NCDEX – Company Overview & Financial Informations

National Commodity & Derivatives Exchange Limited is a professionally managed online commodity exchange, with diverse product offerings setting a benchmark for both agriculture and non-agricultural commodities derivatives segment. NCDEX was incorporated on April 23, 2003, as a public limited company and commenced operations on December 15, 2003, as a recognized association under The Forward Contracts (Regulation) Act, 1952. Effective September 28, 2015, the Exchange became a deemed recognized stock exchange under the Securities Contracts (Regulation) Act, 1956 under the regulation of the Securities and Exchange Board of India (SEBI).

| Company Name | NATIONAL COMMODITY AND DERIVATIVES EXCHANGE LIMITED |

| Company Type | Unlisted Public Company |

| Industry | Trading |

| Founded | 2003 |

| Registered Address | Mumbai, Maharashta, India |

| Website | ncdex.com |

Understanding NCDEX

NCDEX exists to provide an effective platform for discovering commodity prices and managing price risks, a role it has consistently fulfilled for the past two decades. It offers a variety of products like commodity futures, options in goods, and index futures to meet the diverse needs of participants in the commodity derivatives market. NCDEX’s prices are widely acknowledged as benchmarks in both local and global commodity markets. The exchange continuously enhances its product offerings to ensure inclusivity and meet the requirements of all stakeholders. Technology is at the heart of NCDEX’s operations, with the exchange being the first in the country to operate from an Uptime-certified Tier-IV data center. Its technology-driven approach focuses on enhancing the trading experience for all participants.

The NCDEX Group, along with its subsidiaries, offers a comprehensive market infrastructure that includes services like Clearing & Settlement, Repository, and an e-Auction Platform. NCDEX is dedicated to advancing the agricultural sector by fostering connections between primary producers and the Exchange. Through these efforts, NCDEX contributes to sustainable and inclusive growth in the agrarian economy.

Benefits of NCDEX

- NCDEX’s online futures market for crops increases transparency and aids price discovery for Indian farmers.

- It enables farmers to accurately price their goods, reducing reliance on intermediaries and cutting costs.

- Standardized quality specifications through contracts raise quality awareness and improve agricultural practices.

- Traders increasingly use NCDEX contracts for hedging and speculation, indicating growing acceptance in India’s agricultural sector.

Commodities Offered by NCDEX

NCDEX offers a diverse product portfolio catering to various commodities and indexes. Leading agricultural commodities traded on the exchange include barley, wheat, soybeans, and coriander, which are not only pivotal within India but also serve as global benchmarks. Additionally, NCDEX hosts contract for commodities like steel, cotton, palm oil, and guar, providing investors with a wide array of trading opportunities across different sectors. The exchange manages three agricultural commodities indexes, focusing on soybeans, guar, and a composite of several agricultural products, offering investors comprehensive insights into market trends. Moreover, NCDEX serves as a significant source of information on spices, reflecting India’s prominent role as the leading producer and consumer of spices globally.

