About the Company

PayMate, established in May 2006, is a leading provider of B2B payments for Enterprises and SMEs across supply chains. The platform offers a digital workflow tied to payments, ensuring better control, transparency, improved cash flows, and end-to-end reconciliation. This enhances the experience for Enterprises and SMEs in closed-loop supply chains. PayMate has a presence in South Asia (India) and UAE and is actively expanding across CEMEA and APAC. The company partners with major Visa commercial card-issuing banks to streamline credit for payables and receivables, replacing traditional cash, cheque, and EFT with card payments. This offers risk-mitigating benefits for banks and allows buyers more time to pay. The platform boasts features such as Procure to Pay automation, credit assessment, and a discount marketplace. It also provides APIs for seamless integration into existing accounts or ERP systems. Being cloud-based, it’s accessible on all devices, ensuring a smooth deployment process.

| Company Name | Paymate India Limited |

| Company Type | Unlisted Public Company |

| Industry | Fintech/Digital Payments |

| Founded | 2006 |

| Headquarters | Mumbai, Maharashtra, India |

| Website | paymate.in |

PayMate Business Model Overview

PayMate operates as a pioneering entity within the digital technology-based B2B payment services market. The company’s primary objective is to enhance the efficiency of B2B supply chain payment processes by leveraging its platform across the entire value chain. This includes various stakeholders such as:

- Customers: These are entities that have engaged in contracts with PayMate or have registered and downloaded the application to access the company’s service offerings within its ecosystem, platforms, or mobile application.

- Users: This category encompasses individuals or businesses that have utilized the PayMate platform for making or receiving payments without entering into any formal contracts, registration, or app downloads.

- Financial Institution Partners: PayMate collaborates with financial institutions that offer corporate credit cards and other financial products to the company’s customers. These products enable payments to vendors, suppliers, dealers, and distributors of PayMate’s customers, as well as facilitate receiving payments from the buyers of these customers.

Through its comprehensive approach, PayMate aims to streamline B2B payment processes, foster greater efficiency, and provide seamless transaction experiences for all stakeholders involved in the B2B supply chain ecosystem.

