About the Company

Fincare, a financial services company established in 2017, has quickly grown into a significant player in the banking sector. Beginning as a small finance bank and later evolving into a full-fledged commercial bank, Fincare prioritizes financial inclusion, aiming to make banking services accessible to everyone, regardless of their location or background. Guided by “The Fincare Way,” which emphasizes principles such as customer delight, ethical values, and technology-driven processes, the bank focuses on delivering excellent service and building trust with customers in both rural and urban areas. By continuously innovating and leveraging technology, Fincare is working towards making banking easier and more convenient for all its customers, thereby contributing to financial empowerment and progress in India’s banking landscape.

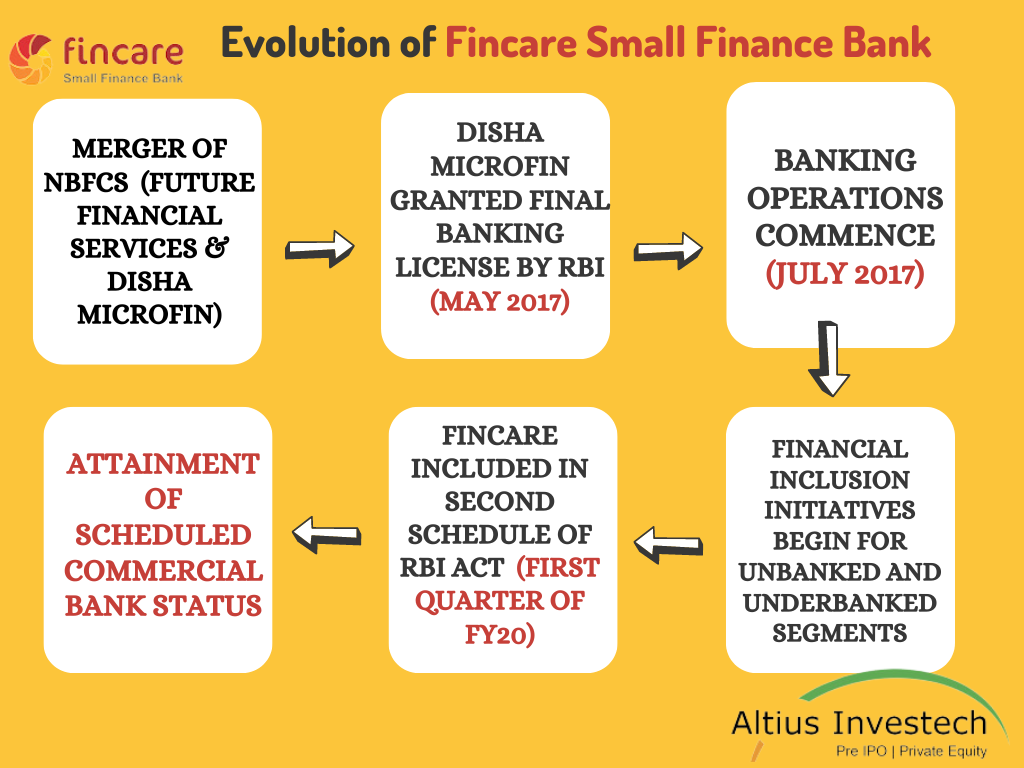

History

The genesis of Fincare Small Finance Bank was the merging of two NBFC Micro Finance Institutions, Future Financial Services and Disha Microfin. In May 2017, Disha Microfin was granted the final license by the RBI under section 22 of the Banking Regulation Act, 1949, to initiate banking operations. Banking operations commenced on 21st July 2017, with a vision to facilitate the financial inclusion of unbanked and underbanked customer segments, including microentrepreneurs and microenterprises, along with broader masses, with active involvement from the affluent. In the first quarter of FY20, Fincare Small Finance Bank was included in the Second Schedule of the Reserve Bank of India Act, 1934. Consequently, the bank attained the status of a Scheduled Commercial Bank, signifying the highest level of trust and governance.

