About Carrier Airconditioning & Refrigeration Limited

Carrier has a rich history in India dating back to 1936 when it installed the country’s first air-conditioning system at the renowned Rambagh Palace in Jaipur. In 1986, Carrier India was formally established, marking a significant milestone. Subsequently, in 1988, the company inaugurated its flagship manufacturing facility in Gurgaon, Haryana. Presently, Carrier produces a diverse range of products including cassettes, ducted splits, package units, air- and water-cooled screw chillers, air- and water-cooled reciprocating chillers, fan coil units, air handling units, refrigeration products, and fire & security products.

| Company Name | Carrier Airconditioning & Refrigeration Limited |

| Company Type | Unlisted Private Company |

| Industry | Manufacturing |

| Founded | 1986 |

| Headquarters | Gurgaon, Haryana, India |

Carrier Business Model

Carrier India Private Limited specializes in the manufacturing and supply of air conditioners, including window split and window air conditioners. Operating 51 factories and 39 research & design centers globally, the company is committed to innovation and quality in the air conditioning sector.

Carrier Products

- Cassettes: Ceiling-mounted units suitable for commercial spaces, offering efficient cooling and heating.

- Ducted Splits: Concealed units designed for centralized air conditioning systems, providing uniform cooling throughout the space.

- Package Units: All-in-one systems combining heating, cooling, and ventilation components in a single outdoor unit for easy installation.

- Chillers: Utilizing both screw and reciprocating compressors for large-scale cooling applications in industrial and commercial settings, available in air- and water-cooled variants.

- Fan Coil Units: Compact units designed to regulate air temperature in small to medium spaces, ideal for hotels, offices, and residences.

- Air Handling Units: Centralized systems for air circulation and conditioning, offering customizable configurations to meet specific building requirements.

- Refrigeration Products: Solutions for cold storage and preservation needs, including refrigerated cabinets, display cases, and walk-in coolers.

- Fire & Security Products: Equipment and systems for fire detection, suppression, and security, ensuring safety and protection in various environments.

- Controls: Advanced control systems for managing HVAC equipment, optimizing performance, and enhancing energy efficiency.

- Carrier VRF Systems: Including Carrier VRF X Power and Carrier VRF XCT7, offering variable refrigerant flow technology for energy-efficient and precise temperature control.

- Packaged Systems: All-in-one HVAC solutions integrating heating, cooling, and ventilation components in a compact outdoor unit, suitable for various applications.

Carrier Services

- Installation and Commission: Professional setup of HVAC systems to ensure optimal performance.

- Maintenance and Repairs: Regular servicing and prompt repairs to keep HVAC systems operating smoothly.

- Retrofit and Modernize: Upgrading existing systems with the latest technologies for improved efficiency.

- Customer Support: Dedicated helpline for inquiries, service requests, and technical assistance.

- Totaline Network: Extensive network of authorized dealers offering genuine Carrier parts and accessories.

Key Business Segment

- Light Commercial Air Conditioning (LC): Ducted Segment is Carrier’s energy-efficient inverter ducted systems that have gained commendable traction since their launch in 2018, catering to the demand for efficient cooling solutions. Cassette Segment is the BEE-labeled Cassette range, particularly the Inverter Cassette, is experiencing increasing demand driven by its high efficiency.

- Commercial Air Conditioning: The growth of locally manufactured screw chillers and increased market penetration, especially in sectors like pharmaceuticals and industry, has fueled growth in the commercial air conditioning segment.

- Commercial Refrigeration: Despite challenges in the food retail sector, Carrier’s commercial refrigeration business has witnessed steady growth, particularly in non-food retail and cold room markets. Expansion into niche segments like IQF and mushroom growth chambers has further boosted sales.

- Service Business: Carrier’s service business has consistently grown, attracting multinational and top local segments with its energy-saving solutions, enhancing its market presence significantly.

