India with an objective of furthering financial inclusion by primarily undertaking basic banking activities to underserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised entities. Like other commercial banks, these banks can undertake all basic banking activities including lending and taking deposits.

Small Finance Banks are created with aims of (1) providing savings vehicles and (2) providing credit to small businesses, small and marginal farmers, micro and small industries, and other unorganised sector entities through high-tech, low-cost operations.

The main difference between a Small Finance Bank and a commercial bank is that commercial banks are not limited to any specific set of customers. Small Finance Banks have to cater to specific set of customers like small scale farmers, small businesses, unorganised workers as well as MSME. A Small Finance Bank has to make sure that 75% of its loans are made to the target customers which Commercial Banks can give loans to all of its customers.

A Commercial Bank can earn revenue by loans and transaction charges. The main source of income for Small Finance Banks is by lending services to the target customers. Another condition which makes Small Finance Banks different from commercial banks is that for the first 3 years of operation, a Small Finance bank has to have 25% of branches should be in rural areas.

Small Finance Banks are good prospects for an IPO as once the Small finance Bank attained the net worth of Rs. 500 crores, within three years the shares of it should list on a stock exchange. Small Finance Banks have been attractive investments for both public and private markets.

AU Small Finance Bank Ltd. –

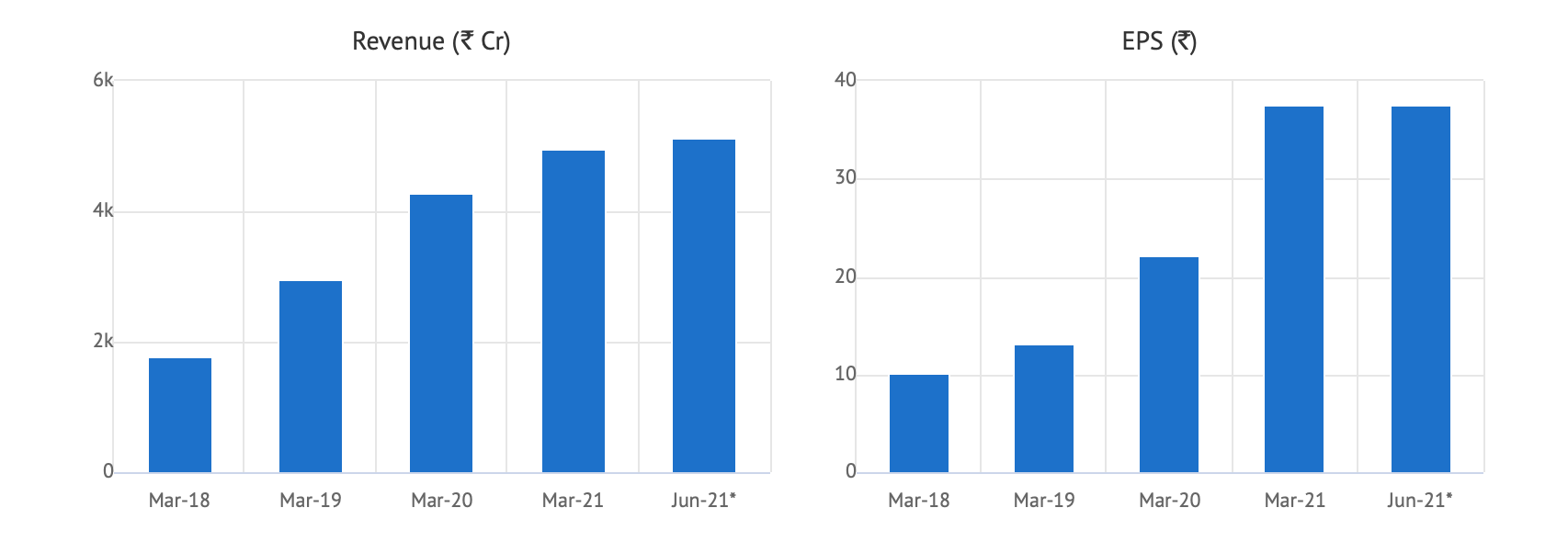

The share price of AU Small Finance Bank Ltd has grown by 62% you. The Revenues of the company have been on a constant uptrend. The company has strengthened asset book with ~84% retail loans and ~ 5 lakh average ticket size.