Fincare Small Finance Bank’s Digital Innovations

Fincare Small Finance Bank has prioritized digital innovation since its inception, leveraging technology to enhance banking services. Their initiatives include developing user-friendly mobile banking apps, offering internet banking platforms, and implementing advanced digital payment solutions. Through a 3D approach encompassing Digital, Doorstep, and attractive Deposit rates, the bank anticipates establishing itself as a formidable contender and the preferred “Smart Bank” for its target customer segments. These efforts aim to improve customer experience, streamline processes, and provide convenient access to banking services anytime, anywhere.

Empowering Principles

Fincare Small Finance Bank’s Values. The name FINCARE represents a set of guiding principles that shape the bank’s ethos and operations: Fair, Innovative, Nimble, Collaborative, Accountable, Resolute, and Excellent.

Fincare SFB: Vision

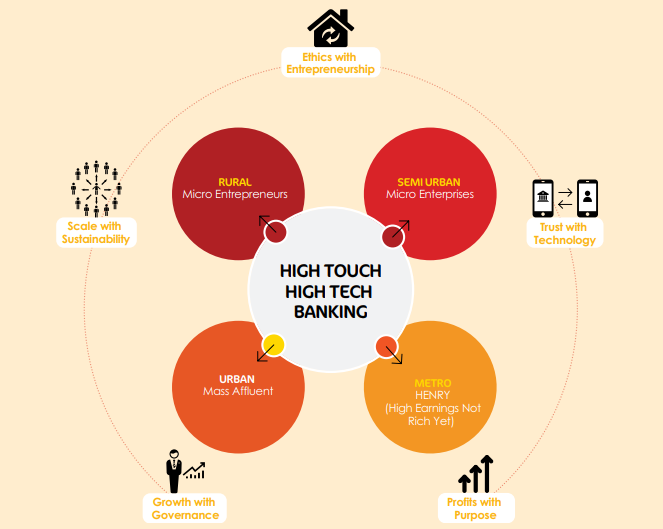

The vision is to facilitate the financial inclusion of unbanked and underbanked households in India, with active participation from more affluent customer segments

Fincare SFB: Mission

The mission is to establish a best-in-class digital bank that delivers value to all stakeholders

Fincare SFB: Business Model

The business model of Fincare Small Finance Bank seamlessly integrates financial inclusion with technology, profitability with social impact, thereby facilitating the provision of affordable and accessible financial products and services to underserved individuals and businesses.

Understanding the AU SFB and Fincare SFB Merger

In a significant development within the Indian banking sector, the Reserve Bank of India (RBI) has granted approval for the merger of Fincare Small Finance Bank (SFB) with and into AU Small Finance Bank (AU SFB). This merger marks a pivotal moment, creating a robust entity with a combined customer base of over 1 Crore and a widespread presence across 25 states and union territories.

Merger Details

| Merger Details | Information |

|---|---|

| Share Swap Transaction | Shareholders of Fincare SFB: 579 shares in AU SFB for every 2,000 shares held in Fincare SFB |

| Post-Merger Shareholding | Existing shareholders of Fincare SFB to hold ~9.9% stake in AU SFB |

| Regulatory Approvals | Approval received from RBI on March 4, 2024; CCI sanctioned the merger scheme on January 23, 2024 |

| Capital Infusion | Promoters of Fincare SFB committed ₹700 Cr in capital infusion |

Regulatory Approvals

The merger received regulatory approval from the RBI on March 4, 2024, following endorsement from the boards and shareholders of both banks. Furthermore, the Competition Commission of India (CCI) sanctioned the merger scheme on January 23, 2024, underlining its compliance with regulatory requirements.

Impact and Statistics

- Expanded Customer Base: Upon completion, the merged entity is poised to serve a diverse customer base exceeding 1 Crore individuals. This substantial increase in clientele signifies the enhanced reach and accessibility of banking services across various segments of the population.

