Small Finance Banks (Utkarsh & Fincare) IPOs: Should You Invest?

Small Finance Banks is a specific segment of banking created by RBI under the guidance of Government of India with an objective of furthering financial inclusion by primarily undertaking basic banking activities to underserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised entities. Like other commercial banks, these banks can undertake all basic banking activities including lending and taking deposits.

Content Bank

Net economics of the SFB industry today

Net economics – What the SFB industry should do!

Utkarsh, Fincare and the 3 factor framework

So what are Utkarsh & Fincare worth?

Background information: Utkarsh and Fincare Small Finance Banks

Basic overview: Utkarsh and Fincare Small Finance Banks

After getting Small Finance Banks licences from the RBI, Fincare and Utkarsh both began operations as small financing banks (SFBs) in 2017.

Let’s start with the fundamentals: what are SFBs? They are a distinct type of bank established with the goal of advancing the financial inclusion agenda. SFBs must follow the following rules:

- 75+% loans to priority sectors, i.e. underserved sectors (compared to 40% for other banks)

- Loans of 50% or more with ticket sizes of =25 lakhs

There are 11 Small Finance Banks in India, and interestingly, the majority of these SFBs were previously microfinance institutions (except AU and Shivalik cooperative bank). In other words, all of them have built their businesses around financial inclusion and are run by exceptional management teams – so it’s no coincidence that these 11 businesses were given licenses!

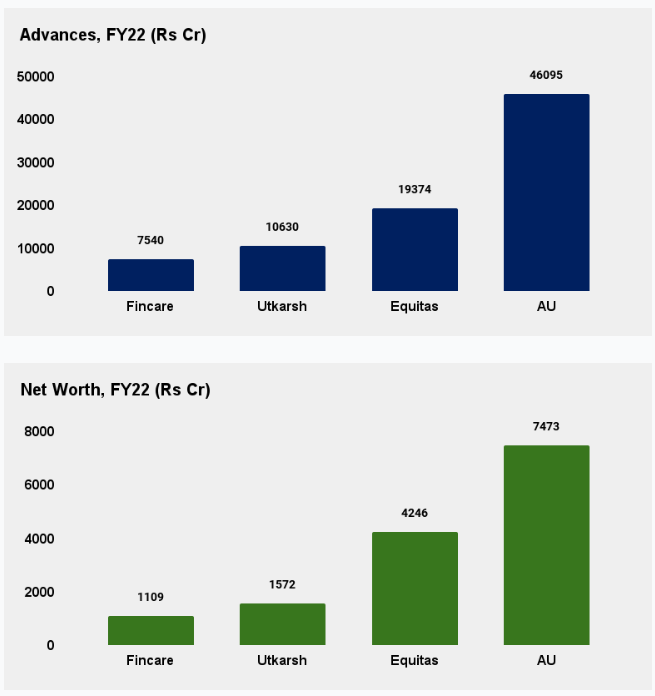

Let us now look at Fincare and Utkarsh. Here are some numbers to put their size in context – we compared them to Equitas and AU Bank, both of which are listed SFBs.

Why the IPO now?

One reason why Utkarsh and Fincare are hitting the public markets now is because they have to.

RBI mandates that Small Finance Banks need to list within 3 years of their networth crossing the 500 crore mark. With this IPO they will join the list of 4 publicly listed SFBs – Ujjivan, AU, Equitas and Suryoday.

Here is how they will use the proceeds:

1. Utkarsh: Raising Rs. 500 crores to supplement its Tier 1 capital base. No offer for sale.

2. Fincare: Raising Rs. 625 crores to supplement its Tier 1 capital base. Offer for sale amount not determined.

Quick explainer on Tier 1 capital – banks are mandated to hold a certain portion of their own equity as a percentage of their assets. For e.g., for every 100 rupees in loans originated by the bank, Rs. 15 has to be share capital and the remaining Rs. 85 can be debt (the actual regulation is way more nuanced, this is a simplified example). This ensures the bank has skin in the game.

Hence, it is clear that the fund infusion will give both SFBs enough room for future growth.

Now that we have that out of the way, let’s get into the economics of SFBs and how they compare to other commercial banks.