- Transicold: Carrier Transicold India is a leader in establishing robust cold chains, offering truck refrigeration systems supported by an extensive sales and service network spanning over 60 service centers.

Management of the Company

Mr. Chirag Baijal: Managing Director

Chirag Baijal serves as the Managing Director of HVAC (Heating, Ventilation & Air Conditioning) for Carrier in India and Chairman of the board of Carrier in India, a subsidiary of Carrier Global Corporation. With over 21 years of experience across various sectors including HVACR, Tools & Automotive Equipment, Financial Services, and Building industries, Baijal has spent over 15 years in leadership roles at Carrier.

Mr. Narendra Singh Sisodia: Independent Director

Narendra Singh Sisodia serves as an Independent Director at Carrier, bringing extensive experience from leadership roles across industries. His appointment highlights Carrier’s commitment to governance and ethical standards. Sisodia’s expertise contributes to strategic direction and oversight, ensuring alignment with Carrier’s mission and values. His diverse background and ethical leadership principles enhance Carrier’s corporate governance and reinforce its dedication to sustainability and excellence.

Ms. Simran Thapar: Whole-time Director

Simran Thapar serves as the Whole-time Director of Carrier, bringing with her a wealth of experience from previous roles at Radio Mirchi and Tata Power. With a PGDM in Human Resources from Amity University, she possesses a strong foundation in organizational management and human capital development. Her diverse background and expertise contribute to Carrier’s leadership team, driving the company’s HR strategies and fostering a culture of excellence and innovation.

Industry Overview

The air conditioner and refrigerator market in India is witnessing steady growth propelled by factors like increasing urbanization, rising disposable income, and changing consumer lifestyles. With a significant middle-class population, these appliances have become indispensable commodities for both residential and commercial sectors, particularly during the scorching summer months. Key players in the market, including Voltas, LG Electronics, Samsung, and Carrier India, among others, offer a diverse range of products to meet varying consumer needs.

Technological advancements such as energy-efficient models, inverter technology, and smart connectivity features are driving market trends, while challenges like seasonality and intense competition persist. Despite these challenges, the industry’s future outlook remains positive, fueled by growing consumer awareness, government initiatives promoting energy efficiency, and ongoing urbanization trends. Manufacturers are expected to focus on innovation and sustainability to capitalize on the expanding market opportunities in India.

Emerging Trends and Growth Prospects in the Indian HVAC Industry

The Indian HVAC industry is poised for significant growth, with a projected compound annual growth rate (CAGR) of 16% from 2021 to 2030, reaching an estimated market size of US$29,283 million by 2030. This growth is driven by technological advancements enabling remote management and supervision of HVAC systems, resulting in enhanced energy efficiency and cost savings for residential property owners. By 2024, the Indian HVAC market is anticipated to reach US$6 billion, reflecting a CAGR of 7% from 2019 to 2024.

Furthermore, the export of white goods like refrigerators and air conditioners has shown promising figures, with refrigerators, freezers, and other refrigerating equipment accounting for US$141 million and air conditioners accounting for US$178 million in exports during 2022-23 (April-November). This positive trajectory highlights India’s emergence as a lucrative market for both domestic and international HVAC manufacturers, with substantial growth opportunities expected in the coming years.

Peer Comparison

Financials as on 31st March,2023: ₹ (in crores)

