Inter alia turns down pleas made by counterparties to transfer all related cases to Bombay High Court

Minority shareholders of the erstwhile Lakshmi Vilas Bank (LVB) have got a breather with the Supreme Court of India accepting their plea to transfer all cases pertaining to the bank’s merger with DBS Bank of India — a subsidiary of DBS Bank, Singapore — to Madras High Court.

“There was a lot of argument and counter-argument wherein we submitted that since most shareholders (of LVB) are situated in Tamil Nadu, most branches are there in Tamil Nadu, 9 out of the total 15 petitions are pending at High Court with Judicature at Chennai, the transfer of all matters should be before Chennai High Court. Our arguments found acceptance with the honorable judge and she was pleased to transfer all petitions, along with the petitions in Bombay, to Chennai,” said Advocate Ankur Kashyap, who represented AUM Capital, one of the minority shareholders of LVB challenging the merger of the bank with DBS Bank India.

The Honorable Supreme Court has also fixed the next date for hearing before the Madras High Court as April 25. Now all LVB matters stand transferred to Chennai”, the counsel added.

By accepting the transfer plea advanced by the minority shareholders of LVB, the Supreme Court has inter alia turned down pleas made by counterparties to transfer all the cases to Bombay High Court.

Diluted shares

On November 25, 2020, the government sanctioned the scheme of amalgamation of LVB with DBS Bank India on the lines of recommendations made by the Reserve Bank of India. As per the scheme, from November 27, 2020, all branches of Lakshmi Vilas Bank were to function as branches of DBS Bank India.

Following this, minority shareholders of LVB — including AUM Capital — approached the Madras High Court, seeking an interim stay against the merger, alleging that the scheme ignored their interests by reducing the value of their shareholding in LVB to virtually nil since the scheme cancelled their existing shares in the bank. They also alleged that their suggestions on the draft scheme of amalgamation were ignored by the apex bank.

The high court prima facie found merit in the argument of the LVB shareholders and granted an interim order directing DBS India to set apart a reserve to meet their claims. It further directed DBS India to not do anything which would harm the interest of Lakshmi Vilas Bank shareholders. APRIL 25th NEXT Hearing.

SMILE is engaged in providing micro-loans to women from poor segments of urban and rural Tamil Nadu

Northern Arc Capital, a diversified non-banking finance company (NBFC) focused on under-served households and businesses, on Thursday announced that it has entered into an agreement to acquire Chennai-based SMILE Microfinance Limited through a slump sale.

on under-served households and businesses, on Thursday announced that it has entered into an agreement to acquire Chennai-based SMILE Microfinance Limited through a slump sale.

The transaction will involve taking over of the microfinance portfolio of SMILE, along with its extensive network of nearly 150 branches catering to over two lakh customers. Around 850 employees of SMILE will move to the rolls of the Northern Arc group upon the consummation of the transaction, the IPO-bound Northern Arc Capital said in a press release.

Stock market update: New T+1 settlement rule kicks in from this week. What it means for investors

The new T+1 Stock Settlement Rules will be implemented in a phased manner starting from this week on Friday, 25th February, 2022. The settlement cycle in stock markets refers to the time between the trade date, when an order is executed in the market, and the settlement date, when participants exchange cash for securities or shares.

Corporate Surcharge To Be Reduced From 12% to 7%, Announces FM Sitharaman in Budget 2022

- Union Finance Minister Nirmala Sitharaman on Tuesday presented Budget 2022 and announced that the government will reduce the corporate surcharge from 12% to 7%

- Giving details, Sitharaman said to provide an opportunity to correct an error, taxpayers can now file an updated return within 2 years from the relevant assessment year

- “I propose to provide that any income from transfer of any virtual digital asset shall be taxed at the rate of 30%. No deduction in respect of any expenditure or allowance shall be allowed while computing such income, except cost of acquisition,” Sitharaman added

- She also said the Centre has proposed to reduce the Minimum Alternative Tax to 15 per cent for co-operative societies at par with the corporate

Long term capital gain surcharge capped at 15% for all assets, how will it impact you

Among the few reliefs which individual taxpayers got in this budget, the capping of surcharge to 15% on long term capital gains on all types of assets irrespective of the capital gain amount, is a significant one. Earlier this cap of 15% was there only for surcharge leviable on LTCG on listed equity shares or a unit of an equity oriented fund or a unit of a business trust.

“The long-term capital gains on listed equity shares, units etc. are liable to maximum surcharge of 15 per cent, while the other long term capital gains are subjected to a graded surcharge which goes up to 37 per cent. I propose to cap the surcharge on long term capital gains arising on transfer of any type of assets at 15 per cent,” said finance minister Nirmala Sitharaman during her budget speech.

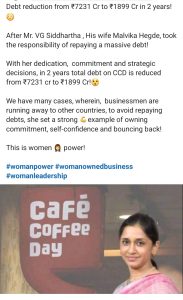

Debt reduction from 7231 Cr to ₹1899 Cr in 2 years

After Mr. VG Siddhartha, His wife Malvika Hegde, took the responsibility of repaying a massive debt!

With her dedication, commitment and strategic decisions, in 2 years total debt on CCD is reduced from 27231 cr to 1899 Cris

We have many cases, wherein, businessmen are running away to other countries, to avoid repaying debts, she set a strong example of owning commitment, self-confidence and bouncing back!

This is women power!

From 01-01-2022

SEBI Circular

Common and simplified Norms for processing Investor Service request by

RTA s.