Segment-Wise, Product-Wise Performance

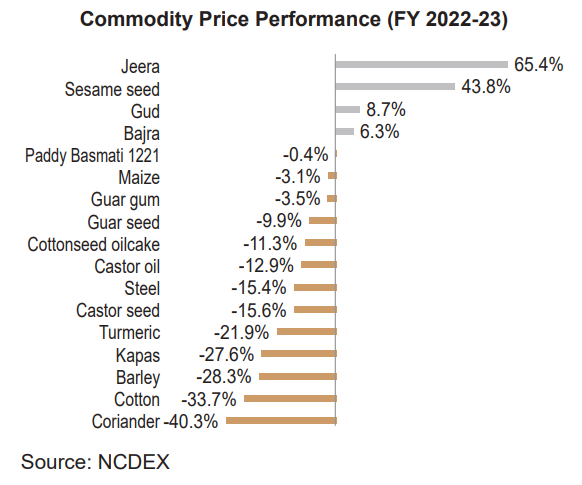

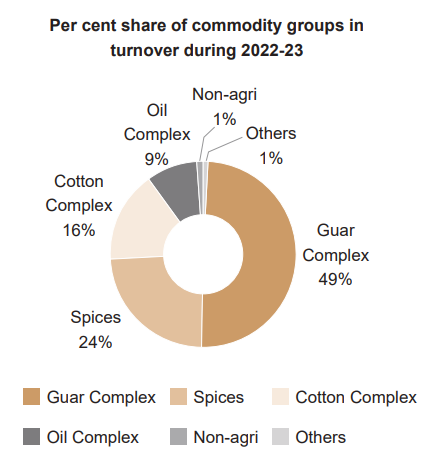

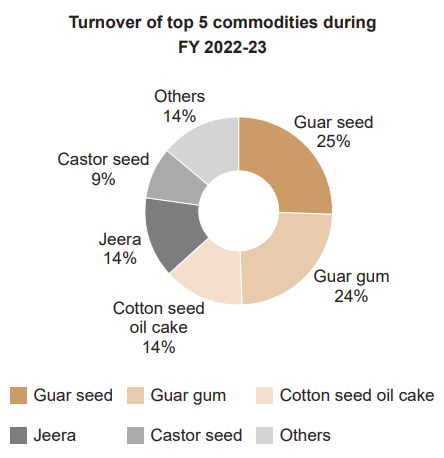

During FY 2022-23, global factors like the Russia-Ukraine crisis and China’s COVID policies influenced commodity markets. Despite initial price hikes, global monetary tightening and reduced demand later moderated prices. Domestically, most agri-commodities declined, except for Jeera, which saw strong demand. Guar complex and spices remained significant contributors to turnover on NCDEX. Cotton exports were impacted, but Cotton seed oilcake futures remained strong. Castor seed and Sesame seed were the primary oilseed options. The exchange diversified with Robusta Cherry AB Coffee futures.

Turnover of top five commodities during FY 2022-23

The segment-wise performance of commodities traded at the Exchange was as follows:

Risks and Concern

- Dependency on Economic Fundamentals: The Exchange’s business heavily relies on robust economic fundamentals, particularly in the Agri-sector.

- Adverse Economic Conditions: Economic downturns and market fluctuations pose potential risks to the Exchange’s business, financial condition, and operational results.

- Technology-Driven Operations: Continuous system upgrades are essential as the Exchange’s operations are predominantly technology-driven, with technology costs forming a significant portion of total expenses.

- Regulatory Environment: Operating in a highly regulated environment, the Exchange faces increasing compliance and regulatory costs beyond its control.

- Impact of Government Policies: Changes in government policies, especially in the agri space, could significantly influence trading volumes and operational dynamics.

- Regulatory Interventions: Regulatory interventions, such as the prolonged suspension of important contracts, have been observed, impacting the Exchange’s value and operational efficiency.

- Collaboration for Market Growth: The Exchange actively collaborates with government organizations to promote commodities market growth, aiming to mitigate risks and enhance operational resilience.

Overview of the Commodities Trading Sector in India

India’s commodities trading sector serves as a vital component of the nation’s economic landscape, boasting a diverse array of commodities ranging from agricultural products to energy resources, metals, and soft commodities. The market landscape is defined by its dynamic nature, with various exchanges such as the Multi Commodity Exchange (MCX), National Commodity & Derivatives Exchange Limited (NCDEX), and Indian Commodity Exchange (ICEX) facilitating trade across different commodities. Agriculture holds a significant position within the sector, with staples like grains, pulses, oilseeds, and spices dominating the market.

Moreover, India’s energy market, driven by commodities like crude oil and natural gas, plays a pivotal role in powering the nation’s industrial and economic growth. Metals and minerals, including gold, silver, copper, and iron ore, are fundamental for infrastructure development and industrial production. Soft commodities such as sugar, coffee, tea, and spices also contribute significantly to India’s commodities trading landscape, reflecting the country’s rich cultural heritage and agricultural diversity. The sector is characterized by technological advancements, regulatory oversight, and both challenges and opportunities for investors and market participants alike.

