In the dynamic landscape of the energy sector, Sterlite Power, a leading global developer of power transmission infrastructure, Sterlite Power’s recently released its Q3-FY24 shareholder update.

This comprehensive report sheds light on the company’s recent achievements, financial performance, future outlook, and the broader market trends impacting its operations.

Infrastructure Business Achievements:

In India:

- Contract Win in Rajasthan: Sterlite Power secured a significant contract for a transmission project in Rajasthan, contributing to the state’s renewable energy goals.

- Expansion of Green Energy Portfolio: With the Rajasthan project, Sterlite Power now manages a total of eight green energy projects, reinforcing its commitment to sustainable energy infrastructure.

- Progress on Ongoing Projects: Sterlite Power is advancing on various projects across India, including those in Mumbai, Goa, and Nangalbibra Bongaigaon. These projects are crucial for enhancing power transmission infrastructure and meeting growing energy demands.

In Brazil:

- Marituba Transmission Project: Approval and financing secured for the Marituba Transmission project in Brazil highlight Sterlite Power’s efforts to expand its presence in international markets.

New Contracts for GPS Division:

- Diverse Contract Wins: Sterlite Power’s Global Products & Services (GPS) division secured new contracts valued at approximately INR 1,400 crores. These contracts, obtained from both domestic and international markets, demonstrate Sterlite Power’s global leadership in the power sector.

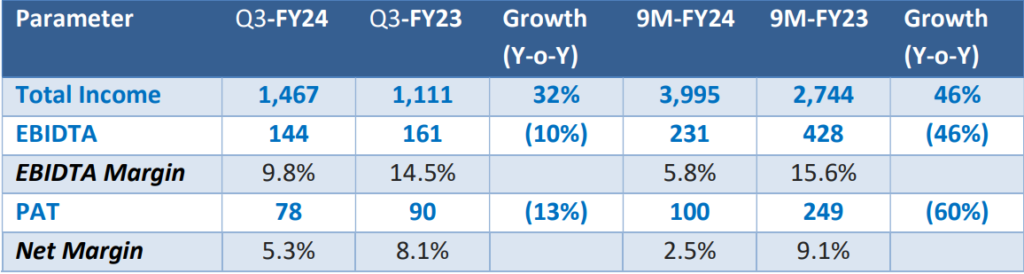

Financial Highlights for Q3 & 9M-FY24:

Factors Contributing to Financial Performance:

- EBIDTA Drop: The company experienced a decrease in EBITDA for the nine months ending December 31, 2023, compared to the same period in the previous fiscal year.

This decline is primarily attributed to increased EPC contract costs for a specific project, resulting in a Rs 202 crore drop in the Infra Business’s EBIDTA.- The rise in project costs, including ‘Interest during Construction (IDC)’ and Force Majeure conditions, led to this increase in EPC contract costs. Sterlite Power aims to mitigate this loss through its Infra SPV by seeking claims from regulatory authorities, and leveraging its proven track record in converting claims into actual payouts.

- Profit After Tax (PAT) Decline: The drop in EBIDTA consequently affected the company’s PAT for the nine months, reflecting a decline compared to the same period in the previous fiscal year.

- Consolidated P&L: The unaudited consolidated Profit & Loss statement for the nine months ending December 31, ’23, indicates a total revenue of Rs 5,365 crores and an EBIDTA of Rs 357 crores.

Financing Updates:

- Equity Partnership Deal: Sterlite Power’s equity partnership deal with GIC for its Infrastructure business is progressing towards closure.

- Demerger Process: The demerger process, aimed at segregating Sterlite Power’s businesses into distinct entities, is advancing, with the NCLT order expected by July ’24.

- Debt/Treasury Activities: Several financing activities have been undertaken, including achieving financial closure for transmission projects and refinancing existing loans, demonstrating the company’s proactive approach to managing its financial obligations and optimizing its capital structure.

Future Outlook

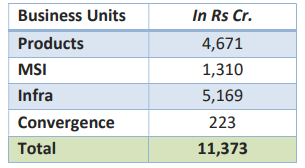

Order book as of Q3 end (Dec. 31st ’23):

Market Outlook

The market outlook for FY24 indicates:

- Tariff-based Competitive Bidding (TBCB): 22 bids worth Rs 43,314 Crores completed, 23 bids worth Rs 88,153 Crores awaiting proposals, and 6 bids approved for Rs 18,914 Crores.

- Power Conductors Market: Global market at 1.35 million MT, growing at 5-6% over 4 years. Indian market to increase from 1.5 lakh MT to 2.6 lakh MT.

- Power Cable Market: Global market at USD 6.7 billion, growing at 8% over 4 years. Indian market valued at USD 1.4 billion, growing at 12% over 4 years.

Currently, Sterlite Power Transmission Limited Share Price is trading at around Rs.515/share. CLICK HERE to Invest.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/