Ixigo Receives SEBI Approval for IPO: A Promising Milestone

Travel tech major Ixigo, operating under Le Travenues Technology Ltd, has received the green light from the Securities and Exchange Board of India (SEBI) for its IPO. This significant milestone comes after Ixigo was issued an observation letter by SEBI on May 14, allowing the company to proceed with its plans to go public.

Ixigo: Company Background

Headquartered in Gurugram, Ixigo was founded in 2007 by Aloke Bajpai and Rajnish Kumar as a travel search website. By FY20, it had transformed into an OTA, offering flights, train and bus tickets, hotel bookings, and holiday packages. The company operates two sets of apps for train bookings and flights/hotels and has adopted a “house of brands” approach, acquiring platforms like ConfirmTkt and Abhibus.

How Ixigo Works?

Ixigo operates as a comprehensive travel platform, integrating various services to enhance the travel experience. Here’s how it works:

- User-Friendly Interface: The company offers a seamless and intuitive user interface, making it easy for users to navigate and find what they need quickly.

- Integrated Services: The platform consolidates multiple services into one app, including flight, train, and bus ticket bookings, hotel reservations, and holiday packages.

- Special Features:

- Train Bookings: Users can book train tickets and check PNR status, with the added benefit of scheduling interstate ride-sharing through BlaBlaCar when train options are limited or waitlisted.

- Flight and Hotel Bookings: The app allows users to search for and book flights and hotels with ease.

- Discounts and Offers: the company provides access to relevant apps and discounts across e-commerce, hyperlocal services, online travel, and food delivery.

- Targeted Outreach: The platform uses contextual brand outreach, particularly to train passengers, to offer tailored services and promotions.

- Ratings and Reviews: The company boasts a stellar 4.6-star rating on the Google Play Store, reflecting its reliability and user satisfaction.

By integrating these features into a single app, Ixigo simplifies the travel planning and booking process, offering a comprehensive solution for travelers.

Ixigo- Founder and Team

Aloke Bajpai

Aloke Bajpai is the Group CEO, Managing Director, and Co-Founder of Ixigo. He holds a BTech in Electrical Engineering from IIT Kanpur and an MBA in General Management from INSEAD, along with an MBA Exchange from The Wharton School.

He began his career as a Software Engineer at Amadeus SAS, where he was eventually promoted to Senior Systems and Network Engineer. He later served as Vice President at Final Quadrant Solutions before launching Ixigo in 2007. In addition to his role at Ixigo, he serves as the Director of Freshbus and Confirmtkt.

Rajnish Kumar

Rajnish Kumar is the Group CPTO and Co-Founder of Ixigo. An alumnus of IIT Kanpur, he graduated from the Computer Science & Engineering department. During his studies, he interned at ETH Zurich, focusing on Data Modelling/Warehousing and Database Administration.

He too began his professional career at Amadeus SAS as a Software Engineer and was later promoted to Senior Software Engineer and Technical Lead. He then served as Director of Development at Isango! before co-founding Travenues, known today as Ixigo, in 2006.

Ixigo: Unique Value Proposition

Ixigo’s focus on Tier II and smaller markets, particularly in the train booking segment, provides a unique value proposition. Unlike major competitors such as EaseMyTrip, Yatra, and MakeMyTrip, Ixigo has capitalized on the train booking market. Train ticketing revenue significantly contributed to its gross ticketing revenue in FY23.

The proceeds will be used for:

- Working Capital Requirements: ₹ 45 Cr

- Technology and Data Science Investments: ₹ 26 Cr

- Technology Investments: Particularly in data science, cloud infrastructure, server hosting, artificial intelligence, and enhancing customer engagement.

Axis Capital, JM Financial, and DAM Capital Advisors are the lead book runners for the issue.

Background and Market Context

Initial Plans and Market Shift

Witnessing a significant surge in revenge travel as the effects of the pandemic began to wane and enticed by India’s bullish IPO market, ixigo initially filed for an ₹ 1,600 Cr public offering in August 2021. However, the startup unexpectedly shelved its IPO plans. This decision proved timely, as the subsequent underperformance of high-valuation IPOs like Paytm, along with market declines in 2022 for companies like Zomato, PB Fintech, and Nykaa, underscored the need for cautious market entry.

Refiling for IPO

In February 2024, with the market showing more resilience, ixigo refiled its DRHP with SEBI for an ₹ 120 Cr public listing. Now, with SEBI’s nod, Ixigo is preparing to join the IPO season in full bloom.

Ixigo: Strategic Strengths

Analysts highlight several strengths for ixigo’s IPO:

- Profitability: The company’s profitability in recent years strengthens investor confidence.