Key Points:

- Diverse Commodities: India’s commodities trading sector covers a wide range of commodities, including agricultural products, energy resources, metals, and soft commodities.

- Market Landscape: Various exchanges like MCX, NCDEX, and ICEX facilitate trade across different commodities, contributing to the dynamic nature of the market.

- Agricultural Emphasis: India’s status as the largest agriculture country in the world underscores the significance of agriculture within the sector, with staples like grains, pulses, oilseeds, and spices dominating the market.

- Energy Market Dynamics: The energy market, driven by commodities like crude oil and natural gas, influences industrial and economic growth in India.

- Metals and Minerals: Metals such as gold, silver, copper, and iron ore are essential for infrastructure development and industrial production.

- Significance of Soft Commodities: Soft commodities like sugar, coffee, tea, and spices contribute significantly to India’s commodities trading landscape, reflecting the country’s rich cultural heritage and agricultural diversity.

- Technological Advancements: Technology has transformed the sector, facilitating electronic trading platforms, algorithmic strategies, and real-time market data.

- Regulatory Framework: The sector is regulated by SEBI and FMC, ensuring fair markets, investor protection, and market integrity.

- Challenges and Opportunities: While facing challenges such as infrastructure constraints and price volatility, the sector offers opportunities for investment, risk management, and economic growth in India.

The Benefits of Investing in Commodities

Investing in commodities can be beneficial for investors for several reasons:

- Diversification: Commodities offer low correlation with traditional assets, spreading risk and reducing portfolio volatility.

- Inflation Hedge: Historically, commodities rise with inflation, preserving purchasing power.

- High Returns Potential: Volatile commodity markets provide opportunities for significant returns.

- Tangible Assets: Commodities represent essential goods, providing exposure to tangible assets like gold, agricultural products, and energy resources.

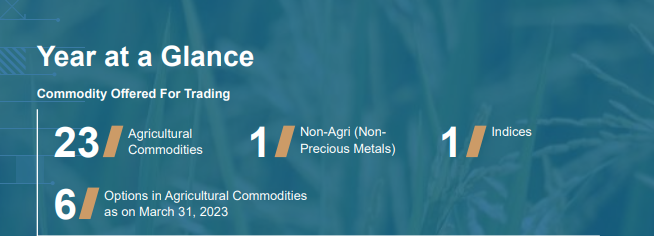

Commodity Offered for Trading (2022-2023)

Recent News

NCDEX and IRMA Launch Center of Excellence to Boost Commodity Derivatives Market

(February 2024) NCDEX and IRMA have launched a center of excellence in Anand, Gujarat, to promote the commodity derivatives market. This initiative aims to redefine policymakers’ perspectives on commodity derivatives markets, with NCDEX providing technical support and data-related assistance. The collaboration seeks to enhance the scope of commodity markets through research, policy advocacy, and capacity building. NCDEX’s MD & CEO emphasized the importance of derivatives markets in driving agri-marketing growth. The initiative is expected to contribute significantly to transforming the agricultural landscape and making agri-marketing more sustainable, with support from various sectors including the cooperative sector.

NCDEX to Have More Commodities for Trading by the End of the Year 2024

(February 2024) NCDEX plans to introduce 15 new commodities, including household items, by year-end, pending approval from the Ministry of Finance. MD Arun Raste believes this expansion will increase stakeholder participation and trading turnover, counteracting the impact of SEBI’s ban on futures trading in seven agricultural commodities. NCDEX aims to grow by adding more Farmer Producer Organizations and expanding its commodity offerings to foster market participation and growth.

