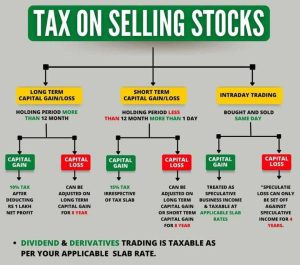

TAX ON SELLING STOCK FOR LISTED STOCK

- LONG TERM CAPITAL GAIN/LOSS

HOLDING PERIOD MORE THAN 12 MONTH

CAPITAL GAIN- 10% TAX After deducting Rs 1 Lakh Net profit.

CAPITAL LOSS- Can be adjusted long term Capital Gain for 8 years. - SHORT TERM CAPITAL GAIN/LOSS

HOLDING PERIOD LESS THAN 12 MONTH MORE THAN 1 DAYCAPITAL GAIN- 15% TAX Irrespective of Tax slab

CAPITAL LOSS- Can be adjusted on Long Term Capital Gain or Short term Capital Gain for 8 Year. - INTRADAY TRADING

BOUGHT AND SOLD SAME

CAPITAL GAIN- Treated as Speculative Business Income & Taxable at Applicable Slab rates

CAPITAL LOSS- Speculative loss can only be set Off against Speculative Income 4 Years.

Percentage Of Citizen Participating in Stock Market by Country

- Today, there are numerous stock exchanges worldwide, representing the capital important to help the enterprise boom. The stock marketplace creates non-public wealth and economic balance through non-public funding, permitting people to fund their retirement and or different ventures.

- Most of the people are not able to comply with markets from 9:15 am to 3:30 pm even as they’re at work, however, the enforced lockdown should have created greater possibilities for informal Indian marketplace with the coronavirus confining humans to their homes. India’s 3 % suggests that there’s lots of headroom for India’s stock marketplace penetration to grow.

Smaller NBFCs, Microlenders May Be Most Impacted By RBI’s New Corrective Framework

- The Reserve Bank of India’s prompt corrective action framework for non-bank finance companies is unlikely to hurt major lenders but may weigh on capital and growth of smaller NBFCs and microfinance companies. The banking regulator has released a new framework intended to take early action against weakness building across NBFCs. The framework will kick-in starting October 2022, based on March

RBI Introduces Prompt Corrective Action Framework for NBFCs

- The Reserve Bank of India (RBI) has introduced the prompt corrective action (PCA) framework for non-banking financial companies (NBFCs). The central bank has defined three risk thresholds for applying prompt corrective action to NBFCs.

- It may be recalled that the revised Prompt Corrective Action (PCA) Framework for Scheduled Commercial Banks (SCBs) was issued on November 2, 2021.

- “NBFCs have been growing in size and have substantial inter-connectedness with other segments of the financial system. Accordingly, a PCA framework for NBFCs has also been put in place to further strengthen the supervisory tools applicable to NBFCs,” RBI said in a statement

Court sends notice to SEBI over handling of complaints

- The petition alleges that the SEBI Complaints Redress System, or SCORES, violates the principles of natural justice by disposing of complaints in a mechanical way. According to the petition, the system also fails to provide copies of replies sent by the party against whom a complaint has been lodged. Cases have been highlighted where investors have been verbally promised returns by PMS services etc. Read more about it here.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/