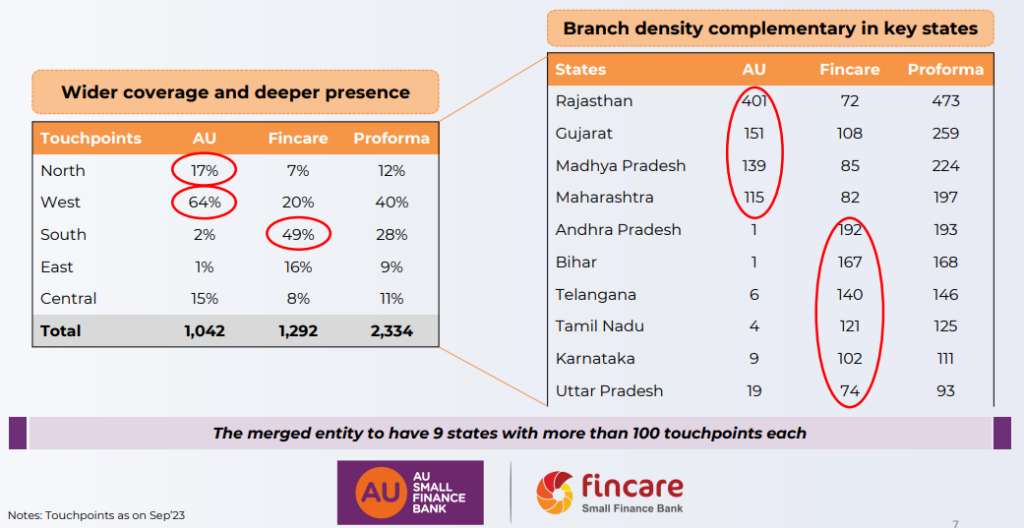

- Widespread Presence: With a network spanning over 2,350 physical touchpoints across 25 states and union territories, the merged bank is primed to offer unparalleled convenience and accessibility to its customers nationwide.

- Financial Strength: As of December 31, 2023, the combined bank will boast a deposit base of ₹ 89,854 Crore and a Balance Sheet Size of ₹1,16,695 Crore, reaffirming its position as a significant player in the Indian banking landscape.

Implementation Timeline

The merger is slated to be effective from April 1, 2024, signaling the commencement of the integration process. During this transition, all employees of Fincare SFB will seamlessly integrate into the AU SFB workforce, ensuring continuity and stability in operations.

Additional Integration Details

- Employee Integration: All Fincare SFB employees will be onboarded as part of the AU SFB family post-merger, preserving talent and expertise within the merged entity. Furthermore, the MD & CEO of Fincare SFB will assume the role of Deputy CEO of AU SFB, ensuring continuity in leadership and strategic direction.

- Board Expansion: Divya Sehgal, current director of Fincare SFB’s board, will join the Board of AU SFB, bringing her expertise and insights to further enrich the governance framework of the merged entity.

- Global HR Expertise: Aon, a renowned global consulting firm, has been engaged to facilitate the integration process and bring forth the best practices in HR management, ensuring a smooth transition and harmonization of organizational culture.

This merger signifies a significant milestone in the evolution of both AU SFB and Fincare SFB, paving the way for enhanced synergies, expanded offerings, and greater value creation for all stakeholders involved.

