About Kannur International Airport Limited

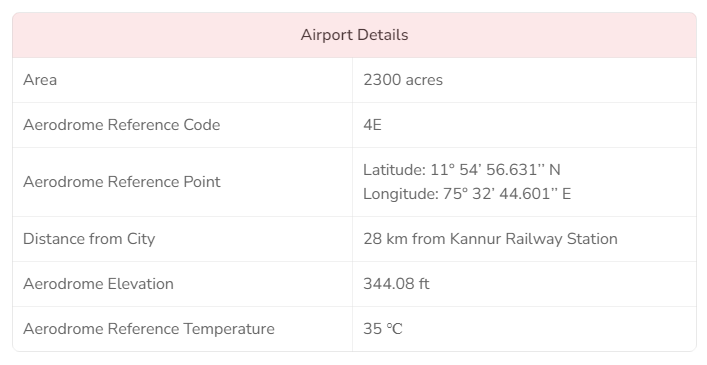

Kannur International Airport Limited (KIAL), owner and operator of Kannur International Airport serving the North Malabar region of Kerala, Kodagu district of Karnataka, and Mahé district of Puducherry in India, opened for commercial operations on 9 December 2018. Within a span of nine months, the airport served one million passengers, and despite the challenges posed by the COVID-19 pandemic, it maintained steady growth, reaching two million passengers in November 2020. The airport’s inaugural landing occurred on 29 February 2016, followed by the first trial passenger flight operation on 20 September 2018. On the inaugural day, 9 December 2018, an Air India Express flight marked the first commercial passenger departure from the airport. The inauguration was attended by the Minister of Civil Aviation and the Chief Minister of Kerala.

| Company Name | KANNUR INTERNATIONAL AIRPORT LIMITED |

| Company Type | Unlisted Public Company(Buy Unlisted share here) |

| Industry | Airport Industry |

| Founded | 2009 |

| Registered Address | Kannur, Kerala, India |

| Website | https://kannurairport.aero/ |

The Journey of Kannur International Airport: From Inception to Inauguration

Kannur International Airport underwent a lengthy process from its initial proposal in 1997 to its eventual inauguration on December 9, 2018. Situated near Mattannur, the airport faced challenges such as land acquisition and ecological concerns before construction began in 2010. Operating under the Public-Private Partnership model, the airport commenced commercial operations with the departure of Air India Express flight IX 715 to Abu Dhabi, jointly flagged off by the Chief Minister of Kerala and the Union Minister for Civil Aviation. Despite facing restrictions due to lacking ‘point of call’ status, the airport saw foreign airlines landing for repatriation flights in June 2020, including widebody aircraft like the Airbus A330-200 of Kuwait Airways.

Development Phases of Kannur International Airport: From Land Acquisition to Expansion Plans

Land Acquisition and Initial Planning

Land acquisition for Kannur International Airport began in phases, with about 1200 acres acquired by August 2010. In July 2011, the government tasked the Airports Authority of India with revising feasibility reports, later assigning Cochin International Airport for detailed project planning. By February 2012, the acquired land was transferred to KIAL.

Construction Phases: EPC-I & EPC-II

The construction proceeded in two stages: EPC-I focused on earthwork, runway, and associated infrastructure, while EPC-II involved terminal buildings and facilities. Larsen & Toubro (L&T) secured contracts for both stages in November 2013 and June 2014, respectively. Despite technical challenges, significant progress was made by December 2015, with substantial completion achieved on the runway and terminal.

Trial Landings and Expansion Plans

Trial landings occurred in February 2016, marking progress toward the eventual 3050-meter runway extension. Phase I expansion, slated until 2025-26, includes runway extension to 4000 meters and city-side facility development. Phase II, scheduled for 2026-27 to 2045-46, encompasses additional runway construction and a dedicated domestic terminal.

Business Model

Kannur Airport’s Business Model involves BPCL-KIAL Fuel Farm Pvt Ltd (BKFFPL), a Joint Venture between BPCL and KIAL with equity shareholding of 74% and 26% respectively. Established on May 18th, 2015, as a Private Limited Company, its scope includes designing, developing, constructing, managing, maintaining, upgrading, and operating the Aviation Fuel farm with associated facilities and hydrant system at both domestic and international terminals of Kannur International Airport. BKFFPL holds exclusive rights for supplying ATF (Aviation Turbine Fuel) at the airport for an initial period of 30 years, extendable for another 30 years subject to mutually agreed terms and conditions.

Services Provided

Aero Services

- Aerobridge Charges: Fees for the use of aerobridges to facilitate passenger boarding and disembarkation from aircraft.