| Particulars | Carrier | Voltas | Whirlpool | Blue Star |

| Total Income | 2221 | 9667 | 6795 | 8008 |

| PAT | 110 | 136 | 224 | 401 |

| Net Profit Margins | 5% | 1.4% | 3% | 5% |

| EPS | 10.33 | 4.08 | 17.26 | 41.6 |

| Market Cap | 4574 | 35863 | 15918 | 25648 |

| CMP (21/03/24) | 540 | 1075 | 1239 | 1252 |

| P/E | 51.31 | 128 | 78.76 | 53.47 |

| P/S | 4.63 | 3.71 | 2.34 | 3.20 |

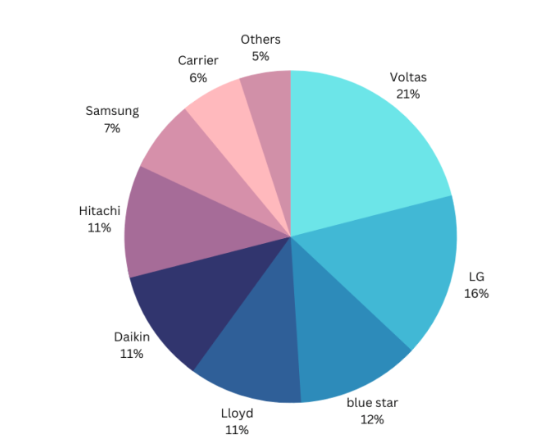

Market Share Distribution of Key Players

Source: cashkaro.com

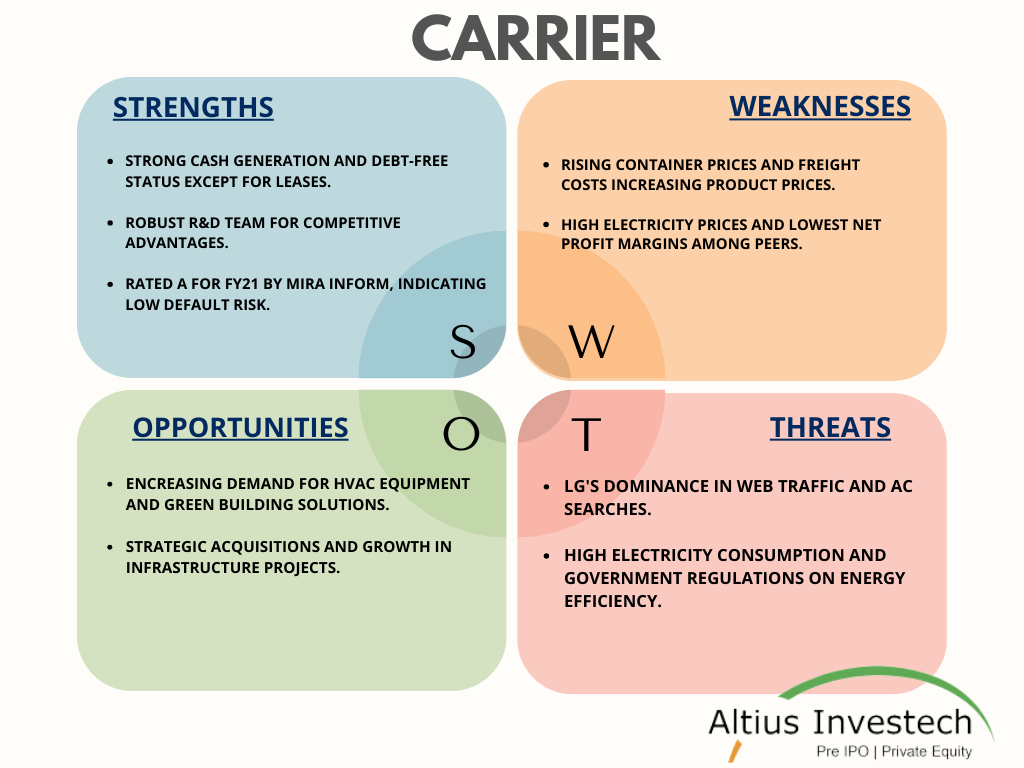

SWOT Analysis

News

Carrier Toshiba Acquisition: 2022

Carrier Acquires Toshiba’s Interest in TCC

In a strategic move, Carrier has acquired the majority of Toshiba’s stake in Toshiba Carrier Corporation (TCC) for around $900 million in 2022. This acquisition comes at a time when TCC was recording annual sales of approximately $2 billion.This acquisition significantly bolsters Carrier’s position in the rapidly expanding and environmentally friendly variable refrigerant flow (VRF) and heat pump market segments. These segments are known for their high efficiency and sustainability, aligning perfectly with Carrier’s commitment to innovation and eco-friendly solutions.