Key Strategic Rationale

Complementary branch footprint

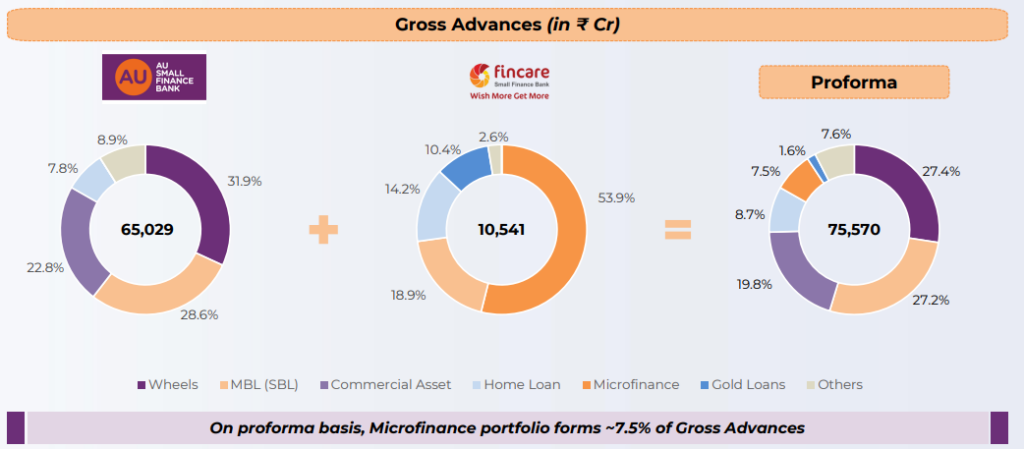

Diversification of portfolio

Fincare SFB: Key Milestone

Fincare SFB: Awards and Accolades

Here is the list of awards received by Fincare Small Finance Bank:

- World HRD Leadership Congress: Awarded Best Technology Orientation for Fincare Connect.

- Great Indian BFSI Award: Recognized as the Best Small Finance Bank.

- ET Future Ready Organizations: Listed as a Future Ready Organization in the banking sector.

- National Awards BFSI, By CMO Asia:

- Awarded for Best Business Banking and Payments Solutions.

- Acknowledged for Cybersecurity Initiatives.

- Quantic India-Technology Excellence Award: Recognized for Technology Excellence in Banking.

- IFTA: Awarded for Best Digital Solution – M Care.

- National Award for Excellence in CSR: Received for outstanding CSR initiatives.

- National Award for Excellence in HR Best Practices: Recognized for exemplary HR practices.

- IBIS Intelligence: Acknowledged for governance excellence.

- Ambition Box: Recognized by Governance Now – Shree Adhikari Brothers for Best Digital Solution – Audit Management Process.

- Governance Now – Shree Adhikari Brothers:

- Recognized as the Best Place to Work.

- Awarded for Best Digital Solution – Fincare Connect App.

Fincare SFB: Products and Services

Deposit Products:

- Savings Account

- Fincare 101 Account

- Current Account

- Recurring Deposit

- Retail Term Deposit

Loan Products:

- Micro Loan

- Loan Against Property

- Loan Against Gold

- Affordable Housing Loan

- Institutional Finance

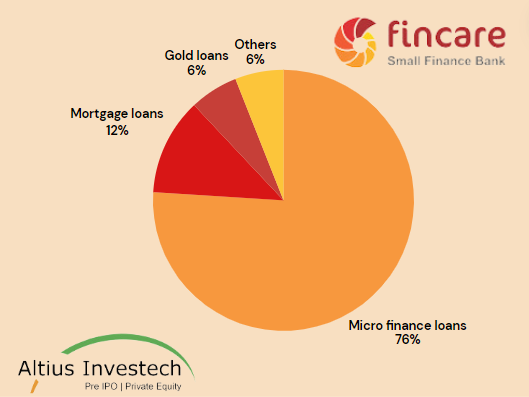

Product Mix

- 93.47% of the bank’s customers originate from rural or low-income areas.

- The Gross Loan Portfolio (GLP) expanded from ₹6,072 crores in FY21 to ₹9,911 crores in FY23, marking a CAGR of 27.76%.

- The number of borrowers increased from 0.22 crores in FY21 to 0.34 crores in FY23, demonstrating a CAGR of 21.87%, which primarily drove the GLP growth.

Fincare SFB: Board of Directors

Rajeev Yadav: MD and CEO

Rajeev Yadav, with 28 years in financial services, has driven strategies at Fincare Small Finance Bank. As the former CEO of the Fincare platform, he spearheaded profitable scaling. With leadership roles at GE Money and telecom experience, Yadav holds a PGDM from IIM Ahmedabad and a B. Tech from IIT Kanpur.