- CUPPS / CUSS / BRS: Charges related to Common Use Passenger Processing Systems (CUPPS), Common Use Self Service (CUSS), and Baggage Reconciliation Systems (BRS) for efficient passenger handling.

- Inline X-Ray Charges: Charges for the use of inline baggage screening systems.

- Landing Charges: Fees levied for the landing of aircraft at the airport.

- Parking Charges: Charges for the parking of aircraft at the airport.

- Revenue Share on Ground Handling: Revenue earned from ground handling services provided to airlines.

- TNLC Collection: Fees collected for Temporary Non-Commercial Landside (TNLC) use.

- User Development Fee (UDF): Fees charged from passengers for airport development and modernization.

Non-Aero Services:

- Space Rentals: Revenue earned from renting out space within the airport premises for commercial purposes.

- Revenue share from Concessionaire: Income received from sharing revenue with concessionaires operating within the airport.

- Car Parking: Charges levied for parking vehicles within the airport premises.

- Visitor’s Entry Pass: Fees collected for entry passes issued to visitors accessing certain areas of the airport.

- Common User Infrastructure Charges (CAM Charges): Charges for the use of common infrastructure facilities by airport users.

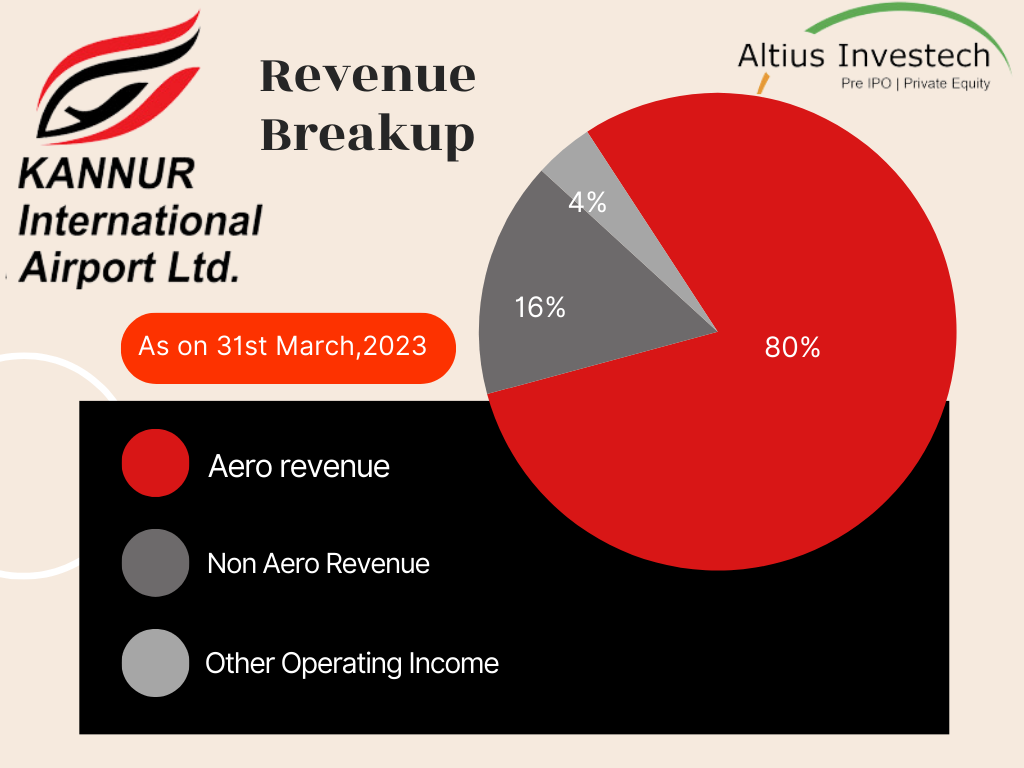

Revenue Breakup for the Year Ended March 31, 2023

₹ (in crores)

| Particulars | Amount |

| Aero revenue | |

| User Development Fee (UDF) | 52.94 |

| Landing Charges | 12.88 |

| Inline X-Ray Charges | 7.34 |

| TNLC Collection | 4.34 |

| Revenue Share on Ground Handling | 3.18 |

| Parking Charges | 2.85 |

| Aerobridge Charges | 2.21 |

| Domestic Cargo | 2.19 |

| CUPPS / CUSS / BRS | 1.92 |

| Non-Aero Revenue | |

| Revenue share from Concessionaire | 9.54 |

| Space Rentals | 4.27 |

| Miscellaneous | 2.07 |

| Car Parking | 1.79 |

| Common User Infrastructure Charges (CAM Charges) | 0.58 |

| Visitor’s Entry Pass | 0.25 |

| Other Operating Income | |

| License Fee for Unpaved Land from BKFFPL, Joint Venture Company (Income from Related parties) (c) | 4.24 |

The revenue breakdown highlights the significant contribution of aero services, particularly the User Development Fee (UDF) and landing charges, to the overall revenue of Kannur International Airport. Non-aero revenue sources such as space rentals and revenue sharing with concessionaires also play a vital role in diversifying the airport’s revenue streams. The substantial revenue generated underscores the airport’s financial viability and its ability to sustain operations while funding ongoing development initiatives.

