About Capital Small Finance Bank Ltd

Capital Small Finance Bank got its license to operate a Small Finance Bank in Feb’ 2017

It began operating on April 24, 2016, becoming India’s first small finance bank. Before, it was the biggest local area bank in India since January 14, 2000. Starting with 47 branches, it now has 159 branches across Punjab, Haryana, Rajasthan, Delhi, and Chandigarh.

Most of the bank’s business, about 71.12%, comes from rural and semi-urban areas. They have opened 6,85,599 accounts. The bank has 161 ATMs, and 74% of its branches are in rural and semi-urban areas.

They offer various services like agriculture loans, trading and MSME loans, and mortgages. As of June 30, 2021, the bank’s loan book is Rs. 3680.8 crores, with agriculture loans at 36.88%, MSME and trading loans at 26.08%, and mortgages at 22.66%.

The bank has the lowest bad loans (GNPA and NNPA) among all small finance banks in India as of March 31, 2021. Their gross NPA ratio is 2.1%, which is the second best among private sector banks.

The bank makes money through different services like forex, money transfer, safe-deposit lockers, and selling insurance.

They have also improved their use of technology, making more digital transactions. Capital Small Finance Bank offers lower interest on savings accounts compared to others, keeping their deposit costs at 5.7%, the lowest among small finance banks.

IPO Synopsis

Capital Small Finance Bank wants to become a publicly traded company. They submitted their plan to do this (DRHP) to SEBI on October 30, 2021 which got lapsed. Recently on October 3,2023 they again filed their DRHP are now waiting for SEBI’s approval.

The IPO will be a mix of fresh issue of Rs. 450 crore and sale of existing shares.

Here is who is selling existing shares: PI Ventures LLP will sell 3.37 lakh shares, Amicus Capital Private Equity LLP will sell up to 6.04 lakh shares, Amicus Capital Partners India Fund will sell 70,178 shares, Oman India Joint Investment Fund will sell up to 8.37 lakh shares, and other shareholders will sell 19.91 lakh shares.

Companies helping with the IPO process are Edelweiss Financial Services Ltd, Axis Capital Ltd, and SBI Capital Markets Ltd. The main reason they are doing this is to add more money to the bank’s Tier-1 capital.

The people who started the bank are Sarvjit Singh Samra, Amarjit Singh Samra, Navneet Kaur Samra, Surinder Kaur Samra, and Dinesh Gupta.

Financial Overview

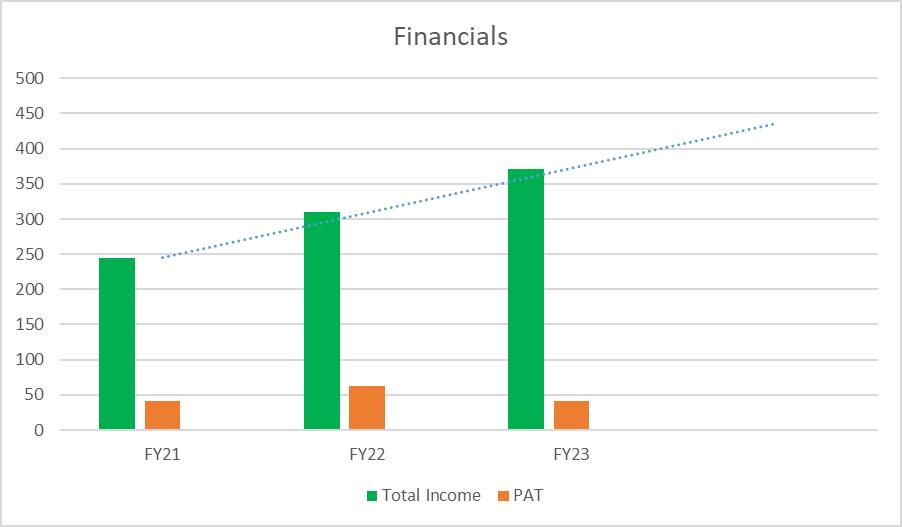

| Particulars (in ₹ Crores) | FY23 | FY22 | FY21 |

| Total Income | 371.46 | 309.47 | 244.47 |

| PAT | 93.60 | 62.57 | 40.78 |

| EPS | 27.35 | 18.41 | 12.04 |

Peer comparison (FY22)

Among its competitors, Capital Small Finance Bank is doing well. They have the lowest loans at 2.08%, which is better than other banks. They also have the most money ready to use, with a liquidity ratio of 441%, which is the highest among similar banks.

Capital Bank is also spending the least on managing loans that might go bad. Their credit cost is only 0.3%, the lowest in the group. The bank lends a lot compared to the money it has. For every 100 rupees it has, it lends out 138.7 rupees, the most in its group. The cost of getting money for the bank is 5.8%, which is the lowest among similar banks. AU Small Finance Bank is the next best but its cost is 70 basis points higher than Capital’s.

| Bank | RoE | Total Income(in ₹ Crore) | PAT |

| Capital SFB | 9.50% | 632.4 | 40.8 |

| AU SFB | 22.30% | 6632 | 1171 |

| Equitas SFB | 12.70% | 3437 | 384.2 |

| Ujjivan SFB | 0.30% | 3390 | 8.3 |

| Jana SFB | 7.80% | 1143 | 84.3 |

| Utkarsh SFB | 9.40% | 862 | 111.8 |

| Fincare SFB | 11.80% | 1404 | 113.1 |

IPO Key Points

Strengths

- Strong Savings: The bank has a lot of people who save money with them, and this has been going up consistently. In the last five years, the percentage of money saved by people (CASA ratio) has gone from 35.16% to 40.07%. Also, the bank has been one of the top banks for deposits compared to other private banks from 2018 to 2021.

- Safe Loans: Most of the money the bank lends out is safe. Almost 99.39% of the loans have something valuable backing them up, and a big chunk (86.24%) is backed by things like houses, which are immovable.

- Good Quality of Money Lent: The bank has been good at making sure the money it lends out comes back. They have a strong process to manage the risk of lending, and they check how likely it is for people to return the money (credit risk assessment).

- Helpful for Middle-Income People: The bank focuses on helping people with medium incomes. It is like a one-stop shop for their financial needs. The bank has taken the time to understand what these customers need and want.

Risks

- Limited Area Focus: The bank mainly does business in the North of India, especially in Punjab. If something goes wrong in these areas and they do not expand to other places, the company’s money situation could get worse.

- Risks in Loan Decisions: If the bank does not make good choices in deciding who they lend money to, it can lead to more financial problems. This could happen if they are not efficient or make mistakes in assessing how likely it is for people to pay back their loans. This is harmful to the bank’s finances.

- Interest Rate Changes: If the rates at which the bank borrows and lends money change a lot, it can hurt how much money the bank makes. This can affect the bank’s cash flow and business.

- Spending More than Earning: If the bank starts spending a lot more money on things like expenses, but does not make more money in return, it can be bad for their finances.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/