About the Company

Established in 1998, India Shelter Finance Corporation Limited specializes in providing housing finance solutions. The company facilitates loans for various housing needs, including construction, extension, renovation, and the purchase of new homes or plots. Additionally, they offer loans against property (LAP).

Business Overview

India Shelter Finance Corporation Limited caters to a range of loan amounts, starting from Rs. 5 Lakhs up to Rs. 50 Lakhs, with a flexible repayment tenure of up to 20 years. As of November 30, 2023, the company has successfully disbursed over Rs. 5500 Crores in loans, contributing to the realization of homeownership dreams for numerous families.

The company’s extensive reach is evident through its network of 183 branches across 15 states, notably in Rajasthan, Maharashtra, Madhya Pradesh, Karnataka, and Gujarat. The growth trajectory is notable, with the number of branches increasing from 115 as of March 31, 2021, to 130 as of March 31, 2022, and further expanding to 183 as of March 31, 2023.

India Shelter Finance Corporation Limited boasts an efficient in-house team comprising more than 300 collection officers, as of March 31, 2023. This dedicated team plays a crucial role in ensuring seamless and effective loan management.

IPO Details

| IPO Date | December 13, 2023 to December 15, 2023 |

| Face Value | ₹5 per share |

| Price Band | ₹469 to ₹493 per share |

| Lot Size | 30 Shares |

| Total Issue Size | 24,340,771 shares (aggregating up to ₹1,200.00 Cr) |

| Fresh Issue | 16,227,181 shares (aggregating up to ₹800.00 Cr) |

| Offer for Sale | 8,113,590 shares of ₹5 (aggregating up to ₹400.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Shareholding pre issue | 90,823,956 |

| Shareholding post issue | 107,051,137 |

Objects of the Issue (India Shelter Finance IPO Objectives)

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- To meet future capital requirements towards onward lending, and

- General corporate purposes.

India Shelter Finance IPO Lot Size

Investors can bid for a minimum of 30 shares and in multiples thereof.

The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 30 | ₹14,790 |

| Retail (Max) | 13 | 390 | ₹192,270 |

| S-HNI (Min) | 14 | 420 | ₹207,060 |

| S-HNI (Max) | 67 | 2,010 | ₹990,930 |

| B-HNI (Min) | 68 | 2,040 | ₹1,005,720 |

IPO GMP

India Shelter Finance IPO GMP indicates a strong listing at a premium of ₹190 as on 11th December, 2023

India Shelter Finance IPO Promoter Holding

Anil Mehta, WestBridge Crossover Fund, LLC, and Aravali Investment Holdings are the company’s promoters.

| Share Holding Pre-Issue | 56.75% |

| Share Holding Post Issue | 48.17% |

India Shelter Finance Corporation Limited Financial Information (Consolidated)

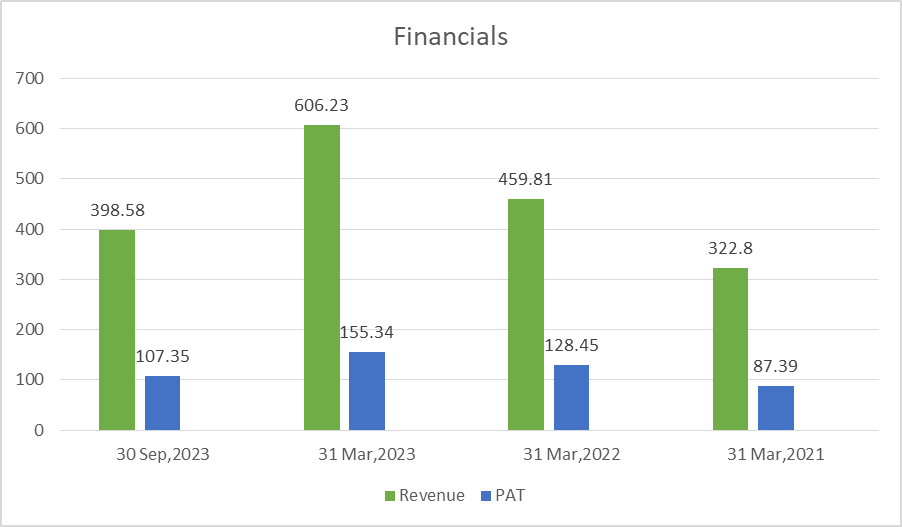

India Shelter Finance Corporation Limited’s revenue increased by 31.84% and profit after tax (PAT) rose by 20.94% between the financial year ending with March 31, 2023 and March 31, 2022.

Amount in ₹Crore

| Particulars | 30 Sep,2023 | 31 Mar,2023 | 31 Mar,2022 | 31 Mar,2021 |

| Assets | 4,758.68 | 4,295.59 | 3,221.22 | 2,462.64 |

| Revenue | 398.58 | 606.23 | 459.81 | 322.80 |

| Profit After Tax | 107.35 | 155.34 | 128.45 | 87.39 |

| Net Worth | 1,374.97 | 1,240.53 | 1,076.13 | 937.27 |

| Reserve & Surplus | 1,335.36 | 1,197.98 | 1,033.02 | 894.20 |

| Total Borrowing | 3,272.48 | 2,973.43 | 2,059.40 | 1,480.72 |

Key Performance Indicator

India Shelter Finance IPO Market Cap is Rs 5291.69 Cr and P/E (x) is 27.77.

| KPI | Values |

| P/E (x) | 27.77 |

| Market Cap (₹ Cr.) | 5291.69 |

| ROE | 13.4% |

| Debt/Equity | 2.12 |

| EPS (Rs) | 17.47 |

| RoNW | 13.4% |

Strengths

- Customer-Focused Approach: India Shelter Finance puts customers first, meaning they prioritize understanding and meeting the needs of the people who come to them for financial assistance.

- Flexible Loan Options: They offer various types of loans that can be tailored to individual needs, making it easier for customers to find a solution that fits their specific situation.

- Quick and Simple Processes: The application and approval processes are designed to be straightforward and quick, ensuring that customers do not face unnecessary delays or complications.

- Transparent Policies: India Shelter Finance believes in transparency, meaning they are clear about their terms and conditions, helping customers understand the financial aspects of their loans better.

Risks

- Interest Rate Risk: If interest rates in the market increase, it could lead to higher costs for borrowers, making it more challenging for them to repay loans.

- Economic Downturn: During tough economic times, people may face difficulties in repaying loans. This could impact India Shelter Finance’s financial health.

- Market Fluctuations: Changes in the real estate market or economic conditions can affect the value of properties, potentially impacting the value of assets held by India Shelter Finance.