Traffic Information

Passenger Movement

| Year | International Passenger | Domestic Passenger | Total Passenger Movement |

| 2021-2022 | 5,22,317 | 2,81,119 | 8,03,436 |

| 2020-2021 | 3,04,285 | 1,87,238 | 4,91,523 |

| 2019-2020 | 8,28,076 | 7,91,647 | 16,19,723 |

| 2018-2019 | 92,008 | 1,37,586 | 2,29,594 |

Aircraft Movement

| Year | International Aircraft | Domestic Aircraft | Total Aircraft Movement |

| 2021-2022 | 4,120 | 5,641 | 9,761 |

| 2020-2021 | 2,320 | 3,923 | 6,243 |

| 2019-2020 | 5,385 | 9,738 | 15,123 |

| 2018-2019 | 577 | 1,456 | 2,033 |

Management of the Company

Shri. Pinarayi Vijayan, Chairman- Hon’ble Chief Minister of Kerala

Pinarayi Vijayan, the current Chief Minister of Kerala, has been actively involved in the development and governance of Kerala. As the chairman of KIAL, Pinarayi Vijayan plays a significant role in overseeing the strategic direction and operations of the airport. His leadership has been instrumental in guiding KIAL towards its objectives of enhancing regional connectivity and boosting economic growth in the North Malabar region of Kerala. Under his tenure, KIAL has achieved notable milestones, including successful operations and expansion initiatives.

………………………………………………………………………………….

Shri. Dinesh Kumar C, Managing Director

Shri Dinesh Kumar C, the Managing Director of Kannur International Airport, brings over 30 years of invaluable experience in the airport sector to his role. Having previously served as the Airport Director at Cochin International Airport, he has demonstrated exceptional leadership and expertise in airport operations and management. With his extensive knowledge and track record of success, Shri Dinesh Kumar C is poised to lead Kannur Airport to new heights of excellence. His visionary approach and strategic insights are expected to drive the airport’s growth trajectory, further enhancing its reputation as a premier aviation hub in the region.

…………………………………………………………………………

Shri. A K Saseendran, Director-Hon’ble Minister for Forest & Wildlife

A. K. Saseendran, an Indian politician, currently serves as the Minister for Forests and Wildlife Protection of Kerala and is the director of KIAL. With extensive experience in governance, he has previously held positions such as Minister for Transport of Kerala. Representing Elathur in the Kerala Legislative Assembly since 2011, Saseendran’s leadership is crucial in guiding Kannur International Airport’s strategic direction for continued growth and success as a key aviation hub in the region.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Industry Overview

The aviation industry encompasses all aspects of air travel and its supporting activities, including airlines, aircraft manufacturing, research firms, military aviation, and more. Airport infrastructure, as a vital component of the aviation sector, plays a pivotal role in driving national economic growth due to its international nature. The quality of airport infrastructure reflects international competitiveness and influences the inflow of foreign investment. Airports generate revenue through aeronautical and non-aeronautical services, maintaining commercial relationships with airlines and passengers. In India, the Airports Authority of India (AAI) manages 137 airports, consisting of 103 domestic, 24 international, and 10 customs airports. However, the COVID-19 pandemic severely impacted air traffic in India during FY22, with a significant decline in passenger traffic and aircraft movements compared to pre-pandemic levels. The pandemic has posed unprecedented challenges to the aviation industry, requiring adaptation and recovery efforts to restore its strength and resilience.

