About The Company

Waaree Energies Limited is the flagship company of Waaree group, founded in 1989 with headquarters in Mumbai,India. It is today one of the largest vertically integrated new energy companies. Waaree has India’s largest solar panel manufacturing capacity of 12GW at its plants in Chikhli, Surat and Umbergaon in Gujarat.

It is a top player now in EPC services, Project Development, solar rooftop solutions, solar inverter, and solar water pump.

It has presence in over 388 locations nationally and 20 countries internationally. The company has supplied 6+GW of solar modules and commissioned 1+GW of solar EPC project.

Management View –

The view is to provide high quality and cost-effective sustainable energy solutions across all the markets, reducing carbon foot print- making a way for sustainable energy thereby improving quality of present and future human life. The manufacturing capacity is poised to expand significantly, from 12 GW to 20 GW by FY24-25. This development could potentially

establish them as the largest solar module manufacturer in India and one of the world’s largest, excluding China.

Company Mission–

“ Waaree- One with the Sun.” By virtue of our commitment to our stakeholders, we strive for continuous improvement in the quality of our products & services.

Financial Overview

Face Value(INR) –10

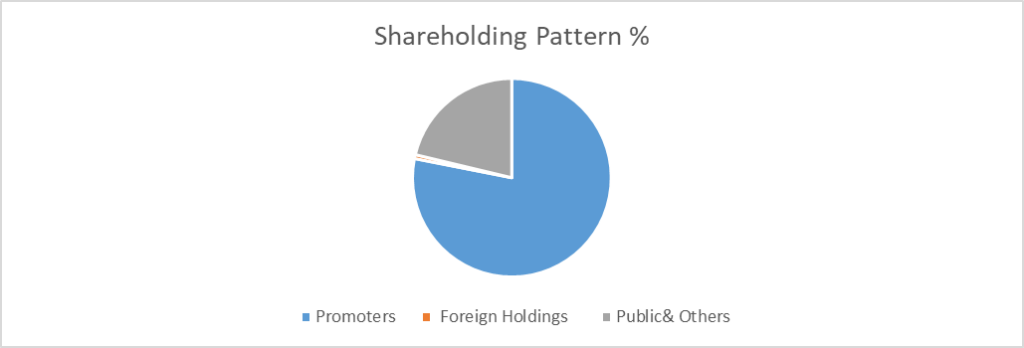

Shareholding Pattern %( As on March,2023)

Promoters- 78.10

Foreign Holdings- 0.64

Public & Others- 21.26

| (INR Cr) | Net Sales | EBITDA | PAT | EPS | EBITDA Margin % | ROE % | ROCE % |

| FY22 | 2,854.3 | 105.9 | 79.6 | 4 | 4% | 18% | 8% |

| FY23 | 6,750.9 | 834.7 | 500.3 | 21 | 12% | 27% | 27% |

Funding Breakdown for Waaree Energies –

Waaree Energies Ltd., a manufacturer of solar panels, has raised ₹1,000 crore in a funding round led by investment firm ValueQuest, known for its strategic focus on sustainable and progressive ventures. The latest funds raised will be used for a 6 GW capacity expansion, adding to the existing capacity of 12 GW. The additional capacity is intended for the manufacturing of solar ingots and wafers, cells and modules. This equity investment is in addition to the PLI tranche II of ₹1,923 crore awarded by the government. The company is planning backward integration in the manufacturing of solar cells with a capacity of 5.4 GW. Within the next two years, Waaree Energies will have 20 GW of module capacity, 11.4 GW Cell and 6GW wafers manufacturing capacity. This expansion plan will consolidate Waaree’s position as the world’s largest solar module manufacturer outside China.

Expansion Plans and Future Targets–

The Company’s strategic approach includes backward integration, beginning with the commissioning of its solar cell plant in FY 2022-23. The company anticipates boosting its cell capacity to 5.4 GW by the close of FY 2023-24, positioning itself as India’s largest solar cell manufacturer and one of the largest non-Chinese players in the World.

