About Fincare SFB Ltd

Fincare started in Bangalore four years ago. It began as a small financial help organization and has now become a small bank. This bank mainly uses digital methods and focuses on people in rural and semi-urban areas in India who do not have easy access to banking services.

They have a large network, with 528 banking outlets, 219 business correspondents, and 108 ATMs.

They operate in 16 states and 38,809 villages, serving about 2.7 million customers by the end of 2021. As of the same time, the bank had about 2.68 million people with deposit accounts. They have 8,114 employees.

Some big investors support this bank, like True North Fund V LLP, Wagner Limited, Tata Opportunities Fund, LeapFrog Investments, SIDBI, Kotak Mahindra Life Insurance, and Edelweiss Tokio Life Insurance.

They have a team of 84 people who are experts in digital technology. These include product managers, designers, engineers, and developers. They work on creating, developing, and putting into action digital solutions.

The MD & CEO and CFO of Fincare SFB have been part of the financial services industry and have worked with the Fincare group for a long time, nine and twelve years respectively. The bank also has a strong management team with 20 leaders and over 30 executives.

IPO Synopsis

The Fincare SFB intends to raise funds through an IPO. The bank plans to issue new equity shares with a face value of Rs 10 each, aiming to generate up to Rs 625 crore through this fresh issue. Additionally, the IPO will include an offer for sale, wherein existing promoters and investor selling shareholders intend to sell up to 17,000,000 equity shares. This strategic move is geared towards augmenting the bank’s financial resources and facilitating its growth objectives.

Objectives of the Issue

The main objective of the offer is to use the net proceeds for the augmentation of the bank’s Tier 1 capital base to meet their future capital requirements.

Financial Overview

Market Cap: ₹4350 Cr

Net Interest Margins: 10.72%

ROE: 8.6%

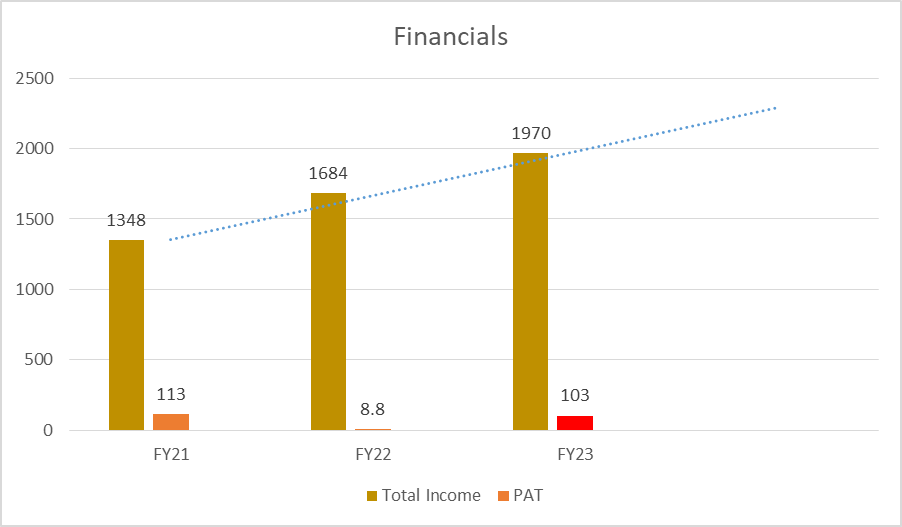

| Particulars (In ₹ Crores) | FY23 | FY22 | FY21 |

| Total Income | 1970 | 1684 | 1348 |

| PAT | 103 | 8.8 | 113 |

| EPS | 4.69 | 0.38 | 17.79 |

Peer Comparison (FY22)

| Bank | ROE | Total Income (in ₹ Crore) | PAT |

| Fincare SFB | 11.80% | 1404 | 113.1 |

| Capital SFB | 9.50% | 632.4 | 40.8 |

| AU SFB | 22.30% | 6632 | 1171 |

| Equitas SFB | 12.70% | 3437 | 384.2 |

| Ujjivan SFB | 0.30% | 3390 | 8.3 |

| Jana SFB | 7.80% | 1143 | 84.3 |

| Utkarsh SFB | 9.40% | 862 | 111.8 |

IPO Key Points

Strengths

- Digital Banking for Everyone:

- The bank really cares about making sure everyone can use their services, and they are doing this a lot through digital banking.

- They have got a big digital plan to make things easier and better for their customers.

- Helping Rural Areas:

- By the end of 2021, a big chunk, 92%, of the people using their bank were from rural places.

- They are thinking about going even more into these rural and semi-urban areas.

- Banking Everywhere:

- They have different ways for people to use the bank – you can go to a bank building or do everything online.

- So, whether you like going to a real bank or doing everything on your phone, they have got you covered.

- Leaders with Know-How:

- The top people at the bank, the MD & CEO and CFO, have been in the money business for a long time – nine and twelve years each.

- They have also been working with the Fincare group for just as long.

- Rapid Growth:

- The bank has been doing well in giving out loans. From 2018 to 2021, they were the fastest growing bank in terms of loans – that is a big deal!

Risks

- Evaluation Challenge for a New Entrant:

- Given the bank’s relatively recent establishment, assessing, and forming judgments about its business operations may present inherent challenges.

- Risk Dynamics in Microloan Portfolio:

- The microloan segment, constituting a substantial part of their business, carries a degree of risk. Notably, 40% of the borrowers are venturing into borrowing for the first time, introducing an element of uncertainty.

- Concentration in Specific Regions:

- A notable concentration of banking outlets exists in select states, namely Tamil Nadu, Gujarat, Karnataka, and Madhya Pradesh. This regional emphasis may influence the bank’s visibility and accessibility in other areas.

- Inherent Rural Economic Risks:

- Given the bank’s strategic focus on rural areas, the business is inherently exposed to risks associated with rural economics. These risks could stem from factors unique to rural environments, introducing an additional layer of complexity.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/