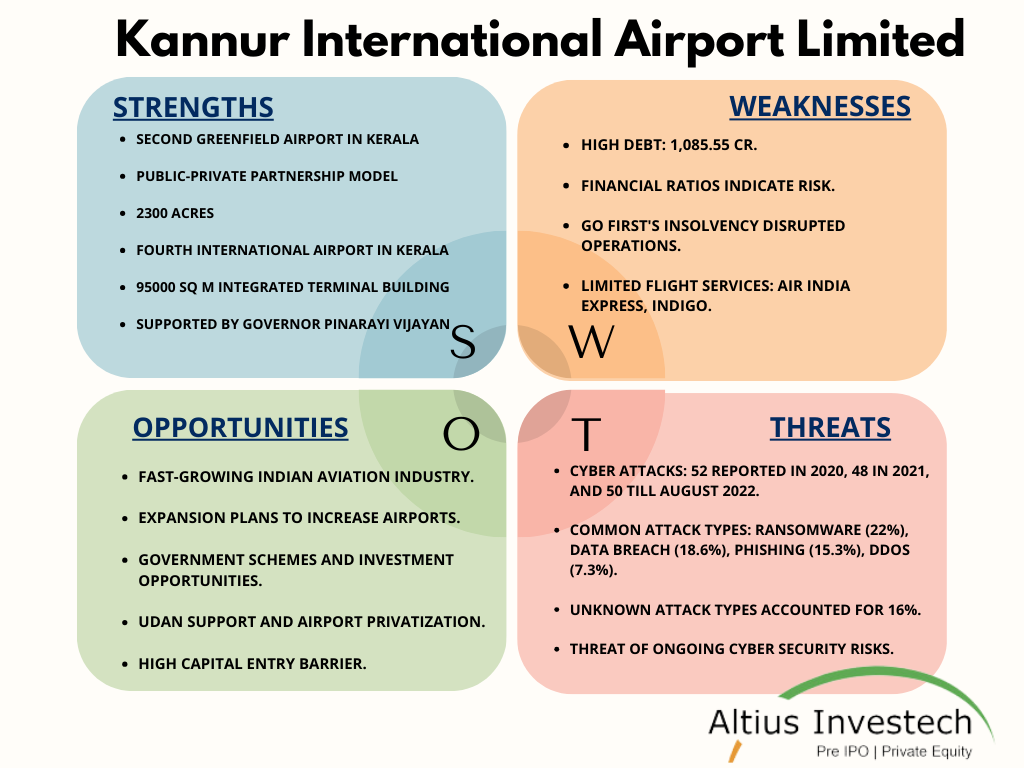

SWOT Analysis

Peer Comparison

| Particulars | Revenue | PAT | EPS | CMP (30/03) | MCAP | P/E | P/B |

| Kannur International Airport Ltd | 115Cr. | (126) | (9.5) | ₹120 | ₹1606Cr. | (12.73) | 2.1 |

| Cochin International Airport Ltd | 940Cr. | 290.5 | 7.5 | ₹269 | ₹ 10290 Cr. | 35.44 | 4.86 |

Share Price

- The buy price of KIAL varies based on quantity, ranging from 123 for quantities between 200 – 420 shares to 120 for quantities between 4202 – 8403 shares, with corresponding rates per share.

- The 52-week high is 120, and the 52-week low is 95 indicating the range of fluctuations in the share price. Additionally, the sell price of KIAL is fixed at 110.

Currently, the KIAL Share Price is trading at around Rs. 120/share. CLICK HERE to Invest.

Financial Metrics for KIAL (as of 01.04.2024)

