In the dynamic landscape of financial markets, the National Stock Exchange of India (NSE) continues to make significant strides, evident in its performance for the first nine months of fiscal year 2023-24. Let’s delve into the key highlights that underscore NSE’s resilience and contribution to the economy.

Key Highlights

- NSE’s standalone Q3 operating revenue up by 21% YoY to Rs.3,170 crores

- NSE’s standalone Q3 profit decreased by 12% YoY at Rs.1,377 crores

- NSE’s consolidated Q3 operating revenue up by 25% YoY to Rs.3,517 crores

- NSE’s consolidated Q3 profit up by 8% YoY at Rs.1,975 crores

- Contributed Rs.28,131 crores to the exchequer in nine months FY24 of which STT/CTT comprised of Rs.23,137 crores, Income tax Rs.1,490 crores, Stamp duty Rs.1,456 crores, GST Rs.1,257 crores and SEBI charges Rs.791 crores.

- STT accounts for 1.57% of the direct tax collections for the first nine months of the current financial year 2023-24.

Financials of Q3 FY24

₹(in crore)

| Particulars | Q3 FY 24 | Q3 FY 23 | Growth % |

| Total Revenue | 11,272 | 8,992 | 25% |

| Operating Revenue | 10,155 | 8,403 | 21% |

| Total Expenses | 3,645 | 1,815 | 101% |

| Profit after Tax | 5,818 | 5289 |

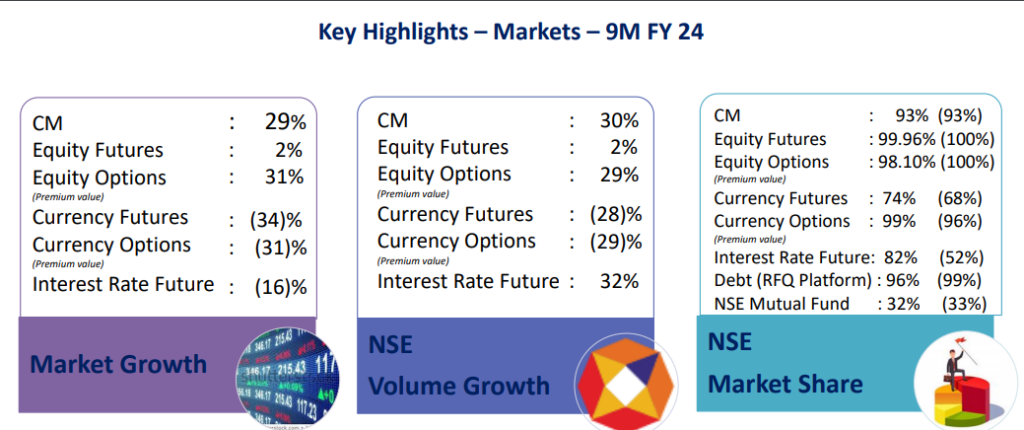

Market Growth: The National Stock Exchange (NSE) saw significant growth in various segments. The cash market surged by 29%, while equity futures experienced a modest 2% increase. Equity options witnessed substantial growth of 31%. However, currency futures and options declined by 34% and 31% respectively.

NSE Volume Growth: In terms of trading volume, NSE experienced notable growth across different categories. The cash market volume surged by 30%, while equity futures remained stable with a 2% increase. Equity options also saw a healthy 29% growth. However, currency futures and options witnessed declines of 28% and 29% respectively. Interest rate futures, on the other hand, showed significant growth of 32%.

NSE Market Share: NSE continued to maintain a strong market share across various segments. In the cash market, NSE held a dominant share of 93%. Similarly, in equity futures and options, NSE’s market share stood at 100%. For currency futures and options, NSE’s market share was 74% and 99% respectively. Additionally, NSE held a significant share of 82% in interest rate futures and 99% in debt trading through the RFQ platform.