NCDEX Partners with Skymet for Weather Derivatives Trading

(August, 2023) NCDEX collaborated with Skymet Weather Services to launch a weather index and enable derivatives trading. The index, based on India Meteorological Department (IMD) rain predictions, aided stakeholders in effective planning. Seeking SEBI approval, NCDEX introduced two indices: the Annual Rainfall Index and the Monsoon Index, attracting institutional investors and mutual funds. The collaboration benefited various industries by providing risk management services. Additionally, NCDEX’s Agridex futures garnered significant interest despite minimal publicity, demonstrating investor enthusiasm.

IPO Plans: NCDEX Aims to Expand Business Operations

In a strategic move to expand its business operations and strengthen its market presence, NCDEX has filed IPO papers with SEBI for Rs. 500 crore. The DRHP reveals that the IPO encompasses an offer for the sale of up to Rs. 1.44 crore equities by existing shareholders, along with a new issue of up to Rs. 100 crore. Major stakeholders including NABARD, Punjab National Bank, Oman India Joint Venture Fund Canara Bank, and IFFCO are poised to sell their stake in the NCDEX IPO. Although the launch date of the IPO remains undisclosed, this development presents a promising opportunity for potential investors to capitalize on early investments and secure potentially high returns.

NCDEX: Competitors

- Multi Commodity Exchange (MCX)

- National Spot Exchange Limited (NSEL)

- Indian Commodity Exchange Limited (ICEX)

- Universal Commodity Exchange (UCX)

Unlisted Share Price of NCDEX (as of 05.04.2024)

- The buy price of NCDEX unlisted shares currently stands at Rs. 400 per share, reflecting stability as both the 52-week high and low remain consistent at this value.

- Investors looking to divest their holdings may consider selling NCDEX unlisted shares at Rs. 355 per share, indicating a potential liquidity opportunity with a difference of Rs. 45 from the current buy price.

CLICK HERE TO INVEST

Financial Metrics for NCDEX (as of 05.04.2024)

