About Utkarsh CoreInvest Limited

Utkarsh CoreInvest Limited, formerly known as Utkarsh Micro Finance Limited, was founded in September 2009 with the intention of serving the unbanked population who have talents but lack funds by offering both financial and non-financial services. The company began offering credit in FY 2009 under the Joint Liability Group (JLG) model. Over time, it added Micro Enterprise Loans (MEL), Housing Loans, and Micro Pension Products to its portfolio. The Reserve Bank of India authorized Utkarsh Micro Finance to open a “Small Finance Bank” in FY 2016. As a result, the business founded ‘Utkarsh Small Finance Bank Limited’ as a subsidiary.

Utkarsh Micro Finance used a slum sale to transfer all of its assets and obligations—aside from a few statutory liabilities, cars, and assets—to its subsidiary, Utkarsh Small Finance Bank Limited, in accordance with regulatory rules. Starting on January 23, 2017, the subsidiary conducted banking operations.

| Company Name | Utkarsh CoreInvest Limited |

| Company Type | Unlisted Public Company. Invest In Utkarsh CoreInvest Unlisted Shares |

| Industry | Finance |

| Founded | 2009 |

| Headquarters | Varanasi, Uttar Pradesh, India |

| Website | www.utkarshcoreinvest.com |

Subsidiary Companies

| Name | State | Incorporation Year | No. Of Shares held |

| Utkarsh Small Finance Bank Limited | Uttar Pradesh | 2016 | 69.10% |

Management of the Company

Mr. Ashwani Kumar: Managing Director & CEO

Mr. Ashwani Kumar brings with him more than seventeen (17) years of industry experience, particularly in the Microfinance and Priority Sector segments of the BFSI Industry. He has held senior management roles in various control and support functions at Utkarsh since its inception as an NBFC-MFI (Utkarsh Micro Finance Pvt. Ltd.), then as a Small Finance Bank (Utkarsh Small Finance Bank Ltd.), and now with an NBFC-CIC (Utkarsh CoreInvest Limited since March 2019). Additionally, he serves as a Director on the Board of Utkarsh Welfare Foundation (UWF), a Section 8 Company. Prior to this, Mr. Ashwani gained experience at NABARD Financial Services Limited (NABFINS) at their Head Office in Bengaluru, Canara Bank at their Head Office in Bengaluru, and Locus Research and Consultants Limited in New Delhi.

Mr. G. S. Sundararajan: Independent Director & Chairperson of The Board

Mr. G. S. Sundararajan has an extensive background in the Banking and Financial Services Sector, serving on the boards of several reputable companies. He has also been actively engaged in Social Entrepreneurship in advisory roles. Until recently, Mr. Sundararajan served as the Group Director at Shriram Group. He initially joined Shriram Group as the Managing Director of Shriram Capital Ltd., which acts as the Holding Company for Shriram Group’s financial services and insurance businesses across India and overseas. Recognized for his experience in the Asian market and his insights into business opportunities within these regions, Mr. Sundararajan was appointed to the Board of Sanlam Emerging Markets in South Africa in August 2013. During his tenure as Group Director, he provided strategic oversight to the group’s subsidiaries, focusing on areas of strategic growth and development. His responsibilities included overseeing the Retail and MSME business at Shriram City Union Finance, as well as the life and non-life Insurance businesses in collaboration with Sanlam, South Africa.

Mr. Atul: Independent Director

Mr. Atul possesses over 37 years of administrative service experience, with a focus on Security, Vigilance, and Anti-Corruption. He is an Indian Police Service (IPS) Officer of the 1976 batch. Mr. Atul served as Director General of Police (DIG) in Uttar Pradesh (UP), DIG CBI in charge of UP, and held the position of Additional Director General of Police, overseeing Crime, Law, and Order. He also had roles in the Personnel Wing of DGP Headquarters, where he managed IPS and PPS Officers in Uttar Pradesh. Throughout his career, Mr. Atul has been recognized for his distinguished service and was awarded the President’s Medal. He has also served as President of the IPS Association in Uttar Pradesh and President of the Lucknow University Alumni Association