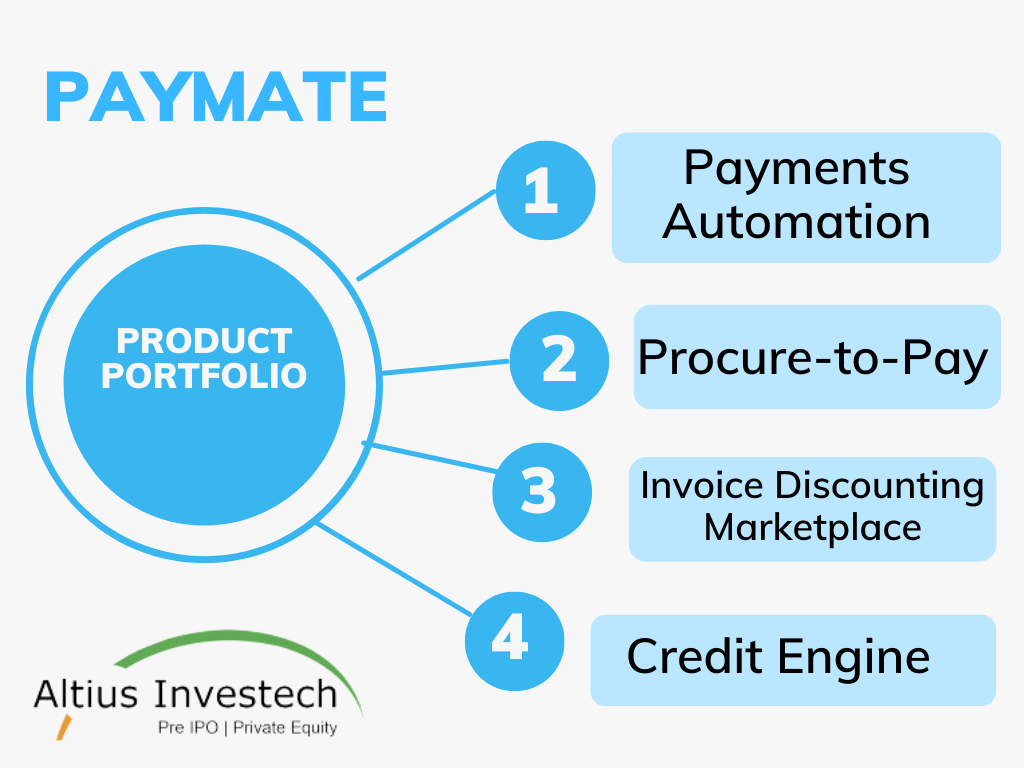

Product Portfolio

Payments Automation

- It simplifies vendor and tax payments, providing advantages like Effortless supplier onboarding through bulk upload and E-KYC.

- Early vendor payments using commercial credit cards, extending payable days.

- Convenient GST payments with commercial credit cards under a single login.

- Direct tax payments, utility bill payments, and seamless payment collection via email and WhatsApp.

- Tailorable approval workflows and automated reconciliations. Instant access to real-time reports for clear visibility into cashflows and transaction history.

Procure-to-Pay

PayMate’s Procure-to-Pay facilitates seamless API integrations with existing ERPs, digital approval of procurement tasks, and real-time status tracking for increased efficiency in payment processing and reporting using commercial credit cards.

Invoice Discounting Marketplace

PayMate’s Invoice Discounting Marketplace facilitates real-time negotiations for discounts on invoices and smooth integrations with ERPs. It provides suppliers with the option for early payments in exchange for discounts and ensures same-day payment processing using commercial credit cards.

Credit Engine

PayMate’s Credit Engine provides AI/ML-driven credit analysis, cash flow and seasonality evaluation, and fully automated, high-accuracy credit assessments for businesses, including SMEs.

Awards and Recognition

- 2018: Finalist at Citi India Fintech Challenge

- 2021: BT-KPMG Best Bank and Fintech Jury Award for Best Fintech

- 2020: BT-KPMG Best Bank and Fintech Jury Award for Best Fintech

Management of the Company

Ajay Adiseshan: Founder and CEO

Ajay Adiseshan, the Founder and CEO of Paymate, is responsible for strategizing, planning, and driving growth, as well as nurturing investor relationships. He leads product innovation and oversees the Company’s operations to achieve its targets. With a bachelor’s degree in science (electrical engineering) from the University of Colorado Boulder, USA, he brings entrepreneurial experience from founding technology companies like Coruscant Tec Private Limited and Web Resource Private Limited, a web development firm.

Vishvanathan Subramanian: CFO & Director

Vishvanathan Subramanian, also known as Ravi, serves as the Whole-time Director and Chief Financial Officer of Paymate. He joined the Company on May 1, 2007. In his current capacity, he oversees collaboration among various departments to ensure operational synergy. Vishvanathan manages operational, financial, and risk management activities, as well as legal and financial compliance. Holding a bachelor’s degree in commerce from the University of Bombay, he is a qualified chartered accountant. Before joining the Company, he was a partner at Hrishikesh Vishvanathan & Associates, Chartered Accountants.

Rakesh Khanna: Chief Commercial Officer

Rakesh Khanna, the Chief Commercial Officer, brings over two decades of experience in the financial services industry to the Company. Previously, he led Business Solutions for Visa in the CEMEA region for seven years, including overseeing business payments for Europe from October 2016 to May 2018. Before his tenure at Visa, he spent a decade at Standard Chartered Bank, where he led global products and solutions for the corporate bank, encompassing lending, asset-backed finance, and trade finance. He commenced his career with GE Capital in India, focusing on sales, and later held various roles in the US and UK, including sales, relationship management, Six Sigma, and Lean.

