About the Company

Urban Tots, a venture under Deepak Houseware and Toys (DH&T), specializes in the manufacturing and sale of plastic toys, electronic toys, and role-playing items. Their products are not only available in renowned retail outlets such as Hamleys, FirstCry, DMart, and Reliance Retail but also through online platforms like Flipkart and Amazon. Urban Tots is expanding its product line to include metallic toys and wooden toys, a first-of-its-kind initiative in India. With a total of 60 machines operational in the factory and a dedicated wooden toys department, the company is well-equipped for this expansion.

The Rajasthan state government’s DIC scheme has selected Urban Tots for a 5% interest subsidy to foster employment within the state. Despite challenges posed by the COVID-19 pandemic, Urban Tots commenced operations in August 2021 and swiftly generated revenue of Rs. 16 crore within nine months, reaching a total revenue of Rs. 16 crore for FY22, just 20 months after its incorporation on August 6, 2020. Headquartered in ROC-Jaipur, Urban Tots stands as a promising player in the toy industry, blending innovation with quality craftsmanship.

Business Model

The company manufactures and sells toys through a variety of retail outlets like Hamleys, DMart, FirstCry, Vishal Mega Mart, City Kart, VMart, and Reliance Retail, as well as online platforms such as Flipkart and Amazon. They also have their retail outlet named Urban Tots.