| Particulars | Amount |

| Price to Sales Ratio (P/S) | 53.91 |

| Price to Book Value (P/B) | 4.79 |

| Industry PE | – |

| Face Value | ₹ 10 |

| Book Value | ₹83.46 |

| Market Cap | ₹2027.04 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

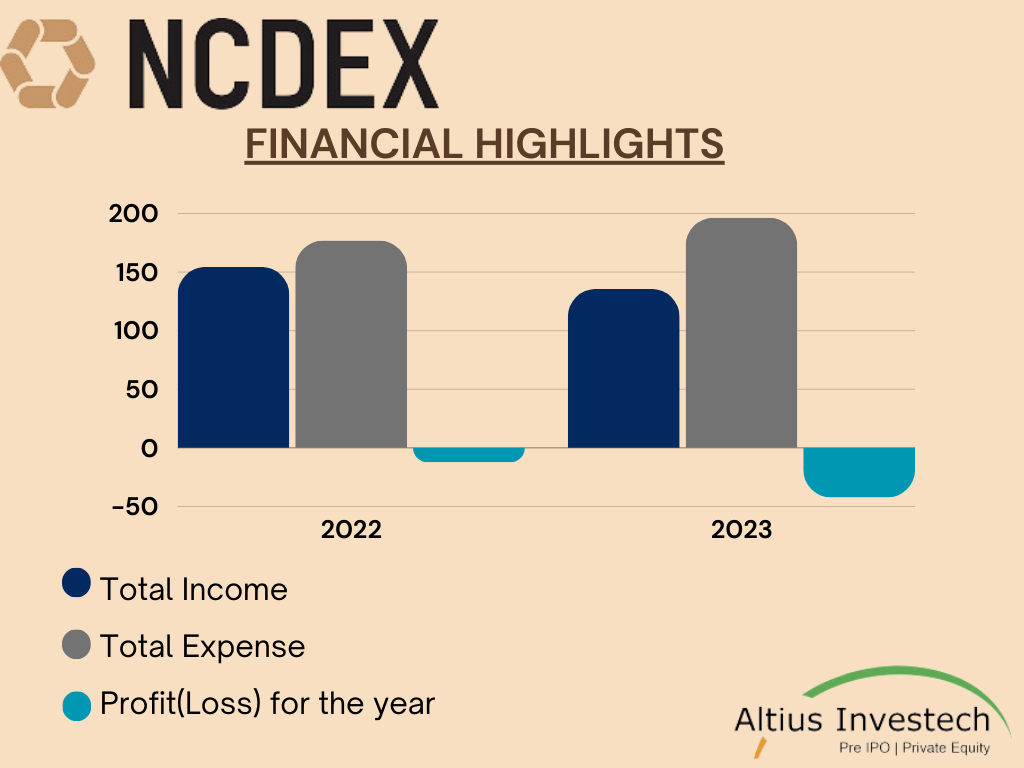

Financial Highlights

₹ (in crores)

| Particulars | FY 2023 | FY 2022 | Y-o-y growth |

| Total Income | 135.57 | 154.37 | decrease of 12.17% |

| Total Expenses | 196.24 | 176.89 | increase of 10.93% |

| Profit After Tax (PAT) | (42.37) | (12.26) | decrease of 245% |

| Earning Per Share (EPS) | (8.01) | (2.24) | – |

NCDEX FY 2022-23: Market Growth, Farmer Support, and Collaboration

In the fiscal year 2022-23, NCDEX faced dynamic and challenging conditions but managed to foster collaboration among stakeholders to promote the relevance of agricultural commodity derivatives. Despite the suspension of key commodity derivatives contracts, NCDEX demonstrated resilience, expanding its market share from 86% to 97% in agricultural derivatives trading. Notably, the exchange successfully introduced India’s largest metal steel contract in the derivatives segment, marking its venture into the non-agricultural sector. Despite facing hurdles, NCDEX achieved a flawless physical settlement of contracts and sustained advocacy efforts with policymakers through active research, strengthening relationships across the value chain.

Key Takeaways:

- Despite challenges, NCDEX increased its market share in agricultural derivatives trading from 86% to 97%.

- NCDEX ventured into the non-agricultural sector with the introduction of India’s largest metal steel contract in derivatives trading.

- The exchange achieved a flawless physical settlement of contracts and sustained advocacy efforts with policymakers through active research.

- NCDEX expanded its footprint by onboarding additional Farmer Producer Organizations (FPOs) from 16 states, representing over 10,67,700 farmers.

- NCDEX continued its initiatives to educate farmers on managing price risks through futures contracts and options, conducting over 362 awareness programs across 17 states.

- The exchange reimbursed FPOs for delivering goods on the exchange platform, leveraging SEBI’s regulatory fee for subsidy purposes.

- NCDEX’s education initiatives aimed at FPOs included investor education programs, trainings, and webinars, reaching 1,299 new FPOs with a shareholder base of 13,742.

Overall, NCDEX’s efforts in fostering collaboration, expanding its market presence, and supporting farmers through education initiatives underscore its commitment to the agricultural ecosystem’s growth and resilience.