Nanda Harish: General Counsel, Company Secretary, and Compliance Officer

Nanda Harish, serving as the General Counsel, Company Secretary, and Compliance Officer, boasts two decades of extensive experience as an award-winning legal counsel in Fintech, Payments, AML, and Privacy domains. She leads the legal and corporate secretarial functions for PayMate, specializing in Strategic Legal Advisory, Investor Relations, Legal Risk Mitigation, Business Compliance, Ethics, and Corporate Governance. In her leisure time, Nanda engages in charitable endeavors supporting destitute women through non-profit organizations.

Industry Overview

The digital payments industry, with key players like PayMate and Paytm alongside industry giants such as PayPal, Square, and Stripe, is experiencing rapid expansion driven by technological innovations and changing consumer preferences. Businesses increasingly rely on digital payment solutions for streamlined transactions, cost reduction, and enhanced efficiency, spurred by the growing demand for convenience and the rise of e-commerce. Advancements in fintech technologies like blockchain and artificial intelligence, coupled with regulatory initiatives promoting digital financial inclusion, further fuel industry growth. Despite challenges such as cybersecurity threats and regulatory compliance, the outlook remains promising, with companies like PayMate, Paytm, and others poised to capitalize on opportunities through innovation and strategic partnerships, shaping the future of finance in the digital era.

Future Prospects in B2B Payments

- Global Growth: According to RedSeer estimates, the global B2B payments market is anticipated to witness substantial growth, soaring from USD 130-135 trillion in 2021 to USD 165-170 trillion by 2025. Cross-border transactions are projected to constitute approximately 16% of total B2B transactions by value in 2025. Despite digital advancements, cash and cheque transactions still dominate, comprising around 51% of payments, with card payments at a mere 3%. However, as companies increasingly digitize their payments, it’s anticipated that the share of cash and cheque transactions will decrease to 46% by 2025, while digital payment modes such as ACH and cards will witness a surge in usage.

- Global Transaction Volume (TPV) Growth: The total global TPV for B2B payments, excluding cross-border transactions, grew from approximately USD 101 trillion in 2018 to USD 114 trillion in 2021. RedSeer predicts this figure to rise to around USD 142 trillion by 2025, representing a compound annual growth rate (CAGR) of 5.7% from 2020.

- Adoption of Cards: As payment infrastructure expands and businesses increasingly adopt commercial credit cards for B2B payments, the adoption of cards is expected to rise. RedSeer suggests that commercial credit cards will be increasingly utilized for B2B transactions, moving away from employee-driven travel and entertainment expenses.

- Indian Market Growth: In India, the B2B payments market is set to witness significant growth, with projections indicating an increase from USD 7.6-8.0 trillion in Fiscal 2022 to USD 10-11 trillion by Fiscal 2026. Despite the global shift towards digital payments, cash and cheque transactions still dominate India’s B2B landscape, constituting 55% of domestic B2B payments in Fiscal 2022. However, it’s anticipated that the share of cash and cheque transactions will decrease, with commercial credit cards expected to increase their share to 0.6% by Fiscal 2026, in line with global trends.