| Company Name | Deepak Houseware and Toys Private Limited |

| Company Type | Unlisted Private Company |

| Industry | Manufacturing |

| Founded | 2020 |

| Headquarters | Rajasthan, India |

Products

- Plastic toys

- Electrical Toys

- Baby swimming pool

- Rolls plays

- Other kids wear and activity toys

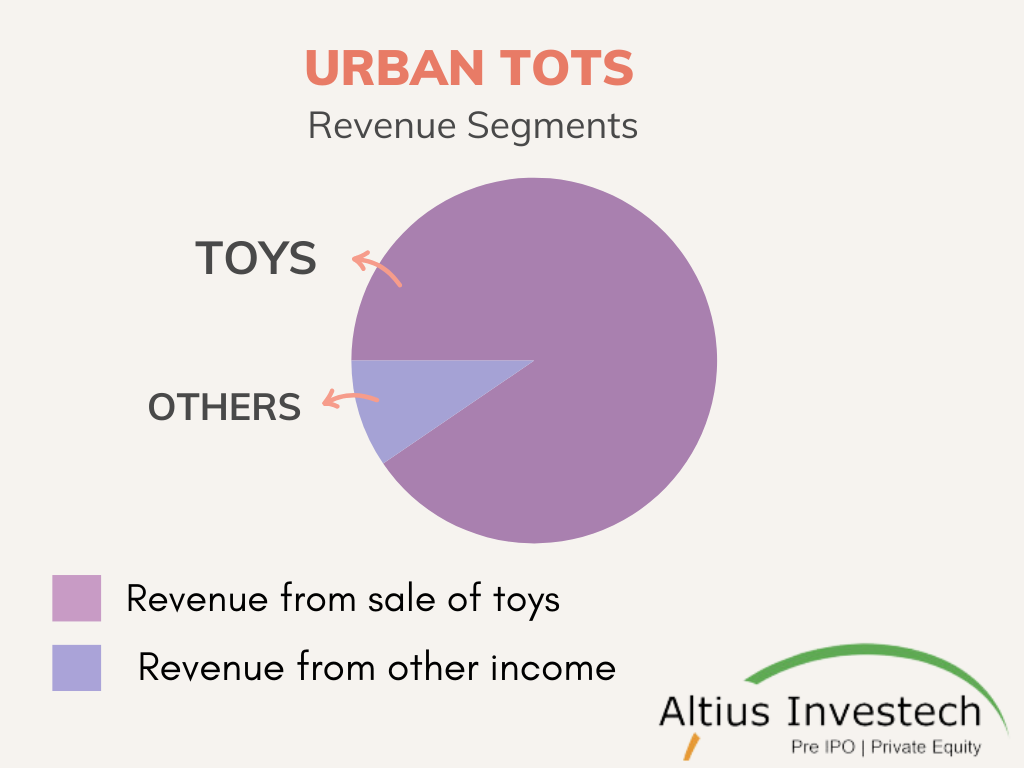

Revenue segments

Management of the Company

Deepak Chaudhary: Director

Satya Chaudhary: Director

Industry Overview

The Indian toy industry has undergone significant growth and transformation, with a remarkable surge in exports by 240% from 2014 to 2023, showcasing its expanding global presence. Despite challenges such as foreign raw material dependence and competition from cheap imports, the industry is poised for substantial growth, driven by government support, increasing consumer demand, and favorable market dynamics. With initiatives like the National Action Plan for Toys (NAPT) and relaxed FDI regulations, the industry is expected to double in value to $2 billion by 2024-25, indicating promising opportunities for both established players and small-scale manufacturers.

Manufacturing Opportunities and Market Size: Labor-intensive segments such as dolls, soft toys, and board games present lucrative manufacturing opportunities in India, driven by cost competitiveness and rising consumer demand. Despite facing hurdles, the Indian toy industry is poised for significant growth, with projections indicating a doubling in value from $1 billion in 2019-20 to $2 billion by 2024-25, showcasing its robust market potential.

Government Policies and Regulations: Recent government interventions have aimed to bolster the Indian toy industry. Notably, the increase in import duties on toys and the implementation of the Toys Quality Control Order (QCO) have been pivotal in ensuring standardized production processes and product safety. Additionally, initiatives like the National Action Plan for Toys (NAPT) underscore the government’s commitment to promoting domestic manufacturing and exports.

Challenges Faced by the Industry: The Indian toy industry grapples with various challenges, including dependence on foreign raw materials, outdated technology, high tax rates, inadequate infrastructure, and stiff competition from low-cost imports, notably from China. Addressing these hurdles is crucial for unleashing the industry’s full potential and fostering sustainable growth.

Government Support and Initiatives: To address industry challenges and promote growth, the government has rolled out several initiatives. These include the vocal for a local campaign, Toycathon, and Aatmanirbhar Toys Innovation Challenge, aimed at fostering innovation, enhancing quality standards, and bolstering competitiveness within the domestic toy sector.

Market Competitors

Major players in the Indian toy industry include Funskool India, Playmates Toys India, Hasbro India, Mattel India, and Simba Toys India, among others. Furthermore, the industry boasts a significant presence of small and medium-sized manufacturers (SMEs), contributing to its vibrant and diverse competitive landscape.

