Company Overview

Medi Assist Healthcare Services Limited operates as a holding company with subsidiaries like Medi Assist TPA, Medvantage TPA (since Feb ’23), and Raksha TPA (since Aug ’23). Through these subsidiaries, it provides third-party administration services to insurance companies. The company serves as a crucial intermediary between (a) insurance firms and their policyholders, (b) insurance firms and healthcare providers, and (c) the government and beneficiaries of public health schemes.

Medi Assist TPA, one of its key subsidiaries, holds a significant market presence with a 14.8% share in the retail health insurance market and an impressive 41.7% share in the group health insurance market, contributing to a cumulative retail and group segment share of 33.7% serviced by third-party administrators as of FY22.

To know about the share price of Tata Capital on our platform Altius Investech. Click here- https://altiusinvestech.com/company/tatacapitalltdIssue Details

| Date of Opening | 15th January,2024 |

| Date of Closing | 17 th January,2024 |

| Price Band (Rs) | 397 – 418 |

| OFS (No. of shares) | 2,80,28,168 |

| Issue Size (Rs cr) | 1,113 – 1,172 |

| No. of shares | 2,80,28,168 |

| Face Value (Rs) | 5.0 |

| Post Issue Market Cap (Rs cr) | 2,734 – 2,878 |

| BRLMs | Axis Capital Ltd., IIFL Securities Ltd., Nuvama Wealth Management Ltd., SBI Capital Markets Ltd. |

| Registrar | Link Intime India Private Limited |

| Bid Lot | 35 shares and in multiple thereof |

| QIB shares | 50% |

| Retail shares | 35% |

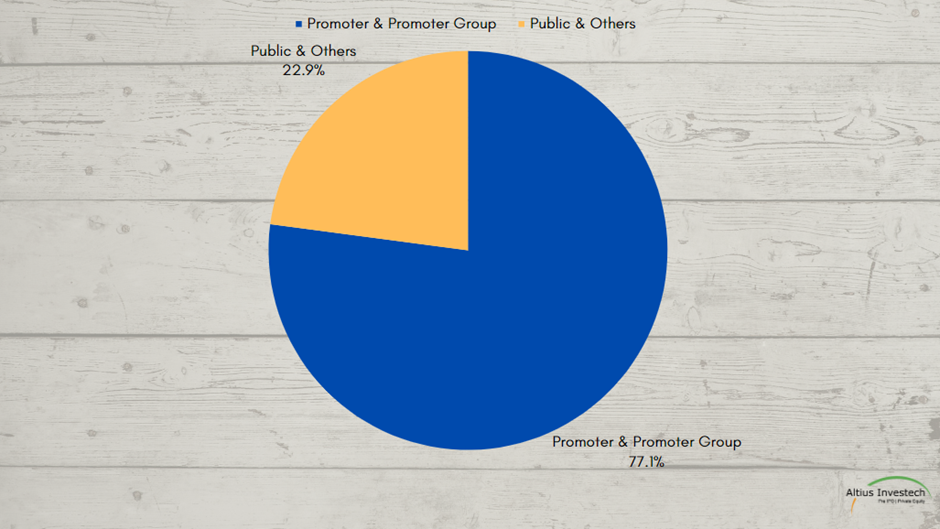

Shareholding Pattern

| Pre-Issue | No. of Shares | % |

| Promoter & Promoter Group | 5,31,17,212 | 77.1 |

| Public & Others | 1,57,42,000 | 22.9 |

| Total | 6,88,59,212 | 100.0 |

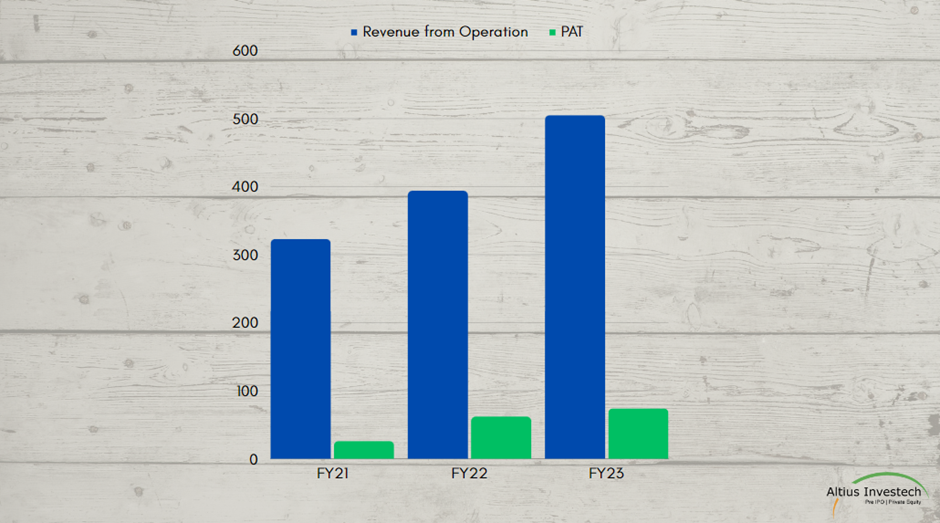

Key Financials

₹ in Crores

| Particulars | FY23 | FY22 | FY21 |

| Revenue from Operation | 505 | 394 | 323 |

| PAT | 74 | 62 | 26 |

| EPS | 10.8 | 8.9 | 3.8 |

Risk Factors

- Client Dependence: In FY21, FY22, FY23 our top five clients contributed Rs 252 Cr, Rs 311 Cr, Rs 394 Cr, and Rs 214 Cr, respectively, representing 78.2%, 79.0%, 78.0%, and 71.0% of total revenue. The potential loss of any of these significant clients poses a risk to our business.

- Premium Under Management: Our revenue from benefit administration services is closely tied to the premium under management for both group and retail portfolios. Any reduction in this premium could have adverse effects on our future revenues and overall profitability.

- Service Quality: Maintaining high-quality services, including swift claims processing, responsiveness, accuracy, and effective grievance redressal, is paramount. Failure to uphold these standards may negatively impact our brand reputation and, subsequently, our business and operational results.

- Competitive Market: The third-party administration industry is marked by intense competition. Inability to compete effectively in this dynamic landscape may have adverse implications for our business, operational outcomes, and financial condition.

To know about the share price of Utkarsh Coreinvest on our platform Altius Investech. Click here-https://altiusinvestech.com/company/utkarsh-coreinvest-buy-sell-unlisted-sharesGrowth Strategy

Securing Leadership Position: The company is adopting a comprehensive strategy to maintain its leadership among corporates, focusing on three key initiatives.

- Inorganic Growth: The company aims to bolster its leadership by actively seeking acquisition opportunities. This includes expanding service offerings, gaining a larger market share in existing regions, and exploring entry into new geographies.

- Technology Infrastructure Enhancement: A critical aspect of the strategy involves ongoing efforts to improve and advance its technology platforms. This ensures the company remains at the forefront of technological capabilities, fostering innovation and efficiency.

- Retail Segment Expansion: In order to solidify its leadership position, the company is dedicated to increasing its market share within the retail segment. This strategic focus aims to tap into new opportunities and broaden the company’s presence in this vital market segment.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.