…..

Pramod Kabra: Part-time Chairman and Non-Executive Director

Pramod Kabra serves as the Part-time Chairman and Non-Executive Director of Fincare Small Finance Bank. He holds a bachelor’s degree in commerce from Jodhpur University and is a chartered accountant with the Institute of Chartered Accountants of India. Currently, he is associated with True North Managers LLP.

..

Keyur Doshi: CFO

Keyur Doshi serves as the CFO of Fincare Small Finance Bank. He holds a Bachelor’s degree in Science (Mathematics) from Maharaja Sayajirao University, Baroda, and a Master’s in Business Administration from the University of Pune. Additionally, he is one of the founders of the company. Prior to his current role, he was a partner at Disha Support Services.

Industry Overview

The formation of Small Finance Banks (SFBs) in India marks a significant evolution in the banking sector, driven by the Reserve Bank of India (RBI) and the Government of India’s vision for enhanced financial inclusion. These banks are specifically tailored to cater to the needs of underserved segments such as small businesses, farmers, and unorganized entities, providing them with access to basic banking services. By functioning as formal deposit-taking institutions, SFBs can tap into low-cost funds, positioning them favorably against Non-Banking Financial Companies (NBFCs).

With a strategic focus on rural areas, SFBs aim to accelerate financial inclusion and promote economic growth by offering essential banking and credit facilities to a wider population. As they expand their footprint, SFBs present a viable alternative to both Public Sector Banks (PSBs) and Private Sector Banks (PVBs), leveraging their specialized offerings and localized approach to gain market share. Additionally, obtaining a scheduled bank license to operate as an SFB provides non-NBFC entities like local area banks and urban cooperative banks with a boost, allowing them to extend their reach and broaden their service offerings to previously underserved communities.