About TCC

Toshiba Carrier Corporation (TCC) is a well-established joint venture between Carrier and Toshiba, specializing in providing residential and light commercial HVAC solutions worldwide. TCC’s product portfolio includes VRF and heat pump products, catering to the growing demand for energy-efficient and reliable heating, ventilation, and air conditioning solutions.

Carrier to Invest $800 Million in India’s HVAC Market Over Next 5 Years: October 2023 Update

Carrier, a global leader in air conditioning and refrigeration solutions, plans to invest $800 million in India over the next five years. This investment aims to capitalize on India’s low air-conditioning penetration, with only 8% of residential homes currently equipped. CEO David Gitlin emphasizes environmentally friendly growth in the HVAC sector. Carrier targets double-digit growth in India, with plans to expand manufacturing, quadruple supply chain spending, and increase employment. The Indian government’s incentives for domestic manufacturing, including the Production Linked Incentive (PLI) program, are viewed positively. Carrier sees India as a strategic growth market and a source of talent.

Surge in Air Conditioner Demand Sweeps India

In April 2022, India experienced a surge in demand for air conditioners, with record-breaking sales exceeding 15 lakh units in March alone. Major manufacturers, including Carrier, anticipated a bumper year for the industry after pandemic-related struggles. The low penetration of ACs in the country, combined with economic activity and improved electricity access, drove higher adoption rates. Challenges such as supply shortages and rising input costs persisted, but government initiatives like the PLI scheme offered support. Despite these hurdles, industry leaders remained optimistic about the sector’s growth prospects in India.

Carrier Toshiba Acquisition Expands CDL’s Product Portfolio: 2021 Update

In 2021, Cool Designs Ltd (CDL), a distributor of Toshiba Carrier air conditioning, expanded its portfolio by adding Carrier’s recently introduced XCT7 VRF system alongside Toshiba’s latest VRF products. With a 17-year association with TCUK, CDL Managing Director Darrel Birkett saw the launch of Carrier’s XCT7 VRF as an opportunity for growth. Initially cautious, Birkett was impressed by the XCT7’s build quality and competitive pricing. He decided to install the Carrier XCT7 system in his own home due to its slim ducts, integrated pumps, flexible return air, and smart, contemporary design. This move demonstrates CDL’s confidence in Carrier’s product quality and its commitment to offering high-quality solutions to its customers. Additionally, Carrier’s recent acquisition of Toshiba’s stake in Toshiba Carrier Corporation (TCC) for around $900 million further solidifies Carrier’s position in the sustainable HVAC market segments.

Carrier Share Price (as of 21.03.2024)

- The buy price of Carrier varies based on quantity, ranging from 549 for quantities between 50 – 130 shares to 530 for quantities between 1501 – 2666 shares, with corresponding rates per share.

- The 52-week high is 545, and the 52-week low is 262 indicating the range of fluctuations in the share price. Additionally, the sell price of Carrier is fixed at 475.

Financial Metrics for Carrier (as of 21.03.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 51.31 |