UTKARSH SMALL FINANCE BANK (Subsidiary Company)

Industry Overview

Indian Banking Industry

Composition of the Industry:

| Sector | Number of Banks |

|---|---|

| Public Sector Banks | 12 |

| Private Sector Banks | 22 |

| Foreign Banks | 44 |

| Regional Rural Banks | 43 |

| Urban Cooperative Banks | 1,484 |

| Rural Cooperative Banks | 9,600 |

Financial Indicators (As of November 2022)

| Financial Indicators | Amount (in lakh crore/trillion) |

|---|---|

| Bank Credit | 129.26 lakh crore |

| Deposits | 173.7 trillion |

Reforms and Stability

- Gross NPA Ratio:

- March 2018: 14.6%

- December 2022: 5.53%

- Reforms have led to a significant decrease in NPAs, promoting stability and profitability within the industry.

Government Infrastructure Spending

- Predicted to stimulate job creation and economic expansion nationwide.

Small Finance Banking Industry

Small Finance Banks (SFBs) are a unique class of banks designed to give underprivileged groups in society access to basic banking services. SFBs have grown significantly while having a limited market share; in FY 2021–2022, deposits increased by 33.1%. Their advances have grown at a rapid pace, with a 40% CAGR in the last four years. Their gross non-performing assets dropped from 5.4% to 4.9% between FY 2020–21 and FY 2021–22 despite obstacles.

Micro Finance Industry

The goal of the microfinance sector, which includes NBFCs and MFIs, is to offer financial services to India’s underbanked and unbanked citizens. It has produced 1.32 crore jobs since 2000 and adds 2.7% to India’s GDP. Despite pandemic hurdles, the MFI sector’s outstanding loan portfolio increased by 20.3% annually to reach 3.25 lakh crore in 2022–2023. The collection efficiency ratio also increased, rising from 70% to 97%.

Micro, Small and Medium Enterprises (MSME)

The Micro, Small and Medium Enterprises (MSME) sector in India comprises more than six crore enterprises, contributing significantly to manufacturing output and GDP. Access to funds is a major challenge, addressed by a ₹9,000 crore credit guarantee scheme announced in the Union Budget 2023-24. This scheme aims to provide collateral-free loans of ₹2 lakh crore to small-scale businesses, fostering growth at a lower cost than standard banking rates.

Reserve Bank of India (RBI) data shows outstanding advances to MSMEs at ₹20.44 lakh crore in 2021-22, with the gross Non-Performing Assets (NPA) declining to 6.1% in 2022-23. Additionally, the Economic Survey 2022-23 highlights a credit growth of 30.6% to MSMEs, supported by the Emergency Credit Line Guarantee Scheme (ECLGS) of the Government of India.

Housing Finance

India’s population growth is contributing to a steady rise in the need for residential space, which in turn is driving up the cost of housing finance. Per capita income increases as the economy bounces back from the COVID-19 disruptions, lowering home costs and stimulating the housing finance industry. Estimates point to a 20.58% CAGR in growth from 2022 to 2027. Optimism in the sector is further fueled by the financial allocation of ₹79,000 crore for 2023–24, a 66% increase from the previous budget.

Commercial Vehicles and Construction Equipment Finance

Finance for construction equipment (CE) and commercial vehicles (CV) has grown significantly in recent years. Sales of CVs climbed by 34.3% in FY 2022–2023, reflecting a rise in demand brought on the post–COVID normalization and an increase in daily commuting. Due to the increased demand, there is a greater need for financial aid, which is why CV financing is more popular nationwide. Furthermore, the government’s emphasis on capital spending is anticipated to propel the Indian CE market, which was estimated to be worth US$ 5.6 billion in 2021, to US$ 9.4 billion by 2027, with a compound annual growth rate of almost 8% predicted between 2022 and 2027.