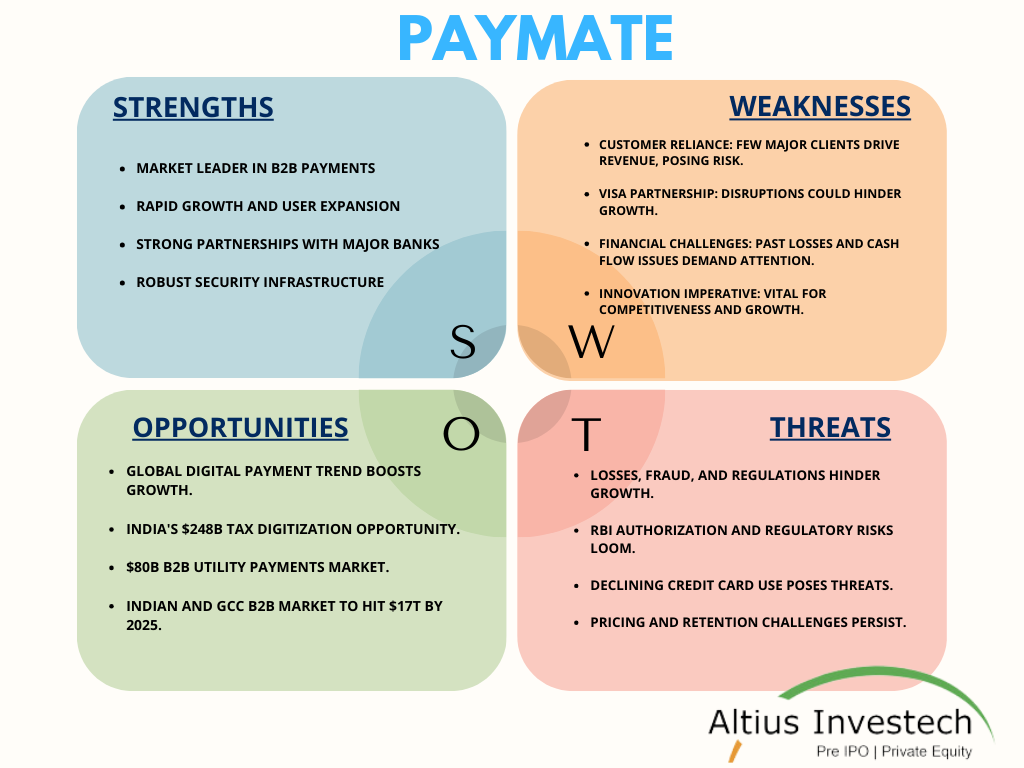

SWOT Analysis

News

PayMate and National Bank of Oman Partner to Digitize B2B Transactions

In January 2024, PayMate and the National Bank of Oman (NBO) joined forces to digitize B2B transactions, marking a significant advancement in Oman’s financial landscape. Through this strategic partnership, PayMate’s innovative solutions will modernize B2B payment processes using Visa Business Credit Cards, providing NBO’s corporate and SME clients with a more efficient transaction method. The collaboration promises enhanced business efficiency with detailed reporting, quick reconciliation, and transparent cash flow visibility. Additionally, Visa Business Credit Cardholders from NBO will enjoy exclusive benefits, including travel insurance and access to airport lounges worldwide. Maha Saud Al Raisi, Assistant General Manager of Retail Products at NBO, expressed enthusiasm about empowering local businesses, while Ashwin Shenoy, Vice President & Business Head, of CEMEA at PayMate, highlighted the partnership’s significance in offering B2B payment solutions in Oman.

Retail B2B Rental Collections Facilitated through Partnerships between Visa, Merex Investment, and PayMate

On 14th March 2024, Visa, Merex Investment, and PayMate partnered to digitize B2B rental collections in the UAE retail sector. In this partnership, PayMate plays a crucial role in facilitating B2B rental collections through Visa’s BPSP solution. PayMate’s platform enables the integration of Visa’s payment solution, allowing non-card-accepting suppliers like Merex Investment to receive payments made on card rails directly into their bank accounts. PayMate’s involvement enhances the efficiency of the rental collection process, eliminates the need for manual reconciliation, and provides secure channels for payment transactions. This underscores PayMate’s relevance as a fintech solution provider specializing in streamlining B2B payment processes and driving digital transformation in financial transactions. Through its technology rails, PayMate empowers businesses like Merex Investment to digitize their operations, improve cash flow management, and enhance overall business efficiency.

RBI Ceases Card-Based B2B Payments Due to Violations

On February 15, 2024, the Reserve Bank of India (RBI) announced that card-based business-to-business payments, facilitated by payment intermediaries, have been suspended due to violations of the Payment and Settlement Systems Act of 2007. This action affects fintech companies like Paymate and EnKash, which collaborate with Visa under its BPSP program to provide B2B payment services through commercial cards. The RBI cited concerns about intermediaries accepting payments from corporates and transferring funds to unauthorized recipients, violating KYC regulations. As a result, Visa instructed these fintech startups to cease their business payment services through commercial cards.

PayMate Raises Funds at ₹557 Per Share

In October 2023, PayMate secured funding from CXI Valley at a share price of ₹557. This investment underscores investor confidence in PayMate’s growth potential.

PayMate Expanded into Fintech with Acquisition of Zaitech

In 2018, PayMate acquired Zaitech, a digital lending platform, marking its entry into the fintech sector. This move was strategic as it allowed PayMate to integrate technology-driven lending solutions, such as machine learning and data insights, into its existing offerings. With this acquisition, PayMate aimed to strengthen its payment operations, provide easier access to growth capital for its vast network of 20,000 registered businesses, and ensure timely payments to SMEs through a newly acquired payment gateway. Additionally, PayMate planned to leverage this acquisition to foster collaborations with banks and NBFCs, further expanding its reach and influence in the fintech landscape.

Peer Comparison

| COMPANIES | REVENUE | PAT | EPS |

| PayMate | 1351.59 | (55.74) | (9.69) |

| PayTM | 8400 | (1776.65) | (27) |

IPO Plans

PayMate’s chairman and managing director, Ajay Adiseshan, revealed that the company is gearing up for an Initial Public Offering (IPO) within the next six to nine months – announced in October 2023. He highlighted several positive developments setting the stage for the IPO, including contractual wins, global expansion efforts, and ongoing implementation and execution activities.

DRHP was initially released on: May 30, 2022.

Fresh Issue: ₹1,125 crore

Offer-For-Sale: ₹375 crore.

SEBI had advised PayMate to refile its prospectus.

Paymate India Limited Share Price (as on 18.03.2024)

- The buy price of Paymate India Ltd. varies based on quantity, ranging from 480 for quantities between 100 – 199 shares to 465 for quantities between 1000 – 5000 shares, with corresponding rates per share.

- The 52-week high is 549, and the 52-week low is 360 indicating the range of fluctuations in the share price. Additionally, the sell price of Paymate India Ltd is fixed at 400

Currently, Paymate India Limited Share Price is trading at around Rs. 470/share. CLICK HERE to Invest.

Financial Metrics for Paymate India Limited (as of 18.03.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | (48.14) |

| Price to Sales Ratio (P/S) | 3.93 |

| Price to Book Value (P/B) | 1788.46 |

| Industry PE | – |

| Face Value | ₹ 1 |

| Book Value | ₹ 0.26 |

| Market Cap | ₹5301 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

.

Institutional Investor

| Institutional Investor | First Investment Date | Investment Amount |

| Felicitas Global Partners | August 24, 2021 | $4.03M |

| Astor Management | August 24, 2021 | $4.03M |

| CXI Valley I | August 24, 2021 | $4.03M |

| Visa | April 23, 2019 | $25M |

| Brand Capital | April 23, 2019 | $25M |

| Recruit Strategic Partners | April 23, 2019 | $25M |

| IPO Wealth | October 12, 2017 | $2.49M |

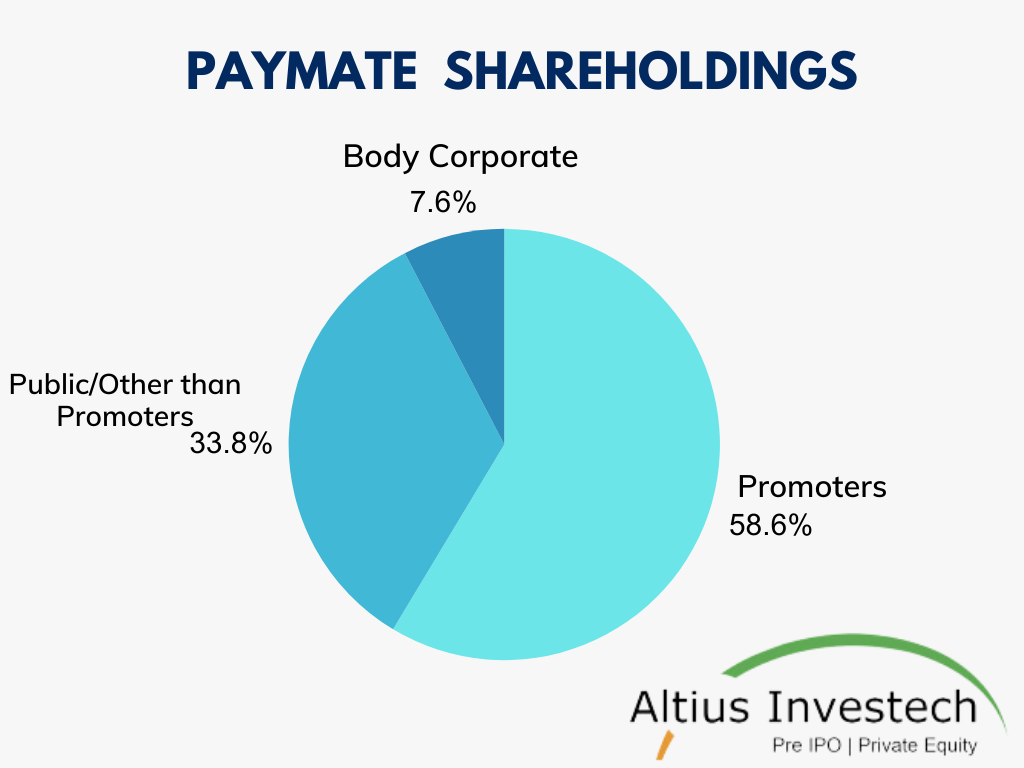

Shareholding Pattern

| SHAREHOLDING PATTERN | Number of shares | Percentage |

| Promoters | 3,38,07,050 | 58.62% |

| Public/Other than promoters: Individual | 1,94,62,068 | 33.75% |

| Body corporate | 43,99,634 | 7.63% |

Financials

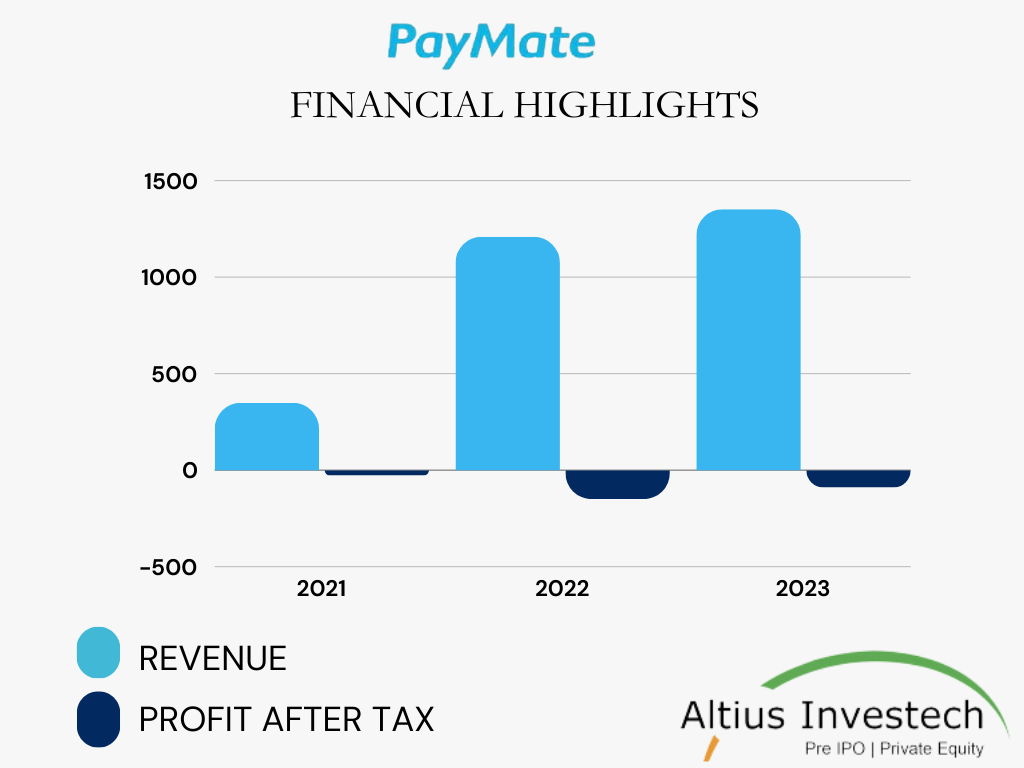

₹ (in crores)