| Price to Sales Ratio (P/S) | 4.63 |

| Price to Book Value (P/B) | 23.77 |

| Industry PE | 50 |

| Face Value | ₹ 10 |

| Book Value | ₹ 22.3 |

| Market Cap | ₹5637.97 Cr |

| Dividend | 0.5 |

| Dividend Yield | 0.09 % |

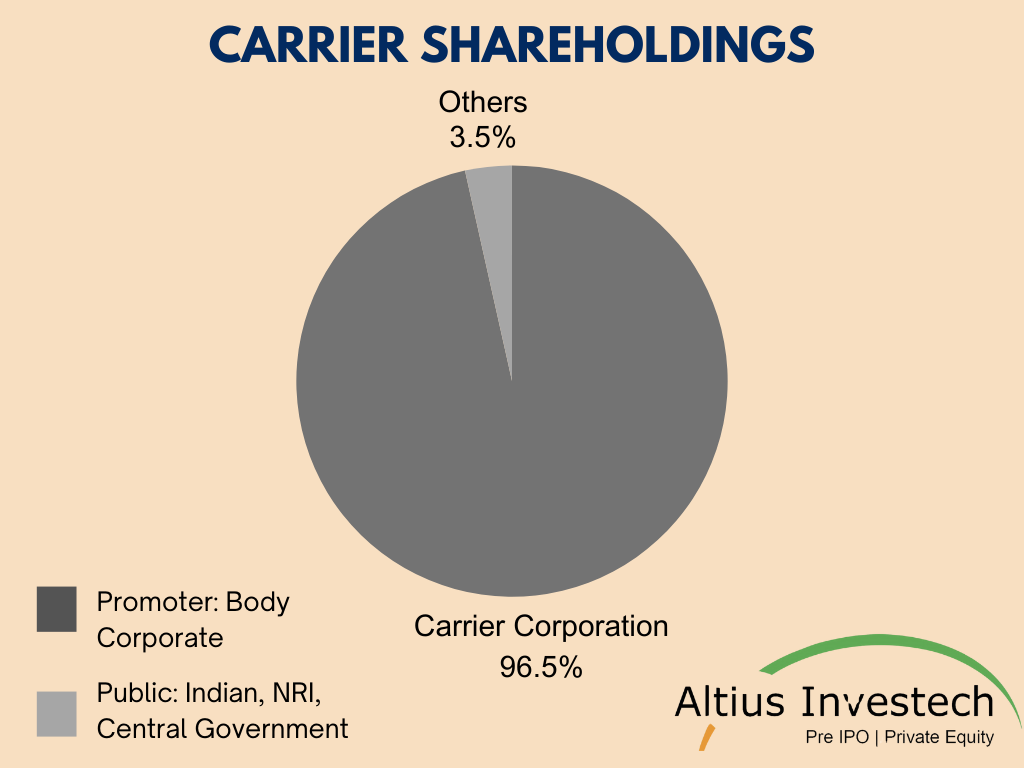

Shareholdings of Carrier

| Shareholding Above 5% | Holding % |

| Carrier Corporation | 96.5 |

| Other | 3.5 |

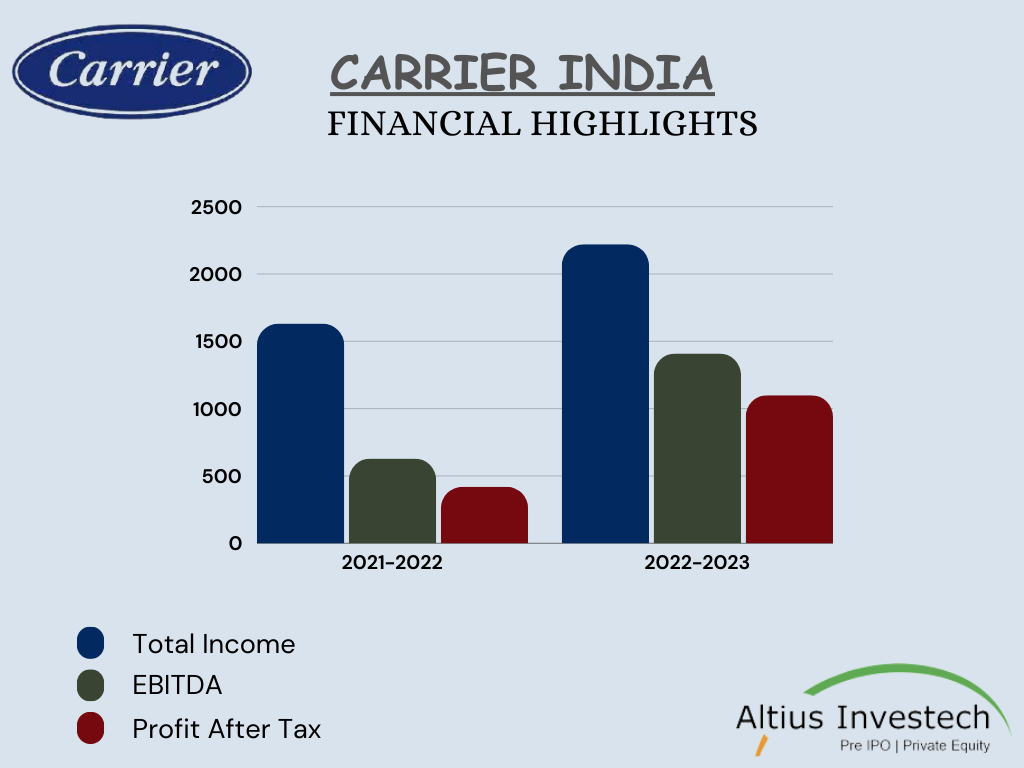

Financials

₹ (in crores)

| Particulars | 2022-2023 | 2021-2022 | Growth |

| Total Income | 2221 | 1632 | 36% |

| EBITDA | 141 | 63 | 124% |

| PAT | 110 | 42 | 162% |

| EBITDA Margins | 6% | 4% | |

| Net Profit Margins | 5% | 3% | |

| EPS | 10.33 | 3.96 | |

| ROE | 30% | 16% |

Dividend Declaration

| Financial Year | Particulars | Record Date | Ratio/Rates/Amount | Remarks |

| 2021-22 | DIVIDEND | 13-Sep-2022 | 1 | Carrier Airconditioning & Refrigeration Ltd has given a dividend of Rs 1/shares |

| 2020-21 | DIVIDEND | 21-Sep-2021 | 0.5 | Carrier Airconditioning & Refrigeration Ltd has given a dividend of Rs 0.5/shares |

Conclusion

- Growth and Innovation: Carrier Airconditioning & Refrigeration Limited has demonstrated robust growth and innovation in the Indian HVAC industry, leveraging its rich history dating back to 1936.

- Leadership and Management: Under the guidance of key executives such as Mr. Chirag Baijal, Mr. Narendra Singh Sisodia, and Ms. Simran Thapar, Carrier has exhibited strong leadership and strategic management.