Peer Comparison

₹ (in crores)- as of 31st March, 2022

| Particulars | Fincare SFB | AU SFB | Equitas SFB | Ujjivan SFB |

| Total Income | 1404 | 6632 | 3437 | 3390 |

| Advances | 7000 | 56300 | 24900 | 21900 |

| Deposits | 6500 | 61100 | 23400 | 23200 |

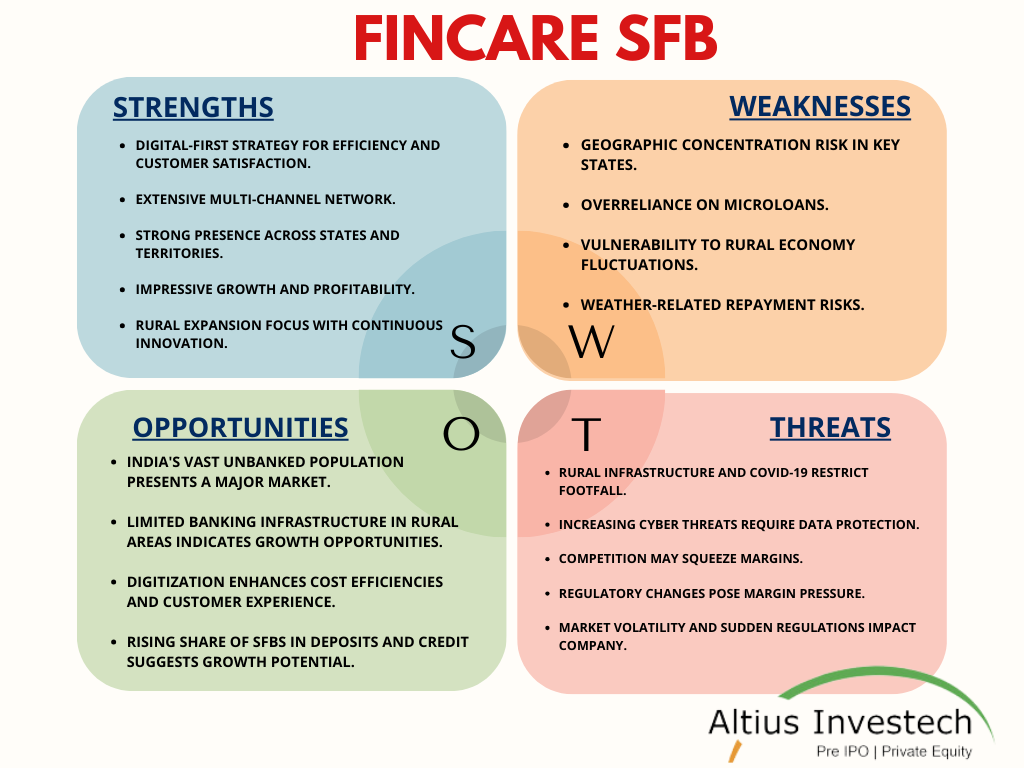

Fincare SFB: SWOT Analysis

Fincare SFB Share Price (as of 01.04.2024)

- The buy price of Fincare SFB varies based on quantity, ranging from 199 for quantities between 50 – 200 shares to 193 for quantities between 2001 – 3355 shares, with corresponding rates per share.

- The 52-week high is 249, and the 52-week low is 151 indicating the range of fluctuations in the share price. Additionally, the sell price of Fincare SFB is fixed at 150.

Currently, the Fincare SFB Share Price is trading at around Rs. 195/share. CLICK HERE to Invest.

Financial Metrics for Fincare SFB (as of 01.04.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 41.15 |

| Price to Sales Ratio (P/S) | 2.44 |

| Price to Book Value (P/B) | 3.28 |

| Industry PE | 18.87 |

| Face Value | ₹ 10 |

| Book Value | ₹ 58.84 |

| Market Cap | ₹4261.05 Cr |

| Dividend | 0 |

| Dividend Yield | 0 % |

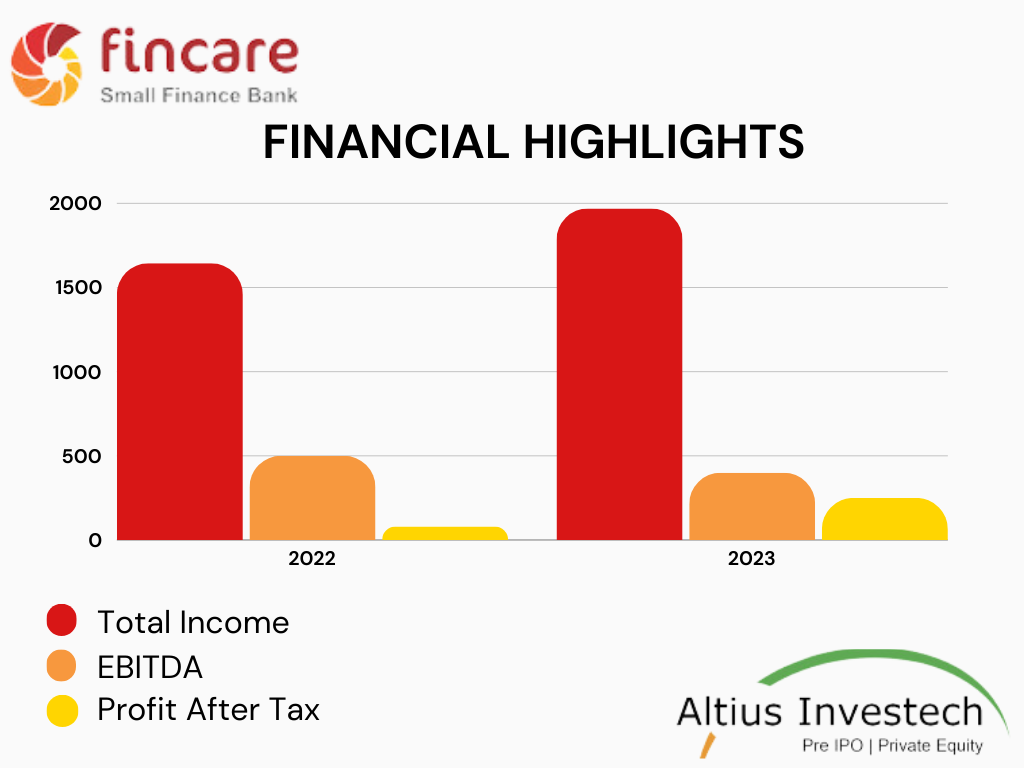

Financial Highlights 2022-23

| Particulars | FY 2023 | FY 2022 | Y-o-y growth |

| Total Income | 1970 | 1644 | 19.95% |

| EBITDA | 216.39 | 229.29 | -5.62% |

| Profit After Tax | 103 | 8.8 | 1070.45% |

| EPS | 4.69 | 0.38 | – |

FINCARE BUSINESS SERVICES: Holding Company of Fincare Small Finance Bank

Fincare Business Services (FBSL) holds an 80% stake in Fincare Small Finance Bank Limited (FSBl). Established on August 1st, 2014, FBSL began as a Private Limited Company headquartered in Bengaluru, Karnataka. Its core objective is to provide financial support to its subsidiary, Fincare Small Finance Bank Limited, as well as other group entities. In 2016, FBSL transformed, transitioning into a public limited company and assuming the role of a non-deposit taking systematically important-core investment company.

Fincare Business Services: Financials

₹ (in crores)

| Particulars | 2023 | 2022 |

| Net Revenue | 1886.5 | 1704.2 |

| PAT | 82.30 | -29.30 |

Merger Updates

Following the approval from the Reserve Bank of India (RBI), the merger of Fincare Small Finance Bank Ltd with AU Small Finance Bank Ltd has been sanctioned, effective from April 1, 2024. All branches of Fincare Small Finance Bank Ltd will transition to operate under AU Small Finance Bank Ltd. This strategic merger enhances the company’s commitment to financial inclusion while expanding and diversifying its offerings.

Implications for Fincare Business Services shares:

- Post-merger, revised AU shares stand at 74.1 crore.

- Pre-merger, AU shares amounted to 66.8 crore.

- The difference in shares issued (74.1 – 66.8) amounts to 7.3 crore shares.

- Fincare Business Services Limited (FBSL) holds 80% of the newly issued shares, equating to 5.8 crore shares.

- Based on the calculation of 5,11,32,583 / 32 crs shares x Rs 565 the share price translates to Rs. 90/- per share.

Fincare SFB: IPO Plans

Fincare Small Finance Bank, initially planning an IPO to raise Rs 625 crore, is now set to merge with AU Small Finance Bank, an already listed entity. With this merger, Fincare SFB will forgo its individual IPO, consolidating operations with AU Bank. This move is expected to bring about synergies and strengthen both banks’ presence in the financial sector.

Conclusion

- Establishment and Growth: Fincare Small Finance Bank established in 2017, quickly became a significant player in the banking sector prioritizing financial inclusion.

- Guiding Principles: The Bank adheres to “The Fincare Way,” emphasizing customer delight, ethical values, and technology-driven processes for accessible banking.

- Digital Innovations: Prioritizes digital initiatives, offering user-friendly mobile apps, internet banking, and digital payment solutions.

- Milestones and Recognition: Inclusion in the Second Schedule of RBI Act, 1934, marked a significant milestone, along with numerous awards and accolades.

- Merger with AU Small Finance Bank: Recent approval for merger with AU Bank signifies a strategic shift and consolidation of operations with the listed entity.

- Forgoing Individual IPO: The decision to forgo individual IPO plans aligns the future trajectory of AU Bank, aiming to drive synergies and strengthen financial sector positions.

- Future Outlook: Merger expected to enhance capabilities and drive financial inclusion, with continued commitment to innovative banking solutions.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/