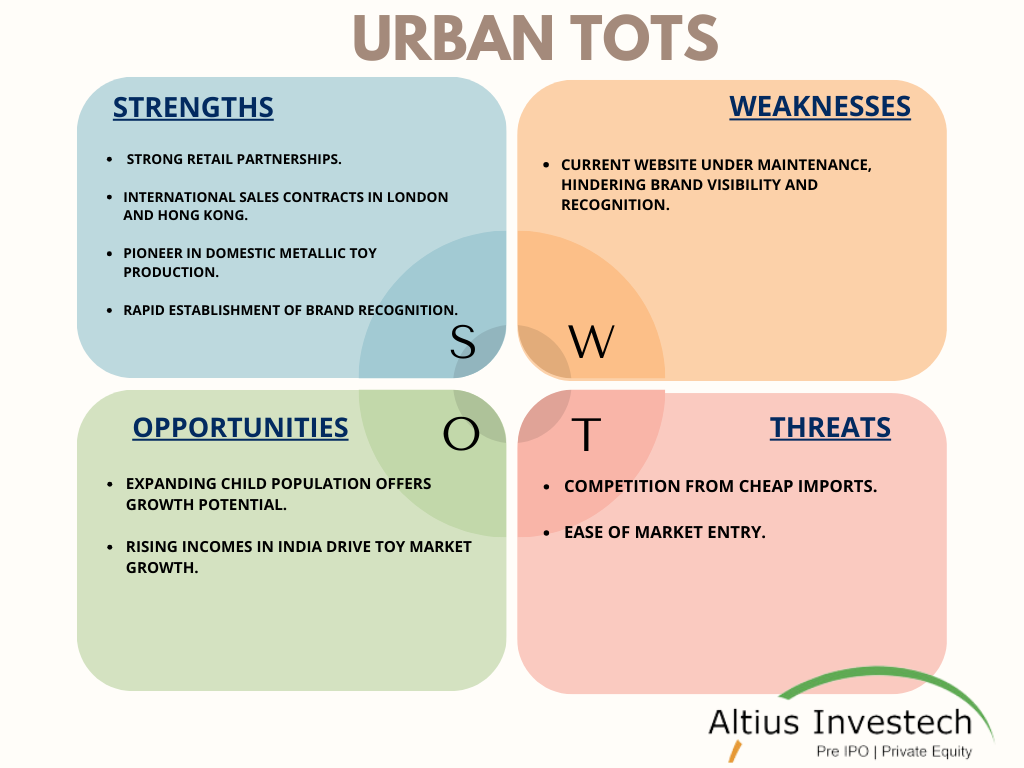

SWOT Analysis

News

Urban Tots and Mahindra Team Up to Transform Indian Toy Market

On February 19, 2024, Urban Tots announced a groundbreaking collaboration with Mahindra, signifying a pivotal moment in the Indian toy industry. This partnership has already yielded significant results, with an order secured for 2,000 Mahindra tractor toy models monthly, contributing an additional Rs 1 crore to the top line. Furthermore, Urban Tots is set to expand its product range by manufacturing XUV700 and Thar toys, aiming for a production ramp-up to 25,000 units within the next 6 months. This strategic move positions Urban Tots as a major player in the premium toy segment, promising substantial growth and brand visibility in the near future.

Indian Oil Corporation Partnered with Urban Tots to Bring Toys to Petrol Pump Stores in January 2023

In January 2023, Indian Oil Corporation (IOC), a leading oil refining and marketing giant, signed an exclusive Memorandum of Understanding (MOU) with Deepak Houseware and Toys Pvt Ltd.(Urban Tots). Under this agreement, Urban Tots was to set up toy shops and kiosks at IOC retail outlets across India, leveraging the company’s extensive network to reach customers, particularly in tier 2 and tier 3 cities. This partnership aimed to enhance customer experience at IOC petrol pumps by offering a range of entertaining toys alongside petroleum products. Urban Tots had expected to inaugurate the first five stores at IOC petrol pumps by February 1, 2023, with the MOU projected to generate an additional annual turnover of 100 crores for the company. With Urban Tots’ products already available at various retail outlets and e-commerce sites, this collaboration further expanded its reach and market presence.

Union Minister Hardeep Puri Inaugurated Toy Kiosk at Urban Tots in Mohali, on April 2023

Following the signing of the exclusive MOU between IOC and Urban Tots, in January 2023, significant strides have been made in solidifying their partnership. On April 2023, Union Minister Hardeep Singh Puri inaugurated a Toy Kiosk at Urban Tots in Mohali, showcasing the collaborative efforts between the startup and IndianOil. This initiative not only highlights Urban Tots’ dedication to providing high-quality toys but also underscores its commitment to fostering entrepreneurship in the country. With IndianOil’s support, Urban Tots aims to expand its reach and offer its products to customers visiting petrol pumps for fuel and other amenities. The partnership, facilitated by the MOU, is set to establish 500 Toy Kiosks nationwide, further strengthening Urban Tots’ presence in the market and Indian Oil’s dedication to enhancing customer experience beyond traditional offerings.

Indian Toy Market Poised for Growth, Expected to Double by 2024-2025

The Indian toy market, valued at $1 billion in 2019-20, is poised for significant growth, doubling in size by 2024-2025, according to a report by FICCI and KPMG. This growth is fueled by increasing demand and a surge in local manufacturing, leading to a rise in exports and a reduction in imports. Factors such as the promotion of “Made in India” toys, higher duties, and stricter import regulations have contributed to this shift. However, the Indian toy industry still lags behind China’s dominance in the global market.

IPO Plans

Urban Tots is gearing up for an IPO within the next 2-3 years, signaling a pivotal moment in its growth journey. This move will fuel expansion plans, including market penetration and product innovation, while enhancing brand visibility and unlocking value for stakeholders.

Urban Tots Share Price (as of 18.03.2024)

- The buy price of Urban Tots varies based on quantity, ranging from 77 for quantities between 1000-1999 shares to 74 for quantities between 10000 – 24999 shares, with corresponding rates per share.