| Particulars | Amount |

| Price to Sales Ratio (P/S) | 14.34 |

| Price to Book Value (P/B) | 2.07 |

| Industry PE | 86.05 |

| Face Value | ₹ 100 |

| Book Value | ₹58 |

| Market Cap | ₹1606.04 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

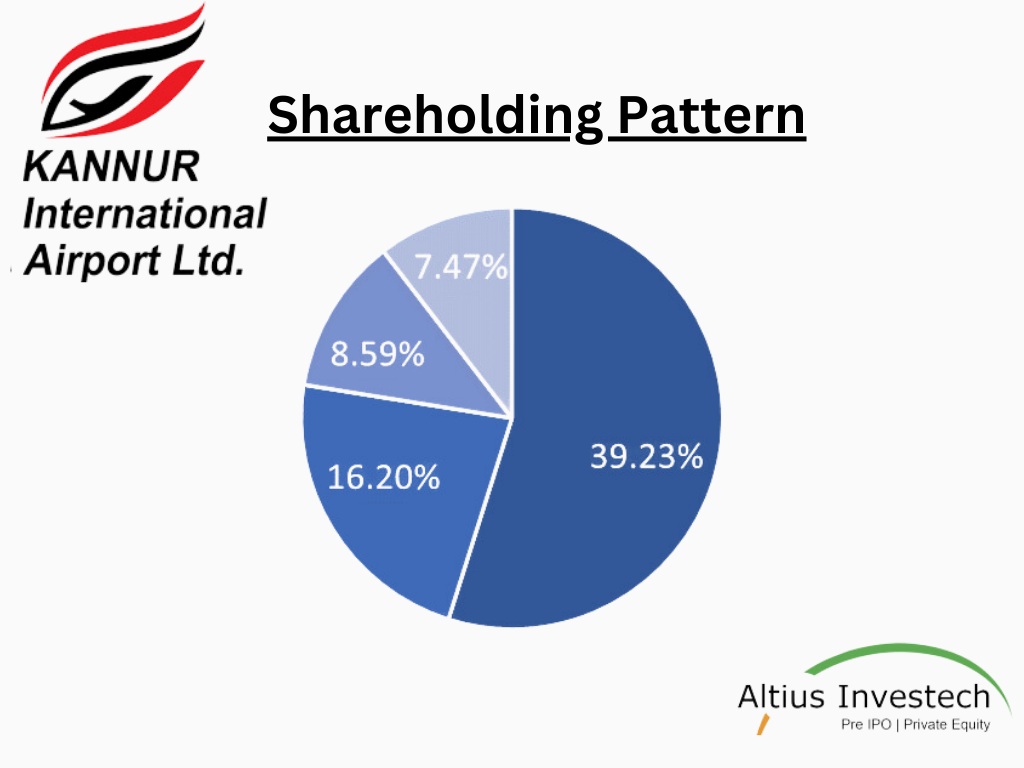

Shareholding Pattern

| Shareholders | Holding |

| Government of Kerala (Only promoter) | 39.23% |

| Bharat Petroleum Corporation Limited | 16.20% |

| M A Yusufali | 8.59% |

| Airports Authority of India | 7.47% |

Financials

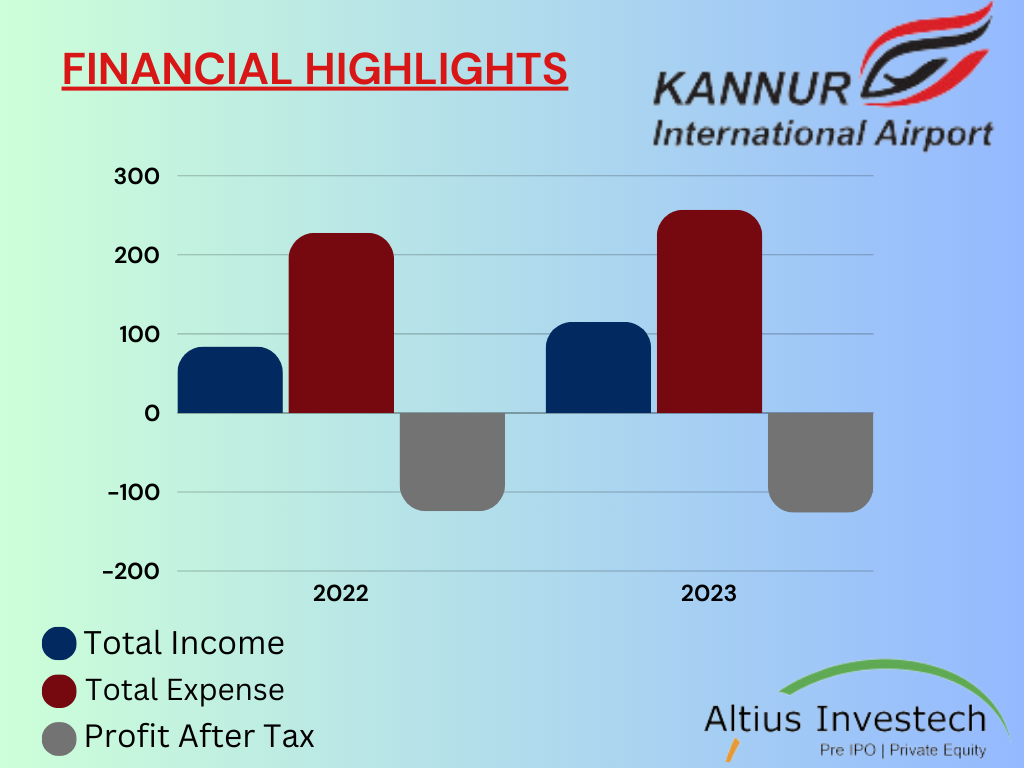

| Particulars | FY 2023 | FY 2022 | Y-o-y growth |

| Total Income | 115.17 | 83.94 | 37% |

| Total Expenses | 257.47 | 227.66 | 13% |

| EBITDA | 29.53 | 13.79 | 114% |

| Profit After Tax (PAT) | (126.27) | (124.30) | 2% |

| Earning Per Share (EPS) | (9.43) | (9.29) | – |

ALSO READ,

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/