About the Company

Jana Small Finance Bank, based in India, focuses on making banking straightforward and accessible.

It caters to individuals with modest savings, offering secure storage for funds and providing uncomplicated loan solutions to meet various financial needs.

The bank is known for its commitment to user-friendly services, aiming to make banking simple and approachable for clients, regardless of their level of financial expertise.

Jana Small Finance Bank, operating in India, stands out for its commitment to simplicity and accessibility in financial services.

Vision

Jana Small Finance Bank envisions becoming a leading and trusted financial institution dedicated to empowering individuals and businesses through accessible and inclusive banking services.

Their vision emphasizes fostering financial inclusion, innovation, and sustainable growth in the communities they serve.

IPO Synopsis

Jana Small Finance Bank filed its DRHP worth over Rs.700 crore, with SEBI on 31 March,2021.

The DRHP got approved by SEBI on 12 July, 2021. The issue comprises of a fresh issue worth Rs.700 crore and an offer for sale of up to 92,53,659 equity shares.

The companies offloading shares in the offer for sale include– Bajaj Allianz Life Insurance Company, Hero Enterprise Partner Ventures, ICICI Prudential Life Insurance Company, Enam Securities, North Haven Private Equity Asia Platinum Pte Ltd, QRG Enterprises and Tree Line Asia Master Fund Ltd.

According to the DRHP, the bank is considering a pre-IPO placement of a maximum of Rs.500 crore. This will reduce the fresh issue size.

The promoters of the issue are ICICI Securities, Axis Capital and SBI Capital Markets.

Share Price

27 July, 2022: Jana had allotted shares worth 30 crores to Amansa Holdings at a per share price of ₹580/share.

Objectives of the Issue

The main objective of the issue is to use the net proceeds to augment the bank’s Tier-I capital base.

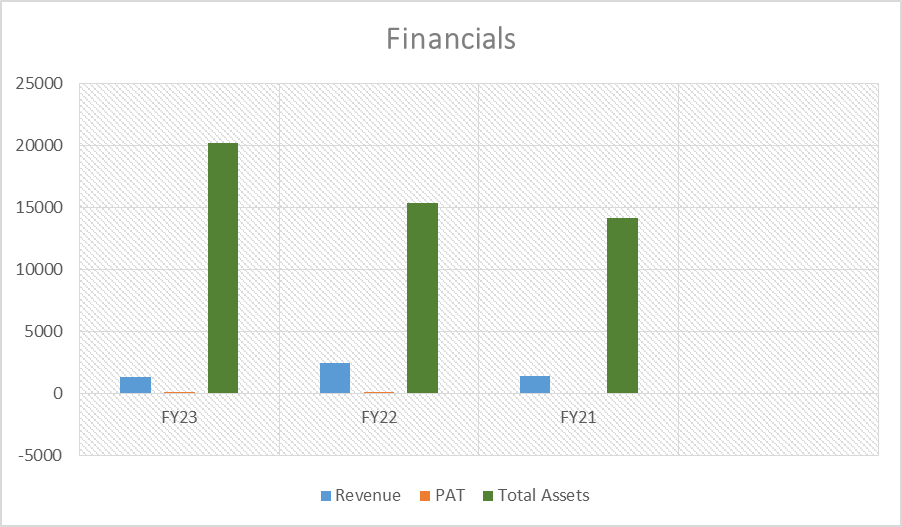

Jana Small Finance Bank Ltd Financial Status

(₹) in Crores

| Particulars (in ₹Crores) | FY23 | FY22 | FY21 |

| Revenue | 3699 | 3051 | 1,368.27 |

| PAT | 2559 | 5405 | 1949 |

| EPS | 15.42 | 5.90 | -471.84 |

| Total Assets | 25643 | 20188 | 14147 |

| Total Borrowings | 6277 | 4509 | 3365 |

| Equity Share Capital | 324 | 201 | 198.3 |

Peer Comparison (FY22)

| Bank | RoE | Total Income (in Rs bn) | PAT | Capital Adequacy ratio | GNPA % |

| AU SFB | 22.30% | 57.5 | 1,171 | 23.40% | 2.70% |

| Equitas SFB | 12.70% | 36.1 | 384.2 | 24.20% | 3.70% |

| Ujjivan SFB | 0.30% | 31.2 | 8.3 | 26.40% | 7.00% |

| Jana SFB | 7.80% | 27.3 | 84.3 | 19.30% | – |

| Utkarsh SFB | 9.40% | 17.3 | 111.8 | 21.90% | 3.70% |

| ESAF SFB | 8.70% | 17.7 | 105.4 | 24.20% | 6.70% |

| Fincare SFB | 11.80% | 13.8 | 113.1 | 29.50% | 3.46% |

| Capital SFB | 9.50% | 5.6 | 40.8 | 19.80% | 2.08% |

| Suryoday SFB | 0.90% | 8.8 | 11.9 | 51.50% | 9.40% |

| North East SFB | 1.90% | 3.1 | 7.2 | 21.22% | 11.58% |

IPO Key Points

Strengths

- Jana Small Finance Bank is a modern, digitized bank with operations on mobile and internet platforms.

- They offer video-KYC and a digital onboarding platform called DIGIGEN for customer convenience.

- The bank has an efficient and integrated risk management process.

- With a pan-India presence, it is the second-largest bank in the country as of March 31, 2021.

- Since 2008, the bank has gained 8 million customers, with 3.05 million actively using their services.

- Jana Small Finance Bank boasts a rapidly growing retail deposit base and is among the top 4 small finance banks in terms of deposit size.

- Impressively, they built their deposits from zero in 2018 to Rs. 10,229.9 crore as of September 20, 2020, showcasing strong execution ability.

Risks

- The bank mainly relies on unsecured loans, particularly group loans, for its business.

- If there are negative changes in the microfinance industry, it will significantly impact the bank’s operations.

- A considerable portion of the bank’s assets are unsecured, and if it struggles to recover these assets on time, it will face operational challenges.

- Strict industry regulations must be adhered to; any failure to comply can adversely affect the bank’s operations.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/