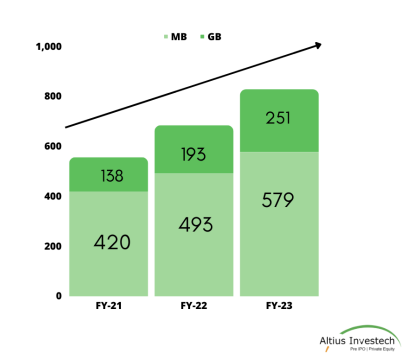

Banking Outlet

- The proportion of the bank’s banking locations in unbanked areas is around 27.35%, which is higher than the 25% statutory minimum.

- The bank opened approximately 270 branches in FY22 and FY23, continuing to grow its franchise in spite of the COVID-19 delays.

- USFBL operates through 830 banking locations as of March 31, 2023; these locations are categorized as General Banking (GB) and Micro-banking (MB) branches internally.

- There are 251 GB branches and 579 MB branches in the bank.

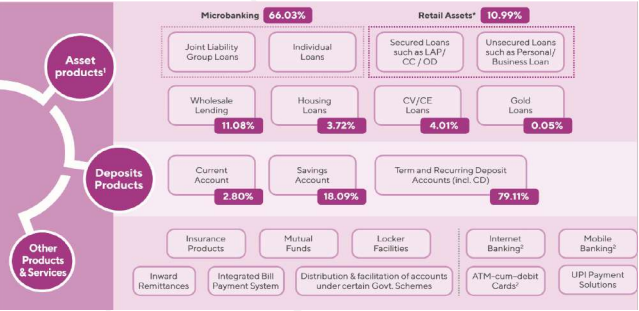

Product Portfolio

- Retail Business Loans: Group and individual loans for small businesses.

- Microfinance Products: Group and individual loans for micro-entrepreneurs.

- Consumer Loans: Personal, vehicle, and consumer durables loans.

- Housing Finance: Home loans, home improvement loans, and loan against property.

- Business Banking Solutions: Working capital loans, term loans, and trade finance.

- Deposit Products: Savings accounts, current accounts, and fixed deposits.

- Digital Banking Services: Mobile banking app and online banking platform.

- Other Financial Services: Insurance products, investment services, and remittance services.

This comprehensive range of products caters to diverse customer needs, promoting financial inclusion and empowerment.

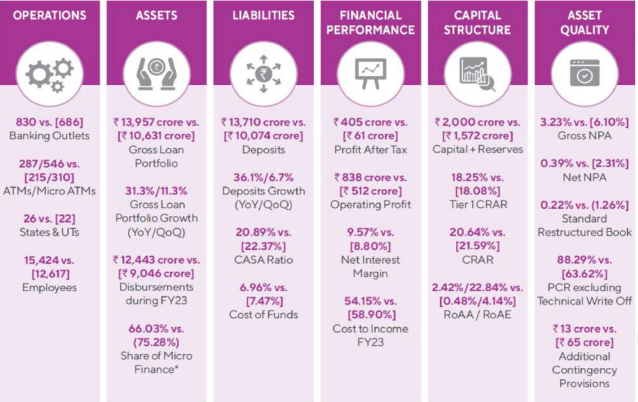

Key highlights of Bank’s Financial Performance during FY23

Operations:

- The bank has expanded its operations significantly, boasting 830 banking outlets, 287 ATMs, and 546 micro ATMs across 26 states and union territories.

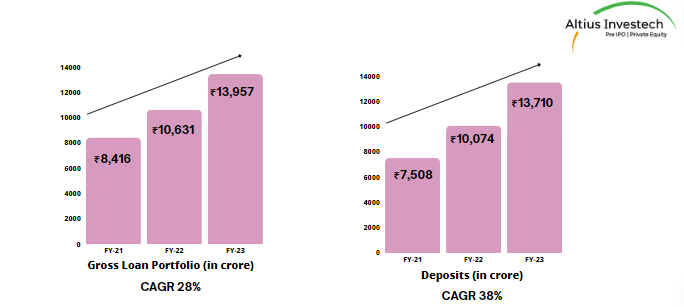

Assets and Liabilities:

- With a substantial increase in assets, the bank’s gross loan portfolio witnessed a growth of 31.3% year-on-year and 11.3% quarter-on-quarter. Deposits also surged, showing a growth of 36.1% year-on-year and 6.7% quarter-on-quarter.