The SFB business modelThere are 4 key financial drivers of the SFB business model –

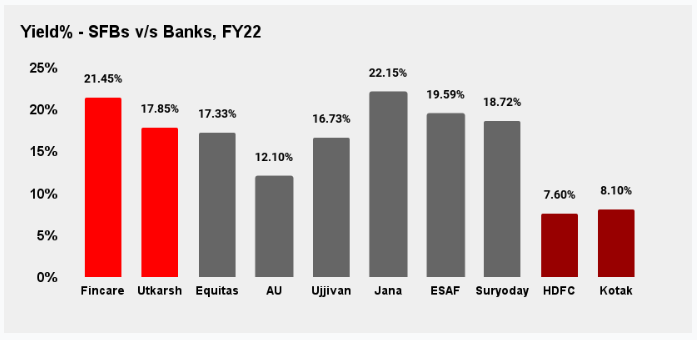

1.) High yields (i.e. interest income as a % of advances)

SFBs are targeting underserved consumers across retail + MSME, and this gives them higher pricing power (note that this pricing is still far lower than informal entities). In addition, SFBs have to price higher to account for higher risk.

The figure above clearly shows that SFBs have substantially greater yields than banks like HDFC and Kotak. Commercial banks offer lower yields because they target customers with thicker credit profiles, which are lower risk and overserved.

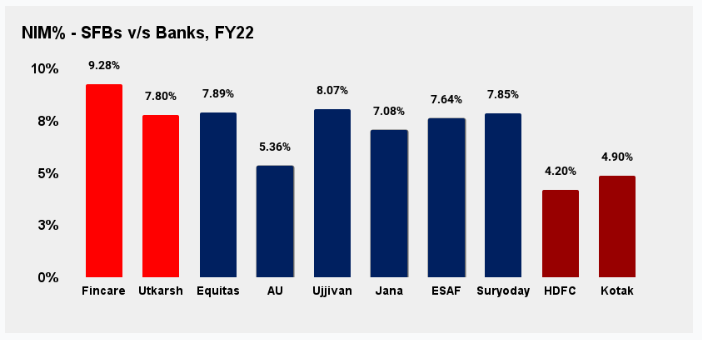

2.) High NIMs

It is critical that higher yields translate into larger NIMs, or the difference between the interest rate you charge and the cost of borrowing.

Remember, Small Finance Banks are banks, thus they may accept low-cost deposits; this is obviously a significant improvement over what they had previous to becoming SFBs. That is, greater yields translate into higher NIMs, as illustrated by the chart below.

Now that we’ve articulated the key revenue drivers, let’s move to expenses.

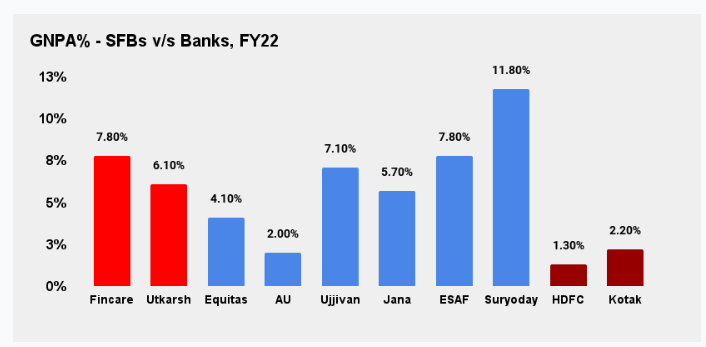

3.) Higher credit losses

Lending to the underserved implies higher delinquencies. Not only are Small Finance Banks susceptible to higher losses, but they also deal with customer segments that are very sensitive to macro economic shocks. The gross NPA numbers below clearly demonstrate this.

Now higher losses are not necessarily a bad thing – as long as Small Finance Banks can appropriately price for risk (i.e. have higher yields & NIM commensurate to portfolio risk), they can deliver strong returns.

But serving this segment comes at another cost…

4.) High operating expenses

The inclusion business is a high opex business. Lending to customers in rural areas requires a physical play in the form of feet on street acquisitions and cash collections. And collection costs only increase further with higher losses, and we have established this is something this segment is susceptible to.

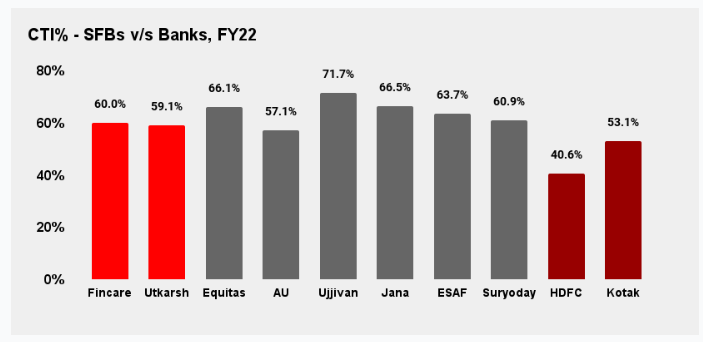

To ground this, let’s look at Cost to Income (total operating expenses as a % of total income). CTI normalizes operating expenses to income and is a comparable metric across banks.

SFBs clearly have greater CTIs. It should be noted that some of this is due to the fact that all SFBs have recently become banks and have had to upgrade their systems in order to offer new products such as loans, deposits, net banking/mobile experiences, and so on – all of which equates to hefty upfront set up expenses. Some of the high CTIs will normalise with time, with AU being an example.

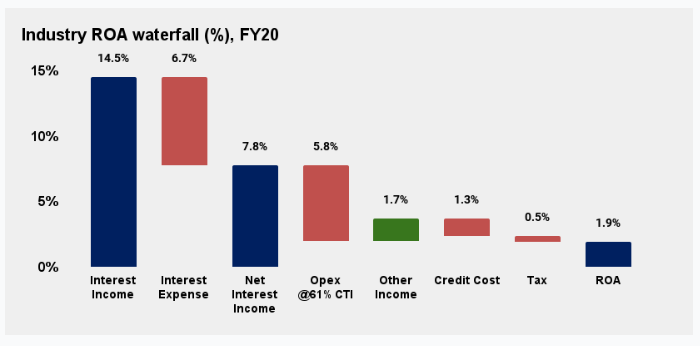

Net economics of the Small Finance Banks industry today

Let’s bring all of these factors together to better understand the economics of SFBs. The ROA waterfall for the total industry for FY2020 is shown below; this should give you a good indication of how each of the drivers stacks up for an SFB.

We chose 2020 because it reflects a stable economy.

The above economics translate into an ROE of slightly less than 14% (assuming a 7x multiple on ROA to ROE).

This isn’t great for a benign economy, when credit costs are low. Increase the credit cost to 2% (which was the case for the industry in 2021 & 2022) and you wipe out a significant portion of the returns.

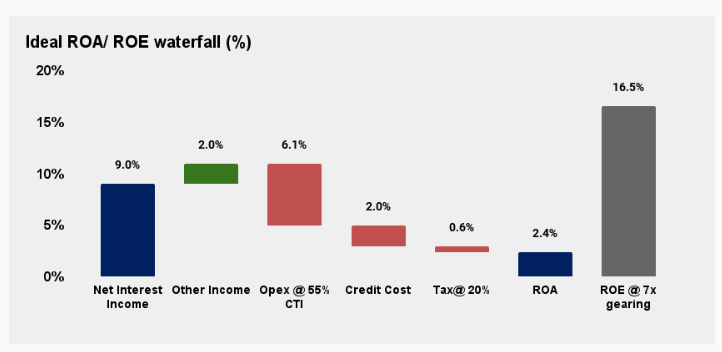

Net economics – What the Small Finance Banks industry should do!

Below is our take on the ideal ROA waterfall – let’s assume this is an average through-the-cycle ROA waterfall (i.e. an average across a good and bad economy), since it only makes sense that this business gives strong returns across cycles.

The above waterfall represents robust returns, with ROEs in the range of what HDFC has done over a long period of time.

Let’s simplify the Small Finance Banks business model into three factors that need to fall in place for SFBs to do well:

1. Scale deposits – Critical to reducing cost of funds and increasing NIMs.

2. Cost efficiency – Reducing costs (CTI in the ideal waterfall above is 55% v/s current levels of 60+%).

3. Loss resiliency – Not only managing losses to lower levels, but also building a resilient book.

Let’s evaluate Utkarsh, Fincare and the SFB bank model on the above three factors.

Utkarsh, Fincare and the 3 factor framework

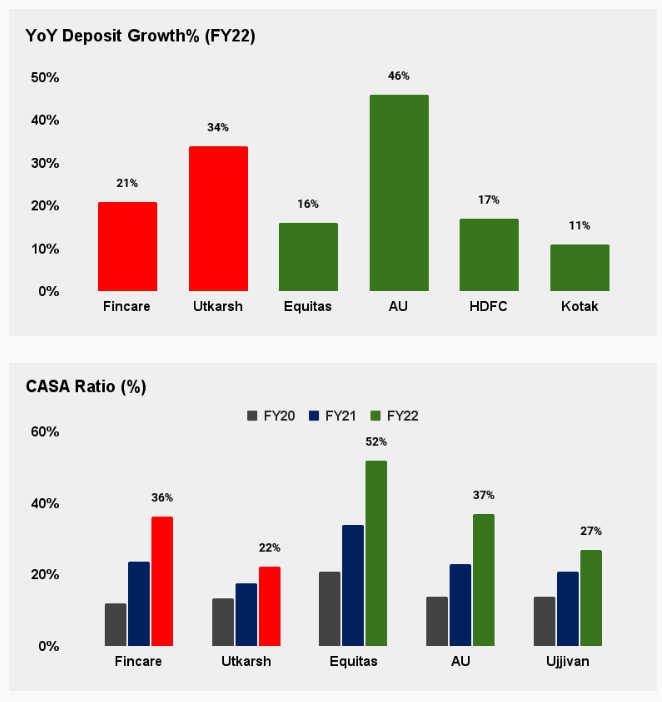

1. Scale Deposits

To evaluate, this let’s look at two data points – deposit growth and growth in CASA ratio. The latter is the proportion of deposits coming from current and savings accounts – the higher the CASA, the lower the cost of deposits and therefore lower the cost of funds.

Both Utkarsh and Fincare have grown their deposits + CASA meaningfully. That said, they both have more room for growth in their CASA, with Utkarsh having some catching up to do.

2. Improve Cost Efficiency

Clearly the whole SFB pack (not just Utkarsh and Fincare) needs to bring down their CTIs – the ideal number for this metric is 55%. AU bank is definitely approaching this number, and we think 55% is a number the group can get to with scale.

3. Build Loss Resiliency

Like we’ve mentioned before, loss levels will be higher for Small Finance Banks given the underserved segments being targeted by them. Hence it is important this metric is not only managed to reasonable levels but also resilient to macro shocks. Let’s look at Gross NPAs across all SFBs to evaluate this.

Equitas and AU clearly stand out in terms of being resilient (losses didn’t worsen as much as the rest of the pack over the pandemic).

But why is this the case? The answer is that resilience over macro shocks is proportional to the concentration of the banks’ Microfinance portfolio (MFI).

Equitas’s MFI concentration is sub-20%, while AU has no MFI exposure – both these SFBs have diverse non-MFI books, making their portfolio resilient to macro shocks.

On the contrary, the rest of the pack is still largely operating in their old microfinance avatars. It is critical the pack diversifies away into other businesses to build robust long term economics.

We think the large MFI concentration for Utkarsh & Fincare is a huge drawback for the business. These SFBs need to urgently diversify away into other segments and also need to demonstrate that they can build a sustainable non-MFI business.

So what are Utkarsh & Fincare worth?

As always, we’ll end this analysis with a simple valuation framework. Let’s try to value these IPOs based on a price to book multiple – a common valuation metric used for banks.

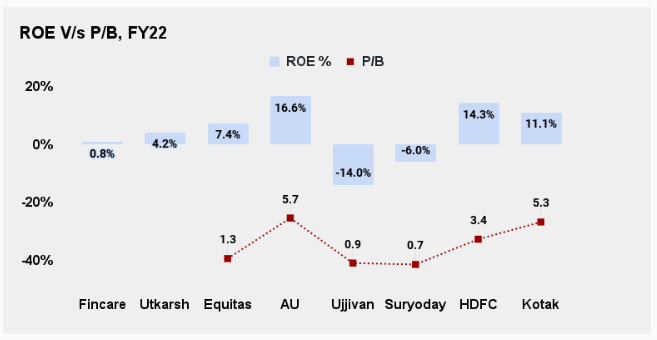

Now the market will pay a premium for a business with superior economics. In this case, let’s measure economics by return on equity. Hence, the market should pay a higher P/B multiple for a business with higher ROE. Let’s test this out…

Clearly, the trend holds – higher ROEs get higher P/Bs. Now it’s upto you to decide what P/Bs are reasonable for Utkarsh and Fincare!

We’d encourage you to not just look at the current ROE but also use the 3 factor framework to evaluate where the ROEs might be headed in the future.

Would you subscribe to either Utkarsh or Fincare? Let us know if you agree with our valuation framework!

To invest in Utkarsh, Click Here

To invest in Fincare, Click Here

Also Read:

Get in Touch with Us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/