- Strategic Moves and Investments: Recent strategic moves, including the acquisition of Toshiba’s stake in Toshiba Carrier Corporation and significant investments in the Indian HVAC market, demonstrate Carrier’s vision for growth and sustainability.

- Financial Stability and Shareholder Value: Carrier’s financial stability is evident from its consistent dividend declarations and impressive financial metrics, reflecting its ability to generate value for shareholders.

- Financial Highlights: Carrier Airconditioning & Refrigeration Limited reported a significant growth in financial metrics for the fiscal year 2022-2023, including a 36% increase in Total Income, a remarkable 124% growth in EBITDA, and a substantial 162% surge in Profit After Tax (PAT). Additionally, the company achieved improvements in EBITDA Margins and Net Profit Margins, with a notable Return on Equity (ROE) of 30%.

- Share Price: The share price of Carrier Airconditioning & Refrigeration Limited (CMP) stands at ₹540 as of March 21, 2024, with a 52-week high of ₹545 and a 52-week low of ₹262. The buy price varies based on quantity, ranging from ₹549 to ₹530 per share, while the sell price is fixed at ₹475, providing investors with insight into potential trading ranges.

- Future Outlook: With a focus on technological advancements, energy efficiency, and market expansion, Carrier is well-positioned for continued success in India and beyond.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/