: 2.1.Minor mismatch in signature

a) In case of minor mismatch in the signature of the securities holder as

available in the folio of the RTA and the present signature, the RTA, while

processing the service request, shall intimate the holder by Speed post

about the minor mis-match in signature, providing timeline of 15 days for

raising objection, if any. In the absence of any objection, the service request

shall be processed.

: b) If the letter returns undelivered or if there is an objection, as aforesaid, the

RTA shall obtain signature verification by the banker before proceeding the

service request.

2.3.Mismatch in name

a) For minor mismatch in name between any two set of documents presented

by holder / claimant for any service request, the RTA shall additionally obtain

any one of the following documents, explaining the difference in names;

Unique Identification Number (UID) (Aadhaar)

Valid Passport

Driving license

PAN card with photograph

Identity card / document with applicant’s Photo, issued by any of the

following: Central / State Government and its Departments,

Statutory / Regulatory Authorities, Public Sector Undertakings,

Scheduled Commercial Banks, Public Financial Institutions.

Marriage certificate

Divorce decree

: 2.2.Major mismatch in signature or Signature Card is not available

In case of major mismatch in the signature of the holder as available in the folio of

the RTA and the present signature or if the same is not available with the RTA, then

the holder / claimant shall furnish original cancelled cheque and banker’s attestation

of the signature as per Form ISR-2

2.6.Self-attestation to replace Affidavits, Attestation / Notarization

For all service request, except transmission, copies of documents that are summited

in hard copy shall be processed by the RTA only if the same is self-attested by the

holder(s), with date. It is clarified that the RTA shall not insist on affidavits or

attestation / notarization of documents.

b) The existing norms of the Depositories, to process Demat request where

there is a minor mis-match on account of initials not being spelt out fully, or

put after or prior to surname, provided the signature in the Demat Request

Form (DRF) matches with the signature card with the RTA, shall continue to

be in force.

2.7.Indemnity

RTA shall not insist on indemnity for any service request, unless the same is

specially provided in the Companies Act, 2013 or the Rules issued thereunder or in

SEBI Regulations or circulars issued thereunder

2.5.Documents for Proof of Address

2.5.1. The RTA shall obtain any one of the following documents from the holder

/ claimant, if the address is not available in the folio or for processing the

request for its change;

a) Valid Passport / Registered Lease or Sale Agreement of Residence / Driving

License / Flat Maintenance bill.

b) Utility bills like Telephone Bill (only land line), Electricity bill or Gas bill – Not

more than 3 months old.

c) Identity card / document with address, issued by any of the following:

Central/State Government and its Departments, Statutory / Regulatory

Authorities, Public Sector Undertakings, Scheduled Commercial Banks,

Public Financial Institutions

d) For FII / sub account, Power of Attorney given by FII / sub-account to the

Custodians (which are duly notarized and / or apostilled or consularized)

that gives the registered address should be taken.

e) The proof of address in the name of the spouse.

f) Client Master List (CML) of the Demat Account of the holder / claimant,

provided by the Depository Participant.

2.10. Mode for providing documents / details by investors

The RTA shall enable the holder / claimant to provide the aforesaid document /

details by any one of the following mode;

2.8.Form for availing investor services

RTA shall process all investor service request by accepting the duly filled up request

Form ISR-1(pdf) (word file) to this circular. Listed companies and RTAs shall make

this form available in their websites.

2.5.2. RTAs shall forthwith send intimation about the request for change in

address to the holder at both the old and new addresses by Speed post,

providing, timeline of 15 days for raising objection, if any.

a) In the absence of any objection, the request shall be processed.

b) If any one of the letter returns undelivered or if there is an objection, the RTA

shall obtain any one of the documents mentioned above reflecting the old

address as available in the folio or counterfoil of dividend warrant received

from the company or bank statement showing credit of dividend this regard, RTA shall update the folio(s) of the holder with the information on 1)present address, 2) bank details, 3) E-mail address and 4) mobile number from the

details available in the Client Master List (CML), if the holder / claimant provides the

CML.: a) through ‘In Person Verification’ (IPV): the authorized person of the RTA shall

verify the original documents furnished by the investor and retain copy(ies)

with IPV stamping with date and initials

b) through hard copies which are self-attested and dated

c) through electronic mode with e-sign, as elaborated subsequently.

2.13. All objections by RTA in once instance

While processing complaints or service request, the RTAs shall raise all objections,

if any / at all, in one instance only; the additional information may be sought only in

case of any deficiency / discrepancy in the documents / details furnished by the

holder.: The RTA shall also use the electronic / on-line mode for communicating with the holder

/ claimant for speedier processing.

3.2. Through service portal of the RTA

In case the RTA is offering on-line processing of service request thought its

portal, then the holder may submit his / her request or complaint through this

portal, using appropriate credential for login and password. The scanned copies

of the documents furnished shall have e-sign.

: 10.Depositories are advised to take necessary steps to;

10.1. implement the provisions of this circular / make necessary amendment(s)

to the relevant bye-laws / business rules / regulations / operational

instructions, as the case may be,

10.2. bring the provisions of this circular to the notice of their constituents and

10.3. disseminate this circular on their websites.

: 11.The Stock Exchanges are advised to;

11.1. comply with the relevant portion(s) of this circular applicable to them,

11.2. bring the provisions of this circular to the notice of listed companies and

11.3. disseminate the same on their websites.

: 3. Electronic interface for processing queries, complaints and service request

3.1.In addition to responding to queries, complaints and service request through

hard copies, the RTA shall also process the same received through e-mails,

provided that it is received from the e-mail address of the holder which is already

registered with the RTA. Additionally, in the case of service requests, the

documents furnished shall have e-sign of the holder(s) / claimant(s)