- The 52-week high is 78, and the 52-week low is 39 indicating the range of fluctuations in the share price. Additionally, the sell price of Urban Tots is fixed at 52.

Currently, Urban Tots Share Price is trading at around Rs. 75/share. CLICK HERE to Invest.

Financial Metrics for Urban Tots (as of 18.03.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 97.37 |

| Price to Sales Ratio (P/S) | 7.09 |

| Price to Book Value (P/B) | 48.68 |

| Industry PE | – |

| Face Value | ₹ 1 |

| Book Value | ₹ 1.52 |

| Market Cap | ₹352.67 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

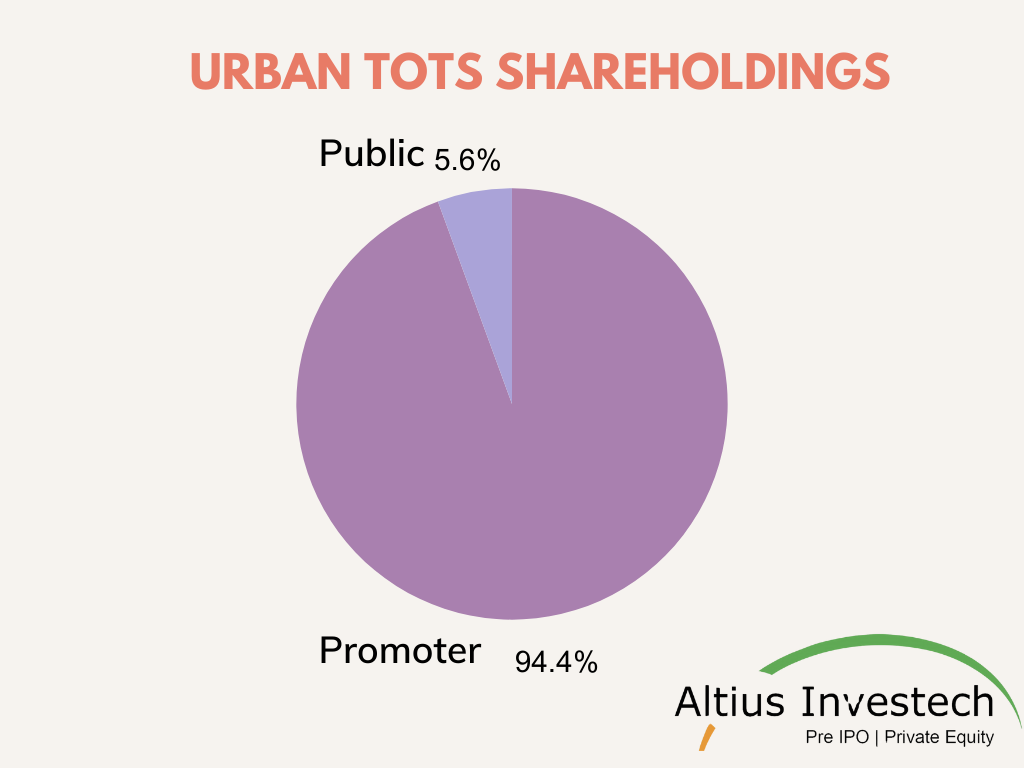

Shareholdings of Urban Tots

| Shareholding Above 5% | Holding % |

| Deepak Choudhary | 56.42 |

| Satya Choudhary | 38 |

Financials

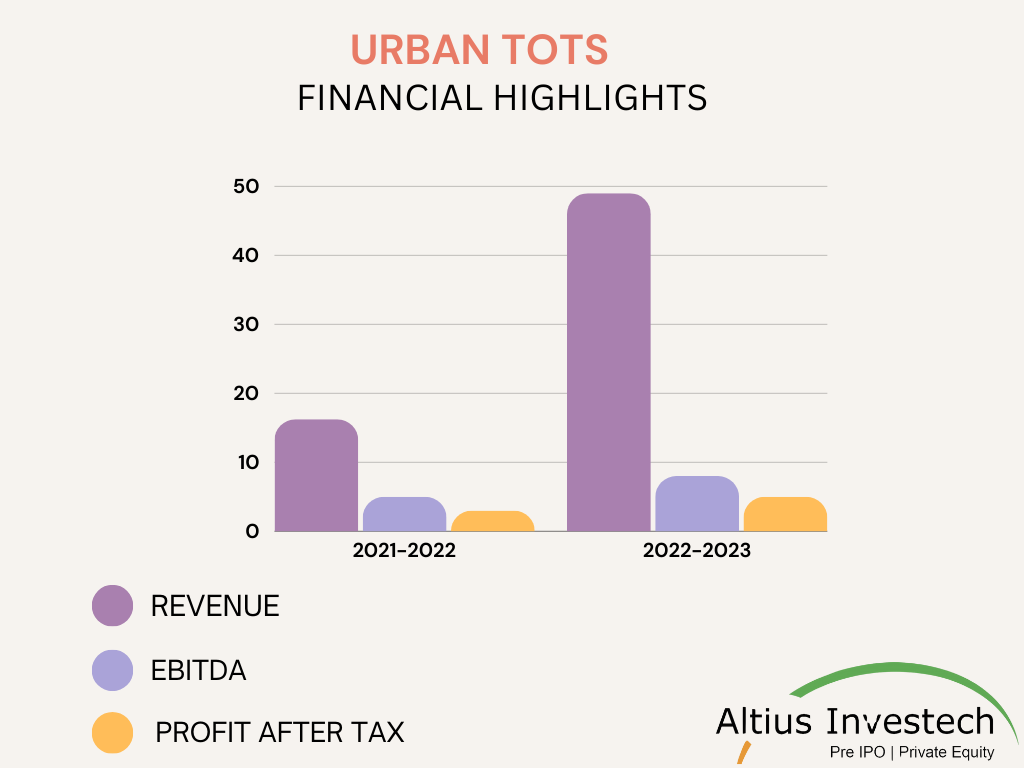

₹ (in crores)

| Particulars | FY 2023 | FY 2022 | Growth |

| Revenue | 49.15 | 16.23 | 202.8% |

| Profit After Tax | 4.18 | 2.42 | 73% |

| EBITDA | 7.97 | 4.82 | 65.3% |

In FY 2023, Deepak Houseware & Toys Private Limited witnessed remarkable growth in its financial performance compared to FY 2022. Revenue surged by 202.8% to ₹49.15 crores, while Profit After Tax (PAT) rose by 73% to ₹4.18 crores. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) also increased by 65.3% to ₹7.97 crores. These figures indicate strong sales, improved profitability, and efficient cost management, reflecting positive momentum for the company.

Key Highlights(1/2):

- Diverse Product Line: Urban Tots, a subsidiary of Deepak Houseware and Toys Private Limited, offers a wide range of toys, including plastic, electronic, and role-playing items, with plans to expand into metallic and wooden toys.