- Railway Ticketing Focus: Ixigo’s specialization in railway ticketing distinguishes it in the travel industry.

- Targeting Tier II and Smaller Markets: This focus allows Ixigo to tap into a growing, underserved market segment.

Ixigo: Financial Performance

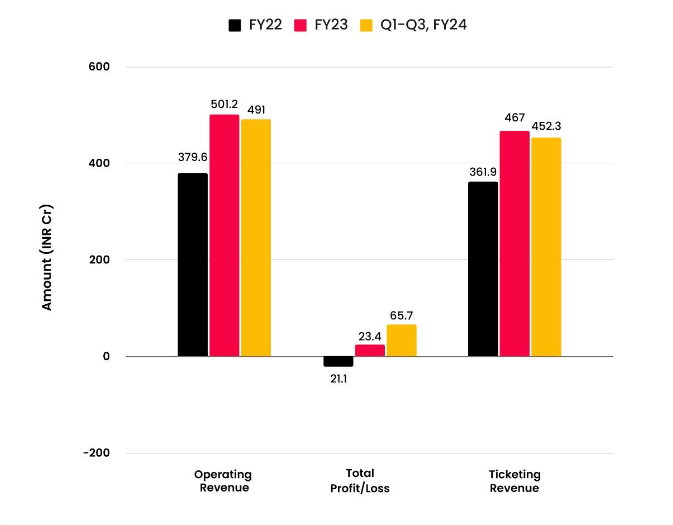

Ixigo’s financial trajectory has been promising:

- FY23: Consolidated net profit of ₹ 23.4 Cr, up from a net loss of ₹ 21.1 Cr in FY22.

- Operating Revenue: Increased 32% YoY to ₹ 501.2 Cr in FY23.

- Nine Months Ending FY24: Net profit of ₹ 65.7 Cr on an operating revenue of ₹ 491 Cr.

Revenue Model

Ixigo makes revenue from different resources; some of the prominent ones are:

- Reservation Fees: By charging customers for the reservation of different transport services, such as bus, train, and airline tickets, Ixigo makes money.

- Revenue from Rail Tickets: Ixigo offers consumers a convenient platform for making rail travel reservations, with a substantial percentage of its revenue coming from fees associated with reserving train tickets.

- Revenue from Airline Tickets: By charging customers a fee to buy airline tickets, the platform meets the varied travel demands of its user base and generates revenue.

- Revenue from Advertising: Through partnerships with advertisers, Ixigo expands its revenue stream by showcasing bargains and pertinent material to its user base.

Acquisitions

Ixigo has acquired 3 companies to date.

Here are the details:

| DATE | COMPANY NAME |

|---|---|

| August 5, 2021 | AbhiBus |

| February 4, 2021 | Confirmtkt |

| January 11, 2017 | Reach App |

Competitive Landscape and Challenges

While Ixigo’s competitive advantage in railway ticketing is a strength, its heavy reliance on IRCTC, which is both a partner and a competitor, poses a risk. The company’s non-exclusive agreement with IRCTC is valid until April 30, 2028, and any changes to this agreement could impact Ixigo’s business.

Market Sentiment and Outlook

The market’s cautious stance post-Paytm’s IPO has led Ixigo to revise its listing appetite, focusing more on profitability and sustainable growth. The travel tech sector is witnessing promising growth, with global market estimates reaching $21 Bn by 2032. Recent successful IPOs, such as Travel Boutique Online’s debut at a 55% premium, indicate strong investor interest.

Ixigo: Comparative Analysis of Competitors’ IPOs

| Company | IPO Year | IPO Size (INR Cr) | Listing Performance |

|---|---|---|---|

| EaseMyTrip | 2021 | 510 | Listed at 10%+ premium |

| Yatra | 2023 | 600 | Listed at 10% discount |

| Travel Boutique Online | 2024 | 600 | Listed at 55% premium |

| Ixigo (Planned) | 2024 | 120+ (Fresh Issue) | SEBI approved |

Conclusion

Ixigo’s approval from SEBI to launch its IPO marks a pivotal moment in its growth trajectory. With a robust financial performance, strategic focus on profitable and underserved market segments, and a clear plan for utilizing IPO proceeds, ixigo is well-positioned to make a significant impact in the public market. As the company gears up for this major step, it stands as a promising example of innovation and resilience in the Indian travel tech industry. Investors and industry watchers alike will be keenly following ixigo’s journey in the coming months.

Read our other blogs

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

For Direct Trading, Visit – https://trade.altiusinvestech.com/.