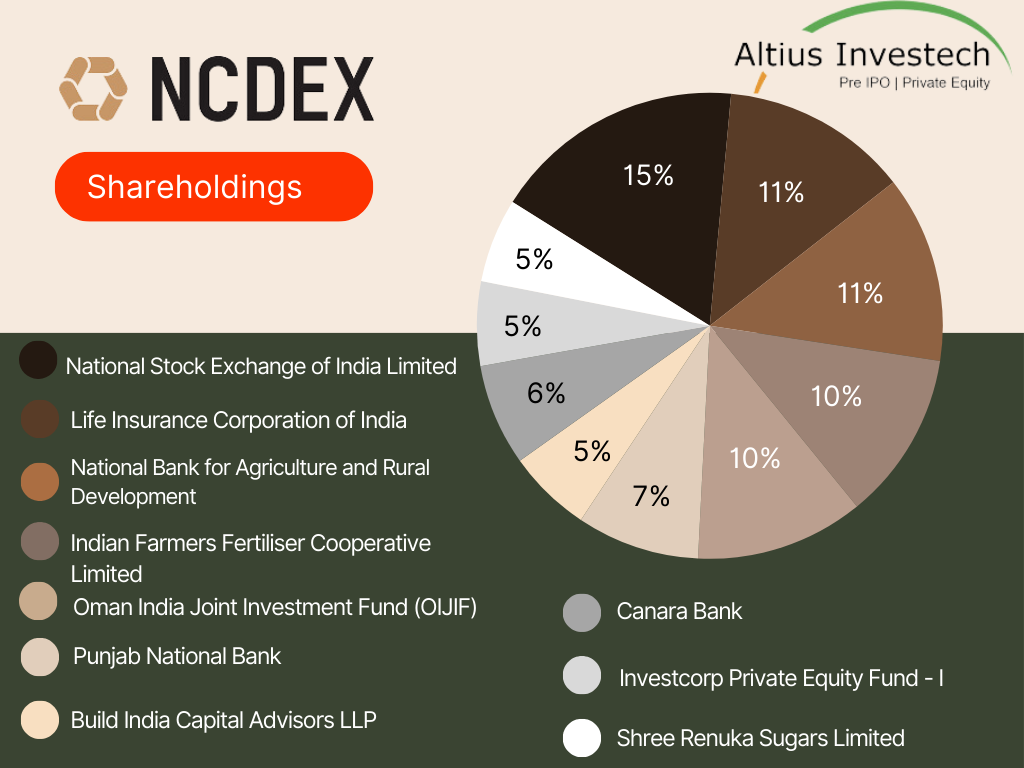

Shareholding Pattern

| Shareholder | No. of Shares | % Holding |

|---|---|---|

| National Stock Exchange of India Limited | 76,01,377 | 15.00% |

| Life Insurance Corporation of India | 56,25,000 | 11.10% |

| National Bank for Agriculture and Rural Development | 56,25,000 | 11.10% |

| Indian Farmers Fertiliser Cooperative Limited (IFFCO) | 50,68,000 | 10.00% |

| Oman India Joint Investment Fund (OIJIF) | 50,67,600 | 10.00% |

| Punjab National Bank | 36,94,446 | 7.29% |

| Build India Capital Advisors LLP | 25,33,799 | 5.00% |

| Canara Bank | 30,55,519 | 6.03% |

| Investcorp Private Equity Fund – I | 25,33,800 | 5.00% |

| Shree Renuka Sugars Limited | 25,33,700 | 5.00% |

If you’re considering investing in NCDEX unlisted shares and seeking a reliable platform for purchasing, look no further than Altius Investech. As one of India’s leading online brokerage platforms, Altius Investech offers seamless access to unlisted shares of various pre-IPO companies. Our seasoned brokers at Altius Investech provide comprehensive guidance throughout your trading journey, offering essential insights into the companies you wish to invest in. From crucial financial metrics like EBITDA and EPS to profit and loss reports, you’ll receive detailed information about each company. In addition to NCDEX, Altius Investech allows you to explore investment opportunities across diverse sectors such as retail, energy, finance, and technology. Don’t hesitate any longer – connect with our expert brokers at Altius Investech today and embark on your journey of investing in unlisted shares.

ALSO READ

To know more about the 5 Advantages of Buying Unlisted Shares in 2024, Click- https://altiusinvestech.com/blog/5-advantages-of-buying-unlisted-shares-in-2024/

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

How to sell shares of unlisted companies. Click – https://altiusinvestech.com/blog/how-to-sell-unlisted-shares/

Guide on How to buy unlisted shares in India 2024 Done https://altiusinvestech.com/blog/buying-unlisted-shares-in-india/

Listed Vs. Unlisted Shares: https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company/

GET IN TOUCH WITH US:

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

For Direct Trading, Visit – https://trade.altiusinvestech.com/.