- Partnership with Indian Oil Corporation: Strategic collaboration with Indian Oil Corporation to set up toy kiosks at petrol pump stores, enhancing market presence and customer reach.

- Government Support: Beneficiary of the DIC scheme by the Rajasthan state government, reflecting governmental support for expansion and employment generation.

- Financial Performance: Significant growth in FY 2023, with revenue surging by 202.8%, Profit After Tax increasing by 73%, and EBITDA rising by 65.3% compared to FY 2022.

Key Highlights(2/2):

- Management Strength: Urban Tots’ strong management team, coupled with a focus on innovation, quality, and strategic partnerships, positions the company for continued success and growth in the Indian toy industry.

- Expansion Initiatives: Urban Tots is expanding its product line to include metallic and wooden toys, a pioneering move in the Indian toy industry, demonstrating innovation and adaptability.

- Market Positioning: Urban Tots’ presence in renowned retail outlets like Hamleys, DMart, and FirstCry, along with its online presence on platforms like Flipkart and Amazon, underscores its strong market positioning and distribution network. The company’s commitment to quality craftsmanship and innovation resonates with consumers, contributing to its rapid growth and market acceptance.

- Future Prospects: With favorable government policies, increasing consumer demand, and a growing emphasis on domestic manufacturing, Urban Tots is well-positioned to capitalize on the burgeoning Indian toy market. Continued focus on product diversification, strategic partnerships, and market expansion is expected to drive sustained growth and solidify Urban Tots’ position as a key player in the Indian toy industry.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

ALSO READ: