About the Company

Suraj Estate Developers is a well-known brand in Dadar, Mahim, and Prabhadevi, Mumbai, with a history dating back to 1986. They have completed 36 projects covering over 10 lac sq. ft in prime locations. Specializing in redevelopment, Suraj combines luxury with spaciousness, aiming to simplify living and provide a high-quality experience. With a prestigious clientele like ICICI Bank and Union Bank, Suraj Estate Developers, led by founder Mr. Thomas Rajan, is recognized for its commitment, meticulousness, and iconic constructions, promising opulent living within promised timelines.

SURAJ DEVELOPERS: “A Fantastic Journey in Building Homes”

Suraj Estate Developers IPO is a book-built issue of Rs 400.00 crores. The issue is entirely a fresh issue of 1.11 crore shares.

Iti Capital Ltd and Anand Rathi Securities Limited are the book running lead managers of the Suraj Estate Developers IPO, while Link Intime India Private Ltd is the registrar for the issue.

Suraj Estate Developers IPO Details

| IPO Date | December 18, 2023 to December 20, 2023 |

| Face Value | ₹5 per share |

| Price Band | ₹340 – ₹360 per share |

| Lot Size | 41 shares |

| Total Issue Size | 11,111,111 shares ( aggregating up to ₹400.00 Crore) |

| Fresh Issue | 11,111,111 shares (aggregating up to ₹400.00 Crore) |

| Issue Type | Book Built Issue IPO |

| Listing at | BSE, NSE |

| Share Holding pre issue | 33,250,000 |

| Share Holding post issue | 44,361,111 |

Suraj Estate Developers IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50.00% of the Net offer |

| Retail Shares Offered | Not less than 35.00% of the Offer |

| NII (HNI) Shares Offered | Not less than 15.00% of the Offer |

Suraj Estate Developers IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 41 | ₹14,760 |

| Retail (Max) | 13 | 533 | ₹191,880 |

| S-HNI (Min) | 14 | 574 | ₹206,640 |

| S-HNI (Max) | 67 | 2,747 | ₹988,920 |

| B-HNI (Min) | 68 | 2,788 | ₹1,003,680 |

IPO Objectives

- Repayment/Prepayment of the aggregate outstanding borrowings of the company and its subsidiaries, Accord Estates Private Limited and Iconic Property Developers Private Limited.

- Acquisition of land or land development rights.

- General corporate purposes.

IPO GMP

Suraj Estate Developers IPO GMP is ₹51, as on Dec 13th 2023.

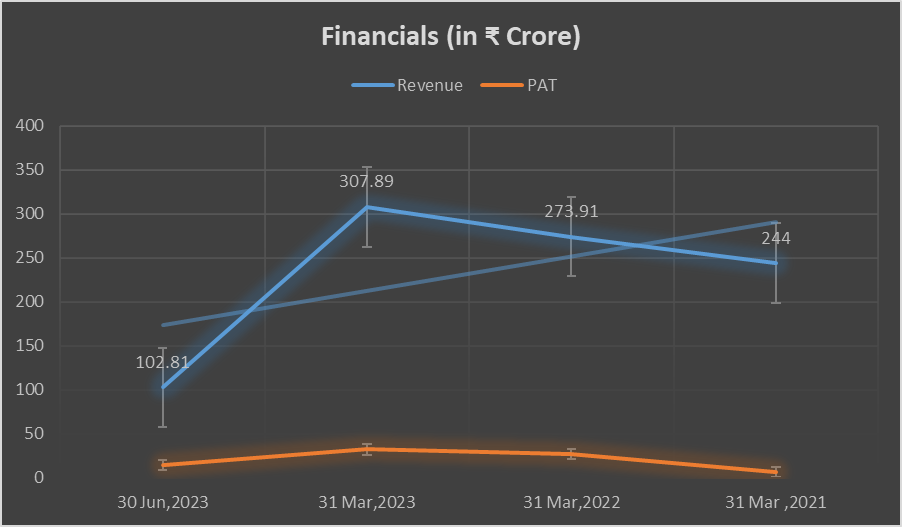

Suraj Estate Developers Limited Financial Information (Consolidated)

Amount in ₹ Crore

| Particulars | 30 Jun, 2023 | 31 Mar,2023 | 31 Mar,2022 | 31 Mar,2021 |

| Assets | 994.73 | 942.58 | 864.00 | 792.00 |

| Revenue | 102.81 | 307.89 | 273.91 | 244.00 |

| Profit after Tax | 14.53 | 32.06 | 26.50 | 6.28 |

| Net Worth | 86.11 | 71.39 | 39.16 | 29.15 |

| Reserves and Surplus | 70.29 | 55.48 | 23.32 | 22.94 |

| Total Borrowing | 598.50 | 593.09 | 638.16 | 600.48 |

Key Performance Indicator

| KPI | Values |

| P/E (x) | 35.64 |

| Market Cap (₹ Cr.) | 1597 |

| ROCE | 21.93% |

| ROE | 58.18% |

| Debt/Equity | 8.31 |

| EPS (₹) | 10.1 |

| RONW | 58.18% |

Strengths

- Experience: Over 30 years of expertise in the field of redevelopment.

- Prime Locations: Projects in the heart of Mumbai – Mahim, Dadar, and Prabhadevi.

- Impressive Track Record: Successfully delivered 36 projects, spanning over 10 lac sq. ft.

- Luxurious Living: Creative collaboration of luxury with spaciousness for a high-quality lifestyle.

- Prestigious Clientele: Trusted by renowned institutions like ICICI Bank, Union Bank, and NSE.

- Founder’s Commitment: Founded by Mr. Thomas Rajan, known for commitment and quality-consciousness.

- Iconic Constructions: Meticulously designed homes in projects like Louisandra, Lumiere, and Tranquil Bay.

- Customer Satisfaction: Happy customers and a niche in redeveloping premium properties in Mumbai.

Risks

- Market Fluctuations: Vulnerability to changes in the real estate market that may impact property values.

- Project Delays: Possibility of construction delays, affecting the timely delivery of homes.

- Regulatory Challenges: Exposure to regulatory changes or approvals that could impact development plans.

- Economic Factors: Sensitivity to economic downturns affecting purchasing power and demand.

- Competition: Increasing competition in the real estate sector may pose challenges for market share.

- Financing Risks: Dependency on external financing, subjecting the company to interest rate fluctuations.

- Execution Risks: Potential challenges in executing large-scale projects with meticulousness.

- Customer Satisfaction: Risks associated with ensuring customer satisfaction and resolving any grievances promptly.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/