The Expansion Plans includes – Cell Manufacturing Facility which aims to establish a 5.4 GW cell manufacturing facility in Gujarat,India And International Expansion which aims to explore the possibility of setting up a 2 GW module manufacturing facility in the United States.

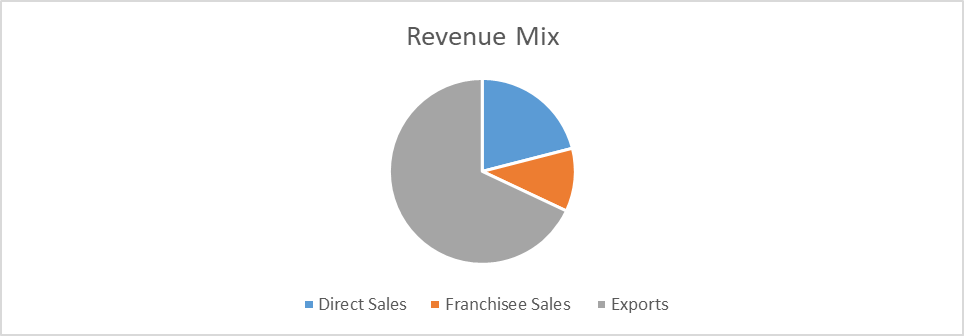

Revenue Mix FY23 Record

- Waaree Energies generated 68% of its FY 2022-23 from exports.

- Exports increased from INR 6,578.21 million to INR 46,165.39 million during the year.

In FY 2022-23, Waaree Energies captured about 70% of India’s export market share, boosting national pride and visibility.

Timeline

| 1985 | The company promoter, upon graduation, started trading in pressure, temperature and velocity measuring instruments. |

| 1991 | Waaree Instruments began its journey in manufacturing measuring instruments. |

| 2007 | The company expanded into the manufacture of solar modules with the establishment of a 30MW manufacturing line in Surat. |

| 2011 | Waaree Group successfully divested its instruments business to Switzerland’s Baumer Group and ventured into the EPC business vertical. |

| 2014 | Formed a joint venture with NEEPCO to undertake the implementation of solar power projects in India. |

| 2017 | Acquired the remaining 40% stake in Waaneep Solar from NEEPCO, making it a wholly-owned subsidiary with over 100 MW solar portfolio. |

| 2017-2019 | Commissioned a 1 GW solar PV module plant and set up a 49.5 MW solar power plant in Vietnam. Divested Waaneep Solar in tranches to Hero Solar. |

| 2019-2021 | Increased the manufacturing capacity to 2.0 GW. Expanded the Waree franchisee network, establishing over 300 solar power centre. |

| 2021-2023 | Expanded manufacturing capacity to 12GW, a 6x increase, and ventured into solar cell manufacturing aiming for 5.4 GW by FY 2024. |

IPO Details and Objectives

Waaree Energies IPO combines fresh equities of INR 1,350 crore and an offer for sale from existing shareholders of 4,007,500 equities. The company proposes to use the net proceeds from the sale of fresh equities to finance establishing a 2 GW solar cell manufacturing facility.

| Strengths | Risks |

| India’s solar capacity will continue to grow, and the company is well- positioned to capitalize on the tailwind. They are approved under the PLI scheme, which aims to promote efficiency in manufacturing PV modules in India and lower import dependency. Waaree enjoys deep penetration in the rooftop segment through the PAN India franchise network. Marquee customer base in India and globally. | Future cash flow depends on the continuously increasing demand for solar energy. A decrease in order will impact profitability. Restrictions on or import duties relating to materials and equipment imported for the manufacturing operations as well as restrictions on or import duties levied on the products in the export markets. Disruptions in the supply or availability of materials and components of the appropriate quality standards and fluctuation in their prices obtained from third party suppliers. |

Click Here – To buy Waaree Energies unlisted shares.