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Total Income | 1351.59 | 1209.22 | 349.02 |

| Profit After Tax | (55.73) | (57.74) | (28.11) |

| Earning per share | (9.69) | (10.65) | (5.41) |

In FY23, PayMate managed to reduce its consolidated net loss by 3.5% to INR 55.7 Cr compared to INR 57.7 Cr in FY22, while experiencing an 11.7% growth in operating revenue to INR 1,350.1 Cr. However, total expenses rose by 11% to INR 1,407.3 Cr, with 95% attributed to the cost of materials. Notably, the company’s expenditure on materials consumed increased by 11% to INR 1,339 Cr from INR 1,207.5 Cr in FY22. Employee benefit expenses saw a slight increase of 1.6% to INR 50.5 Cr, and advertising promotional expenses more than tripled to INR 1.3 Cr from INR 44.7 Lakh in FY22.

PayMate also reported a significant increase in sales, with an 84.53% surge in customer adoption, reaching over 390,000 customers. With a strong customer base in India and the UAE, PayMate is expanding to the CEMEA and APAC regions. In FY23, the company recorded a total payment volume of INR 84,519 Cr, reflecting a 21% year-over-year increase.

PayMate Operating Efficiency

- Despite ongoing losses, PayMate exhibits positive growth through service enhancements and client base expansion, notably processing a substantial TPV through Visa cards due to strategic partnerships.

- Leveraging cash deposits as collateral with payment gateway partners allows for reduced Acquiring Rates, thereby enhancing gross margins.

- With plans to allocate a portion of Net Proceeds as collateral, PayMate aims to further optimize Acquiring Rates and improve gross margins, capitalizing on this operational efficiency opportunity.

Conclusion (1/2)

Resilience and Growth: Despite facing losses in previous financial years, PayMate has demonstrated resilience and achieved significant growth in the competitive fintech landscape.

Revenue Growth: The company’s revenue surged to ₹1351.59 crores in FY2023, fueled by strategic partnerships, geographical expansion efforts, and a growing client base of over 390,000 customers.

Operational Efficiency: PayMate showcased operational efficiency through cost management strategies, leveraging cash deposits as collateral to reduce Acquiring Rates and enhance gross margins.

Partnership and Expansion: Strategic collaborations with financial institutions like Visa and expansion into regions such as South Asia, UAE, CEMEA, and APAC position the company for sustained growth and market penetration.

Investor Confidence: PayMate’s ability to attract investments from institutional investors reflects confidence in its business model and growth prospects.

Conclusion (2/2)

IPO Plans: The company is gearing up for an Initial Public Offering (IPO) within the next six to nine months, as announced in October 2023. Despite SEBI’s advice to refile its prospectus, positive developments such as contractual wins and global expansion efforts set the stage for the IPO.

Recent News: PayMate’s strategic partnership with the National Bank of Oman to digitize B2B transactions and its collaboration with Visa, and Merex Investment to digitize B2B rental collections in the UAE retail sector underscore the company’s commitment to innovation and market expansion. However, the suspension of card-based B2B payments by the RBI due to violations poses challenges for PayMate and similar fintech companies.

Financial Performance: While experiencing revenue growth, PayMate managed to reduce its consolidated net loss in FY2023. However, total expenses rose primarily due to material costs. With plans to optimize Acquiring Rates and improve gross margins, the company aims to enhance profitability and capitalize on its operational efficiency.

Promising Outlook: Despite challenges, PayMate’s strong revenue growth, strategic partnerships, operational efficiency, IPO plans, and recent news developments indicate a promising outlook as it navigates the evolving fintech landscape.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/