Financial Performance:

- Despite a notable cost of funds and a decrease in profit after tax, the bank managed to maintain a healthy operating profit of 405 crore and a net interest margin of 9.57%.

Capital Structure:

- The bank’s capital and reserves reached 2,000 crore, contributing to a tier 1 capital adequacy ratio of 3.23%.

Asset Quality:

- While the gross NPA stood at 3.23%, the net NPA ratio showed a remarkable improvement, standing at 0.22%. The standard restructured book accounted for 20.64% of the total.

Financial Ratios:

- The bank’s cost-to-income ratio for FY23 was 18.25%, demonstrating efficient cost management. However, the PCR excluding technical write-offs was 713 crore, indicating the bank’s proactive approach towards managing provisions.

Risk and Return:

- The bank’s CRAR stood at 2.42% (Tier 1) and 22.84% (total), indicating a strong capital base to absorb risks. The return on average assets (ROAA) and return on average equity (ROAE) were 88.29% and 63.62%, respectively, showcasing the bank’s ability to generate profits efficiently.

Business Performance

The bank maintains a robust rural and semi-urban presence, with 63% of its branches strategically located in these areas as of March 31, 2023, aligning with its strategy for continuous asset build-up. While emphasizing equal focus on liabilities across rural, semi-urban, urban, and metropolitan regions, its micro-banking (MB) branches primarily cater to micro-credit and retail loans, whereas general-banking (GB) branches concentrate on deposit mobilization. Additionally, select GB and MB branches offer a diverse range of products including MSME loans, housing loans, vehicle loans, and gold loans.

With 79 branches dedicated to MSME lending and 45 branches to housing loans, the bank leverages its extensive branch network for significant cross-selling opportunities. In the fiscal year 2022-23, the bank witnessed substantial growth with total assets expanding by 26.91% to 19,117.54 crore, gross loan portfolio increasing by 31.29% to 13,957.11 crore, and deposits rising by 36.09% to `13,710.14 crore, underscoring its commitment to financial inclusion and sustainable expansion.

| States | Total Banking Outlets | MB Outlets | GB Outlets | MSME Locations | HL Locations | Wheels Locations | Gold Locations |

| Bihar | 206 | 188 | 18 | 9 | 3 | 3 | 5 |

| Uttar Pradesh | 168 | 126 | 42 | 17 | 12 | 15 | 21 |

| Jharkhand | 75 | 64 | 11 | 3 | 1 | 2 | – |

| Maharashtra | 68 | 36 | 32 | 17 | 9 | – | 11 |

| NCT of Delhi | 28 | 4 | 24 | 3 | 1 | 1 | 14 |

| Other States | 285 | 161 | 124 | 30 | 19 | 10 | 31 |

| Total | 830 | 579 | 251 | 79 | 45 | 31 | 82 |

Peer Comparison

₹ in crores (as of 31.03.2023)

| Particulars | Utkarsh Small Finance Bank | Ujjivan Small Finance Bank |

| Total Income | 2938 | 4754 |

| Net Interest Income | 1529 | 2968 |

| PAT | 405 | 1140 |

| PAT Margins | 14% | 24% |

| Gross Loan Portfolio | 13957 | 24085 |

| Total Deposits | 13710 | 25538 |

| GNPA | 3.23% | 2.6% |

| NNPA | 0.39% | 0.04% |

| Net Interest Margins | 9.57% | 9.5% |

Government Initiatives:

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Launched in August 2014, PMJDY aims to ensure every household in India has a bank account accessible from anywhere, offering various financial services like savings, deposits, remittances, credit, and insurance at affordable rates.

- Pradhan Mantri Awas Yojna Gramin (PMAY G): As of September 20, 2021, PMAY-G has completed around 15.0 million houses. The government targets constructing 20.2 million houses by fiscal 2022 under this scheme.

Loan Book Split

| Particulars | FY-23 | FY-22 | Growth |

| Loan Portfolio | 13957 | 10630 | 31.3% |

| Micro Finance | 9215 | 8002 | 15.16% |

| Non-Micro Finance | 4742 | 2628 | 80% |

| Particulars | FY-23 | FY-22 | Growth |

| Wholesale Lending | 1547 | 926 | 67% |

| Retail Lending | 1534 | 840 | 83% |

| Housing Loans | 519 | 359 | 45% |

| CV/CE Loans | 560 | 212 | 164% |

Deposit and Loan Portfolio

- The Bank has witnessed a healthy growth during FY-23, wherein the total assets grew by 26.91% to 19,117.54 crore.

- The Bank’s business growth is supported by its expanding franchise and presence and diversified product offerings. The gross loan portfolio and deposits grew by 31.29% and 36.09%, respectively, during FY-23 and stood at ₹13,957.11 crore and ₹13,710.14 crore, respectively, as on March 31, 2023.

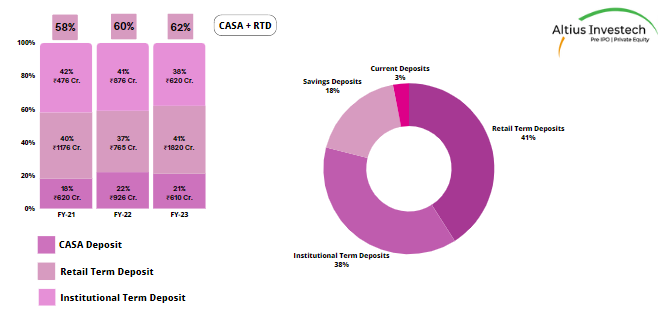

Deposit Composition

- Retail term deposits of the Bank have been a key driver for the growth of deposits in FY23. The Bank’s Retail Term Deposits (RTDs) grew by 48.46% to ₹5,575.13 crore as of March 31, 2023.

- Bank’s CASA deposits grew by 27.09% in FY23 to ₹2,863.74 crore as on March 31, 2023 from ₹2,253.29 crore as of March 31, 2022. Growth in CASA deposits has been impacted by hardening interest rate scenario because of which depositors would have preferred term deposits over keeping their surplus in savings deposits.

- Overall, the Bank has been focusing on improving the share of CASA plus retail term deposits consistently. As a result, the share of CASA and retail term deposits increased to 61.55% of total deposits of the Bank as of FY-23, compared to 59.64% of total deposits as of FY-22.

UTKARSH COREINVEST LIMITED (Holding Company)

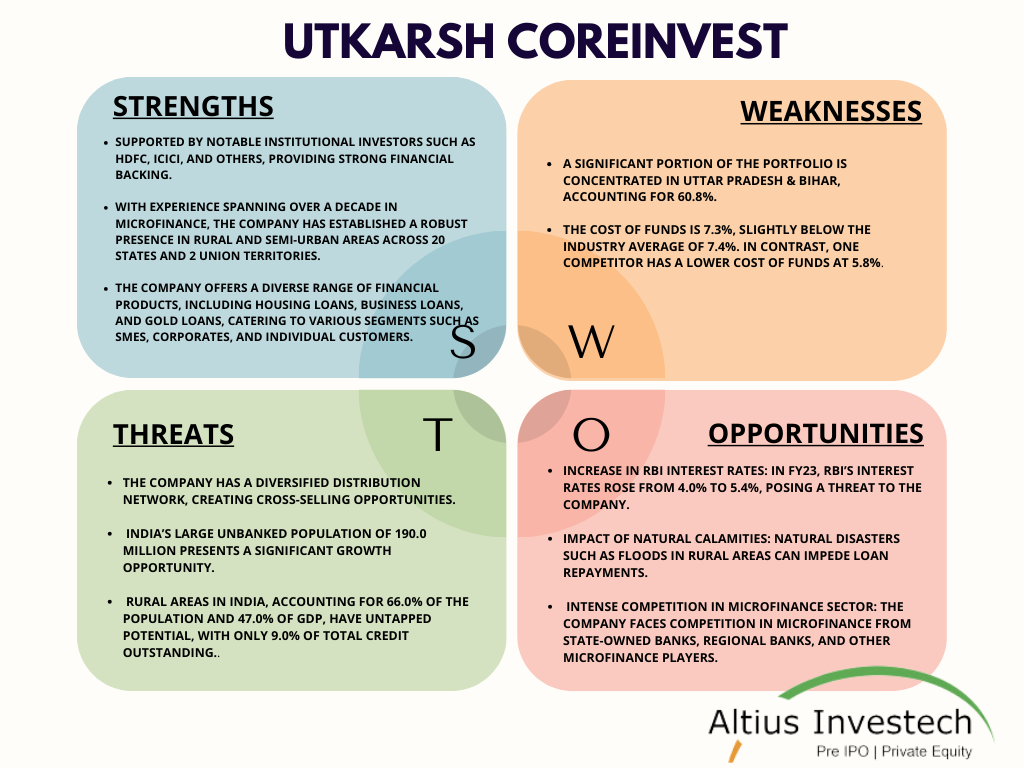

What Differentiates Utkarsh CoreInvest Limited From Its Competitors?

Utkarsh CoreInvest Limited stands out from its competitors such as AU Small Finance Bank, Fincare Small Finance Bank, and Ujjivan Small Finance Bank in several ways. While these competitors are prominent players in the Indian banking sector, Utkarsh CoreInvest Limited differentiates itself by expanding its services across 18 states and union territories, with a network of over 530 outlets and a continuous focus on reaching remote areas. Moreover, investors place trust in Utkarsh CoreInvest Limited, evident from its successful fundraising efforts, having raised over $93.5 million across six funding rounds, compared to AU Small Finance Bank’s $130 million raised over 12 rounds.

Utkarsh CoreInvest Awards & Recognitions:

- Recognized as Microfinance India Organization of the Year (Small and Medium Category) in 2012.

- Honored with the Mix STAR (Socially Transparent And Responsible) Award in 2013.

- Received the MF Transparency Seal of Pricing Transparency Award.

- Acknowledged with CIMSME’s MSME Banking Excellence Award in 2015.

- Awarded the MFIN Awards in 2018 for the “Effective Grievance Redressal Systems” category.

- Received the “Social Impact Initiatives Award” at the 5th Eastern India Microfinance Summit in 2019.

SWOT Analysis

Recent News

Utkarsh Small Finance Bank IPO: Allotment and Listing Details

The allotment for Utkarsh Small Finance Bank IPO was completed on Wednesday, July 19, 2023, with shares listed on both BSE and NSE on July 21, 2023. The IPO price band was set at ₹23 to ₹25 per share, with a minimum lot size of 600 shares per application.

Utkarsh Small Finance Bank Considers Reverse Merger with Utkarsh CoreInvest

Utkarsh Small Finance Bank is considering merging with its holding company, Utkarsh CoreInvest. They received a proposal for a reverse merger, which they will evaluate in an upcoming board meeting. This move is to comply with RBI guidelines on shareholding in banking companies. The bank’s profits increased by 23% in the last quarter, with net interest income also rising. They have re-appointed Govind Singh as managing director and CEO. Utkarsh Small Finance Bank started operations in 2017 and was listed on exchanges in July 2023. Experts predict good returns for the bank due to its presence in underdeveloped areas and strong track record in managing assets.

Share Price of Utkarsh CoreInvest(as of 06.03.2024)

- The buy price of Utkarsh CoreInvest varies based on quantity, ranging from 320 for quantities between 251 – 500 shares to 310 for quantities between 2501 – 4878 shares, with corresponding rates per share.

- The 52-week high is 336, and the 52-week low is 149, indicating the range of fluctuations in the share price. Additionally, the sell price of Utkarsh CoreInvest is fixed at 265.

Financial Metrics for Utkarsh CoreInvest (as of 06.03.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 5.49 |

| Price to Sales Ratio (P/S) | 1.11 |

| Price to Book Value (P/B) | 1.47 |

| Industry PE | 48.62 |

| Face Value | ₹ 10 |

| Book Value | ₹ 211.02 |

| Market Cap | ₹ 3051.05 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

Shareholdings of Utkarsh CoreInvest

| Shareholding above 5% | Holding % |

| CDC Group PLC | 13.95 |

| RBL Bank Limited | 9.86 |

| NMI Frontier Fund KS Norway | 7.83 |

| Faering Capital India Evolving FUND II | 7.78 |

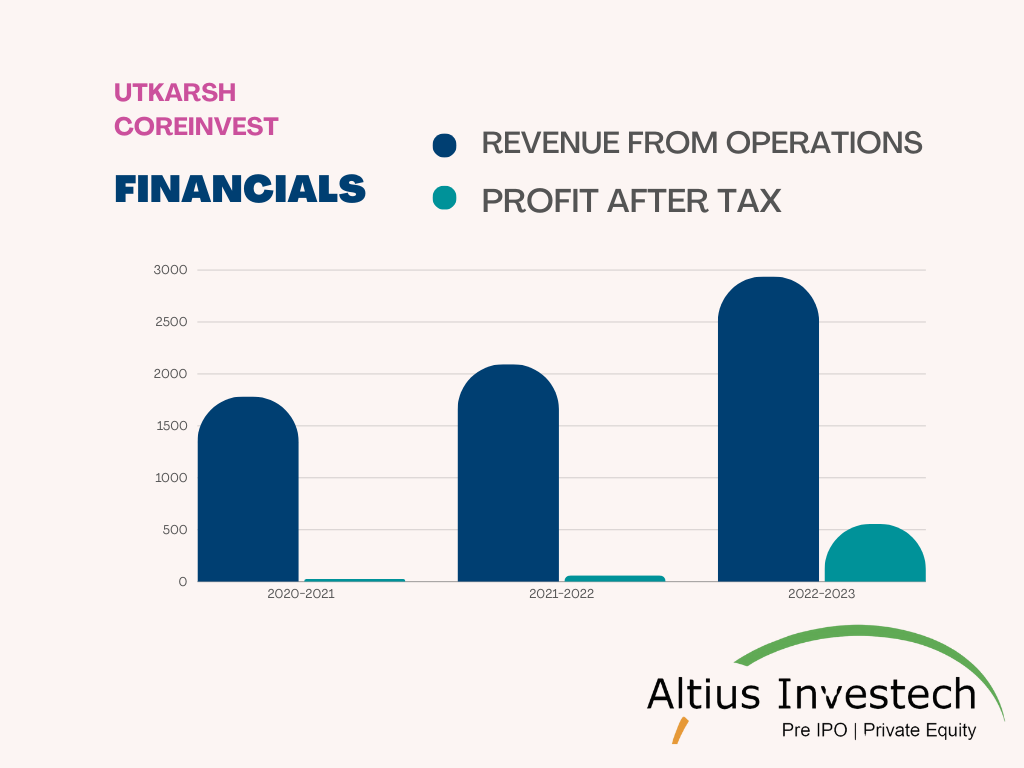

Financials

Amount in (₹ crore)

| Particulars | FY 2022-2023 | FY 2021-2022 | Change y-o-y |

| Deposits | 13,710.1 | 10,074.1 | 36.09% |

| Gross Loan Portfolio | 13,957.1 | 10,630.7 | 31.29% |

| Total Income | 2,804.2 | 2,033.6 | 37.89% |

| Operating Profit | 838.3 | 511.93 | 63.76% |

| Profit After Tax | 404.50 | 61.4 | 558.14% |

| Earning per Share (per share of INR 10.00 each) | 56.45 | 6.36 | – |

The financials reflects significant growth across key financial indicators: deposits and gross loan portfolio increased by over 30%, total income surged by nearly 38%, and operating profit saw a remarkable 64% rise. Profit after tax soared by over 550%, translating to a substantial increase in earnings per share. Overall, the institution has exhibited robust financial performance and profitability.

Value Unlocking

What is Reverse Merger?

A reverse merger is a type of merger where a private company (in this case, Utkarsh CoreInvest) merges with a publicly traded company (Utkarsh Small Finance Bank), allowing the private company to go public without an initial public offering (IPO).So, in essence, a reverse merger allows a private company, such as Utkarsh CoreInvest, to become publicly traded by merging with an already existing public company like Utkarsh Small Finance Bank, without having to go through the lengthy and costly process of an IPO.

Let us understand this with a few examples and understand how the investors have benefited from the reverse merger process.

Example 1: Equitas Holdings & Equitas SFB Reverse Merger

Swap ratio 100:231 – Post the reverse merger, 231 shares of Equitas SFB were issued to the shareholders holding 100 shares in Equitas HL.

Received No Objection from RBI : May, 2022

Received shareholder approval : September, 2022

Final Approval received: 17 January, 2023

Record date: 3rd February,2023

Calculations as per the data on 2nd February 2023

| Current Holding % of Equitas holdings in Equitas SFB | 75% |

| Equitas SFB Market Cap | 6100 crores |

| Holding of Equitas Holdings in Equitas SFB | 4575 crores |

| Equitas Holdings number of shares | 34.7 crores |

| Price per share | 132 |

| Equitas Holdings share price as on record date | 110 |

| Discount | 22 per share (16.6%) |

Example 2: Ujjivan Financial Services & Ujjivan SFB Reverse Merger

Swap ratio 116:10 – Post the reverse merger, 116 shares of Ujjivan SFB will be issued to the shareholders holding 10 shares of Ujjivan FS.

Merger announced: 14 October, 2022

Received approval from NCLT: 8 September, 2023

The process is expected to be finished by the end of FY-24.

Calculations as per the data on 3rd January 2024

| Current Holding % of Ujjivan FS in Ujjivan SFB | 73% |

| Ujjivan SFB Market Cap | 11500 crore |

| Holding of Ujjivan FS in Ujjivan SFB | 8395 crores |

| Ujjivan FS number of shares | 12.1 crores |

| Price per share | 694 |

| Ujjivan FS share price as on record date | 565 |

| Discount | 120 per share (18.6%) |

Example 3: Utkarsh CoreInvest & Utkarsh SFB

We anticipate that Utkarsh will experience something akin to Equitas and Ujjivan. Here, a reverse merger process might occur, giving the investors an opportunity for wealth creation. With precedence, the reverse merger has become more streamlined.

Calculations as per the data on 12 March 2024

| Current Holding % of Utkarsh CoreInvest in Utkarsh SFB | 69% |

| Utkarsh SFB Market Cap | 5468 crores |

| Holding of Utkarsh CoreInvest in Utkarsh SFB | 3773 crores |

| Utkarsh CoreInvest Number of shares outstanding | 9.64 crores |

| Price per share | 390 |

| Utkarsh CoreInvest CMP | 300 |

| Discount | 90 per share (23%) |

Conclusion

Strategic Evolution:

- Utkarsh CoreInvest Limited has demonstrated adaptability and resilience since its establishment, evolving from a microfinance institution to a diversified financial services provider.

- The company’s strategic initiatives, including the transition to a small finance bank and exploration of a reverse merger, underscore its commitment to regulatory compliance and sustainable growth.

Financial Performance:

- The fiscal year 2022-2023 witnessed robust financial performance for Utkarsh CoreInvest Limited, marked by significant growth across key financial indicators.

- Notable increases in deposits, gross loan portfolio, total income, operating profit, and profit after tax reflect the company’s strong market presence and effective operational strategies.

Strategic Initiatives:

- Consideration of a reverse merger with Utkarsh Small Finance Bank indicates the company’s proactive approach to optimizing its organizational structure and enhancing shareholder value.

- Continued focus on regulatory compliance and alignment with Reserve Bank of India guidelines underscores the company’s commitment to governance and risk management.

Market Position and Outlook:

- With support from notable institutional investors and extensive experience in microfinance, Utkarsh CoreInvest Limited is well-positioned for sustained growth and value creation in the Indian financial sector.

- The company’s emphasis on innovation, customer-centricity, and social impact reinforces its role as a key player in driving financial inclusion and fostering economic development nationwide.

Read our other related blogs:

Get in Touch with Us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/