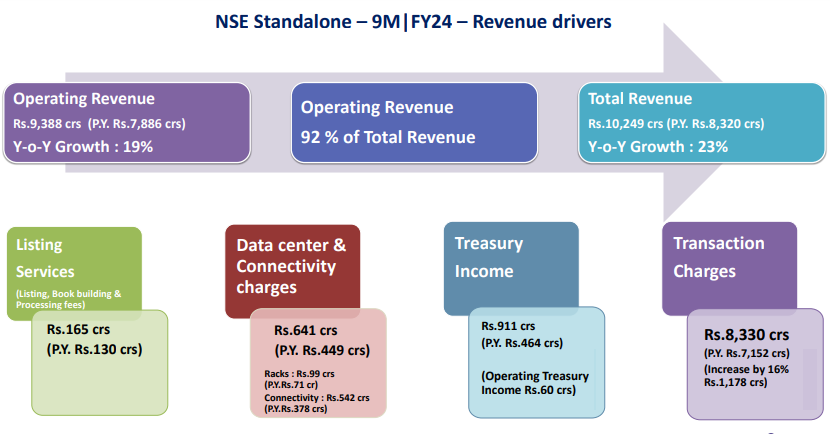

NSE Standalone – 9M|FY24 – Revenue drivers

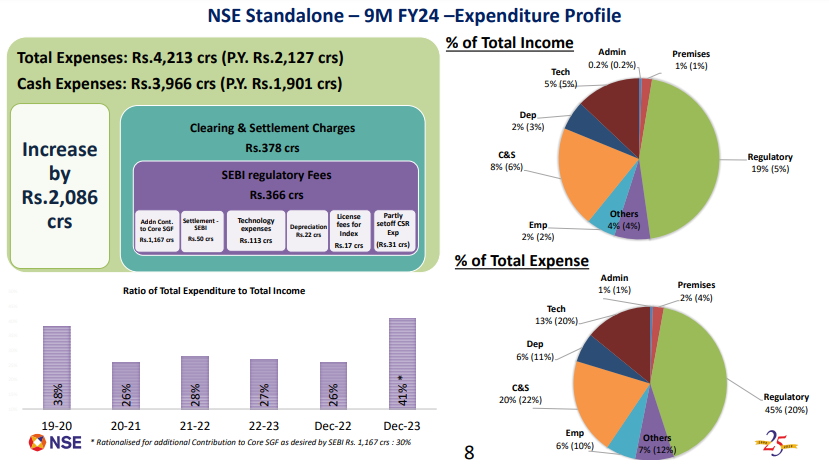

NSE Standalone – 9M FY24 –Expenditure Profile

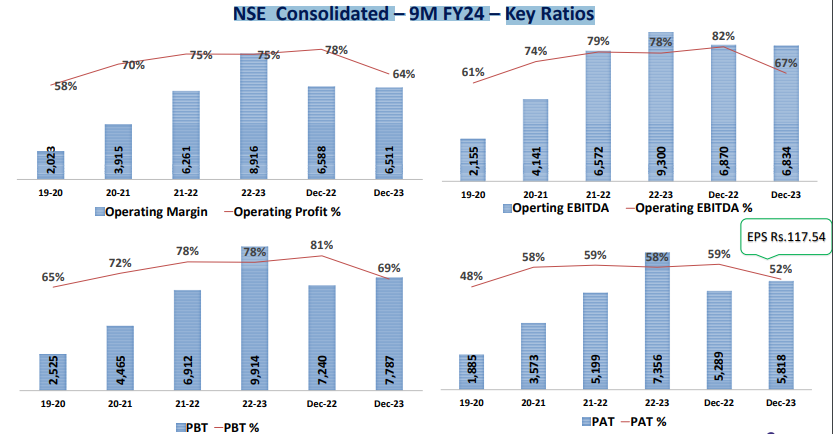

NSE Consolidated – 9M FY24 – Key Ratios

Currently NSE Share Price is trading at around Rs. 4175/share. CLICK HERE to Invest

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To know more about NSE Share Price. Click here- https://altiusinvestech.com/company/national-stock-exchange-ltd-nse

For Direct Trading, Visit – https://altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/