Improved asset portfolio IRR to 14.7% (14.3% in FY 2018-19) driven by improving spread.

The three prominent Small Finance Banks in the private equity space are Fino Paytech, Fincare Small Finance Bank and Utkarsh Small Finance Bank Limited.

Fincare Small Finance Bank Ltd. –

Since inception, the digital paradigm has always been the force multiplier that would enable the company to emerge as a best-in-class player in the banking landscape in India.

The Income of the company increased by 80% YoY while the Net Profit increased by over 500%+ YoY.

Fincare Small Finance Bank has already filed for an IPO and has received SEBI’s approval to obtain Rs. 1,330 crores via its initial public offering. According to its DRHP, the IPO will comprise a fresh issue of equity shares worth Rs. 300 crores. In addition, there would be an OFS (Offer for Sale) of Rs. 1,000 crores by its promoter, Fincare Business Services Ltd. This offer will also include a reservation for subscriptions by Fincare employees.

Click on the link to find out more information on Fincare Small Finance Bank Ltd.

Fino Payments Bank –

Fino principally relies on fee and commission based income generated from its merchant network and strategic commercial relationships. As of FY20 data, Fino had the largest payments bank network with 0.64 Mn banking touch points, followed by Airtel and India Post. In addition, as of March 31, 2021, around 55% of the micro-ATMs deployed in India belong to FBCL.

In FY21, it reported 641,892 merchants (comprising 52% “own” merchants and remaining merchants on the open banking network via its API channel), and 17,269 active business correspondents or agents. Over 87% of its income (INR 675.5 Cr) in the FY21 came from commissions, exchange and brokerage fees.

Income derived from all of FBCL’s financial products and services in the FY19, FY20 and FY21 was INR 351.9 Cr, INR 673.3 Cr and INR 770.7 Cr, respectively, representing a CAGR of 29.9%. It reported a net profit of INR 20.5 Cr in FY21 compared to a loss of INR 32 Cr in FY20.

Click on the link to find out more information on Fino Payments Bank –

https://altiusinvestech.com/company/Fino-Paytech

Utkarsh Small Finance Bank Limited –

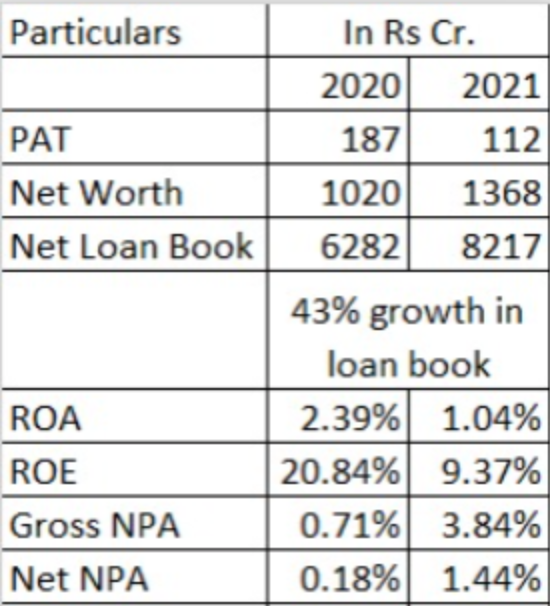

The company, keeping in mind the disruptions caused by the pandemic, has delivered a strong performance as seen in the Financials of Utkarsh Small Finance Bank on the left, however the asset quality of the Small Finance Bank has taken a hit, leading to an increase in gross and net NPAs. In the past few years the company has started diversifying its operations in terms of the product portfolio to mitigate the risks associated with microfinance, but still around 87.9% of the loan book consists of Microfinance loans.

Diversification is also being done in terms of geography and the company has forayed into Eastern India, where the market is not that saturated and where there a lot of potential for credit industry, hence it shows that the company has identified its huge dependence on 2 states i.e. Bihar and UP for 75% of the loans granted.

Click on the link to find out more information on Utkarsh Payments Bank –

https://altiusinvestech.com/company/Utkarsh-Coreinvest-Buy-Sell-Unlisted-Shares